This process allows the business to maintain a register of the services provided by the administrator.

Note concerning VAT on fees:

Any fee charged is vatable or not, depending on the type of service for which that fee is charged, e.g. fees on the following services are not vatable:

- Risk premiums

- Brokerage where the intermediary is not a registered VAT vendor

Note:

The service TAX DIRECTIVE is created for the deduction of a fee prior to the payment of the benefit payment. Refer to

The service TAX DIRECTIVE is created for the deduction of a fee prior to the payment of the benefit payment. Refer to

Processes

Benefits

Benefit Payment Update Type

Benefit Payment Update Types (Standard Benefit Rules)

Benefit Payment Update Type: Adjust Benefit

OR

Processes

Benefits

Benefit Payment Update Type

Benefit Payment Update Types (Flexible Benefit Rules)

Benefit Payment Update Type: Adjust Benefit

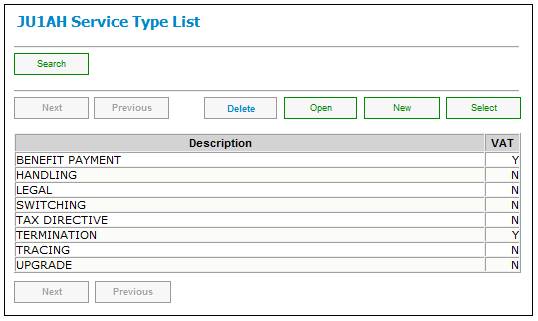

From the System Data menu select General>Service Type.

The JU1AH Service Type List screen will be displayed.

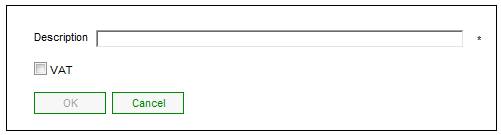

To add new service type, click NEW. The New Service Type screen will be displayed.