Applies for Type of Run:

- ANNUITIES

- BENEFICIARY FND

- INVESTMENT FUND

- LIVING ANNUITIES

- INVESTMENT FUND

- TRUST

This report is done per payment run and displays all cases where an Annuitant or Beneficiary’s Tax amount has increased from the previous month.

Note:

This Schedule Reconciliation Report is also available as a report for payment run reconciliation purposes in the Processes > Regular Payments > Reports > Summarised Recon Report.

The Summarised Recon Report shows all of the changes for all the schemes for all the payment days under a holding fund for a specific month.

Refer to the TAXINCR XL Spreadsheet that is extracted in the Summarised Recon Report.

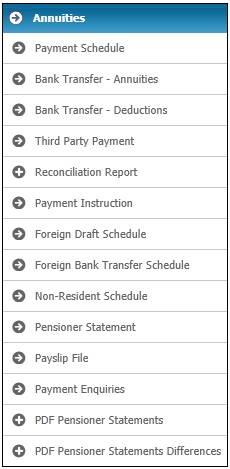

From the Annuities menu, click ![]() alongside Reconciliation Report on the sub-menu on the left.

alongside Reconciliation Report on the sub-menu on the left.

Additional options will be displayed.

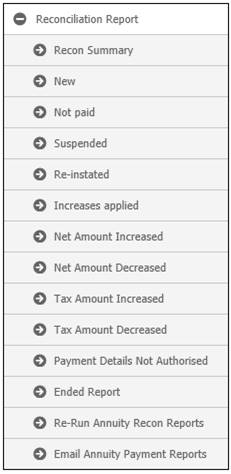

Select Tax Amount Increased below Reconciliation Report on the menu.

The following screen is displayed.

The following columns are displayed:

- Scheme Code

- Date Captured

- Report Type

- Sequence Number

- Scheme Code

- Scheme Name

- Report Header Sequence Number

- Action

Scheme Code

If a Scheme Code is captured and SEARCH is selected, the system will display the applicable report for only the Scheme selected in the list for the run.

If the Scheme Code is deleted and SEARCH is selected, the system will display the screen with all of the reports for the run.

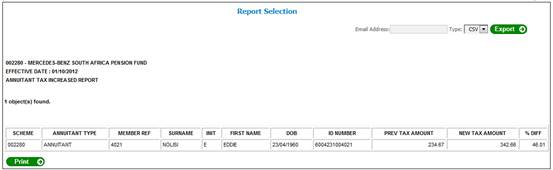

Click display alongside the required report. The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme Code

- Annuitant Type

- Member Reference Number

- Surname

- Initials

- First Name

- Date of Birth

- ID Number

- Previous Tax Amount

- New Tax Amount

- Percentage Difference

Click PRINT in order to print the report.