This option enables you to capture details of the regular payment amounts to be made to the member / policyholder.

Select Regular Payment from the sub-menu on the left.

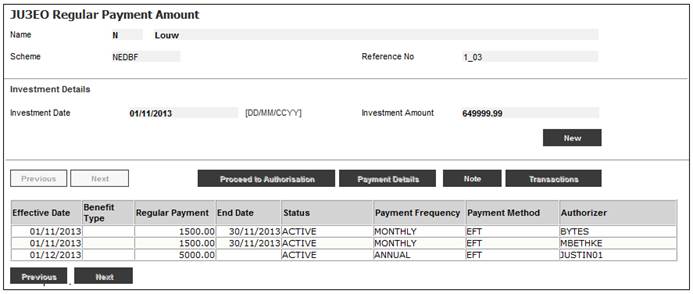

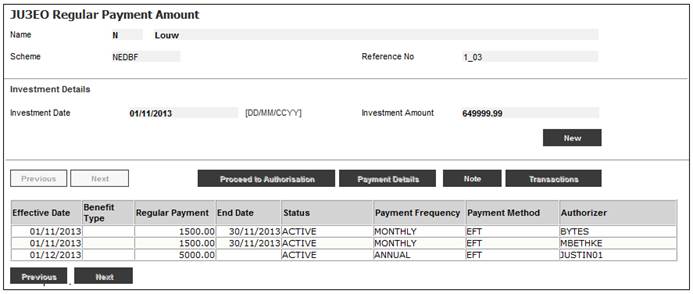

The JU3EO Regular Payment Amount screen will be displayed.

If there is an existing Membership Payment and Membership Payment Detail record with a Payment Type of ANNUITY, these details will be displayed.

If there is no existing Membership Payment and Membership Payment Detail record with a Payment Type of ANNUITY, the NEW button will be enabled.

To display an existing payment, highlight a line and click PAYMENT DETAILS.

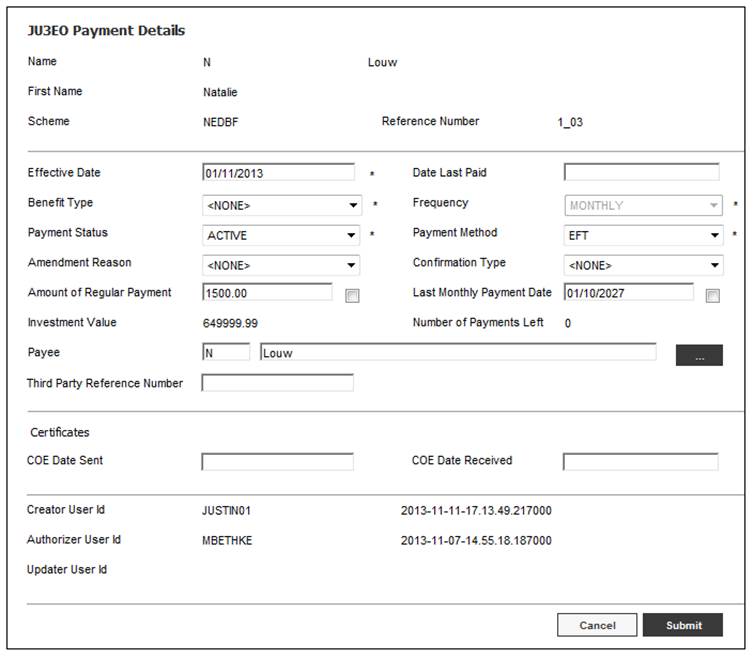

The JU3EO Payment Details screen will be displayed.

To add a new regular payment, click NEW. The JU3EO Payment Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Effective Date |

The effective date of the regular payment. |

|

Benefit Type |

Selection from list of Benefit Types linked to the Scheme. Mandatory |

|

Payment Status |

Select the payment status from the drop-down list, e.g. ACTIVE, CANCELLED, SUSPENDED etc. Mandatory |

|

Amendment Reason |

When the status is SUSPENDED, this field will be enabled and is mandatory. Select a reason from the drop-down box and provide an effective date. The following are some of the values that can be selected: - DECEASED - ADJUSTMENT - CLOSED - PRORATA - REVERSAL - NONE - BONUS - OVERPAYMENT - SALARY INCREASE - UNCASHED CHEQUE - ADHOC (used for once off payments - no end date is required, as the system will end date the payment once it is paid). |

|

Amount of Regular Payment (Tick Box) |

The amount that will be paid regularly.

When the tick box is selected, the system will determine the last monthly payment amount using the Effective Date, balance on the Member’s Investment Accounts and the Last Monthly Payment Date.

