Homepage > Products > List

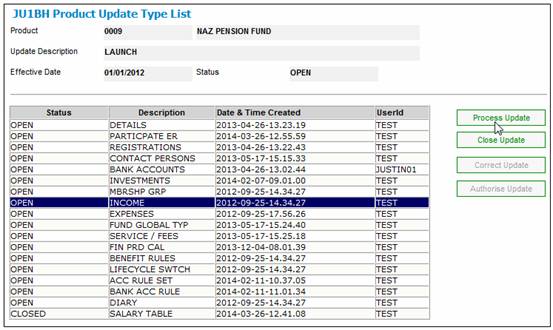

In this section we link in all the Income Types that will appear on the Schedule.

Highlight the INCOME update type and click on the PROCESS UPDATE button.

From the menu on the left click the first menu.

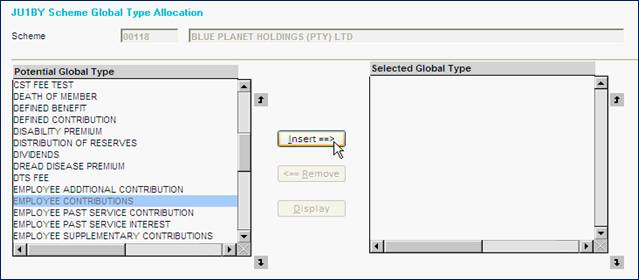

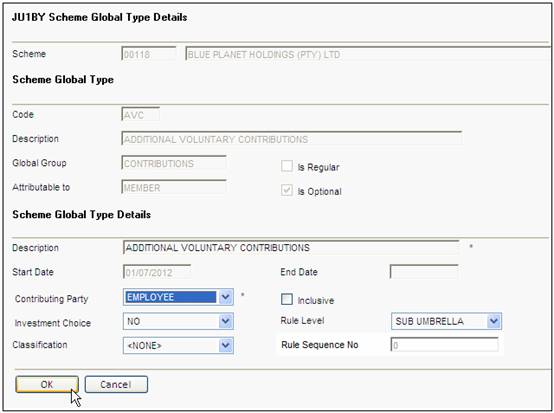

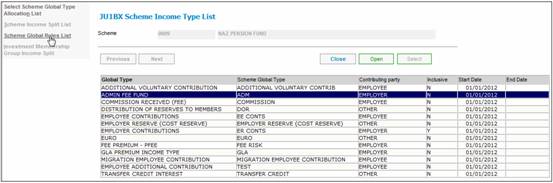

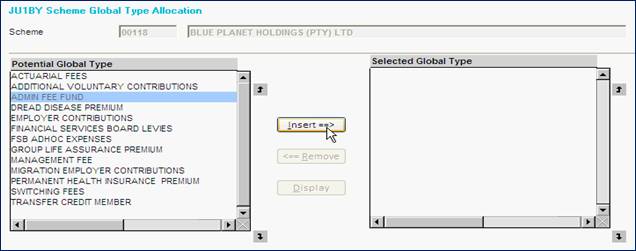

A list of POTENTIAL GLOBAL TYPES will be displayed – insert those applicable for the product.

Note:

When adding EMPLOYER CONTRIBUTIONS, if the costs are INCLUDED in the Employer Contribution amount, the INCLUSIVE FLAG must be ticked.

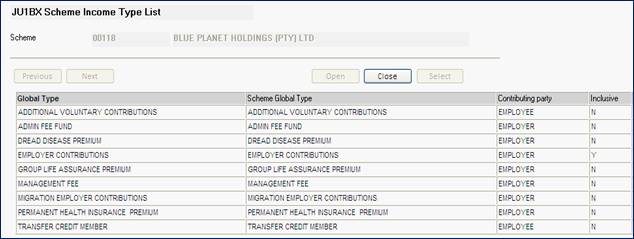

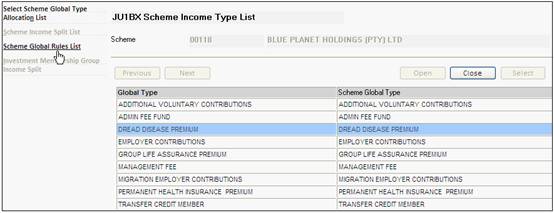

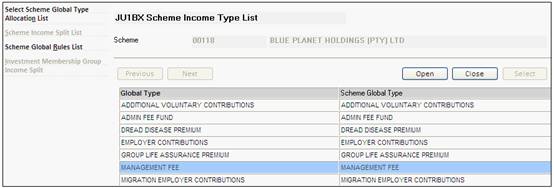

The income types added will be listed on the JU1BX Scheme Income Type List screen.

