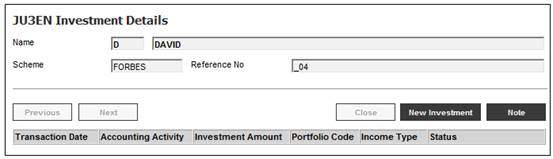

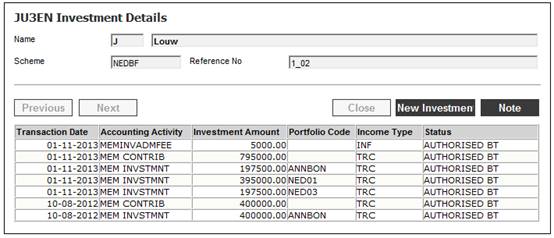

If the member has a Membership Status of Beneficiary, the JU3EN Investment Details screen will be displayed.

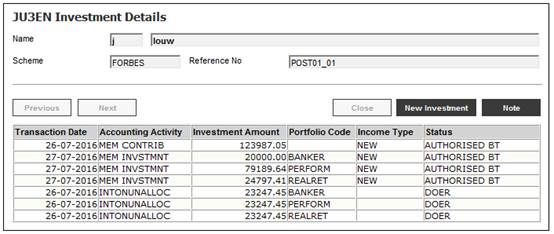

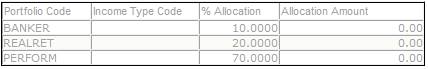

If data has been captured, this screen displays the investment amounts per Portfolio and Income Type and the Accounting Activity that will produce the business transactions.

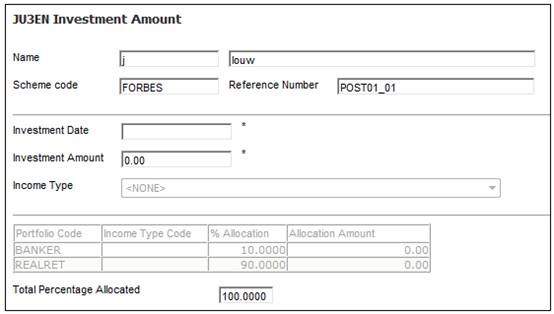

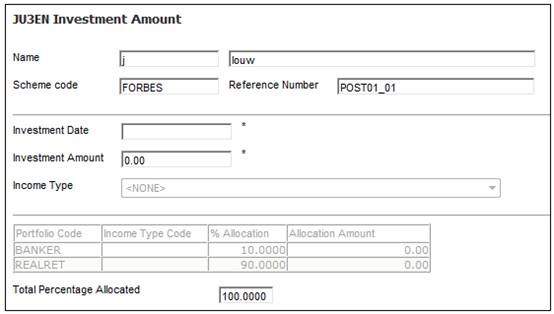

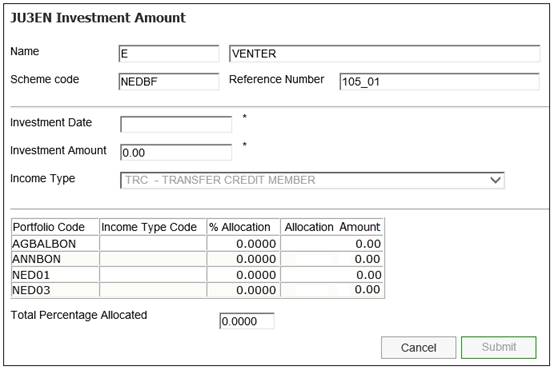

To capture new details, click NEW INVESTMENT. The JU3EN Investment Amount screen will be displayed.

Capture data as follows:

|

Investment Date |

The date of investment |

|

Investment Amount |

The amount to be investment |

|

Income Type |

Select the Income Type to which the investment must be applied, from the drop-down list. The drop-down list will display both the Income Type Code and the Income Type Description. |

|

% Allocation |

The percentage of the death benefit that this beneficiary is to receive (refer to Allocating percentage below).

Note: As values are captured in this field, the system updates the total in the Total Percentage Allocated field, until the percentages total is 100%. |

|

Allocation Amount |

The amounts allocated per Portfolio |

Select an Income Type from the drop-down list then double-click on the percentage in the % Allocation column for the appropriate Portfolio.

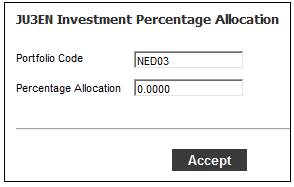

The JU3EN Investment Percentage Allocation screen will be displayed.

Capture the percentage to be allocated, in the Percentage Allocation field, and click ACCEPT.