If no Last Monthly Payment Date has been captured, then the following message will be displayed:

Note: When the Amount of Regular Payment Tick box is ticked, the Last Monthly Payment Date Tick box will not be enabled. |

|

Investment Value |

The value of the member’s investment account.

To determine the value of the member’s investment account retrieve the balances on the Member’s investment account.

If the Portfolio for which a balance is retrieve is a BONUS portfolio, the balance of the Member’s INVESTMEMB account will be displayed.

If the Portfolio is UNITISED the value will be calculated by multiplying the unit balance by the latest unit price.

If there are balances for multiple Portfolios, these values will be summed. |

|

Date Last Paid |

The date on which payment was last made. |

|

Frequency |

Select the payment frequency from the drop-down list, e.g. MONTHLY, QUARTERLY, ANNUAL, etc.

Optional |

|

Payment Method |

Select the method of payment from the drop-down list, e.g. CHEQUE, EFT, etc. Mandatory |

|

Confirmation Type |

Indicates the method used to confirm the ID type, e.g. HOME AFFAIRS. Select the relevant value from the drop-down box. The following values may be selected: CERTIFICATE H/A DO NOT SUSP HOME AFFAIRS

Mandatory. |

|

Last Monthly Payment Date (Tick Box) |

The date of the last monthly instalment.

When the tick box is selected, the system will determine the Last Monthly Date using the Effective Date, balance on the Member’s Investment Accounts and the Amount of Regular Payment.

If no Regular Payment Amount has been captured, then the following message will be displayed:

Note: When the Last Monthly Payment Date Tick box is ticked, the Amount of Regular Payment Tick box will not be enabled.

Mandatory |

|

Number of Payments Left |

The number of payments still to be paid.

This value will be calculated by dividing the value of the member’s investments by the Regular Payment Amount.

Note: The Number of Payments Left value will only be an accurate value if the Investment Balance remains unchanged or increases in the monthly payment amount are granted on a basis that is consistent with the interest added to the investments and at the same intervals. If not, then this value will be a rough estimate value. |

|

Third Party Reference Number |

The reference number identifying the third party for Third Party Payments linked to a payee. |

|

COE Date Sent |

The date the Certificate of Existence was sent to the member. |

|

COE Date Received |

The date the Certificate of Existence was received from the member. |

|

Creator User Id |

The User Id of the User who created the record. |

|

Authorizer User Id |

The User Id of the User who authorised the record. |

|

Update user Id |

The User Id of the User who updated the record. |

Capture the relevant information, then click SUBMIT.

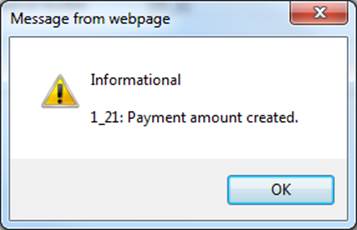

The following message will be displayed:

Payment amount created.

Click OK to remove the message.

The system will create a Membership Payment and a Payment Detail record.

When money is disinvested to cover a regular payment amount, there will be a write-up of the book value in the unitised investment account.

Note:

There is no tax implication, however it can result in a negative monetary balance on the unitised investment account as the market value realised will in most cases be greater than the book value.

Calculation of profit or loss

In the Living Annuity Payment run, irrespective of the Type of Run for each Portfolio from which money is to be disinvested and for which the Type of Investment is UNITISED, the value of the realised profit or loss Portfolio will be calculated as follows:

A. Calculate the estimated number of units to be disinvested by dividing the proportion of the payment amount to be disinvest from the Portfolio by the latest Unit Price for the Portfolio

B. Retrieve the latest unit balance on the INVSTMEMUNIT account for the Portfolio

C. Retrieve the latest monetary balance on the INVSTMEMUNIT account for the Portfolio

D. Calculate the realized profit or loss per Portfolio as follows:

Amount to be disinvested for the Portfolio – (A / B * C)

If the result is positive it is a profit and if it is negative it is a loss.

Note:

For daily priced Portfolios the unit price will not be available at the time the BT’s are created and therefore the number of units that will be realized can only be estimated based on the latest unit price. This will result in a slight inaccuracy in the calculation of the realized profit or loss.

The system will create Business Transactions (BT’s) with the following Accounting Activities with the monetary amount of the profit or loss calculated:

Profit

|

Process |

Accounting Activity |

Stakeholder |

DR Account |

CR Account |

|

BENEFICIARY PMT |

MEMM/VWRTEUP |

MEMBER |

INVSTMEMUNIT |

INV MEM P/L |

Loss

|

Process |

Accounting Activity |

Stakeholder |

DR Account |

CR Account |

|

BENEFICIARY PMT |

MEMM/VWRTDWN |

MEMBER |

INV MEM P/L |

INVSTMEMUNIT |