The following is the setup required to provide a process for the administration of deferred annuity increases for members, spouses and disabled dependents who reach a predefined age.

Example: At age 75, pensioners and widows will receive a 10% increase in their birthday month. No further increase will apply thereafter.

Set up an Expense Type with a Global Type of ANNUITY and a Code equal to the Code of the Benefit Type used for the annuity payments for each of the Benefit Types e.g. BONA, BONP, etc.

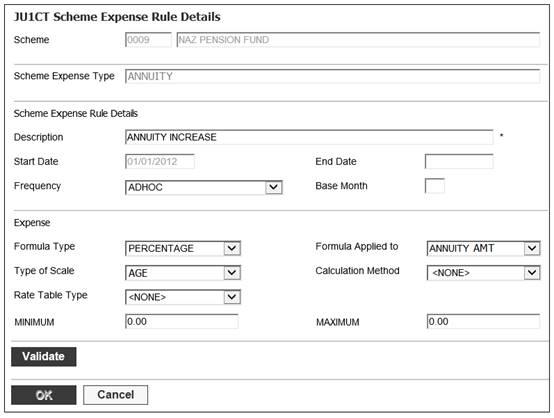

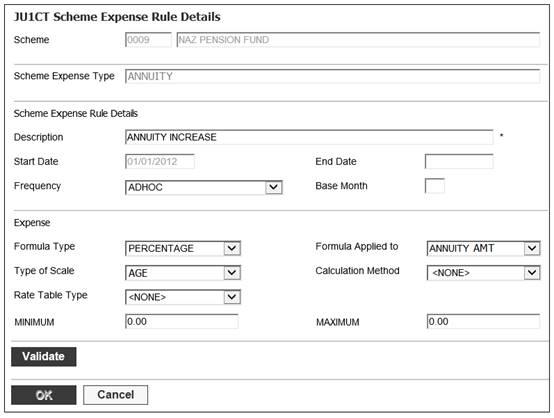

Select the Global Types with a Group Type of ANNUITY on the JU1BX Scheme Expense Type List screen and capture Expense Rules for it.

If the value for Formula Applied To selected on the JU1CT Scheme Expense Rule Details screen is ANNUITY AMT then select AGE in the Type of Scale field drop down list.

Set up an Expense Rule for each of the Expense Types for which an Ad Hoc annuity increase must be calculated with the details as per the table below:

|

Field |

Value |

|

Description |

AGE BASED ANNUITY INCREASE |

|

Frequency |

AD HOC |

|

Formula Type |

PERCENTAGE |

|

Formula Applied To |

ANNUITY AMT |

|

Type of Scale |

AGE |

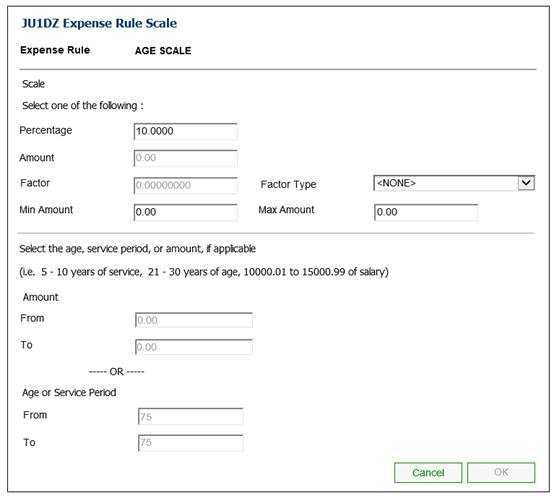

On the JU1DZ Expense Rule Scale screen under Age or Service Period, select a value for From not equal to zero and a value for To equal to the From value.

Set up an Expense Rule Scale with the details in the table below: (

|

Field |

Value |

|

Percentage |

Applicable increase percentage |

|

Age or Service Period |

|

|

From |

Age at which age based increase applies |

|

To |

Age at which age based increase applies |

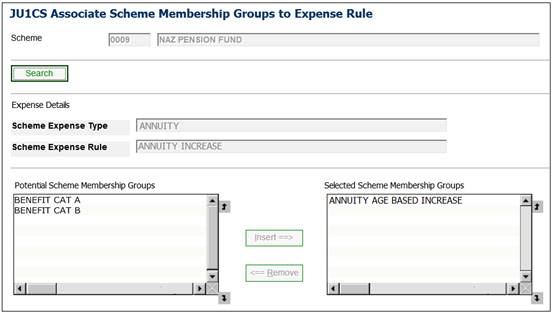

On the JU1CS Associate Scheme Membership Groups to Expense Rule screen include the Membership Groups with a Type of ANNUITY.

The BJU3TS Annuity Special Increases batch job is scheduled to run monthly and will process all annuitants eligible for an ad hoc increase on a specific event.

When the Annuity Special Increases batch job runs, the system will find the schemes for which there is an Expense Rule for an Expense Type with a Global Group Type of ANNUITY linked to a Membership Group with a Type of ANNUITY.

