Terminations are processed as benefit payments, using a benefit event of WITHDRAWAL.

Refer to

Processes

Benefits

Claims Administration Overview

In order to calculate and deduct the termination fee, a benefit adjustment must be done.

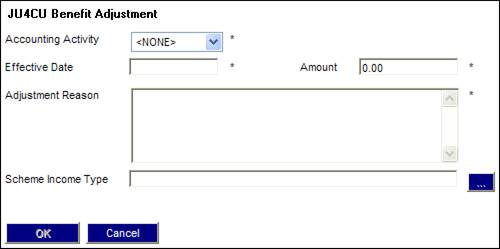

From the JU4CU Benefit Adjustment screen, select an accounting activity of TERMINATION FEE from the drop-down list, then enter the effective date, amount, and a description of the adjustment in the ADJUSTMENT REASON box.

When the TERMINATE FEE accounting activity is selected, the following will be applied:

If there is an expense rule for which the FORMULA APPLIED TO is BENEFIT AMOUNT for the benefit membership group to which the member is linked, the system will calculate the fee according to the expense rule, and create the TERMINATE FEE business transactions for the amount calculated.

- If the formula type is PERCENTAGE, the fee will be calculated as a percentage of the amount realized, i.e. the realization accounting activities in the member's BENPAYABLE account using the percentage on the scale linked to the expense rule. Any minimum or maximum values will be applied.

- If the formula type is AMOUNT, the fee will be calculated according to the amount on the scale linked to the expense rule.

Refer to

Processes

Benefits

Benefit Payment Update Type

Benefit Payment Update Types (Standard Benefit Rules)

Benefit Payment Update Type: Adjust Benefit

OR

Processes

Benefits

Benefit Payment Update Type

Benefit Payment Update Types (Flexible Benefit Rules)

Benefit Payment Update Type: Adjust Benefit