This report displays details of tax payable.

The report is produced in two stages:

- input the selection criteria and submit the job

Note:

The reports are not displayed automatically.

- view the completed reports.

Reports can be exported.

For more information, refer to

Supplements

Calculation of Monthly PAYE for Annuities

For details of scenarios where the payment start date has an influence in determining the tax period, therefore affecting the way in which tax is calculated, refer to

Supplements

Use of Payment Start Date for Annuity Tax Calculation

From the Reports menu, click ![]() alongside Tax on the sub-menu on the left. Additional options will be displayed.

alongside Tax on the sub-menu on the left. Additional options will be displayed.

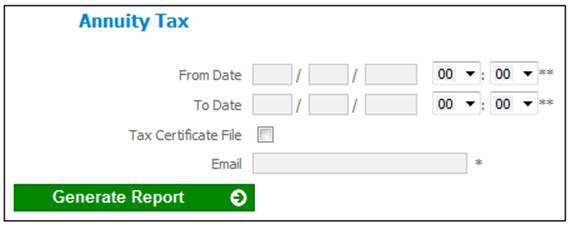

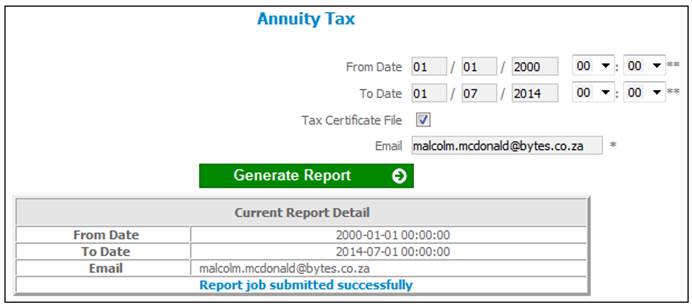

Click New below Tax. The Annuity Tax screen will be displayed.

Select the required FROM DATE (optional) and specify the TO DATE and e-mail address (mandatory). If you require a tax certificate file, place a tick in the box alongside TAX CERTIFICATE FILE (refer to Export below).

Click GENERATE REPORT.

The current report detail will be displayed on the lower portion of the screen.

A message will indicate once the job has been successfully submitted (and an e-mail will be sent to you).

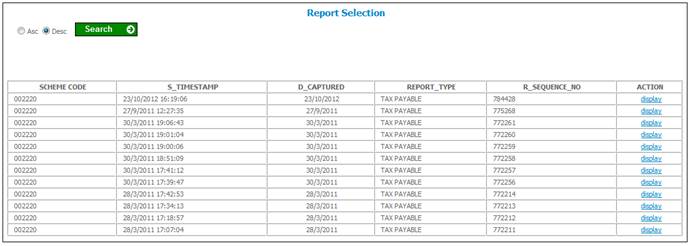

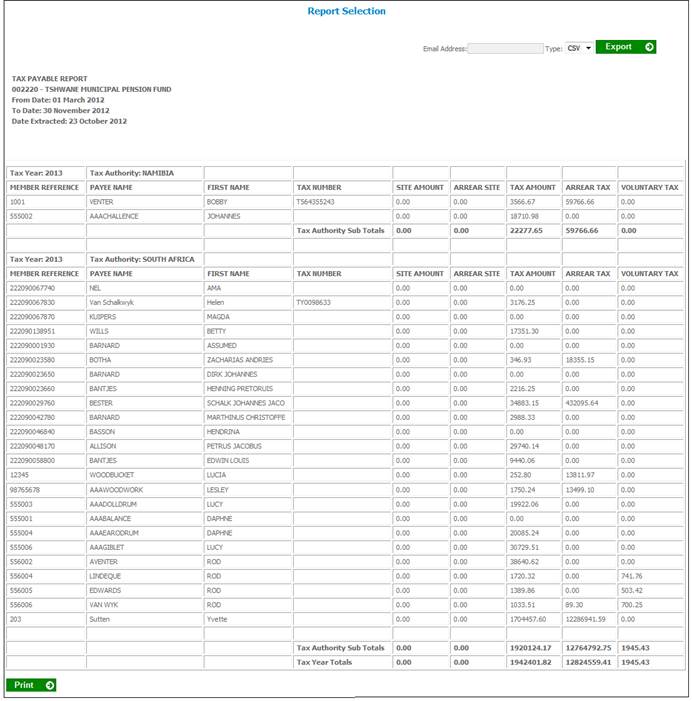

Click View below Tax. The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme code

- Timestamp

- Date captured

- Report type

- Sequence number

- Action

To select a report, click on the hyperlinked display in the Action column alongside the appropriate report.

The Report Selection screen will be displayed.

The following columns are displayed, per tax year:

- Member reference number

- Payee name

- First name

- Tax number

- Site Amount

- Arrear Site

- Tax amount

- Arrear tax

- Voluntary tax

Note:

Reports will only be available for export if a tick was placed in the box alongside TAX CERTIFICATE FILE (refer to New above).

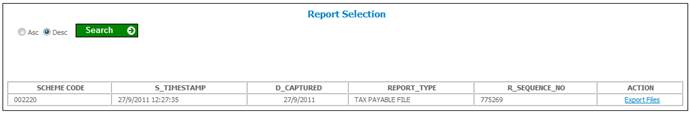

Click Export below Tax. The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme code

- Timestamp

- Date captured

- Report type

- Sequence number

- Action

To export a report, click on the hyperlinked Export Files in the Action column alongside the appropriate report.

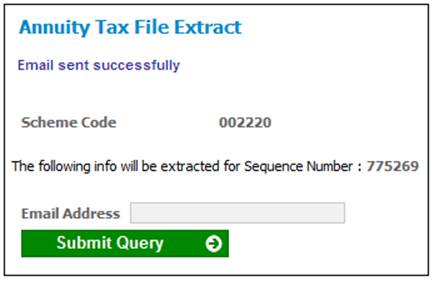

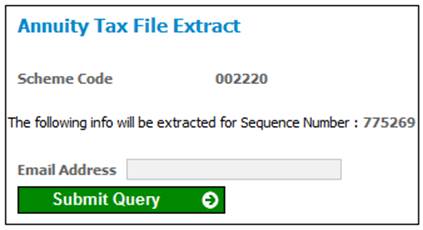

The Annuity Tax File Extract screen will be displayed.

Enter the e-mail address to which the file must be sent and click SUBMIT QUERY.

The Annuity Tax File Extract screen will be displayed, and a confirmation message will indicate that the e-mail has been sent.