Repeat the steps below for the following income types:

- Additional Voluntary Contributions

- Migration Employee Contributions

- Migration Employer Contributions

- Transfer Credit Member

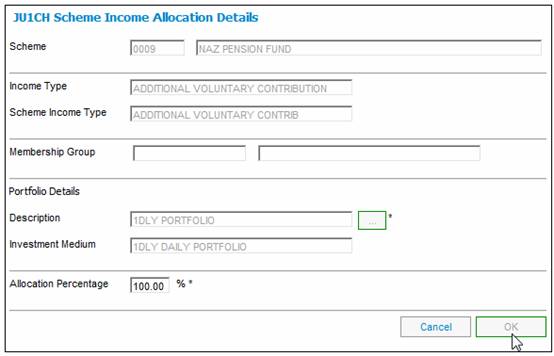

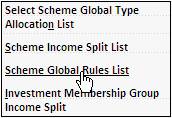

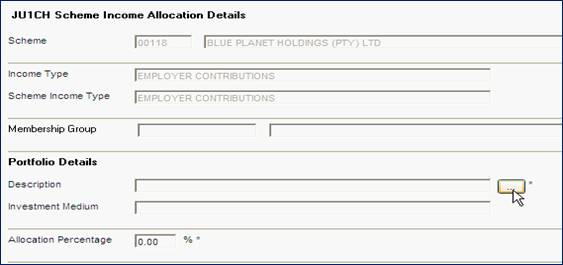

Highlight the income type and from the menu on the left, click on SCHEME INCOME SPLIT LIST.

This allows the administrator to select the portfolio in which this contribution must be invested.

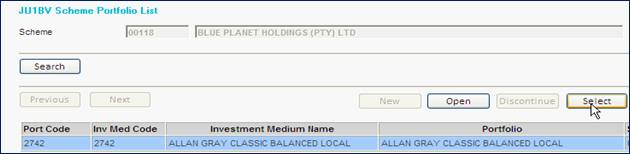

Use the FLOW button to select the Investment Medium.

Insert the % applicable.

Once the investment allocation has been added, use the close/cancel buttons to return to the previous screen.

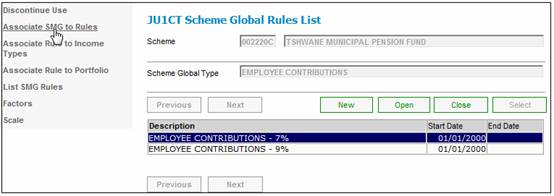

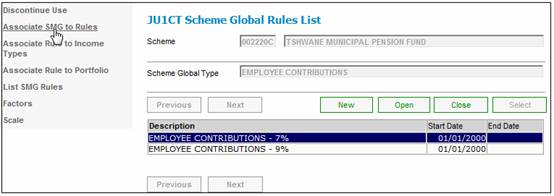

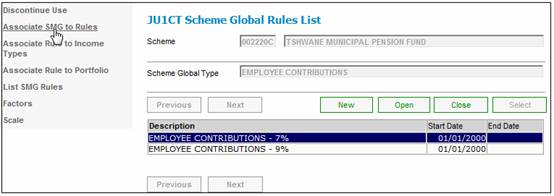

Highlight the same Income type again and from the menu on the left, click on SCHEME GLOBAL RULES LIST.

