This facility enables you to:

- generate quotations for selected events

- view all previous quotations that have been requested

- view breakdowns of the quotation results

Select the required employee membership as described under

Processes

Benefits (Insurance Products)

Claims Administration Overview

Selecting Members

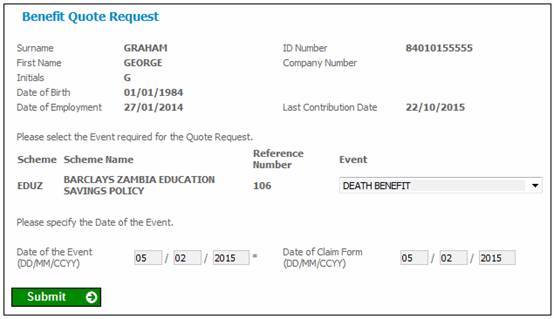

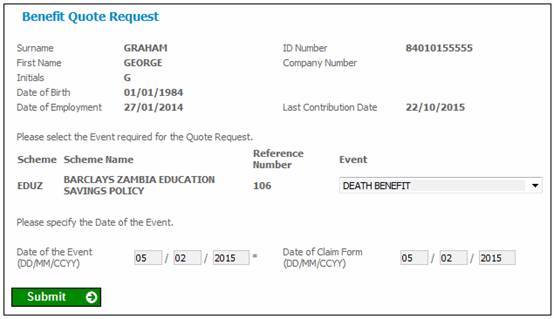

Select Quotes from the top menu and then select New Quote from the sub-menu on the left. The Benefit Quote Request screen will be displayed.

Select an event from the drop-down list by clicking on the Event drop-down box .

Note:

The Date of the Event field displays the current date. This date may not be changed. To do a quotation for a future date, the projection facility should be used.

The Date of Claim Form field is used for cases where the Accrual Date on the Tax Directive Request must be the date that the claim form was signed by the Member. This is an optional field.

Note:

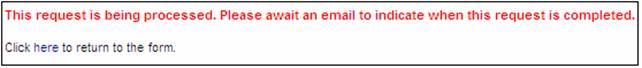

When the number of benefit package rules exceeds the number defined on the batch parameter PACKAGE THRESH, the calculation is processed in batch mode.

A message will be displayed on the screen.

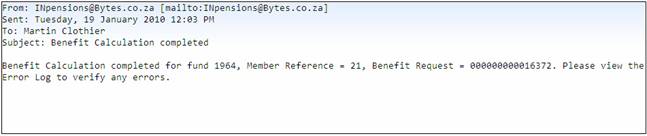

When the calculation has completed, an e-mail will be sent to the user.

Note:

If the member is entitled to a retirement benefit (early, normal or late), the appropriate warning message will be displayed.

When SUBMIT is selected on the Benefit Quote Request screen, the system will read the rules of the scheme.

If the scheme does not allow for member choice, the Benefit Quote Results screen will be displayed (see below).

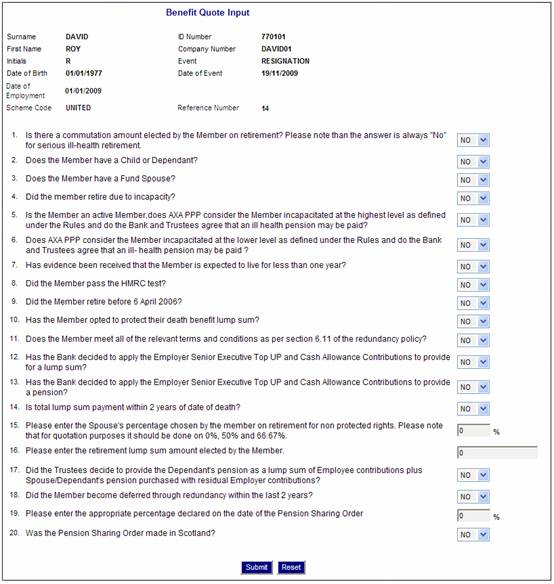

If the scheme allows for member choice, a list of questions will be compiled by the system and the Benefit Quote Input screen will be displayed.

In order for the system to perform the calculation of the quotation that you have requested, there are a number of questions that may be presented to you for your input.

The questions displayed will depend on the benefits for which you qualify in terms of the rules of the scheme as well as the particular calculation that you are requesting.

