For information on the MI Dashboard, refer to MI Dashboard under

System Reports

MI Reports

Log in to the system from the Logon page.

Click processes, then click tax.

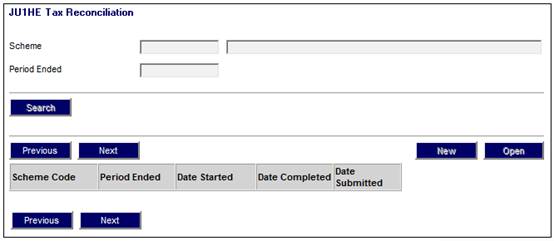

From the main menu on top, select Tax Reconciliation. The JU1HE Tax Reconciliation screen will be displayed.

The following menu options will be displayed in the sub-menu on the left:

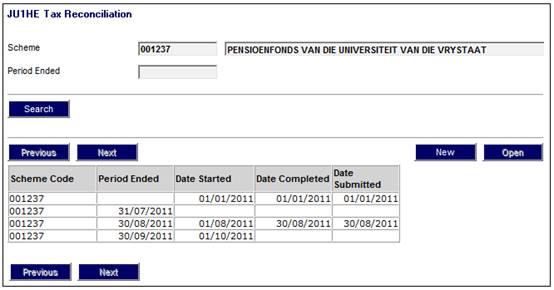

To display all tax reconciliation records for a scheme, capture a scheme code in the Scheme field and click SEARCH.

To display a tax reconciliation record for a particular period for a scheme, capture a scheme code in the Scheme field and a financial period in the Period Ended field. Click SEARCH.

The details will be displayed on the JU1HE Tax Reconciliation screen.

The following columns are displayed:

- Scheme Code

- Quarter Ended

- Date Started

- Date Completed

- Date Submitted

To create a new tax reconciliation record, click NEW.

The system will read the Business Process Template with a Business Process of TAX RECON linked to the Scheme and read the Process Functions linked to the template.

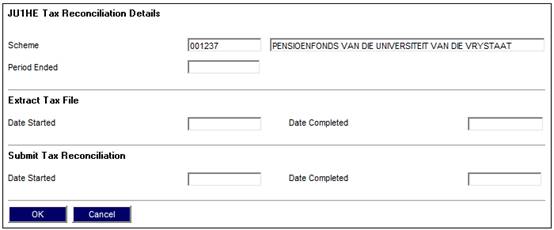

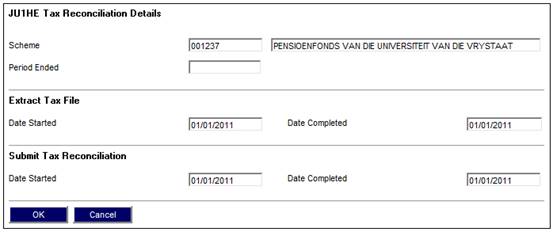

The JU1HE Tax Reconciliation Details screen will be displayed.

Capture details for the following fields:

|

Period Ended |

The date on which the tax reconciliation period ended. |

|

Extract Tax File |

|

|

Date Started |

The date on which the tax reconciliation was started. |

|

Date Completed |

The date on which the tax reconciliation was completed. |

|

Submit Tax Reconciliation |

|

|

Date Started |

The date on which the tax reconciliation was started. |

|

Date Completed |

The date on which the tax reconciliation was completed. |

Click OK.

The system will create a Process Control record with a Business Process of TAX RECON.

To display an existing tax reconciliation record, highlight a tax reconciliation record on the JU1HE Tax Reconciliation screen and click OPEN.

The JU1HE Tax Reconciliation Details screen will be displayed.

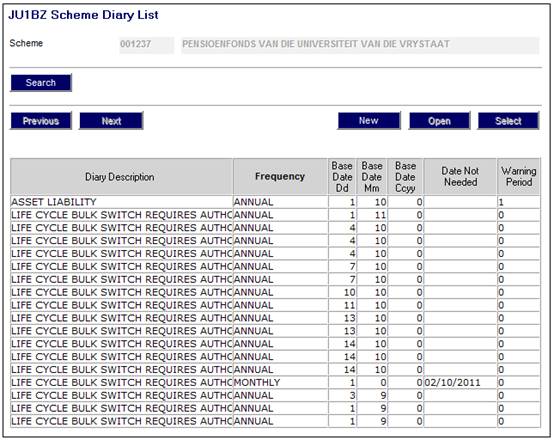

This facility allows events that occur on a monthly, annual or ad hoc basis to be diarised.

Highlight an asset/liability matching record on the JU1HE Tax Reconciliation screen. The following menu options will be displayed in the sub-menu on the left:

Select Diary.

The JU1BZ Scheme Diary List screen will be displayed.

For more information refer to Diary under

Product Launch Requirements

Additional Menu Options

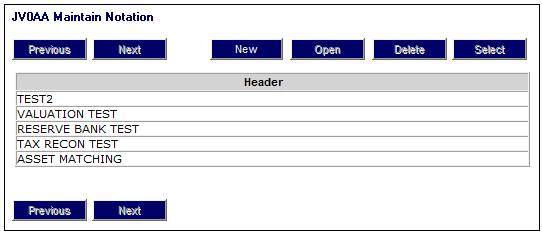

The notation facility allows the addition of any number of free form text notes for a scheme. These notes are usually reminders of things that cannot be stored on the system.

Highlight an asset/liability matching record on the JU1HE Tax Reconciliation screen. The following menu options will be displayed in the sub-menu on the left:

Select Notes.

The JV0AA Maintain Notation screen will be displayed.

For more information refer to Notes under

Product Launch Requirements

Additional Menu Options