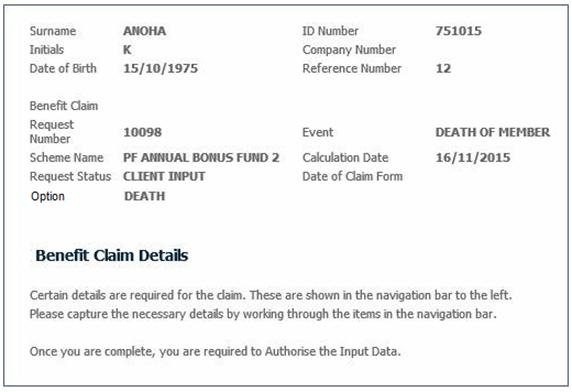

From the Benefit Claim Details screen, select Tax Details from the sub-menu on the left. The lower portion of the screen expands to display Tax Details.

Scroll to the lower section of the screen, and provide the necessary details:

Note:

Always check to see if there are any documents that have been uploaded for the member as these documents may contain information required to be captured on this screen. Documents that have been uploaded are selected from the View Document menu option.

For more information, refer to

Processes

Benefits

Benefit Payments Processing

Capturing of Exit Notifications

Complete a Claim

Documents

|

Tax Ref. Number |

The member’s Tax Reference required when applying for tax. |

|

Reason |

If the Tax Ref. Number is not provided, select a reason from the drop-down list. |

|

Other |

If the reason is not included on the drop-down list, enter free form text explaining why the Tax Ref. Number is not provided. |

|

ID Number |

|

|

First Name1 |

If there is a value for FIRST NAME 1 on the Natural Person record to which the Membership is linked, the system will display the value in this field. When the Tax Details screen is saved, the TAXPAYER FIRST NAME 1 field will be updated on the Benefit Tax Directive record. When the screen is closed, if there is no value for First Name 1, the following error message will be displayed:

A first Name is required |

|

First name 2 |

If these is a value for FIRST NAME 2 on the Natural Person record to which the Membership is linked, the system will display the value in this field. When the Tax Details screen is saved, the TAXPAYER FIRST NAME 2 field will be updated on the Benefit Tax Directive record. |

|

Other ID Number |

Required if no ID Number is specified. |

|

Residential Address |

|

|

Postal Code (Residential Address) |

|

|

Postal address is the same as the Residential Address |

Complete the tick box, as appropriate. |

|

Postal Address |

|

|

Postal Code (Postal Address) |

|

|

Excess Contributions |

Enter the total of any excess contributions during the membership. |

|

Estimated Net Remuneration |

The estimated net amount of remuneration. |

|

Current Gross Annual Taxable Salary |

This defaults to the member's monthly salary as at date of exit, multiplied by 12. This can be overwritten if necessary. |

|

LESS Total Annual Pension Contributions |

The total amount of annual pension contributions made. |

|

LESS Additional Voluntary Contributions |

The amount of additional voluntary contributions made. |

|

Retirement Annuity Contributions |

The total amount of retirement annuity contributions made. |

|

Arrear Retirement Annuity Contributions |

The total amount of arrear retirement annuity contributions made. |

|

PLUS Any Annual Bonus paid during the tax year |

The amount of any annual bonus paid during the tax year. |

If a retirement or death benefit is being processed, the Tax Details screen displayed on the lower portion of the screen is different.

Scroll to the lower section of the screen, and provide the necessary details:

|

Tax Ref. Number |

The member’s Tax Reference required when applying for tax. |

|

Reason |

If the Tax Ref. Number is not provided, select a reason from the drop-down list. |

|

Other |

If the reason is not included on the drop-down list, enter free form text explaining why the Tax Ref. Number is not provided. |

|

First Name1 |

If there is a value for FIRST NAME 1 on the Natural Person record to which the Membership is linked, the system will display the value in this field. When the Tax Details screen is saved, the TAXPAYER FIRST NAME 1 field will be updated on the Benefit Tax Directive record. When the screen is closed, if there is no value for First Name 1, the following error message will be displayed:

A first Name is required |

|

First name 2 |

If these is a value for FIRST NAME 2 on the Natural Person record to which the Membership is linked, the system will display the value in this field. When the Tax Details screen is saved, the TAXPAYER FIRST NAME 2 field will be updated on the Benefit Tax Directive record. |

|

ID Number |

|

|

Other ID Number |

Required if no ID Number is specified. |

|

Residential Address |

|

|

Postal Code (Residential Address) |

|

|

Postal address is the same as the Residential Address |

Complete the tick box, as appropriate. |

|

Postal Address |

|

|

Postal Code (Postal Address) |

|

|

Excess Contributions |

Enter the total of any excess contributions during the membership. |

|

Gross Annual Taxable Salary |

The gross annual taxable salary. |

|

Current Gross Annual Taxable Salary |

This defaults to the member's monthly salary as at date of exit, multiplied by 12. This can be overwritten if necessary. |

|

Tax Directive Application Form 'D' Information (Tax Year Ending and Annual Salary) |

Line 1 will default to the current tax year end date, and the salary will default to the member's monthly salary as at date of exit, multiplied by 12. This can be overwritten if necessary. Enter the dates and amounts for the highest average annual salaries earned during any 5 consecutive years of service. |

|

Annual salary |

The member’s annual earnings.

Includes any amount received or receivable annually under a contract of service including cost of living allowances, commission, share of profits, etc. but not occasional bonuses or fees. |

Once all the details have been captured, click SUBMIT.

The Benefit Claim Details screen will be re-displayed.

For additional tax information, refer to

Supplements

SARS Interface