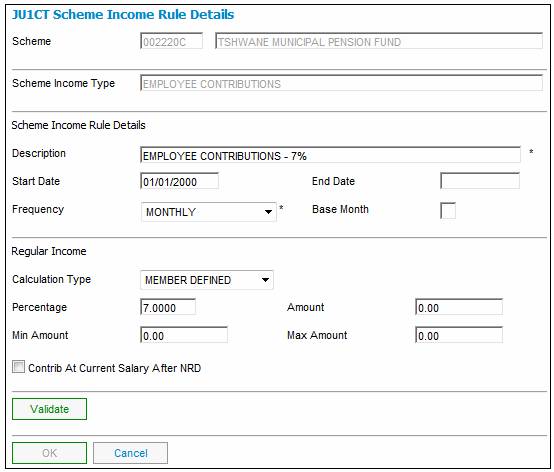

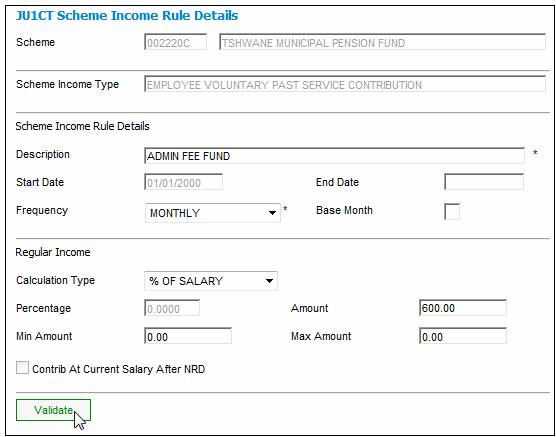

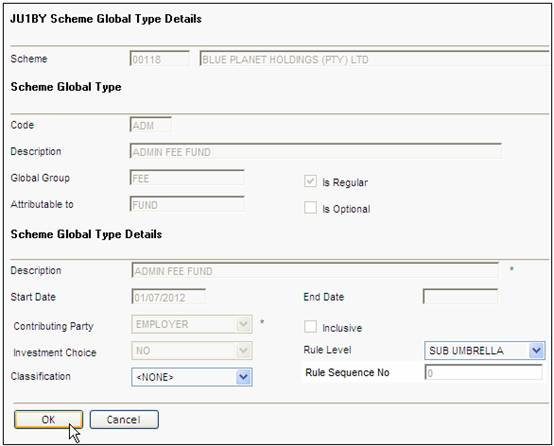

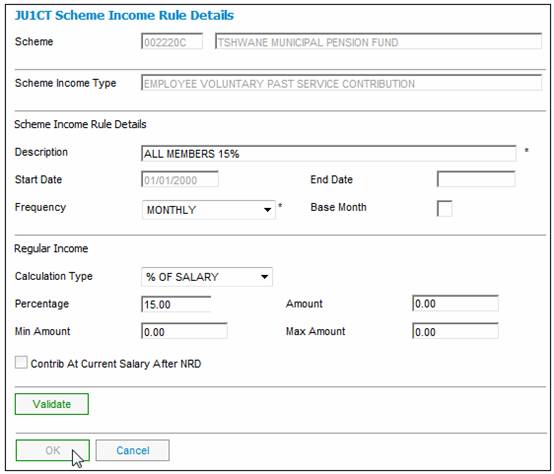

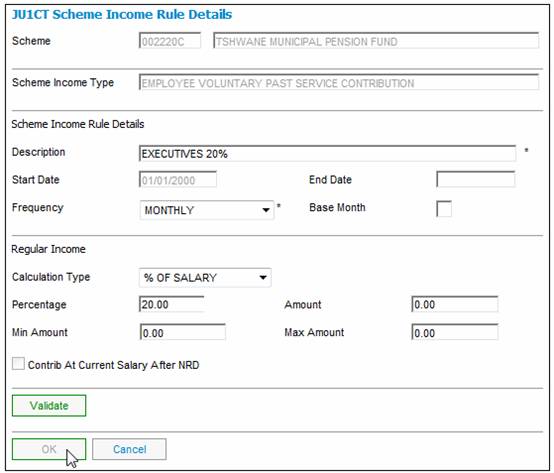

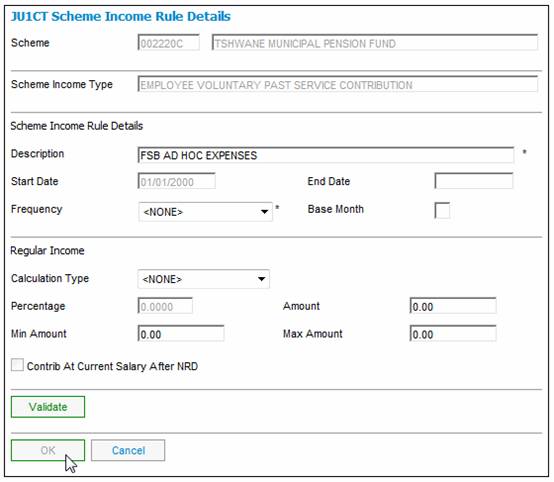

On the GLOBAL RULE LIST screen, click on the NEW button to add a rule. Complete the details as indicated in the screen below.

