EFT rules define the bank accounts to be used when generating EFT's. They are also required to define the bank account to be used whenever a bank account is used in an accounting rule, e.g. for cheque payment accounting activities the EFT rule defines the bank account that must be credited in the product’s ledger.

Currently the following accounting activities require an EFT rule (Bank Account Rule). This list could change as accounting activities are added or discontinued, and as the client configures the rules of these accounting activities:

|

Process |

Accounting Activity |

|

|

EFT Rules |

|

|

|

INCOME |

SFEFTPAY |

FROM ACC & TO ACC |

|

INCOME |

SFFEEIN |

FROM ACC & TO ACC |

|

INCOME |

SFFEEOUT |

FROM ACC & TO ACC |

|

INCOME |

SFINVIN |

FROM ACC & TO ACC |

|

INCOME |

SFPRMIN |

FROM ACC & TO ACC |

|

INCOME |

SFPRMOUT |

FROM ACC & TO ACC |

|

INCOME |

EXITCONEFT |

FROM ACC & TO ACC |

|

Bank Account Rules |

|

|

|

BENEFIT PAYMENT |

BENPAYEPAY |

TO ACCOUNT |

|

BENEFIT PAYMENT |

BENTRANSFER |

TO ACCOUNT |

|

BENEFIT PAYMENT |

BENPAYAMNT |

TO ACCOUNT |

|

MANUAL INITIATE |

BANKCHARGES |

TO ACCOUNT |

|

MANUAL INITIATE |

BANKINTEREST |

FROM ACCOUNT |

|

MANUAL INITIATE |

BENPAYEPAYRE |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPOSITALLOC |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPALLOCREV |

TO ACCOUNT |

|

MANUAL INITIATE |

DEPDISINV |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPOSITCONTR |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPCONTRREV |

TO ACCOUNT |

|

MANUAL INITIATE |

DEPOSITFEES |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPFEESREV |

TO ACCOUNT |

|

MANUAL INITIATE |

DEPOSITPREM |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPPREMREV |

TO ACCOUNT |

|

MANUAL INITIATE |

DEPCOVERRREC |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPCOVERREV |

TO ACCOUNT |

|

MANUAL INITIATE |

INVESTMENT |

TO ACCOUNT |

|

MANUAL INITIATE |

MISCFUNDEXP |

TO ACCOUNT |

|

MANUAL INITIATE |

FEESPAID |

TO ACCOUNT |

|

MANUAL INITIATE |

PREMIUMPAID |

TO ACCOUNT |

|

MANUAL INITIATE |

MISCFUNDINC |

FROM ACCOUNT |

|

MANUAL INITIATE |

PAYMENTALLOC |

TO ACCOUNT |

|

MANUAL INITIATE |

RFTPAY |

TO ACCOUNT |

Rules must be captured for the accounting activities listed under EFT Rules. These rules define the internal and external bank accounts between which money will be transferred via electronic fund transfer (EFT) on a regular basis. In these cases EFT’s will always take place according to these pre-defined rules. One of the accounts, depending on whether money is being transferred in or out of the product’s bank account, will also define the bank account that must be credited or debited in the product’s ledger.

EFT Rules can be specific to an Income Type. For example, if SFPRMOUT is set up, then for Risk Premiums, a separate EFT Rule can be set up for each Income Type:

Group Life Assurance premiums to Insurer 1

Disability premiums to Insurer 2

A bank account rule must be captured in all cases where the Process is not Manual Initiate.

For the Manual Initiate accounting activities, if a bank account rule is not captured then every time a manual accounting activity journal is processed using one of these accounting activities the relevant bank account must be selected. If a bank account rule has been captured the bank account will be selected automatically according to the bank account rule.