The following is a list of the questions that may be asked by the system:

|

What is the member's actuarial reserve value? |

|

What is the annuity rate to purchase the member's pension? |

|

What percentage of the pension is to be commuted? |

|

What is the lump sum commutation as determined by the actuary? |

|

What is the lump sum commutation factor? |

|

What % do you want to commute? |

|

The dependant's credit account pension payable on Member's death in deferment( as advised by Scheme Actuary) |

|

The dependant's investment account pension payable on Member's death in deferment( as advised by Scheme Actuary) |

|

Appropriate percentage declared on the date of the Pension Sharing Order. |

|

Is the member retiring due to ill-health on the higher level? |

|

Is there a commutation amount elected by the Member on retirement? Please note than the answer is always "No" for serious ill-health retirement. |

|

Is the member transferring to a contracted-out scheme? |

|

Does the spouse qualify for the contracted out benefits? |

|

Does the Member have a Child or Dependant? |

|

Have the Trustees agreed to use the NonPRInvAccBalance to provide benefits for a Spouse and Dependants? |

|

Does the Member have a Dependant? |

|

Does the Member have a Fund Spouse? |

|

Did the member retire due to incapacity? |

|

Is the Member an active Member, does AXA PPP consider the Member incapacitated at the highest level as defined under the Rules and do the Bank and Trustees agree that an ill health pension may be paid? |

|

Does AXA PPP consider the Member incapacitated at the lower level as defined under the Rules and do the Bank and Trustees agree that an ill- health pension may be paid ? |

|

Has evidence been received that the Member is expected to live for less than one year? |

|

Did the Member pass the HMRC test? |

|

Did the Member retire before 6 April 2006? |

|

Has the Member opted to protect their death benefit lump sum? |

|

Does the Member meet all of the relevant terms and conditions as per section 6.11 of the redundancy policy? |

|

Has it been agreed between the Bank and the Member that Protected rights pension can be determined with reference to the Member only? |

|

Has the Bank decided to apply the Employer Senior Executive Top UP and Cash Allowance Contributions to provide for a lump sum? |

|

Has the Bank decided to apply the Employer Senior Executive Top UP and Cash Allowance Contributions to provide a pension? |

|

Is the member transferring out overseas? |

|

Is the member transferring out? |

|

Is total lump sum payment within 2 years of date of death? |

|

How much money is owed by the Member? |

|

What is the Old Fund pension equivalent as determined by the actuary? |

|

What is the value of the member's preserved benefit? |

|

For ill health retirement(HIGHER LEVEL) obtain the protected lump, if any, from technical department |

|

Does Gibraltar member have any retained benefits from any other Scheme? |

|

Please enter the retirement lump sum amount elected by the Member. |

|

Was the Pension Sharing Order made in Scotland,Wales or outside England? |

|

Please enter the Spouse's percentage chosen by the member on retirement for non protected rights. Please note that for quotation purposes it should be done on 0%, 50% and 66.67%. |

|

Did the Trustees decide to provide the Dependant's pension as a lump sum of Employee contributions plus Spouse/Dependant's pension purchased with residual Employer contributions? |

|

What is the annuity rate to purchase the spouse's pension? |

|

The spouse's pension payable on Member's death in service iro of Employer Senior Executive Contributions (as advised by Scheme Actuary) |

|

Has the technical team given consent to proceed with payment of trivial commutation amount? |

