This process allows the business to maintain the tax calculation formulae required when calculating tax due on benefit payments.

From the System Data menu on the top, select Tax Tables from the sub-menu on the left.

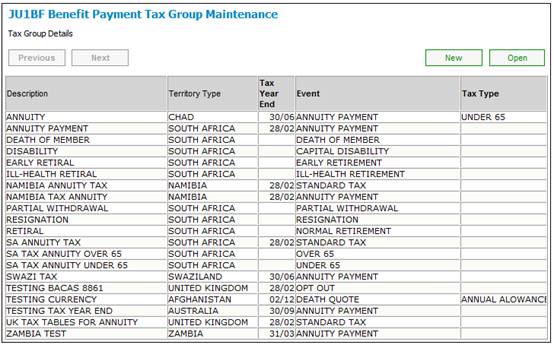

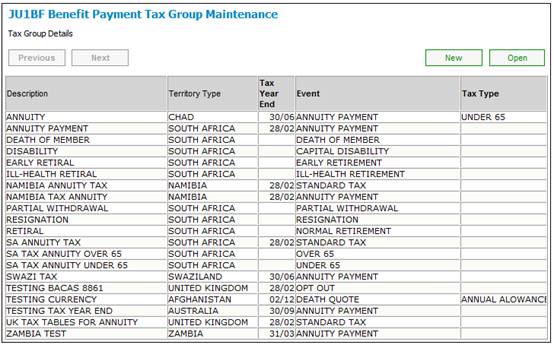

The JU1BF Benefit Payment Tax Group Maintenance screen will be displayed.

A sub-menu will be displayed on the left.

![]()

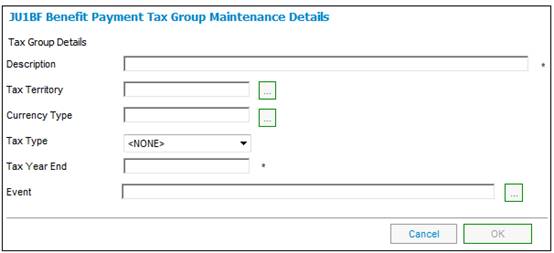

To add a new benefit payment tax group, click NEW.

The JU1BF Benefit Payment Tax Group Maintenance Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Description |

Description of the benefit payment tax group |

|

Territory Type |

Click LIST to select a Territory from a list. |

|

Currency Type |

Click LIST to select a Currency from a list. |

|

Tax Type |

A classification on the Benefit Product Scale to lookup the legislative tax details where Formula Applied To = TAXRATES.

Select a value from the drop-down list. E.g. Over 65, Under 65.

The capture of a value is optional.

Note: For UK members of a money purchase product that is contracted out i.e. does not participate in the additional state pension, the equivalent portion of the contribution that would have been paid to the National Insurance Contribution Office (NICO) is paid into the pension fund each month.

For those members that have not reached State Pension Age an Age Related Rebate is received annually from NICO based on their earnings on which their National Insurance contributions are based.

The rebate for each member is calculated annually using the applicable earnings and the percentage applicable to the member’s age as at the start of the tax year. |

|

Tax Year End |

The day and month end of the tax year |

|

Event |

The benefit payment event type being maintained for the tax calculation. Click LIST to select an Event Category and Event Type from a list. (see screen below and refer to the benefit rules documentation) |

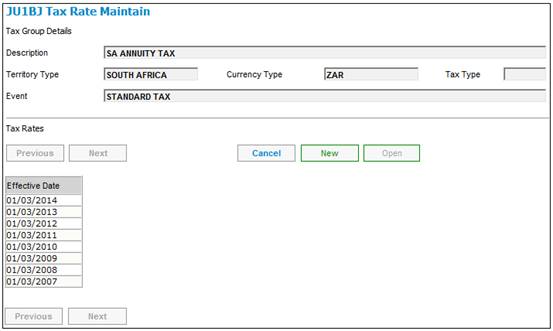

This facility is used to record the tax rate values and the effective date of the tax rates for use in the calculation of tax on benefit payments.

From the JU1BF Benefit Payment Tax Group Maintenance screen, select a tax group, then select Tax Rates from the sub-menu on the left.

The JU1BJ Tax Rate Maintain screen will be displayed.

A sub-menu will be displayed on the left.

To add the ages, rebate amounts and percentages applicable to each tax rate, from the JU1BJ Tax Rate Maintain screen, highlight an effective date for a tax rate and select Rebates from the sub-menu on the left.

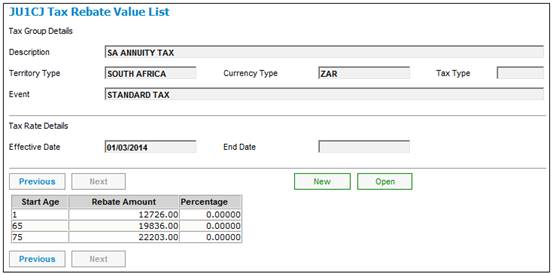

The JU1CJ Tax Rebate Value List screen will be displayed.