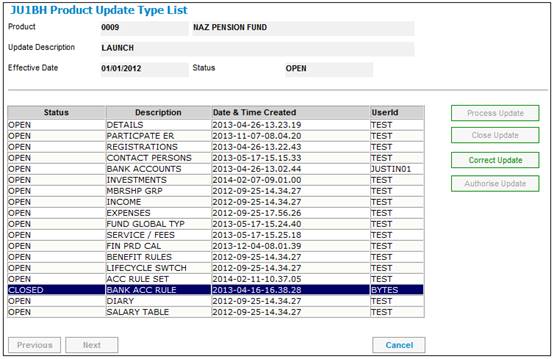

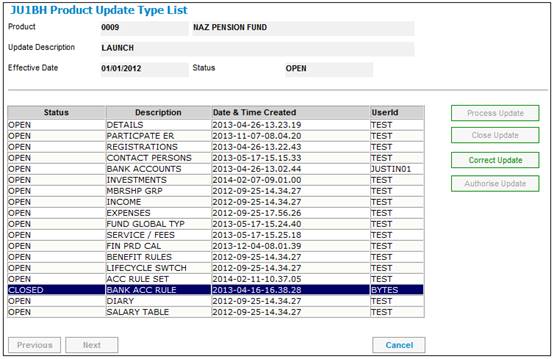

From the JU1BH Product Update Type List screen, highlight the BANK ACC RULE Update Type, then click PROCESS UPDATE.

Click PROCESS UPDATE. The JU1BH Product Update Type List screen will be displayed.

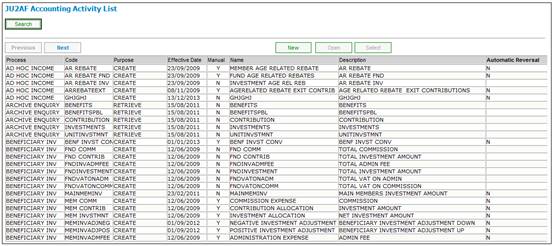

The JU2AF Accounting Activity List screen will be displayed.

Note:

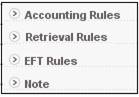

From the JU2AF Accounting Activity List screen, it is possible to select Accounting Rules, Retrieval Rules, EFT Rules or Note from the sub-menu on the left.

However, the set up of Accounting Rules and Retrieval Rules is not appropriate during the Product launch process. These particular options are available for the purposes of configuring the accounting rules.

Accounting Rules and Retrieval Rules are fully documented elsewhere in this manual. Refer to

Accounting

Structure

Accounting Activity Maintain

Because EFT Rules and Note (if applicable), should always be set up during Product launch, these options are covered in this document.

To define the EFT Rules for the Product, select an Accounting Activity from the JU2AF Accounting Activity List screen and then select EFT Rules from the sub-menu on the left.

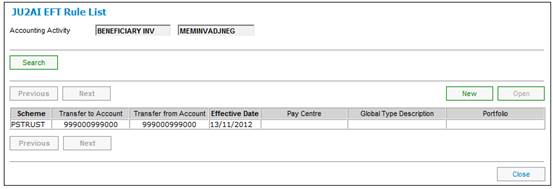

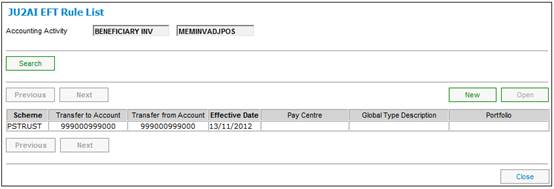

The JU2AI EFT Rule List screen is displayed showing products with which this accounting activity has been associated.

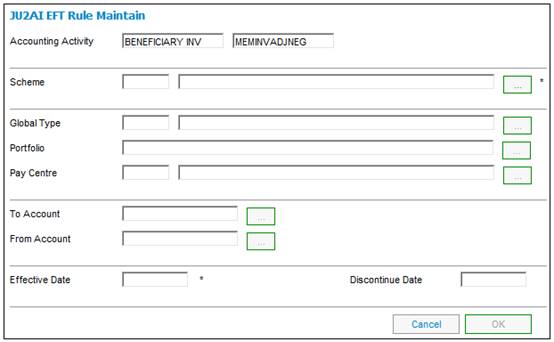

To insert a new EFT Rule, click NEW. The JU2AI EFT Rule Maintain screen will be displayed.