|

Did the Member become deferred through redundancy within the last 2 years? |

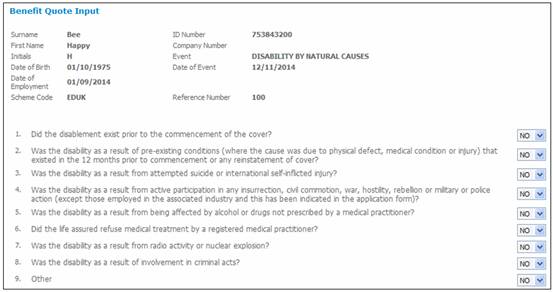

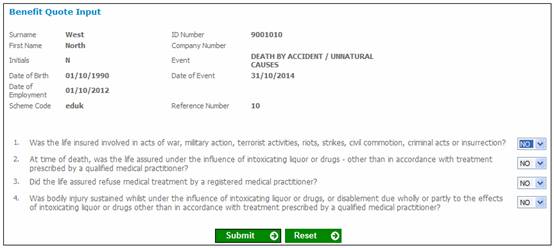

Validation Questions

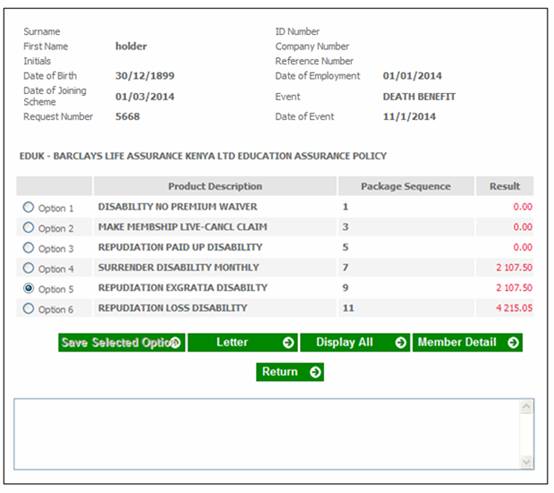

For the Disability and Death Claim Process, there are validation questions which determine if a claim is paid out or repudiated.

If a Death Claim is repudiated, an option is given for a surrender claim to be paid out and the policy is end dated.

If a Disability Claim is repudiated, an option is given for the policy to be made paid up.

In Addition to this, an Ex-Gratia or Loss Event payment can be processed where a management decision is taken to pay out the claim irrespective of the repudiation. For this, any value can be paid out based on the outcome of the decision.

Event: Death (all variations)

The following is a list of the questions that may be asked by the system:

|

Did the death result from suicide or attempted suicide or intentional self-inflicted injury, within the first 2 (two) years of the commencement date or ant reinstatement date? |

|

Was the notification received later than 12 months after date of death? |

|

Was the disability as a result of pre-existing conditions or a condition that existed within 6 months prior to commencement? |

|

Other |

Event: Disability (all variations)

The following is a list of the questions that may be asked by the system:

|

Did the disablement exist prior to the commencement of the cover? |

|

Was the disability as a result of pre-existing conditions (where the cause was due to physical defect, medical condition or injury) that existed 12 months prior to commencement or any reinstatement cover? |

|

Was the disability as a result from attempted suicide or intentional self-inflicted injury? |

|

Was the disability as a result of active participation in any insurrection, civil war, hostility, rebellion or military or police action (except those employed in the associated industry and this has been indicated in the application form)? |

|

Was the disability as a result from being affected by alchol or drugs not prescribed by a medical practitioner? |

|

Did the life assured refuse medical treatment by a registered medical practitioner? |

|

Was the disability as a result from radio activity or nuclear explosion? |

|

Was the disability as a result a result of involvement in criminal acts? |

|

Other |

Answer each question and capture an answer (if applicable), using either the drop-down box to capture YES or NO, or capturing a percentage or amount (if applicable). Note that if a selection for a question that has a drop-down box is not made, the default answer will be NO.

Once the necessary details have been captured, click SUBMIT.

Note:

The answers will be saved to the member values table. These answers are used by the system during the calculation of the benefit.

If there is a scale linked to the benefit product, and there is therefore a choice of values, the values will be displayed in a drop-down list on a Benefit Quote Input screen for selection.

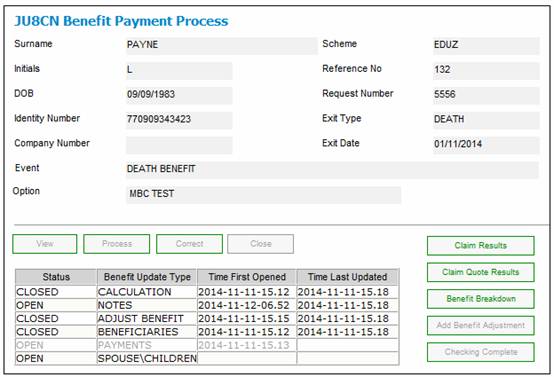

When a Death or Disability Claim is processed, the following screen with questions will display with a dropdown list of YES Or NO.

Select the required value from the drop-down list and click SUBMIT.

Note:

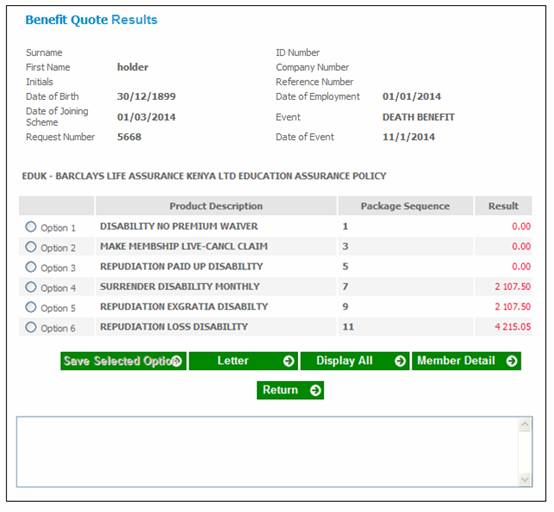

The above results will show that the death benefit is payable and hence a claim can be processed as per normal. The option with the value can be selected.

