Log in to the system from the Logon page.

Click accounting.

The Welcome screen will be displayed.

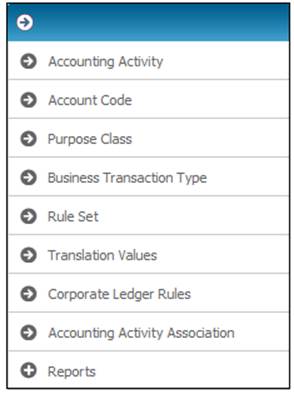

From the main menu on top, select Structure. A sub-menu will be displayed on the left.

From the Structure sub-menu on the left, select Accounting Activity.

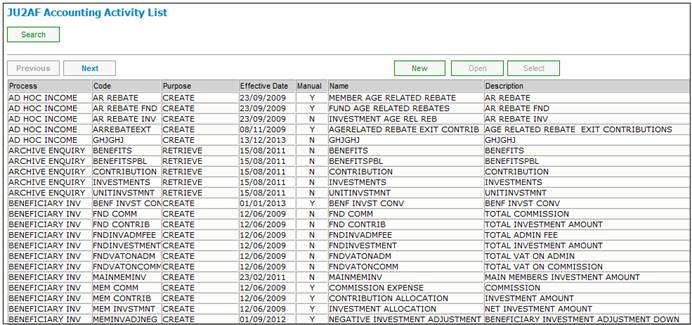

The JU2AF Accounting Activity List screen will be displayed, listing all accounting activities.

Purpose:

To flow to the Accounting screens in order to capture the accounting infrastructure data and/or rules.

The steps below represent the recommended sequence in the setting up of the accounting infrastructure using the Structure menu. Following this recommended sequence ensures that the respective data is created in the order of data dependency.

Recommended sequence of steps for setting up of Accounting Infrastructure Data.

|

STEP 1 |

|

|

Accounting > Structure > Accounting Activity |

Flows to the JU2AF Accounting Activity List screen Set up/Create an Accounting Activity |

|

Accounting > Structure > Account Code |

Flows to the JU2AE Account Code List screen Set up/Create an Account Code |

|

Accounting > Structure > Purpose Class |

Flows to the JU2AK Purpose Class List screen Set up/Create a Purpose Class |

|

STEP 1.1 |

|

|

Accounting > Structure > Accounting Activity |

When NEW is selected, flows to the JU2AF Accounting Activity Details screen Set up/Create EFT Rule

For more information refer to Supplements Processes Adding a new EFT Rule |

|

STEP 2 |

|

|

Accounting > Structure > Business Transaction Type |

Flows to the JU2AH Business Transaction Type List screen Set up/Create the Business Transaction Type |

|

STEP 2.1 |

|

|

Accounting > Structure > Accounting Activity |

Accounting Activity > Accounting Rules: JU2AG Accounting Rule List screen Set up/Create Accounting Rule |

|

OR |

|

|

STEP 2.2 |

|

|

Accounting > Structure > Accounting Activity |

When NEW is selected, flows to the JU2AG Accounting Activity Details screen Set up/Create Retrieval Rule |

|

STEP 3 |

|

|

Accounting > Structure > Rule Set |

Flow to the JU2AN Rule Set List screen Set up/Create Rule Set |

|

STEP 4 |

|

|

Accounting > Structure > Rule Set |

Rule Set > Maintain Rule Links: JU2AM Rule Maintain List |

|

STEP 4.1 |

|

|

Accounting > Structure > Rule Set |

Rule Set > Maintain Rule Links > Maintain Rules: JU2AS Rule Set Accounting Rule List Associate Accounting Rule |

|

STEP 4.2 |

|

|

Accounting > Structure > Rule Set |

Associate Retrieval Rule Close screen and at JU2AN Rule Set List screen: Rule Set > Rule Set Schemes: JU2AR Rule Set Scheme List screen |

|

STEP 5 |

|

|

|

Associate the Rule Set with the relevant Scheme. |

|

STEP 6 |

|

|

Accounting > Transaction Capture > Manual Accounting Transactions |

JU2BK Manual Accounting Journal screen Set up/Create Manual Business Transaction Supply Scheme/ Member identifiers and Transaction Details. |

Set-up Notes:

When the "Transfer Money (via EFT / Cheque )" indicator for an Accounting Activity is set to "Y", one (not more or less than one) of the Accounting Rules attached, must contain a BT that updates an account that is qualified by DTI (Bank Account Number).

When the Money Movement creation process creates an EFT instruction and it is found that no DTI limits are set up for one of the accounts, it will be assumed that the Debit and Credit limits for the mandate on this account are maximum. The mandate limit usage counters will not be updated in this situation, as there is no need to test for the possible exceeding of the limits.

When a line number is not supplied for a DTI-Account number (Bank Account), the account cannot be used as a "FROM" account in an EFT instruction. The reason is that the Banks use line-numbers to identify and validate "FROM" accounts.

In this case when an Accounting Activity is transacted, using such a "FROM" bank account in the EFT-Rules and with the "Payment Type" as "EFT", the Process creating the Money Movement / EFT Instruction will fail. This will cause the creation of the BT to fail as well. The process creating the Accounting Activity Transaction will be notified about the failure. (The message is "DEBIT DTI ACCOUNT NOT FOUND").

Only a cheque payment can be used against such an account.

Once an instance of an Account Code has been created, it may not be deleted but only discontinued. Discontinuance prevents future allocation for use of the instance while preserving existing usage. This means that discontinuing an Account Code prevents it from being assigned in further accounting rules. However, if it is already assigned in any accounting rules it will continue to be used there until the rule is changed.

In order to maintain the data integrity of the system, changing an Account Code’s qualifier is not allowed.

When a change is required, the ‘old’ account code must be discontinued when applicable, and a new account code must be created with the new qualifier. Other rule references to the ‘old’ code must be changed to that of the new one where applicable or where required.

For one Rule Set / Accounting Activity combination:

If one of the BT-Rules connected has its "Unitized Transaction" flag set to ‘Y’, the Create BT process will insist on receiving a Unit Value for that Activity Occurrence. This unit value will only be carried to the Business Transactions created where the "Unitized Transaction" flag is set to ‘Y’ (Yes).

If none of the BT-Rules connected has its "Unitized Transaction" flag set to ‘Y’, the Create BT process will reject the Accounting Activity occurrence when a Unit Value is supplied.

When a Unitised portfolio is used for a Scheme, two accounts are necessary in the "books" of the member relating to that Portfolio. The one account is used to record all Investment Activities that still need to be unitised. The next account is used to record the Monetary and Unit values (e.g. from the Unitisation process). Obviously, the second account will, in some cases, carry transactions that do not contain units such as the Market Value Write Up transactions.