The file received from the Swaziland Revenue Authority must be converted to the AB78 Annuity Payment Detail Upload Input file format in a text file and saved on the drive.

In the take-on layout, the following must be specified:

- Payment Type of Tax Refund and Tax Recovery

- Payment Frequency of Once Off

- Annuity Status of Ad Hoc

The fields 1 to 8, 10 and 57 are used to identify the Member and Annuity record to which the new Payment detail records will be connected. The rest of the mandatory (M)or conditional (C) fields are required to store the new record.

When successfully uploaded, the once off annuity payment records for the payment of the refund or the recovery or the deduction of the under payment will be created.

Input file layout

Header record

|

|

Field Name |

Field Size |

DEC |

ATTR |

Start |

End |

Description / Value |

|

1 |

MaskCode |

4 |

|

Char |

1 |

4 |

AB00 |

|

2 |

szFundNumber |

7 |

|

Char |

5 |

11 |

Fund number |

|

3 |

szSchemeCode |

7 |

|

Char |

12 |

18 |

System scheme code |

|

4 |

dteConvDate |

8 |

|

Num |

19 |

26 |

CCYYMMDD |

|

5 |

dteSystemDate |

8 |

|

Num |

27 |

34 |

CCYYMMDD - system date |

Detail record

|

|

Field Name |

Field Size |

DEC |

ATTR |

O/M |

Start |

End |

Description / Value |

|

1 |

File indicator |

4 |

|

Char |

M |

1 |

4 |

AB78 |

|

2 |

FundNumber |

7 |

|

Char |

M |

5 |

11 |

Scheme code |

|

3 |

MemberNumber |

20 |

|

Char |

M |

12 |

31 |

Member reference number |

|

4 |

Surname |

30 |

|

Char |

M |

32 |

61 |

Surname |

|

5 |

Initials |

5 |

|

Char |

M |

62 |

66 |

Initials |

|

6 |

DOB |

8 |

|

Num |

M |

67 |

74 |

CCYYMMDD - Date of Birth |

|

7 |

IDnumber |

15 |

|

Char |

M |

75 |

89 |

ID number |

|

8 |

Status |

15 |

|

Char |

M |

90 |

104 |

ANNUITANT LIVING ANNUITNT SPOUSE DEPENDANT DISABLED DEPDNT |

|

9 |

Purchase Amount |

11 |

2 |

Num |

|

105 |

115 |

Not Required |

|

10 |

Payment Type |

15 |

|

Char |

M |

116 |

130 |

Type of payment. TAX RECOVERY TAX REFUND |

|

11 |

Payment Start Date |

8 |

|

Num |

|

131 |

138 |

Not Required. Zero fill |

|

12 |

EFFECTIVE_DATE |

8 |

|

Num |

M |

139 |

146 |

CCYYMMDD - the effective date from which the payments must start. |

|

13 |

DATE_OF_LAST_ PAYMENT |

8 |

|

Num |

|

147 |

154 |

Not Required. Zero fill |

|

14 |

AMOUNT_OF_ REGULAR_ PAYMENT |

11 |

2 |

Num |

M |

155 |

165 |

The amount of the payment to be made regularly. |

|

15 |

C_UDPV_ FREQUENCY |

15 |

|

Char |

M |

166 |

180 |

The frequency of the payment. ONCE OFF |

|

16 |

C_UDPV_ ANNUITANT_ STATUS |

15 |

|

Char |

M |

181 |

195 |

ACTIVE ADHOC

These are the only values allowed. |

|

17 |

PAYMENT_ REVIEW_DATE |

8 |

|

Num |

|

196 |

203 |

Not Required. Zero fill |

|

18 |

PERCENTAGE |

7 |

4 |

Num |

|

204 |

210 |

Not Required. Zero fill |

|

19 |

COE_DATE_SENT |

8 |

|

Num |

|

211 |

218 |

Not Required. Zero fill |

|

20 |

COE_DATE_ RECEIVED |

8 |

|

Num |

|

219 |

226 |

Not Required. Zero fill |

|

21 |

PRIORITY_OF_ DEDUCTION |

4 |

|

Num |

C |

227 |

230 |

A number to denote the priority that must be placed on a payment. The lowest number indicates the highest priority. /this applies to deductions if there is a specific priority order. |