The EFT Rule screen is used for the creation, update or display of the EFT Rule associated with a selected Accounting Activity. The screen displays the parent Accounting Activity, associated product, any linked subjects (i.e. combinations of EFT Rule associations, viz. Global Type, Portfolio and Pay Centre), and any existing values for this EFT Rule.

The EFT Rules are very specific to the product and any combination of Global Type, Portfolio, and Pay Centre. An EFT is always associated with a product. The other associations are optional and are determined by the indicators on the Accounting Activity.

Once an EFT Rule has been created, it may not be deleted (there is no delete facility) but may only be discontinued. Discontinuance prevents the EFT Rule from being allocated in the future, but preserves its existing usage.

Once an EFT Rule has been created, all fields become protected. The Discontinue Date is the only field that can be subsequently updated.

Note:

Once there is an EFT Rule for an Accounting Activity, it will not be able to be overridden. If accounting transactions must be created using a different Bank Account, a different Accounting Activity should be used. The old bank account can then be linked to this Accounting Activity via the EFT Rule. It is recommended that Manual Initiate Accounting Activities are used for manual accounting journals so that it is clear from the Process on the BT that the transaction was created manually.

Depending on the Accounting Activity indicators, the associations to the Global Type, Portfolio, or Pay Centre become mandatory, and validation checks

will be performed.

When the money movement creation process creates an EFT instruction and it is found that no DTI limits are set up for one of the accounts, it will be assumed that the Debit and Credit limits for the mandate on this account are unlimited. In this situation, the mandate limit usage counters will not be updated, as there is no need to test for the possible exceeding of the limits.

Where a line number has not been supplied (on the SCHEME BANK ACCOUNT DETAILS screen), the account cannot be used as a "From" account in an EFT instruction. This is because banks use line numbers to identify and validate "From" accounts, and if an Accounting Activity is transacted using a bank account without a line number, and if the Payment Type is EFT, then the process creating the money movement / EFT instruction will fail. This will cause the creation of the business transaction (BT) to fail as well. The process creating the Accounting Activity Transaction will be notified about the failure (the message is "DEBIT DTI ACCOUNT NOT FOUND"). Only a cheque payment can be used against such an account.

For more information on setting up a new EFT Rule, refer to

Supplements

Processes

Adding a new EFT Rule

These values can be found under Accounting on the main functionality menu. Select Transaction Capture from the top sub-menu, then select Manual Accounting Transactions from the sub-menu on the left.

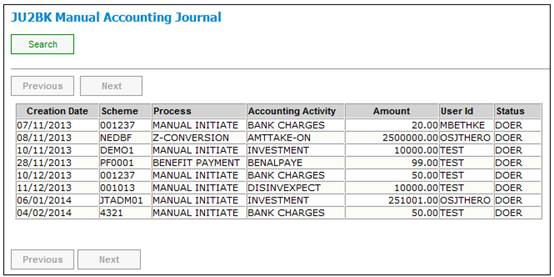

The JU2BK Manual Accounting Journal screen will be displayed.

Descriptions of the input fields for the creation of a new EFT Rule on the JU2AI EFT Rule Maintain screen appear below.

|

Accounting Activity |

Displays the Accounting Activity Process and Code, e.g. Benefit payment / BEBPAYAMNT. |

|

Scheme Details |

A unique identifier for the Product, and the name by which the Product is registered with the Financial Services Board. For new records, select the appropriate Product by using the LIST button. The List screen is displayed. Select a Product from the list and click SELECT. For existing records, the selected details will be displayed. |

|

Global Type |

Associates this EFT Rule with a Global Type. For new records, select the appropriate Product by using the LIST button. A screen displaying a list of Global Types is displayed. Select a Global Type from the list and click SELECT. Note: The system determines via the Accounting Rule for the Accounting Activity selected whether the Global Type is required or not. If Global Income Type is not required then the LIST button is greyed out.

