There are two methods of loading values onto the system.

- uploading using the ad-hoc income process

- uploading using the conversion utility

The method used depends on the reason for the value being take-on to the system.

When a new employee joins the Fund and takes up employment at a new employer and his/her previous contributions are transferred, then this money is deposited in the Fund’s bank account.

Load the transfer value via the ad-hoc income process.

For more details refer to Upload Files under

Processes

Contributions

Income

A comma delimited file containing the relevant data must be loaded and then processed in the same way as contributions received from the employer.

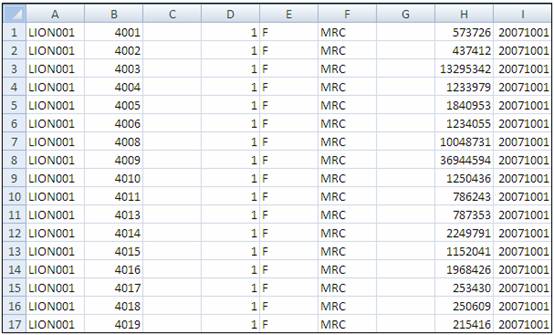

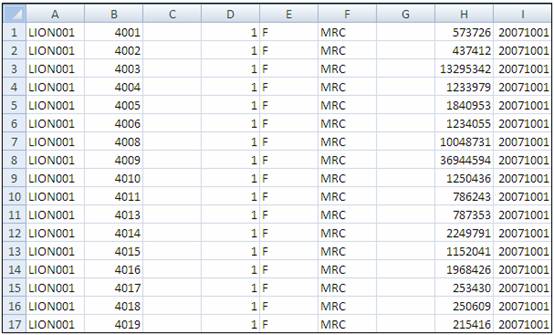

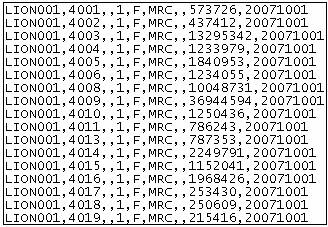

This data can also be received from another administrator in a comma-delimited file which is then imported into an Excel spreadsheet.

Note:

Fund and member level contribution entries will be created.

Investment entries and investment advices will be created.

Create the journals to record the deposits and pay over investments.

Any monies transferred from another fund for an individual or for a group of members can be loaded via the ad-hoc income process.

Example:

When a fund moves between administrators and the money remains invested with the existing investment houses.

A text file containing the relevant data must be loaded.

This data can also be received from another administrator in a comma-delimited file, which is then imported into an Excel spreadsheet. It must be converted to a text file.

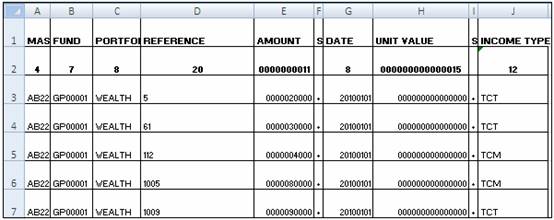

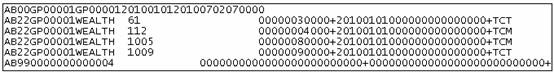

Load the take-on values using the AB22 input file layout. For more details refer to Annexure C: Member Financial under

Processes

File Layouts

Member Financial

Note:

The fund and member level investment entries will be created.

No investment advices will be created.

Create the journals to record the value of the investments in the fund's ledger (if it has not already been created). No money will be deposited in the fund's bank account.