The Annuity Special Increases batch job will find the memberships linked to the ANNUITY Membership Group to which the Expense Rule is linked for which there is an active Membership Payment record with a Benefit Type with a Code equal to the Code of the Expense Type.

The Annuity Special Increases batch job will read the Type of Scale on the Expense Rule and if it is Age, will read the values for Age From and Age To on the Scale of Benefit linked to the Benefit Product.

If the Membership Payment Detail record is for the member, the member’s age as at the last day of the run month will be determined. If it is greater than the value for From Age and To Age on the Scale of Benefit, the system will check if the month and year of the member’s date of birth is equal to the month and year of the run.

If it is, the system will check if there is a Membership Payment Detail record with a value for Amendment Reason equal to SPEC INCREASE for the Member.

If the Formula Type is PERCENTAGE and the Formula Applied To is ANNUITY AMT, an increase will be calculated based on the Regular Payment Amount on the current Membership Payment Detail record and the value for the Percentage on the Expense Scale.

Note:

This assumes that any member loaded via a conversion after the Scheme Parameter Age will already have received the age based increase.

If the Membership Payment Detail record is for a Beneficiary with a Client Relationship Type of SPOUSE, the Spouse’s age as at the last day of the run month will be determined.

If it is greater than the value for From Age and To Age on the Expense Scale, the system will check if the month and year of the Spouse’s date of birth is equal to the month and year of the run.

If it is, the system will check if there is a Membership Payment Detail record with a value for Amendment Reason equal to SPEC INCREASE for the member.

If it is not found, the age of the member to which the spouse is linked as at the Start Date of the Spouse’s Membership Payment record will be determined.

If it is less than the value for From Age and To Age on the Expense Scale, an increase based on the Regular Payment Amount on the current Membership Payment Detail record and the value for Percentage on the Expense Scale will be calculated.

If the spouse’s age as at the last day of the run month is greater than the value for Age on the From Age and To Age on the Expense Scale, the age of the member to which the spouse is linked as at the Start Date of the spouse’s Membership Payment record will be determined. If it is less than the value for From Age and To Age on the Expense Scale, the system will check if there is a Membership Payment Detail record with a value for Amendment Reason equal to SPEC INCREASE for the spouse.

If it is not found, an increase will be calculated for the spouse.

When an increase is calculated, the system will create the new Membership Payment Detail record for the increased amount with an Amendment Reason equal to SPEC INCREASE based on the Regular Payment Amount on the current Membership Payment Detail record and the value for Percentage on the Expense Scale.

Note:

If the age at which the age based increase applies is 75, then this would mean that in the case of a spouse who is over 75 at the time of the death of the member who was under 75 at the time of death, the increase will be calculated in the first Annuity Special Increases run after the Membership Payment and Membership Payment Detail records have been captured for the spouse.

The BJU3TS Annuity Special Increases batch job must be scheduled to run monthly by the 15th of the month for the following month. This will allow for schemes with an early payday to have their increases completed before the payment run.

The Job can also be scheduled directly via the online process using the exact same due date as the automated Schedule date. The system will allow multiple runs for the same due date.

The Increase Schedule is created in the same way as for the normal Increase run.

Note:

The increases for the Annuity Special Increase run are included in the Pending Increases Report.

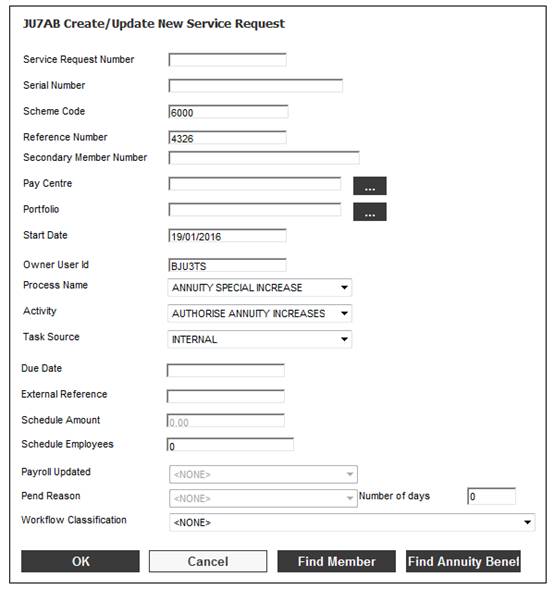

When all of the increases have been processed a Service Request with an Activity Status of OPEN will be created with the following information:

|

Field |

Value / Description |

|

Service Request Number |

Next sequential number |

|

Serial Number |

Blank |

|

Scheme Code |

Scheme Code |

|

Reference Number |

Blank |

|

Pay Centre |

Blank |

|

Start Date |

Date on which the batch job ran |

|

Due Date |

Increase Effective Date |

|

Owner User ID |

Batch Program ID |

|

Process Name |

ANNUITY SPECIAL INCREASES |

|

Activity |

AUTHORISE ANNUITY INCREASES |

|

Task Source |

INTERNAL |

|

Schedule Amount |

Blank |

|

Payroll Updated |

Blank |

|

Pend Reason |

Blank |

|

Workflow Classification |

Blank |