This report provides additional information in the valuation report for Retirement Annuities.

As the requirements for the retirement annuity fund valuation are less complex than that required for the valuation for the retirement funds, a separate extract is provided.

From the General menu, click ![]() alongside Retirement Annuity Valuation on the sub-menu on the left. Additional options will be displayed.

alongside Retirement Annuity Valuation on the sub-menu on the left. Additional options will be displayed.

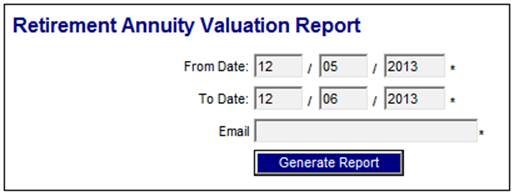

Click New below Retirement Annuity Valuation. The Retirement Annuity Valuation Report screen will be displayed.

Capture the date from which the report must apply in the From Date field and capture the date to which the report must apply in the To Date field. Capture your email address.

Note:

The system will default to the current date starting 1 year earlier.

Click GENERATE REPORT.

The screen will display the captured details for the report with the message:

Report job submitted successfully

The report is available for viewing.

The system will extract the information for each of the Memberships for the Scheme selected and for which the Membership Status as at the From Date captured is not EXIT FINALISED or EXIT IN PROCESS as per the details in the table below:

|

Information |

Source |

|

Policy Number |

Membership Reference Number |

|

Contribution Membership Group |

Description of Membership Group with a Type of CONTRIB to which the Membership is linked as at the To Date of the report |

|

Benefit Membership Group |

Description of Membership Group with a Type of BENEFIT to which the Membership is linked as at the To Date of the report |

|

Insurable Event |

Read the Translation Value table where the Purpose is RA VALUATION and for which the Source System ID is INSURABLE EVENT and the Source System Attribute is SCHEME CODE, and the Target System ID is INSURABLE EVENT and the Source System Attribute is INSURABLE EVENT.

Read the Target System Translation value for the Source System Translation value equal to the Scheme Code for which the report is being extracted. If not found read the Source System Translation value equal to the Main Scheme Code to which the Scheme is linked. |

|

Policy Status Reason |

Read the Membership Status as at the To Date of the report and derive the values as per the Policy Status Reason section below.

Read the Translation Value table where the Purpose is RA VALUATION and for which the Source System ID is POLSTATREASON and the Source System Attribute is POLSTATREASON, and the Target System ID is POLSTATREASON and the Source System Attribute is POLSTATREASON. |

|

Gross Premium |

Sum of the Regular Payment Amounts on the Membership Payment Detail records for the Membership active as at the To Date of the report |

|

Premium Increase |

Value for Increase Percentage on the Membership Payment record for which the Income type is REC |

|

Payment Frequency |

Value for Frequency on the Membership Payment record |

|

Sum Assured |

Value on the Member Values record for the Type SUM ASSURED |

|

Policy Fee |

Read the Income Rule for the Benefit Membership Group to which the Membership is linked for the Global Type PFEE |

|

Maturity Date |

Value for Date of Retirement on the Membership Payment for which the Income type is REC |

|

Date of Birth |

Date of Birth on Natural Person record to which the Membership is linked |

|

Gender |

Gender on Natural Person record to which the Membership is linked |

|

Life Insured |

Membership Reference Number |

|

Smoker Code |

Read the Sub-Type on the Member Values record for the Type SMOKER STATUS

Read the Translation Value table where the Purpose is RA VALUATION and for which the Source System ID is SMOKER CODE and the Source System Attribute is SMOKER CODE, and the Target System ID is SMOKER CODE and the Source System Attribute is SMOKER CODE.

Read the Target System Translation value for the Source System Translation equal to the value on the Member Value record. |

|

Investment Account Value |

Retrieve the unit balances on the members’ INVSTMEMUNIT accounts as at the Report To Date and sum the balances per Investment Portfolio. Read the unit price for each Portfolio as at the Report To Date and calculate the total market value per Portfolio. Sum all of the values. |

|

Management Fee Charge |

Read the Expense Rule for the Benefit Membership Group to which the Membership is linked for the Global Type INVC |

|

Premium Expiry Date |

If the Membership Status is LIVE set this to Maturity Date.