For existing records, the selected details will be displayed. |

|

Portfolio |

Associates this EFT Rule with an Investment Portfolio. For new records, select the appropriate Investment Portfolio by using the LIST button. The Scheme Portfolio List screen is displayed. Select a Portfolio from the list and click SELECT. Note: The system determines via the Accounting Rule for the Accounting Activity selected whether the Portfolio is required or not. If Portfolio is not required then the LIST button is greyed out.

For existing records, the selected details will be displayed. |

|

Pay centre |

Associates this EFT Rule with a Pay Centre. For new records, select the appropriate Pay Centre by using the LIST button. The Scheme Pay Centre List screen is displayed. Select a Pay Centre from the list and click SELECT. Note: The system determines via the Accounting Rule for the Accounting Activity selected whether the Pay Centre is required or not. If Pay Centre is not required then the LIST button is greyed out.

For existing records, the selected details will be displayed. |

|

To Account |

The account number to which the money must be moved. For bank deposits - the account into which the money is deposited. For EFT payments - the account into which the money is to be transferred. For new records, select the appropriate Account number by using the LIST button. This button is enabled until Product details have been added. The Scheme Bank Account List screen is displayed. Select a Bank Account from the list and click SELECT.

For existing records, the selected details will be displayed.

When using this rule in the creation of a business transaction and money movement instruction, if no value is supplied here, the process initiating the accounting activity occurrence must supply the "To Account" (e.g. with the payment of a member benefit). If, however, the process does not supply it, the payment type must be by cheque, otherwise the Create BT process will reject. |

|

From Account

|

The account number from which the money must be moved.

For cheque payments and EFT’s – the account out of which money is to be paid. For bank debits, e.g. bank charges, transaction reversals, etc. – the account to be credited. For new records, select the appropriate Account number by using the LIST button. This button is enabled until Product details have been added.

The Scheme Bank Account List screen is displayed. Select a Bank Account from the list and click SELECT.

For existing records, the selected details will be displayed. |

|

Effective Date

|

The date when this EFT rule becomes effective. This date cannot be earlier than the current date, but it can be future dated. |

|

Discontinue Date |

The end date of this EFT rule. This date cannot be earlier than the Effective Date, but it can be future dated. If this date is later than the current date, then it can be changed. If it is equal to the current date, then it cannot be changed. |

Click OK.

This button is only enabled once all mandatory fields on the screen have been populated. It might be necessary to TAB beyond the last field before the button becomes enabled.

The JU2AI EFT Rule List screen is displayed.

The new EFT Rule is added on the screen.

To view any notes for an Accounting Activity, select an Accounting Activity on the JU2AF Accounting Activity List screen, and select Note from the sub-menu on the left.

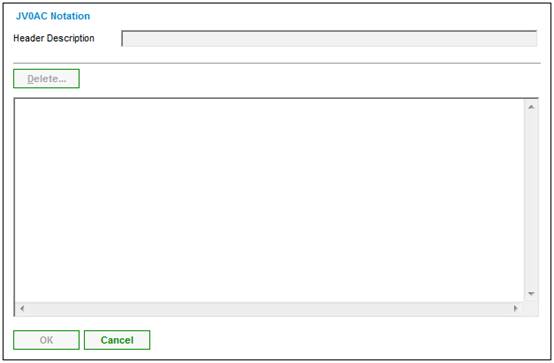

The JV0AC Notation screen is displayed.

To view the contents of the notes, highlight a note and click OPEN. The JV0AC Notation screen will be displayed.

To return to the JU2AF Accounting Activity List screen, click CANCEL then select Close Maintain Notation from the sub-menu on the left.

![]()

For further information regarding the notes facility, refer to

Product Launch Requirements

Additional Menu Options

Notes

To end the capturing of the EFT Rules and to return to the Product Update Type List screen, select Close.

Click CLOSE UPDATE to close this update type.