|

22 |

TAX_RELIEF |

1 |

|

Char |

C |

231 |

231 |

Indicates whether or not this Deduction qualifies for tax relief. Y N |

|

23 |

END_DATE |

8 |

|

Num |

|

232 |

239 |

Not Required. Zero fill |

|

24 |

C_UDPV_ PAYMENT_ METHOD |

15 |

|

Char |

M |

240 |

254 |

BANK TRANSFER CHEQUE EFT FOREIGN DRAFT |

|

25 |

TAX_RELIEF_ PERCENTAGE |

7 |

4 |

Num |

C |

255 |

261 |

The percentage allowed for tax relief by the tax authority. Required if the member’s Tax Relief value is “Y” |

|

26 |

GN18_ INDICATOR |

1 |

|

Char |

M |

262 |

262 |

Per General Note 18 issued by SARS. Y = annuity purchased by the member (member owned annuity) N = annuity not purchased by the member |

|

27 |

DISINVEST_ LIVING_ANNUITY_RATE |

7 |

4 |

Num |

|

263 |

269 |

Not Required. Zero fill |

|

28 |

TAX_DIRECTIVE_ PERCENTAGE |

7 |

4 |

Num |

C |

270 |

276 |

If the member has a Tax Directive

Tax rate percentage for a pension payment that a member or beneficiary has applied for, and for which a tax directive has been received. |

|

29 |

TAX_DIRECTIVE_ START_DATE |

8 |

|

Num |

C |

277 |

284 |

If the member has a Tax Directive

CCYYMMDD - the start date of a tax rate percentage, for which a tax directive has been received. |

|

30 |

TAX_DIRECTIVE_ END_DATE |

8 |

|

Num |

C |

285 |

292 |

If the member has a Tax Directive

CCYYMMDD - the end date of a tax rate percentage, for which a tax directive has been received. |

|

31 |

INCREASE_ PARTICIPATION |

1 |

|

Char |

|

293 |

293 |

Not Required. Space fill |

|

32 |

CO_INCOME_ DATE_SENT |

8 |

|

Num |

|

294 |

301 |

Not Required. Zero fill |

|

33 |

CO_INCOME_ DATE_RECEIVED |

8 |

|

Num |

|

302 |

309 |

Not Required. Zero fill. |

|

34 |

CO_MEDICAL_ DATE_SENT |

8 |

|

Num |

C |

310 |

317 |

CCYYMMDD - the date on which a request for medical evidence of health for the member was sent. |

|

35 |

CO_MEDICAL_ DATE_RECEIVED |

8 |

|

Num |

C |

318 |

325 |

CCYYMMDD - the date on which a request for medical evidence of health for the member was received. |

|

36 |

CO_EDUCATION_ DATE_SENT |

8 |

|

Num |

C |

326 |

333 |

CCYYMMDD - the date on which a request for education certification documents for the member was sent. |

|

37 |

CO_EDUCATION_ DATE_RECEIVED |

8 |

|

Num |

C |

334 |

341 |

CCYYMMDD - the date on which a request for education certification documents for the member was received. |