If the Membership Status is DEFERRED set this to the Start Date of the Membership Status |

|

GLA Accounting Code |

Read the Translation Value table where the Purpose is RA VALUATION and for which the Source System ID is GLACCOUNTCODE and the Source System Attribute is SCHEME CODE, and the Target System ID is GLACCOUNTCODE and the Source System Attribute is GLACCOUNTCODE.

Read the Target System Translation value for the Source System Translation equal to the Scheme Code for which the report is being extracted. If not found read the Source System Translation value equal to the Main Scheme Code to which the Scheme is linked. |

|

Movement Code |

Read the Membership Status as at the From Date of the report and as at the To Date of the report. If the values are different derive the movement codes as per the Movement Code section below.

Read the Translation Value table where the Purpose is RA VALUATION and for which the Source System ID is MOVEMENT CODE and the Source System Attribute is MOVEMENT CODE, and the Target System ID is MOVEMENT CODE and the Source System Attribute is MOVEMENT CODE.

Read the Target System Translation value for the Source System Translation equal to the Movement Code. |

|

Movement Effective Date |

Start Date of the latest Membership Status record with a Start Date less than or equal to the report To Date and greater than or equal to the report From Date. |

|

Status |

Read the Membership Status. Read the Translation Value table where the Purpose is RA VALUATION and for which the Source System ID is STATUS and the Source System Attribute is STATUS, and the Target System ID is STATUS and the Source System Attribute is STATUS.

Read the Target System Translation value for the Source System Translation equal to the Membership Status. |

|

Tax Status |

Default to value of 4.

4 = Untaxed Policyholder Fund. This will always be the value for retirement annuity funds |

|

Number of Life Insureds |

Default to value of 1.

For Retirement Annuities there will always only be 1 life insured. |

|

Investment Portfolio 1 |

Retrieve the unit balance on the Member’s INVSTMEMUNIT account as at the To Date of the report per Portfolio.

Extract the Portfolio Code for the first portfolio for which the member has a unit balance. |

|

Investment Portfolio 2 |

See Investment Portfolio1 above.

Extract the Portfolio Code for the second portfolio for which the member has a unit balance. If no unit balance is found leave blank. |

|

Investment Portfolio 3 |

See Investment Portfolio1 above.

Extract the Portfolio Code for the third portfolio for which the member has a unit balance. If no unit balance is found leave blank. |

|

Units Portfolio 1 |

Extract the unit balance for Investment Portfolio 1 |

|

Units Portfolio 2 |

Extract the unit balance for Investment Portfolio 2 |

|

Units Portfolio 3 |

Extract the unit balance for Investment Portfolio 3 |

|

Four Fund |

Default to value of 4.

4 = Untaxed Policyholder Fund. This will always be the value for retirement annuity funds |

Policy Status Reason

The Policy Status Reason values are derived as per the details in the table below:

|

Movement Code |

Details |

|

LIVE |

The Membership Status as at the report To Date is LIVE and the Frequency is not ONCE OFF and the Benefit Membership Group to which the Membership is linked is not HOLLARD DIR OE or DIRECT OE ANN |

|

DEFERRED |

The Membership Status as at the report To Date is DEFERRED and the Benefit Membership Group to which the Membership is linked is not HOLLARD DIR OE or DIRECT OE ANN |

|

LIVE SINGLE PRM |

The Membership Status as at the report To Date is LIVE and the Frequency on the Membership Payment record is ONCE OFF |

|

LIVE OPEN ENDED |

The Membership Status as at the report To Date is LIVE and the Code of the Benefit Membership Group to which the Membership is linked is HOLLARD DIR OE or DIRECT OE ANN |

|

DEFERRED OPEN |

The Membership Status as at the report To Date is DEFERRED and the Code of the Benefit Membership Group to which the Membership is linked is HOLLARD DIR OE or DIRECT OE ANN |

|

EXITED |

The Membership Status as at the report To Date is EXIT IN PROCESS or EXIT FINALISED |