The JU3EN Investment Amount screen will be redisplayed with the value captured.

Continue capturing values in the required Percentage Allocation fields until these total 100%.

Note:

As a value is captured in the Percentage Allocation field, the system updates the total in the Total Percentage Allocated field, until the percentages total 100%.

Once all of the data has been captured, click SUBMIT.

Note:

SUBMIT will not be enabled for selection until the percentages captured in the Percentage Allocation fields total 100% exactly.

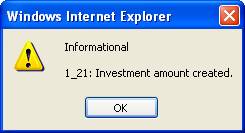

A confirmation message will be displayed.

Click OK to remove the message. The JU3EN Investment Details screen will be updated with the data captured.

Capture data for each of the beneficiaries related to the deceased member.

When SAVE is selected on the JU3EN Investment Amount screen, the system will read the value for Life Cycle Investment Default on the Scheme Details. If it is Y then it will find the Investment Membership Groups for which the value for Life Cycle is Y and read the value for Life cycle Basis. If it is AGE AND AMOUNT then it will find the Investment Membership Group for which From Age is less than or equal to Member’s age and the To Age is greater than the Member’s Age and the value for Start Amount is less than or equal to the Member’s Investment Amount and End Amount is the greater than the Member’s Investment Amount.

When allocating the Member’s net investment amount, i.e. the investment amount less fees, the system will read the Investment Allocation linked to the applicable Investment Membership Group as per above and check the values for Minimum Investment and Maximum Investment on the Investment Mediums linked to the Investment Allocation for the Membership Group.

The investment amounts per Portfolio will be calculated based on the percentages per Portfolio. The system will check the value calculated for the Portfolio for which the values for Minimum Investment and/or Maximum Investment on the Investment Medium to which the Portfolio is linked are not null.

If the allocation calculated for that Portfolio is less than the value for Minimum Investment Amount, the value for the Investment Amount for that Portfolio will be set to the Minimum Investment Amount value. The system will read the value for Sequence Number on the Invest To Portfolio record for the Membership Group and adjust the allocation for the Portfolio with the next sequence number to the one with the value for Minimum Investment by the difference between the allocation calculated for the Portfolio with the Minimum Investment Amount and the allocation calculated for that Portfolio.

If the allocation calculated for that Portfolio is greater than the value for Maximum Investment Amount, the value for the Investment Amount for that Portfolio will be set to the Maximum Investment Amount value. The system will read the value for Sequence Number on the Invest To Portfolio record for the Membership Group and adjust allocation for the Portfolio with the next sequence number to the one with the value for Maximum Investment by the difference between the allocation calculated for the Portfolio with the Maximum Investment Amount and the allocation calculated for that Portfolio.

The system will read the value for the Scheme Parameter BEN TERM PERIOD (value in months) and if a value is found, will read value for Period End on the Member Values record with a Type of BENEFICIARY FUND, Subtype of TERMINATION and Subtype Detail of TERMINATION DTE. The period from the Start Date of the members CAR record to the Period End date will be determined. If the period is greater than the value for BEN TERM PERIOD the net investment amount based on the Investment Split for the applicable Membership Group will be allocated. If the period is less than the value for the BEN TERM PERIOD Scheme Parameter then the system will read the value for the Scheme Parameter BEN TERM PORT.

If there is a BEN TERM PORT Scheme Parameter and the value for Description on the BEN TERM PORT Scheme Parameter is equal to the Portfolio Code for one of the Portfolios linked to the Allocation for the Investment Membership Group applicable to the Member, then a percentage of the net investment amount to this Portfolios will not be allocated. The system will allocate the amount that would have been allocated to this Portfolio to the Portfolio for which the Allocation Sequence Number is immediately prior to the restricted Portfolio with the lowest sequence number.

If no BEN TERM PORT Scheme Parameter is found or the value for Description on the BEN TERM PORT is not equal to one of the Portfolios linked to the Membership Group, the net investment amount will be allocated based on the Investment Split for the applicable Membership Group.

Example:

BEN TERM PERIOD = 2 years

BEN TERM PORT = Income Fund1

Allocation:

Portfolio: Cash Sequence No: 1 Allocation: 25%

Portfolio: Income Fund Sequence No: 2 Allocation: 75%

Beneficiary’s period to termination is less than 2 years

Allocation:

Portfolio: Cash Allocation: 100%

Portfolio: Income Fund Allocation: 0%

The percentage allocation will be calculated and the values will be displayed in the % Allocation column. The allocation amounts per Portfolio will be displayed in the Allocation Amount column.

When SUBMIT is selected the MEM INVSTMNT Pre-Authorised Business Transactions (BT’s) will be created.