|

38 |

C_UDPV_ AMENDMENT_ TYPE |

15 |

|

Char |

M |

342 |

356 |

“BULK UPDATE” |

|

39 |

Organization Code |

6 |

|

Char |

|

357 |

362 |

Not Required. Space fill |

|

40 |

FIRST_NAME |

20 |

|

Char |

|

363 |

382 |

Not Required. Space fill |

|

41 |

MIN_PENSION_ |

7 |

4 |

Num |

|

383 |

389 |

Not Required. Zero fill |

|

42 |

YEAR_TO_DATE_ |

15 |

2 |

Num |

|

390 |

404 |

Not Required. Zero fill |

|

43 |

UNIQUE_ID_FROM_ORIG_SYSTEM |

8 |

|

Char |

|

405 |

412 |

Not Required. Space fill |

|

44 |

CLIENT_ |

15 |

|

Num |

|

413 |

427 |

Not Required. Zero fill |

|

45 |

TOTAL_AMOUNT_REPAID |

15 |

2 |

Num |

|

428 |

442 |

Not Required. Zero fill |

|

46 |

TOTAL_AMOUNT_OUTSTANDING |

15 |

2 |

Num |

|

443 |

457 |

Not Required. Zero fill |

|

47 |

TYPE_OF_ ANNUITY |

15 |

|

Char |

|

458 |

472 |

Not Required. Space fill

|

|

48 |

DATE_OF_RETIREMENT |

8 |

|

Num |

|

473 |

480 |

Not Required. Zero fill |

|

49 |

GUARANTEED_ DATE |

8 |

|

Num |

|

481 |

488 |

Not Required. Zero fill |

|

50 |

SALARY_AT_RETIREMENT |

15 |

2 |

Num |

|

489 |

503 |

Not Required. Zero fill |

|

51 |

APPLY_RULE_IND |

1 |

|

Char |

|

504 |

504 |

Not Required. Space fill |

|

52 |

COMMUTATION_AMOUNT |

15 |

2 |

Num |

|

505 |

519 |

Not Required. Zero fill |

|

53 |

BONUS_PARTICIPATION |

1 |

|

Char |

M |

520 |

520 |

Bonus participation indicator “Y” or “N” |

|

54 |

CONFIRMATION_ TYPE |

15 |

|

Char |

C |

521 |

535 |

For home affairs report. Values “HOME AFFAIRS”, “NONE” |

|

55 |

YEARLY_REVIEW_DATE |

8 |

|

Num |

C |

536 |

543 |

CCYYMMDD – this is for Living Annuitants |

|

56 |

CESSATION_REASON |

15 |

|

Char |

|

544 |

558 |

Not Required. Space fill |

|

57 |

BENEFIT_TYPE |

4 |

|

Char |

M |

559 |

562 |

Eg. SCHD, INKT, BONT,etc |

|

58 |

CURRENCY |

15 |

|

Char |

M |

563 |

577 |

The currency where payment is made |

|

59 |

TOTAL_PENSION |

11 |

2 |

Num |

|

578 |

588 |

Not Required. Zero fill |

|

60 |

COMMUTED_PENSION |

15 |

2 |

Num |

|

589 |

603 |

Not Required. Zero fill |

|

61 |

TAX_TYPE |

11 |

|

Char |

|

604 |

614 |

Not Required. Space fill |

|

62 |

BASE_CURRENCY |

15 |

|

Char |

|

615 |

629 |

Not Required. Space fill |

|

63 |

INCREASE_TYPE |

15 |

|

Char |

M |

630 |

644 |

Eg. SCHEDULED |

|

64 |

INCREASE_MONTH |

2 |

|

Num |

|

645 |

646 |

Not Required. Zero fill |

|

65 |

INCREASE_PERC |

7 |

|

Num |

|

647 |

653 |

Not Required. Zero fill |

|

66 |

PRO_RATA_INCREASE_TYPE |

15 |

|

Char |

|

654 |

668 |

Not Required. Space fill |

|

67 |

PURCHASE_PRICE_RATE |

7 |

|

Num |

|

669 |

675 |

Not Required. Zero fill |

|

68 |

POLICY_NUMBER |

50 |

|

Char |

|

676 |

725 |

Not Required. Space fill |

|

69 |

TAX_DIRECTIVE_AMOUNT |

15 |

|

Num |

C |

726 |

740 |

If the member has a Tax Directive |

|

70 |

TAX_DIRECTIVE_NUMBER |

15 |

|

Char |

C |

741 |

755 |

If the member has a Tax Directive |

|

71 |

TAX_DIRECTIVE_ISSUE_DATE |

8 |

|

Num |

C |

756 |

763 |

If the member has a Tax Directive. CCYYMMDD |

|

72 |

Title |

15 |

|

Char |

|

764 |

778 |

Not Required. Space fill |

|

73 |

Gender |

15 |

|

Char |

|

779 |

793 |

Not Required. Space fill |

|

74 |

Beneficiary Tax number |

20 |

|

Char |

|

794 |

813 |

Not Required. Space fill |

|

75 |

Third party reference number |

20 |

|

Char |

|

814 |

833 |

Not Required. Space fill |

O = Optional field

C = Conditional field

M = Mandatory field

The Input File requires no Header or Trailer record but an EOF record must be provided.