Movement Codes

The Movement Code values are derived as per the details in the table below:

|

Movement Code |

Details |

|

TAKE-ON |

The Membership Start Date is greater than the report From Date and less than or equal to the report To Date and the Membership Status as at the report To Date is LIVE and a Business Transaction is retrieved from the Member’s INVSTMEMUNIT account with an Accounting Activity of UNITSTAKE-ON |

|

NEW |

The Membership Start Date is greater than the report From Date and less than or equal to the report To Date and the Membership Status as at the report To Date is LIVE and a Business Transaction is NOT retrieved from the Member’s INVSTMEMUNIT account with an Accounting Activity of UNITSTAKE-ON |

|

TRANSFER IN |

The Membership Start Date is greater than the report From Date and less than or equal to the report To Date and the Membership Status as at the report To Date is LIVE and a Business Transaction is retrieved from the Member’s CONTRIBUTION account with an Accounting Activity of MEMCONTRIB and an Income Type of TRF |

|

TRANSFER OUT |

The Membership Status as at the report To Date is EXIT IN PROCESS or EXIT FINALISED and the Benefit Category for the Benefit Event on the Benefit Request is WITHDRAWAL and the CAR End Date is greater than the report From Date and the Disposal Type is TNSFR TO FUND |

|

RETIREMENT |

The Membership Status as at the report To Date is EXIT IN PROCESS or EXIT FINALISED and the Benefit Category for the Benefit Event on the Benefit Request is RETIRAL and the CAR End Date is greater than the report From Date |

|

WITHDRAWAL |

The Membership Status as at the report To Date is EXIT IN PROCESS or EXIT FINALISED and the Benefit Category for the Benefit Event on the Benefit Request is WITHDRAWAL and the CAR End Date is greater than the report From Date |

|

DEATH |

The Membership Status as at the report To Date is EXIT IN PROCESS or EXIT FINALISED and the Benefit Category for the Benefit Event on the Benefit Request is DEATH and the CAR End Date is greater than the report From Date |

|

PAID-UP |

The Membership Status as at the report To Date is DEFERRED |

|

REINSTATED |

|

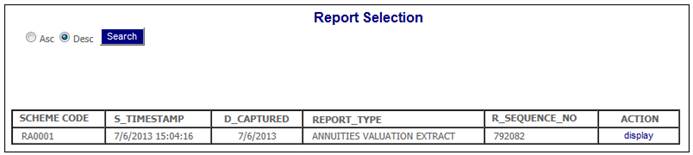

Click View below Retirement Annuity Valuation. The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme Code

- Timestamp

- Date Captured

- Report Type

- Sequence Number

- Action

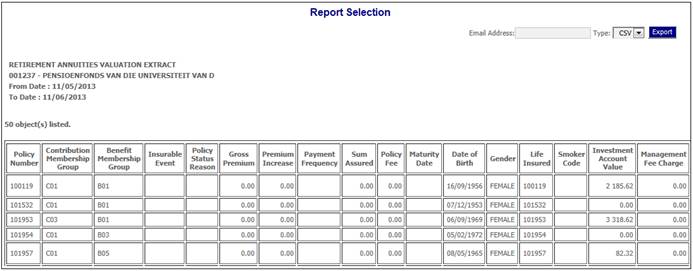

To view details, click on the hyperlinked display in the Action column. The Report Selection screen will be displayed.

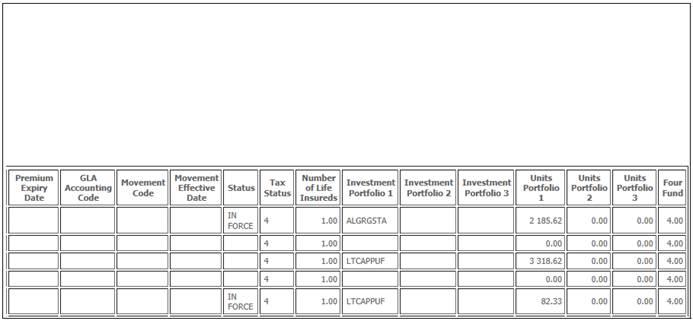

Tab to the right

The following columns are displayed:

- Policy Number

- Contribution Membership Group

- Benefit Membership Group

- Insurable Event

- Policy Status Reason

- Gross Premium

- Premium Increase

- Payment Frequency

- Sum Assured

- Policy Fee

- Maturity Date

- Date of Birth

- Gender

- Life Insured

- Smoker Code

- Investment Account Value

- Management Fee Charge

- Premium Expiry Date

- GLA Accounting Code

- Movement Code

- Movement Effective Date

- Status

- Tax Status

- Number of Life Insureds

- Investment Portfolio (1 – 3)

- Units Portfolio (1 – 3)

- Four Fund