The transactions generated in the retirement funds’ ledgers for fees paid are extracted by a batch job. A file is then created for loading into SAPS. A report will display the details of the transactions included in the Interface File. This can be accessed via the following menu selections:

Processes > Expense Billing > SAP Fees Extract

Reports > Financial > SAP Fees Extract.

For more information on the report, refer to

Processes

Expense Billing

The following must be set up on the system:

Bulk Association

Add FEE EXTRACT as a value to the UDPV Object Bulk Purpose.

Using the JU2CL Bulk Payment Control Allocation screen, set up control records for each of the Accounts to be included in the extract of admin fees and associate the accounting activities that must be included for each of these accounts.

Similarly, set up the Accounting Activities to be used for the payment of the fees.

Fee Accounts

An example of the Accounts for which Bulk Payment Control records need to be set up together with the Accounting Activities that must be retrieved is contained in the table below:

|

Account |

Process |

Accounting Activity |

|

FEEPAYABLE |

MANUAL INITIATE |

FEEPAYABLE-A |

|

FEEPAYABLE |

MANUAL INITIATE |

FEEPAYABLE-AR |

|

FEEPAYABLE |

MANUAL INITIATE |

FEESPAID |

|

SWFEEPAYABLE |

MANUAL INITIATE |

SWFEEPAYAB-A |

|

SWIFEEPAYABLE |

MANUAL INITIATE |

SWFEEPAYB-AR |

|

TAXDIRFEEPBL |

MANUAL INITIATE |

TAXDFEEPAY |

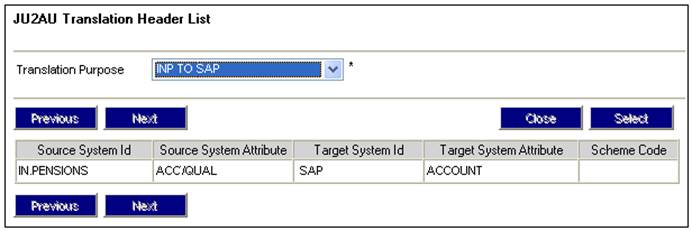

Translation Values

Add INP TO SAP to the UDPV object Translation Type:

Create translation values for the following Source System and Target system ID’s:

|

Source System ID |

Target System ID |

|

IN.PENSIONS |

SAP |

The following table details the Source System Attribute for which translation values must be captured, the fields that need to be read for each attribute and the combination of fields that need to be read on the Business Transaction (BT) for each Attribute:

|

Source System Attribute |

Source |

Details |

|

ACC/QUAL |

Business Transaction |

ACCOUNT CODE / ACCOUNT QUALIFIER (INCOME TYPE, EXPENSE TYPE) |

|

ADMIN BRANCH |

Scheme Details |

COST CENTRE |

A translation value equal to the SAP Account Number must be captured for each combination of Account Code and Account Qualifier and a translation value equal to the SAP Cost Centre must be captured for all of the Administration Branches.

The JU3FK_FEEEXT batch job will extract all of the fees payable to the Administrator for all Schemes and is scheduled to run on the first day of the each month.

When the batch job runs, the system will read the Bulk Payment Control records with a Bulk Purpose of FEE EXTRACT. For each of the Accounts for which a record is found the system will retrieve the Business Transactions (BT’s) for the Accounting Activities associated to the Account for every Scheme and with a Due Date less than or equal to the last day of the month preceding the date of the run and for which the Link Date is null.

For each Business Transaction included in the Interface file the Link Date will be updated with the run date.

The BT’s for which the Scheme Code, Account Code, Qualifier (Income Type or Expense Type) and Due Date are the same will be summed.

The system will read the Pooling Status for each Scheme. If it is SUB-UMBRELLA, it will find the Scheme to which it is associated and for which the Pooling Status is MAIN UMBRELLA. BT’s per Account Code, Qualifier and Due Date will be summed for all of the Schemes linked to the same Main Umbrella fund.

The data extracted will be written to the SAP Fees Extract report. For more information on the report, refer to

Processes

Expense Billing

A file must be created in the format as per the table below for uploading to SAP.

|

Field Name |

Start |

End |

Length |

Description |

System / Default Value |

|

IMS-TRAN-CODE |

1 |

4 |

4 |

FO Supply |

Default value to be supplied by ACA |

|

FUNCTION-CODE |

5 |

8 |

4 |

GCJR / GJDR |

If the system BT is the Debit transaction then this must be GJCR. If the system BT is the Credit transaction then this must be GJDR See note 1 below. |

|

FINANCIAL-INDICATOR |

9 |

9 |

1 |

F |

Default to F |

|

TRAN-AMOUNT |

10 |

25 |

16 |

Unsigned, 2 dec |

BT Amount |

|

EFFECTIVE-DATE |

26 |

34 |

9 |

YYYYMMDD |

Due Date |

|

TRANSACTION-TIME |

35 |

41 |

7 |

Numeric |

Run Time |

|

PROCESSING-DATE |

42 |

50 |

9 |

YYYYMMDD |

Transaction Date |

|

TRAN-BRANCH-CODE |

51 |

57 |

7 |

Numeric |

632005 |

|

SUB-BRANCH-CODE |

58 |

64 |

7 |

Numeric |

Zeroes |

|

TELLER-NUMBER |

65 |

71 |

7 |

Numeric |

Zeroes |

|

TRAN-CORP-CODE |

72 |

74 |

3 |

Alpha |

1082 |

|

SYSTEM-INDICATOR |

75 |

75 |

1 |

Fixed ‘S’ |

S |

|

ACCOUNT-TYPE |

76 |

78 |

3 |

Zero |

Zeroes |

|

ACCOUNT-DOMICILE-BRANCH |

79 |

85 |

7 |

Numeric |

DTI Account Number on DTI Account for the Admin Branch linked to the Scheme |

|

ACCOUNT-CORP-CODE |

86 |

88 |

3 |

Alpha |

|

|

ACCOUNT-BALANCE |

89 |

104 |

16 |

Zero |

Zeroes |

|

ACCOUNT-NUMBER |

105 |

120 |

16 |

Numeric |

Read translation value for combination of Account Code and Account Qualifier on BT on Translation record for which the Purpose is INP TO SAP |

|

PRODUCT-CODE |

121 |

125 |

5 |

FO Supply |

Default value to be supplied by ACA |

|

TRAN-CORP-CODE |

126 |

128 |

3 |

Alpha |

|

|

INTER-DIV-CORP-CODE |

129 |

131 |

3 |

Alpha |

1082 |

|

FILLER |

132 |

200 |

69 |

Blanks |

Spaces |

Note:

The transaction in the retirement fund’s ledger on the system will be for the payment and the entry in the fee payable account but the transaction in the SAP ledger will be for the deposit in ACA’s bank account and for the income transaction. Therefore the entry in the file will be the converse of the system transaction.