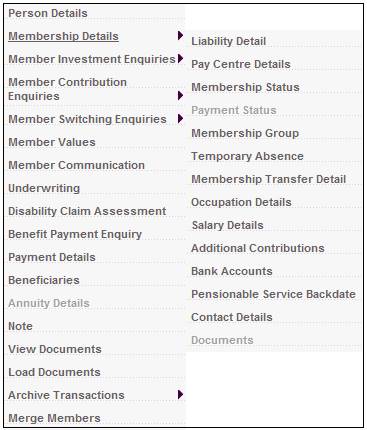

From the JU3AO List of Members for a Scheme/Pay Centre screen, highlight the required member, then select Membership Details>Salary Details.

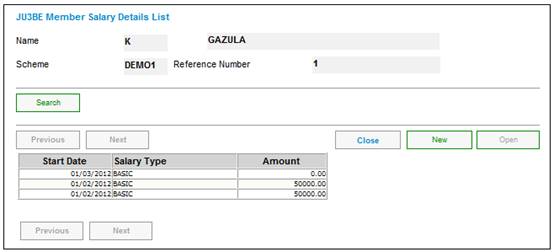

The JU3BE Member Salary Details List screen will be displayed.

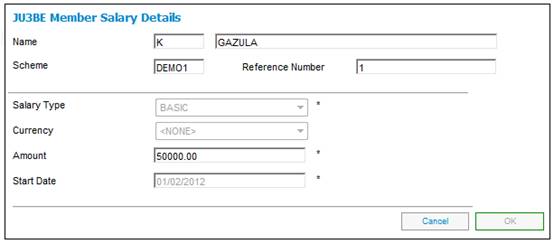

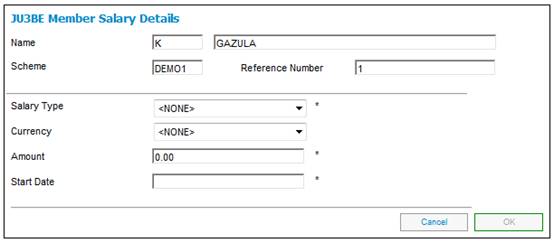

To add new salary details, click NEW. The JU3BE Member Salary Details screen will be displayed.

Field notes:

* denotes mandatory fields

|

Salary Type |

The type of salary which is being defined, e.g. basic salary or risk salary. Click

The completion of this field is mandatory. |

|

Currency |

The currency of the salary amount. Click

The completion of this field is optional. |

|

Amount |

The monthly amount of salary. |

|

Start Date |

The date from which a monthly salary for this member applies. Refer to Further information about membership transfer dates below. |

Further information about salary details:

– The start date for monthly salary must be equal to the first day of the month and may not be greater than the current date.

– The start date month may not be equal to the month of an open payroll cycle (unless the type of scheme is PRESERVATION).

– The start and end date may not fall between the start and end dates (inclusive) of any existing monthly salary, (i.e. it cannot overlap into other periods already defined).

– The start date of a monthly salary may be backdated to an earlier date (as long as this earlier date is not earlier than the start date of another salary for the same member).

– When an existing monthly salary is changed, the existing salary must be discontinued by adding an end date that is one day earlier than the start date for the new monthly salary. This is to ensure that there is no period for which the member does not have a salary of the same salary type.

When a Salary is captured and the Type of Fund for the Scheme is DEBIT ORDER UMBRELLA FUND, the system will read the Income Rule linked to the Contribution Membership Group to which the Membership is linked, and if the Formula Type is % OF SALARY, the system will calculate the Member’s monthly contribution amount based on the value for Percentage for the current Income Rule for the Income Types for which the value for Income Optionality is M (Mandatory) and Income Regularity is R (Regular) and for which the Group Type is CONTRIBUTION, and the salary captured.

The system will create a new Membership Payment Details record linked to the Membership Payment record with a Type of Payment of BASIC, with a value for Regular Payment Amount equal to the value calculated and an Effective Date equal to the Last Payment Date on the existing record plus 1 day, and End Date the existing record.

If the Start Date of the Salary is prior to the Last Payment Date on the current Membership Payment Detail record, the system will calculate the difference between the Regular Payment Amount on the current Membership Payment Detail record and the contribution amount calculated, per Income Type based on the updated salary multiplied by the number of months from the Start Date of the Salary to the Last Payment Date.

A Membership Payment record will be created with an Effective Date equal to the Salary Start Date and a Membership Payment Detail record with an a Frequency of ONCE-OFF and a Regular Payment Amount equal to the amount calculated.

To view or update existing salary details, highlight the required line, then click OPEN. The JU3BE Member Salary Details screen will be displayed.