Click on the VALIDATE button.

Thereafter, click on the OK button to save the rule.

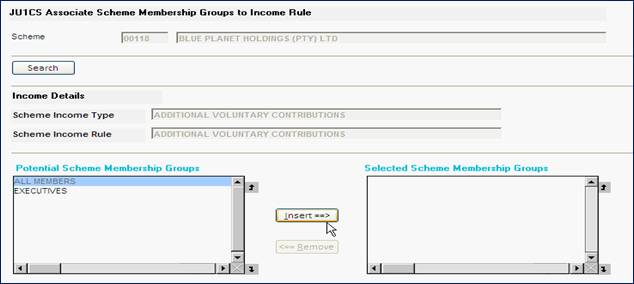

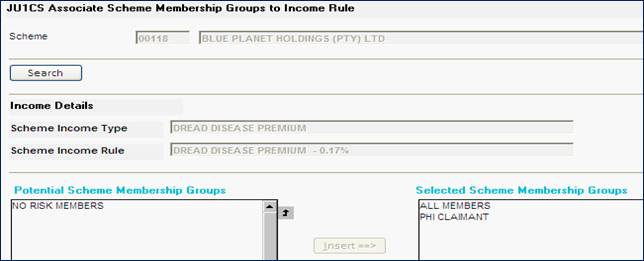

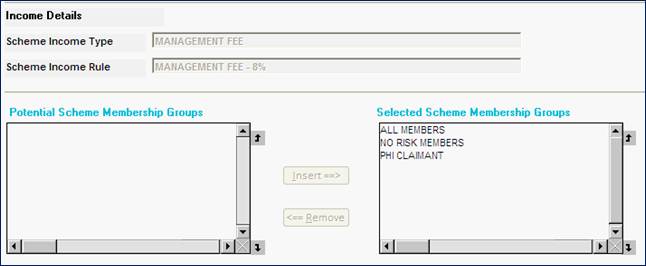

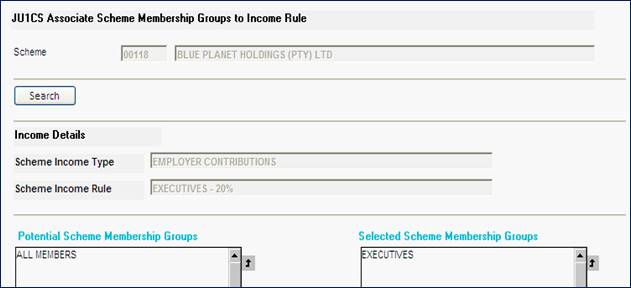

At this point, the user needs to indicate WHICH CONTRIBUTION CATEGORY will use this income type.

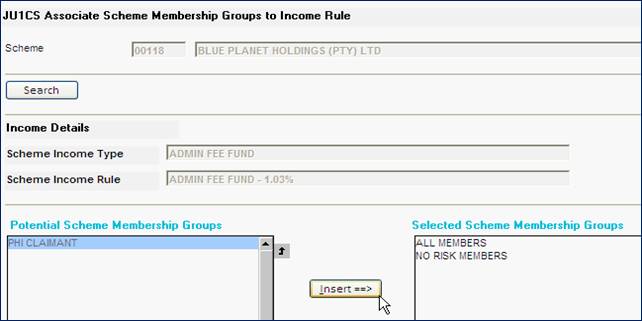

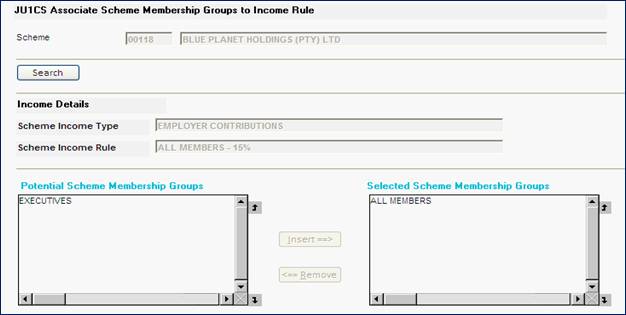

Highlight the rule that was just created, from the menu on the left click on ASSOCIATE SMG to RULES.