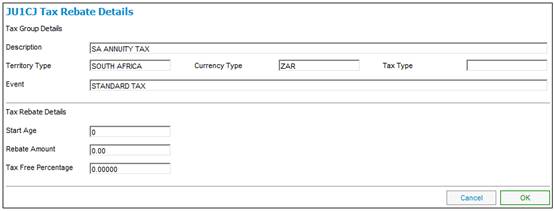

Click NEW. The JU1CJ Tax Rebate Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Tax Rebate Details |

|

|

Start Age |

The age from which the rebate will apply Note: The first start age must always be 1, to ensure there is a rebate amount for every age. |

|

Rebate Amount |

The amount of the rebate |

|

Tax Free Percentage |

The percentage that is tax free |

Capture the required information, then click OK. The JU1CJ Tax Rebate Value List screen will be re-displayed.

Click ![]() to return to the JU1BJ Tax Rate Maintain screen.

to return to the JU1BJ Tax Rate Maintain screen.

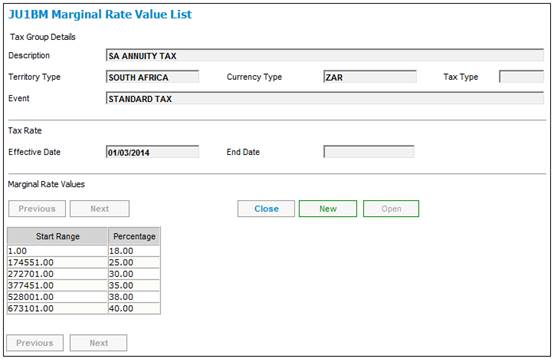

To capture marginal rates, from the JU1BJ Tax Rate Maintain screen, highlight an effective date for a tax rate and select Marginal Rates from the sub-menu on the left.

The JU1BM Marginal Rate Value List screen will be displayed.

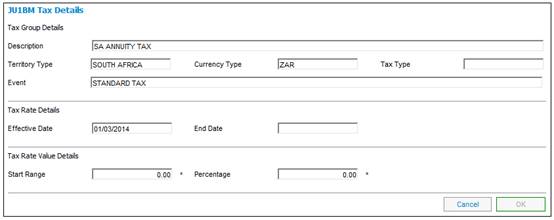

Click NEW. The JU1BM Tax Details screen will be displayed.

Capture the required information, then click OK. The JU1BM Marginal Rate Value List screen will be re-displayed.

Click ![]() to return to the JU1BJ Tax Rate Maintain screen.

to return to the JU1BJ Tax Rate Maintain screen.

This facility is used to record the current estimated net remuneration (ENR) amount to be used in tax calculations.

From the JU1BF Benefit Payment Tax Group Maintenance screen, select a tax group, then select Tax Limits from the sub-menu on the left.

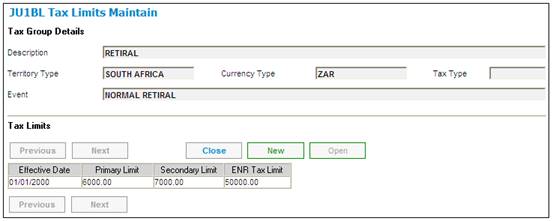

The JU1BL Tax Limits Maintain screen will be displayed.

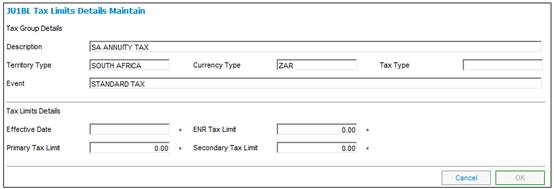

To record a new tax table, click NEW. The JU1BL Tax Limits Details Maintain screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Effective Date |

The date the tax limits become effective |

|

ENR Tax Limit |

A salary limit based on estimated net remuneration. ENR below this limit allows the administrator to do calculation and deduct tax from benefit. SARS to do calculation if above this limit |

|

Primary Tax Limit |

A benefit limit amount above which tax application must be sent to SARS |

|

Secondary Tax Limit |

A benefit limit amount above which tax application must be sent to SARS and the limit above which tax must be deducted. Benefits below this limit and above the primary limit, no tax to be deducted but SARS to be informed of the benefits. |

Capture the required information, then click OK. The JU1BL Tax Limits Maintain screen will be re-displayed.

Click ![]() to return to the JU1BF Benefit Payment Tax Group Maintenance screen.

to return to the JU1BF Benefit Payment Tax Group Maintenance screen.

Refer to

Supplements

Calculation of Monthly PAYE for Annuities

Note:

For Swaziland tax, refer to

Client Specific

PSPF

Annuity Tax Computation Method

Annuity Tax Computation Method