For more information on the processing of the AB78 Annuity Payment Detail Upload Input file refer to Processing below.

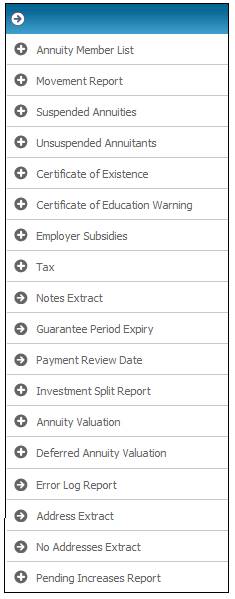

Navigate as follows: Processes > Regular Payments > New Business

The following menu will be displayed.

Select Annuity Details File Upload

Select Annuity Details File Upload from the sub-menu on the left.

This facility is used to load address details, annuity payment details, ad-hoc pension payments and ad-hoc pension increases and bank account details.

The banking details must be for the member and not a 3rd party.

A record is required for each payment , i.e. the principal member OR each dependant, AND for each deduction to be paid to a third party. A record is also required for each person receiving an annuity, i.e. the principal member OR each dependant, for who address or bank account details are required.

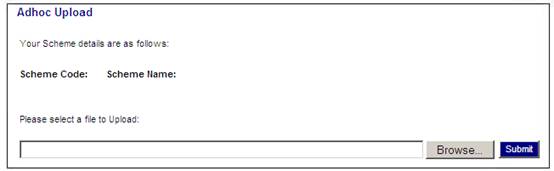

Once Annuity Details File Upload has been selected from the sub-menu on the left, the Adhoc Upload screen will be displayed.

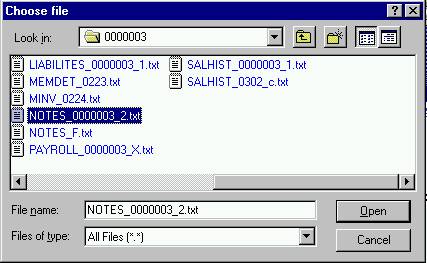

Click BROWSE. This will allow you to search the available drives (user network or local) for the file to be loaded.

Highlight the AB78 data take-on layout text file that you saved (refer to Create data take-on layout above), and click OPEN.

The file name will appear in the box. Click SUBMIT to submit the file for upload.

Refer to

Processes

Regular Payments

New Business

Annuity Details

Annuity Details Load

For more information on the data take-on process, refer to

Supplements

Processes

Data Take-on Process for Pensioners

For information on annuity payment details, refer to

Processes

File Transfer

File Layouts

Annuity Payment

For information on ad-hoc pension payments and ad-hoc pension increases, refer to

Processes

File Transfer

File Layouts

Annuity Payment Details Changes Upload

For information on loading addresses, refer to

Processes

File Transfer

File Layouts

Addresses

For information on loading bank accounts, refer to

Processes

File Transfer

File Layouts

Bank Accounts

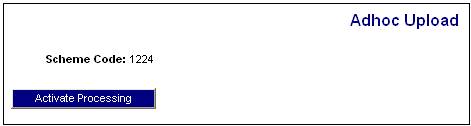

Select Annuity Details Load

Select Annuity Details Load from the sub-menu on the left.

This facility initiates the batch job (BJU5AA) after a file has been submitted for upload.

Once Annuity Details Load has been selected from the sub-menu on the left, the Adhoc Upload screen will be displayed.

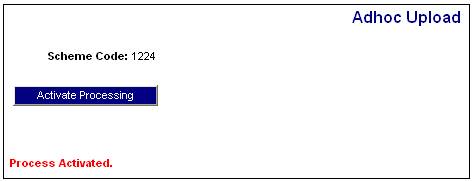

Click ACTIVATE PROCESSING in order to commence the processing. A message will confirm that processing has been activated.

You will now be able to monitor the progress of the batch job.