From the Potential list on the left, link in the Membership that will be contributing to this income type.

Use the cancel/close buttons to navigate back to the Scheme Income Type List.

ADMIN FEE (EXAMPLE)

Highlight the Admin Fee Income Type.

From the menu on the left click on the Scheme Global Rules List to add the rule applicable for Admin Fee.

Click on the NEW button to add a rule.

Complete the fields as indicated below, using the applicable rate.

Click on the VALIDATE button and then the OK button to save the rule.

Once the rule has been added – link the rule to the Scheme Membership Group (SMG).

Reminder: On this screen, we indicate – WHO WILL PAY ADMIN FEE

From the Potential list of Membership, insert those applicable.

Use the cancel/close buttons to navigate back to the Scheme Income Type List.

The above steps (Admin Fee) can be repeated for the following income types:

- Dread Disease

- GLA

- Funeral

- Disability

- PHI

DREAD DISEASE (EXAMPLE)

Highlight the income type, from the menu on the left, click on the SCHEME GLOBAL RULES LIST MENU.

Click on the NEW button to add a rule

Similar to the ADMIN FEE add the rule with the applicable rate.

Now, link the rule to the Scheme Membership Group.

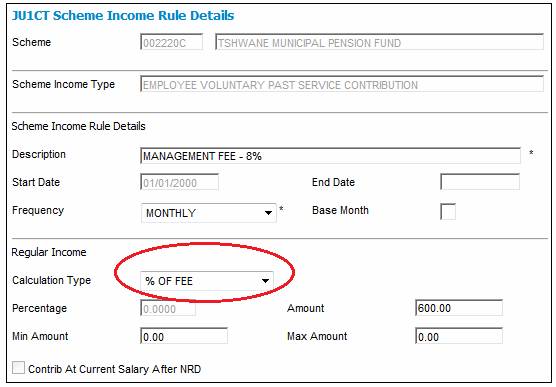

MANAGEMENT FEE

Highlight the income type, from the menu on the left, click on the SCHEME GLOBAL RULES LIST MENU.

Click on the NEW button to add a rule.

Complete the details below.

Click on the VALIDATE and OK buttons to save the rule.

Once the rule is added, link the rule to the SMG.

An additional step is required for MANAGEMENT FEE as we need to indicate against which FEE the 8 % is calculated.

Highlight the rule and from the menu on the left, click on the ASSOCIATE RULE TO INCOME TYPE menu.

From the Potential list on the left, insert ADMIN FEE (i.e. Management Fee is 8% of ADMIN FEE).

EMPLOYEE & EMPLOYER CONTRIBUTIONS

Highlight the income type and from the menu on the left click on SCHEME INCOME SPLIT LIST.

Use the FLOW buttons, to insert the portfolio (where the contribution will be invested).

If the whole contribution is going to this portfolio, set the ALLOCATION PERCENTAGE = 100%.

Use the close/cancel options to navigate back to the Scheme Income Type List.

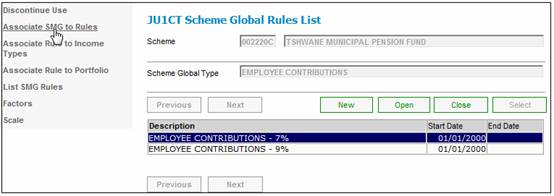

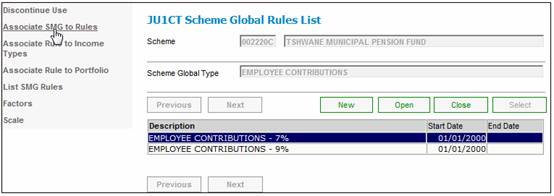

Highlight the contribution again and add a rule.

Click on the NEW button to add a rule.

Complete the fields as indicated below (as an example).

Click the VALIDATE and OK buttons to save the rule.