The rest of the options will have no results.

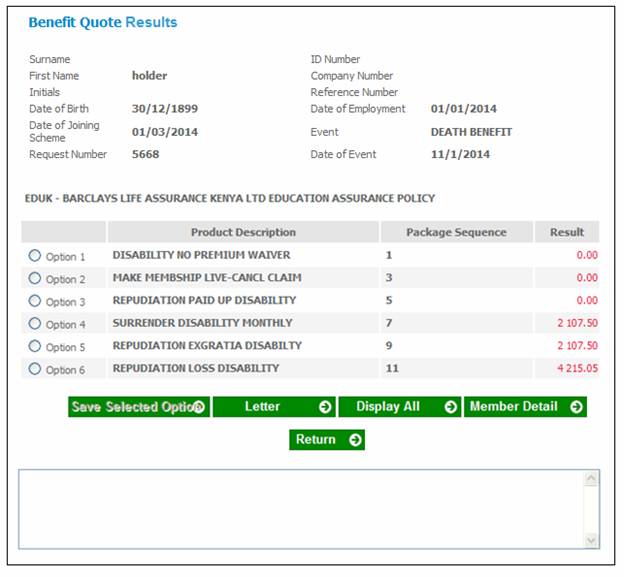

If any or all of the answers is YES, the following results will display:

This will be an indication that the claim has been repudiated. At this point the claim may need to be referred for a management decision if a payment is to be made for LOSS EVENT or EX-GRATIA.

Alternatively, the policyholder will most probably be contacted to inform that a Surrender Value will be paid. The claim checklist can be used to indicate this step or once a decision has been made, the document / email of the decision can be uploaded and viewed prior to authorise the actual payment.

If an EX-GRATIA or LOSS EVENT is payable, a benefit adjustment can be processed via the Benefit Payment Process screen.

For more details refer to

Supplements

Claim, Quote and Projection Input Questions

The Benefit Quote Results screen will be displayed.

The following is a description of the data displayed in the columns on this screen:

|

Option |

The benefit package options available for selection.

Note: The selection of an Option is mandatory. If an Option is not selected and saved, then when the Complete a Claim menu Option is selected, the system will redirect the user back to the Claim Enquiry screen in order to select an Option. |

|

Product Description |

A description of the Product or the name of the Operand used in the calculation. |

|

Package Sequence |

The system generated sequence used for this part of the calculation. |

|

Result |

The Benefit Product calculation result value. |

The calculation breakdown displays a result for each of the products for which the member is eligible. There may therefore be several products displayed, each with a result.

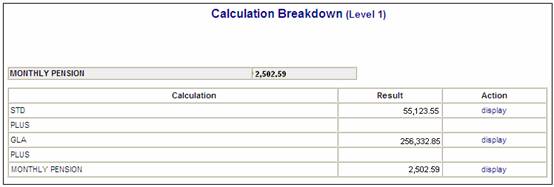

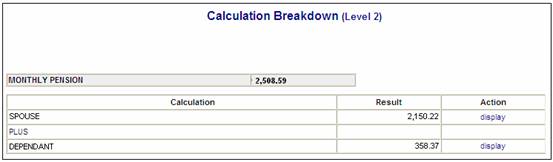

Each result may be broken down to display the constituent parts of its calculation. Each breakdown may then be further broken down. This may continue for any number of breakdowns.

To view a breakdown of an amount for a Product, click on the hyperlinked value that is displayed in the Result column for that Product.

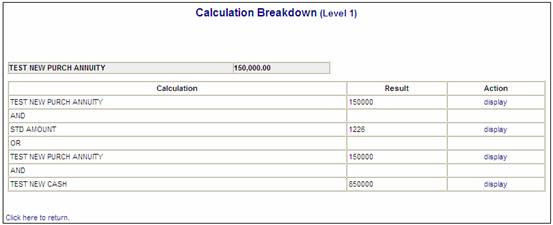

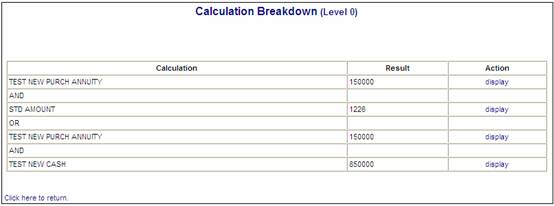

The Calculation Breakdown screen will be displayed. You may breakdown the calculation into multiple lower levels by selecting the hyperlinked Display in the Action column. At each successive breakdown, the screen displays the breakdown level in its title.