For more information on the data take-on process, refer to

Supplements

Processes

Data Take-on Process for Pensioners

For information on annuity payment details, refer to

Processes

File Transfer

File Layouts

Annuity Payment

For information on ad-hoc pension payments and ad-hoc pension increases, refer to

Processes

File Transfer

File Layouts

Annuity Payment Detail Upload

For information on loading addresses, refer to

Processes

File Transfer

File Layouts

Addresses

For information on loading bank accounts, refer to

Processes

File Transfer

File Layouts

Bank Accounts

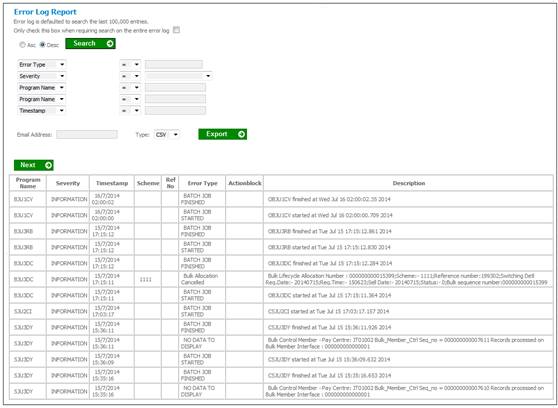

Monitor the progress of the batch job using the Error Log Report.

The error log report is a crucial report. This report registers the start and end of batch jobs as well as any errors that may have occurred.

Note:

It is good practice to make regular use of this report in order to check that batch jobs have run successfully.

This report displays messages in the error log for a selected scheme.

Navigate as follows: Processes > Regular Payments > Reports

The following menu will be displayed.

Select Error Log Report from the sub-menu on the left.

The Error Log Report screen will be displayed.

The following columns are displayed:

- Program Name

- Severity

- Timestamp

- Scheme

- Ref No

- Error Type

- Actionblock

- Description

The following fields are available as search criteria:

- Error type

- Severity

- Program name

- Timestamp

To choose a severity, click the drop-down list and select ERROR, INFORMATION OR WARNING.

Once all of the required selections have been made and / or data has been captured in the Program Name or Timestamp fields, click SEARCH.

The error log will display the last 100 000 entries. In order to search the entire error log, tick the box at the top of the screen.

![]()

Check that the batch job that has been run has started and finished without any errors.

For more detailed information, refer to

Reports

General

Error Log Report

Once the data has successfully been uploaded, check some of the members to ensure that the correct data is displayed.

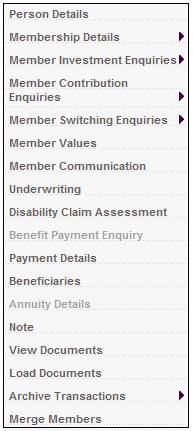

Navigate as follows: Clients > Members

The JU3AO List of Members for a Scheme/Pay Centre screen will be displayed.

Once the required member has been selected, the JU3AO List of Members for a Scheme/Pay Centre screen will be displayed. Highlight the required member and select Annuity Details from the sub-menu on the left.

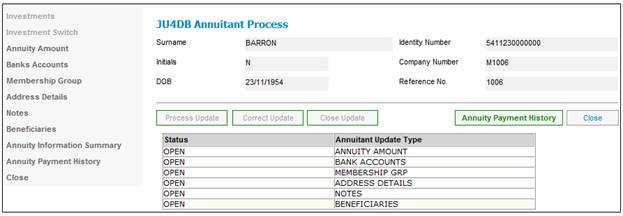

The JU4DB Annuitant Process screen will be displayed.

Either select ANNUITY AMOUNT under Annuitant Update Type and click PROCESS UPDATE or select Annuity Amount from the sub-menu on the left.

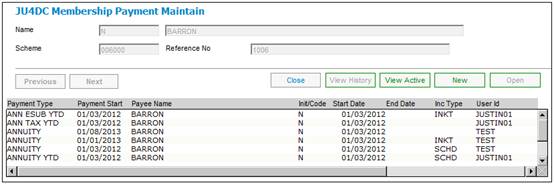

The JU4DC Membership Payment Maintain screen will be displayed.

The uploaded data with payment types of TAX REFUND and / or TAX RECOVERY will be displayed in the Payment Type column.

The data has now been successfully loaded.