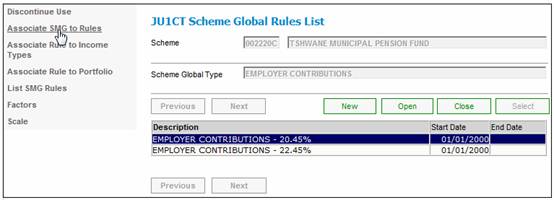

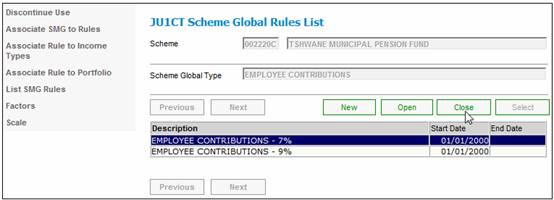

If there is more than 1 rate, click on the new button to add the 2nd rule.

Both rules will be listed.

Link the appropriate rule to the correct membership group.

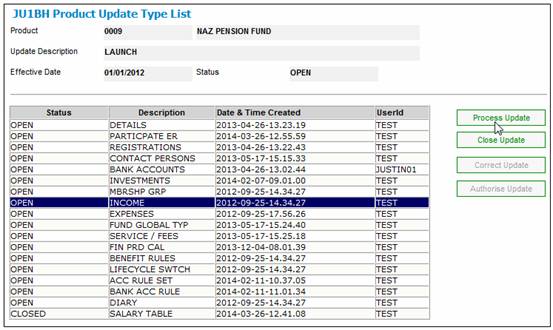

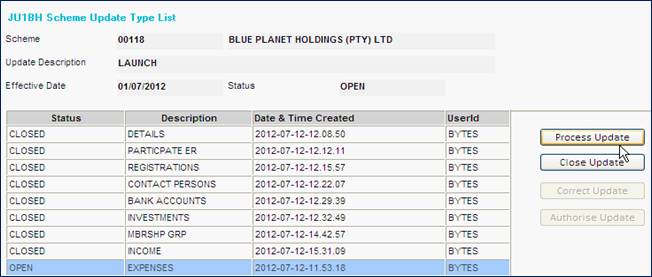

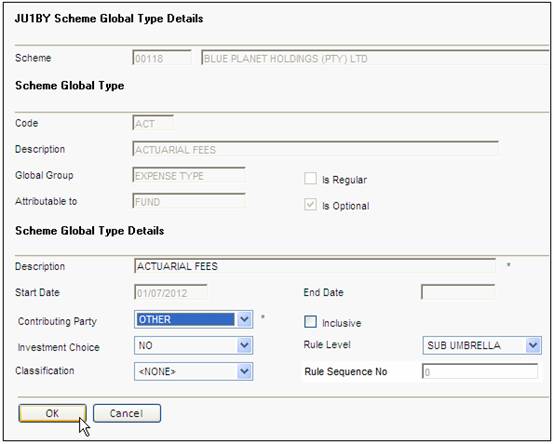

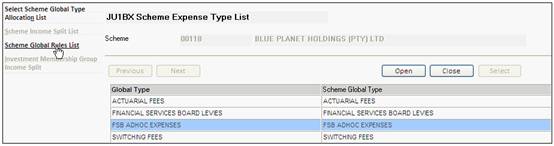

In this section we link in additional Global types for any expenses (e.g. FSB).

Highlight the EXPENSES update type and click on the PROCES UPDATE button.