Note:

The DISPLAY ALL button can also be used as it also displays a hyperlinked Display per product.

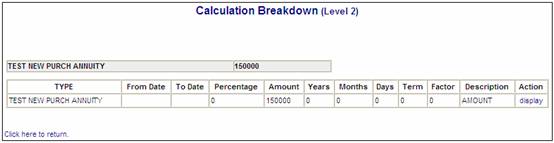

The first breakdown selected will be called Calculation Breakdown (Level 1) followed by Calculation Breakdown (Level 2) etc, until there are no further breakdowns available.

Examples

The Calculation Breakdown (Level 1) screen.

To display a further breakdown of the calculation, click on the display hyperlink in the Action column. The Calculation Breakdown (Level 2) screen will be displayed.

When you click on the display hyperlink in the Action column, and there is no further breakdown, the following message will be displayed.

Click OK to remove the message.

A blank Calculation Breakdown screen is displayed with a Click here to return hyperlink.

Note:

Each calculate ion breakdown screen displays a hyperlink called Click here to return. To return to a previous screen, click the hyperlink.

On the Benefit Claim Results screen, if a calculation is the result for a Benefit Product for which the Formula Type is CALCTYPELOOP, then when the display hyperlink on the Calculation Breakdown screen is selected, the system will display the results of each of the results calculated within the CALCTYPELOOP.

When a quote is done, the Beneficiary records are read and the spouse’s portion of the monthly pension and the dependants’ portions are calculated based on the number of dependants for which there is a beneficiary record.

In the following example, the results of the CALCTYPELOOP are the calculation of the Spouse’s portion of the monthly pension and one dependant’s portion of the monthly pension.

Example:

The display hyperlink will flow the beneficiaries.

The following screen buttons are displayed on the Benefit Quote Results screen:

SAVE SELECTED OPTION

This button is not enabled for selection.

DISPLAY ALL

This button displays a full Calculation Breakdown screen with the details of all of the benefit products and operands contained in the benefit package down to the lowest level. A hyperlinked Display allows for the selection of a calculation breakdown.

Note:

You can also click on the hyperlinked value that is displayed in the Result column per Product on the Benefit Quote Results screen.

Note:

Since no breakdown has been selected yet, this screen is called Calculation Breakdown (Level 0).

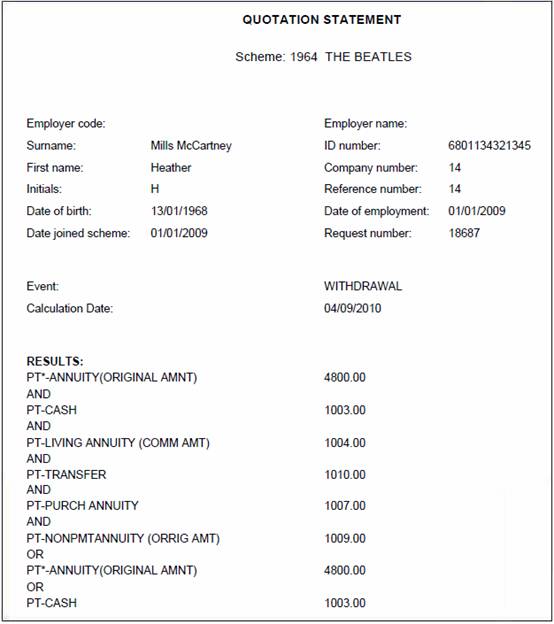

LETTER

Click LETTER to view a Quotation Statement in PDF format. The Quotation Statement will be displayed.

MEMBER DETAIL

This button is not enabled for selection.

RETURN

Click RETURN to return to the previous screen.

When a quote is processed and the Type of Investment for one of the Member’s investment portfolios is BONUS and the Pricing Frequency is MONTHLY, the system will retrieve the business transactions in the Member’s INVESTMEMB account with a Timestamp greater than the Timestamp of the latest Monthly Bonus run. Interest will be calculated on the business transactions from the Transaction Date or Due Date depending on the value for Interest From on the Scheme Details, to the Date of Event using the Bonus Rate effective for the relevant period.