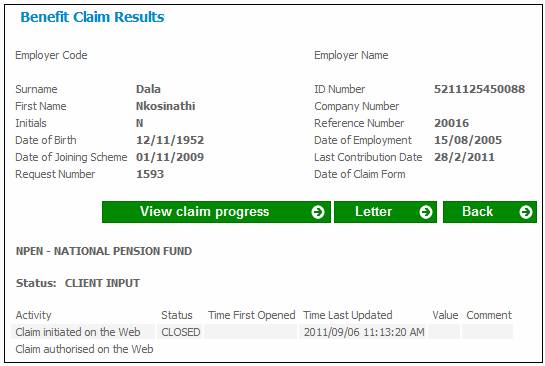

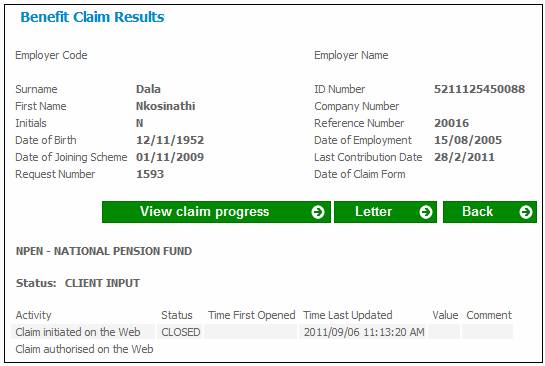

On the Benefit Claim Results screen, click VIEW CLAIM PROGRESS. The lower portion of the screen expands to display the progress of the exit.

The following columns are displayed:

- Activity

- Status

- Time First Opened

- Time Last Updated

- Value

- Comment

The Activity column shows the progress of the initiation of the claim and the subsequent completion of the various benefit payment update types.

Initiation of claim

Claim initiated on the web

Claim authorised on the web

DB benefit calculated

Member instruction checked

Monies disinvestment

Underwritten amount applied for

Prior claim details completed

Outstanding contributions

Benefit amount finalised

Tax directive applied for

Tax directive received

Beneficiary allocations checked

Annuity details captured

Benefit disbursement done

Benefit Payment Update Types

|

Benefit Payment Update Type |

Description of Activity |

|

PAYMENT DETAILS |

Member instruction checked |

|

REALISATION |

Monies disinvestment |

|

DB CALC |

DB benefit calculated |

|

DEATH |

Underwritten amount applied for |

|

DISABILITY |

Underwritten amount applied for |

|

BENEFICIARIES |

Beneficiary allocations checked |

|

PRIOR CLAIMS |

Prior claim details completed |

|

CALC BENEFIT |

Benefit amount finalised |

|

TAX DIR REQUEST |

Tax directive applied for |

|

TAX DIRECTIVE |

Tax directive received |

|

ANNUITY |

Annuity details captured |

|

BENEFIT PAYABLE |

Benefit disbursement done |

Note:

Only the benefit payment update types that are applicable for this claim will be shown. The update types NOTES and ADJUST BENEFIT will not be shown.

The Value column shows values only for certain benefit payment update types:

|

Benefit Payment Update Type |

Value |

|

CALC BENEFIT |

Gross benefit amount |

|

TAX DETAILS |

Total of the amount captured for tax amount under TAX DIRECTIVE DETAILS (IRP3), and the following amounts captured under OUTSTANDING TAX (IT88): - Employee Tax Amount - Value Added Tax Amount - Provisional Tax: Amount 1 - Provisional Tax: Amount 2 - Provisional Tax: Amount 3 |

The Comment column shows certain notes that were captured during the benefit payment process. For these notes to be displayed correctly, the note headers must be created as follows:

|

Benefit Payment Update Type |

Note Header |

|

PAYMENT DETAILS |

PAYMENT ALLOCATION |

|

DEATH |

COVER or RISK DEATH DECISION |

|

DISABILITY |

COVER or RISK DISABILITY DECISION |

|

TAX DIR REQUEST |

TAX DIRECTIVE |

|

TAX DIRECTIVE |

TAX |

|

BENEFIT PAYABLE |

BENEFIT PAYMENT |

Example:

If a note was created with the header BENEFIT PAYMENT, the free-form text that was entered into the text input area of the New Notation screen will be displayed in the Comments column alongside the activity Benefit disbursement done.

All notes that were captured for the member will be displayed (including notes that may have been captured for an exit that was subsequently cancelled). Comments captured on the specific screens during the death and disability process will also be displayed.

For more information on benefit payment update types, refer to

Processes

Benefits

Benefit Payment Update Type

Benefit Payment Update Types (Standard Benefit Rules)