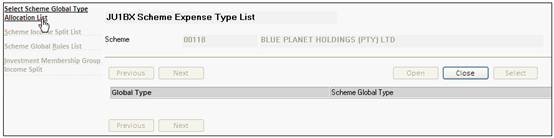

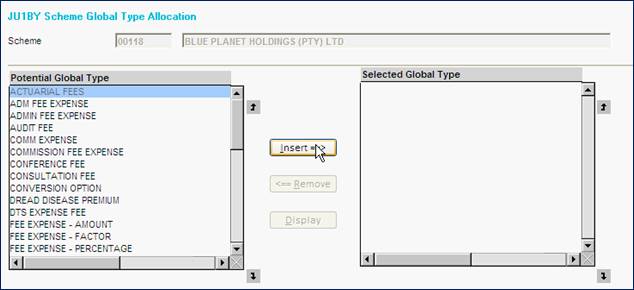

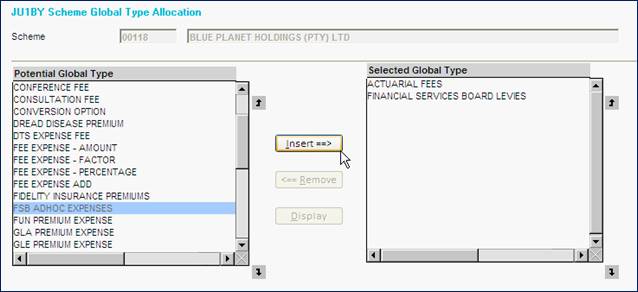

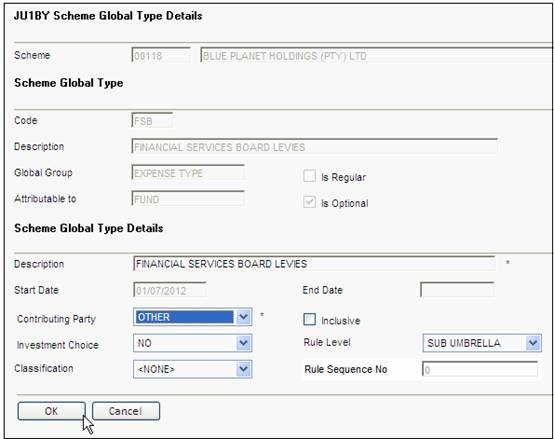

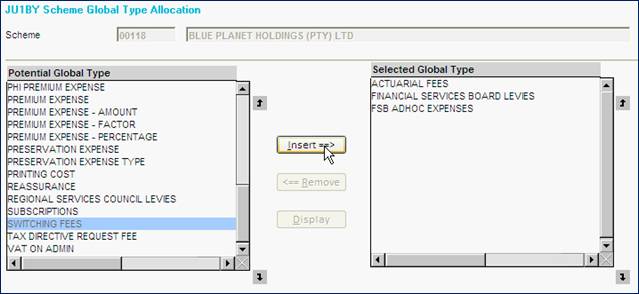

From the menu on the left click on SCHEME GLOBAL TYPE ALLOCATION LIST (to link in the applicable expense types).

Add in the Expense Types displayed below

- ACTUARIAL FEES

- FINANCIAL SERVICES BOARD LEVIES

- FSB ADHOC EXPENSES

- SWITCHING FEES

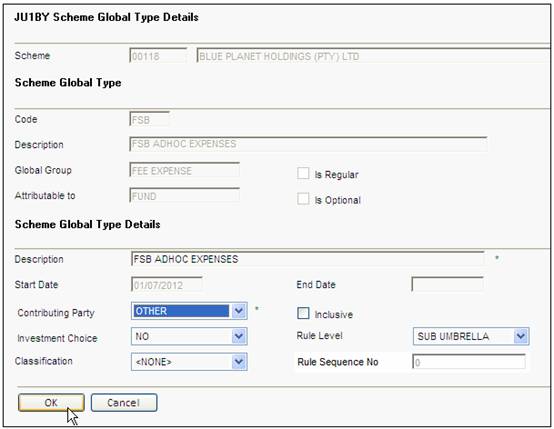

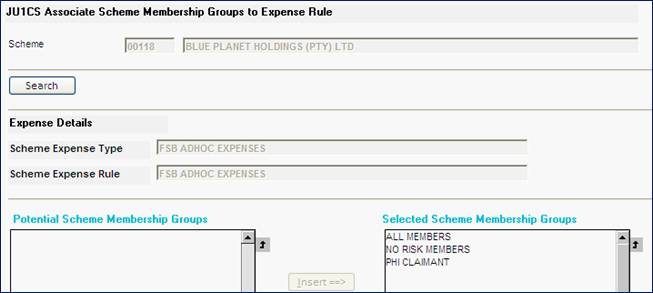

FSB ADHOC EXPENSES

Highlight FSB ADHOC EXPENSES and click on the SCHEME GLOBAL RULES LIST menu.

Click on the NEW button to add a rule (as there is no fixed amount for FSB ADHOC EXPENSES, no fixed value will be entered).

Link this rule to the relevant SCHEME MEMBERSHIP GROUPS (SMG).

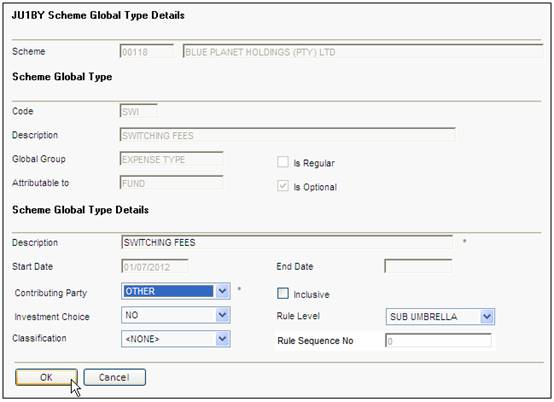

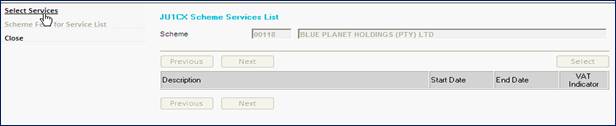

In this section we need to link a SERVICE FEE for the SWITCHING EXPENSE.

Highlight the SERVICE / FEES update type and click on the PROCESS UPDATE button.

From the menu on the left, click on SELECT SERVICES.

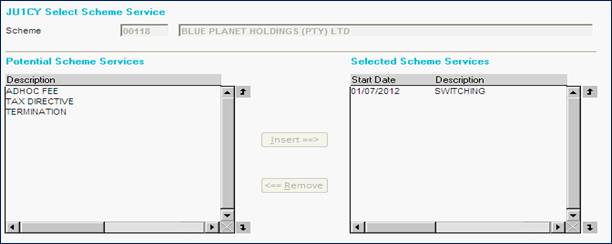

From the POTENTIAL LIST insert SWITCHING.

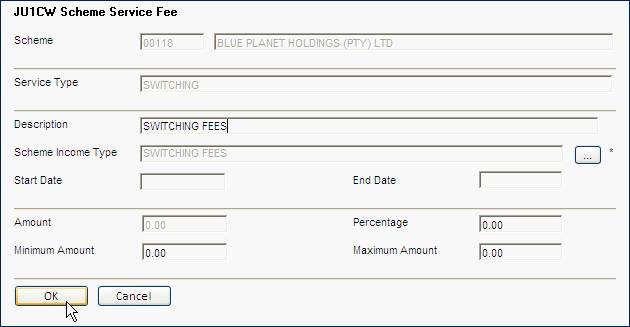

Highlight the SWITCHING SERVICE and link in a FEE.

Click on the NEW button to add a rule.

Note:

Currently, no FEE is applicable; therefore the values will be 0.00.

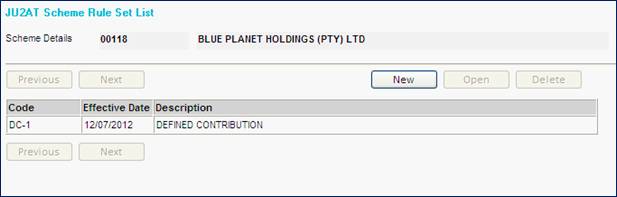

In this section we link the product to a set of Accounting Rules.

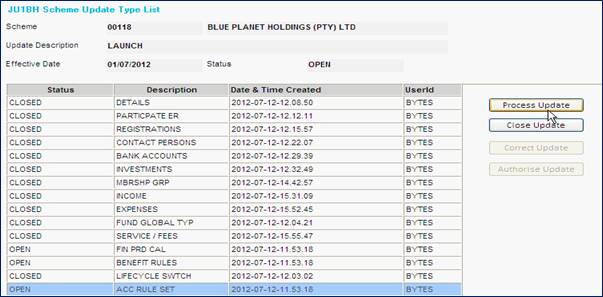

Highlight the ACC RULE SET update type and click on the PROCESS UPDATE button.

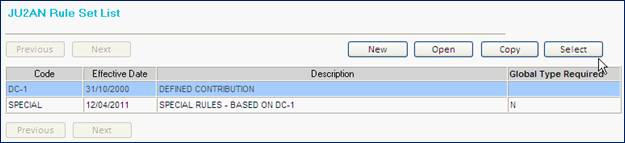

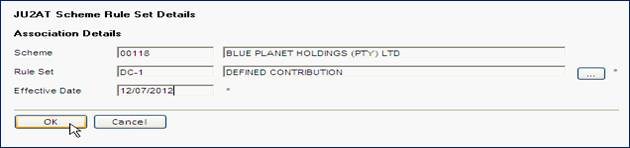

Click on the NEW button and Flow to the list of Rule-Sets. Always select DC-1.

EFFECTIVE DATE = CURRENT DATE.

The product is now linked to this rule-set.