Product details and rules are captured through the creation of a Product update record which is used to record the scope of the update and to control its progress. All updates are passed to an Authoriser and carry an effective date. History is kept of all changes and changes are only effective once authorised.

All rules are applied according to their effective dates. This enables the correct rules to be applied even if the various Pay Centres applicable to a Scheme are processing data for different periods at any given time.

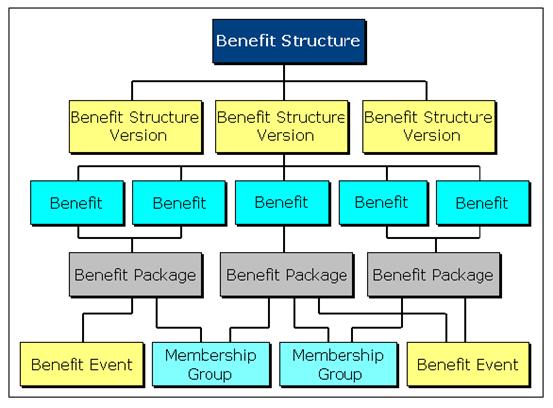

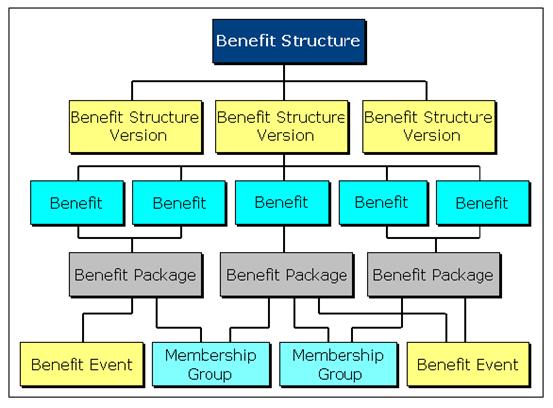

The set up of a Scheme’s Benefit Structure is done during the Scheme update process and any number of structures can be created and linked to different groups of Members.

- Product Update

- Details

- Participating Employers

- Registration

- Contact Persons

- Bank Accounts

- Interest

- Pay Centres

- Membership Groups

- Eligibility Rules

- Investments

- Income

- Expenses

- Service Fees

- Benefit Rules

- Accounting Rule Set

- Bank Accounting Rule

- Financial Period Calendar

- Formats

- Disclaimers

- Distribution

- Life Cycle Switching Rules

- Notes

- Diary

- Salary Table

- Product Parameters

- Underwriting

- Discontinuance

- Membership Group Enquiry

- Interface Enquiry

- Document Template

- Document Template Element

- Trustee Nomination Template

Selection of Product Update type for capture or update. Product Update types include:

- Details

- Participating Employers

- Registration

- Contact Persons

- Bank Accounts

- Membership Groups

- Financial Period Calendar

- Investments

- Income

- Services and Fees

- Benefit Rules

- Life Cycle Switch

- Accounting Rule Set

- Bank Account Rule

- Diary

- Code

- Name

- Short Name

- Main Product of Pool details

- Launch Date

- Previous Product Code

- Status (Accepted Proposal, Launch, Authorised)

- Sponsor Name

- Principal Employer Name

- Country

- Currency

- Product

- Business Unit

- Type of Product (e.g. Retirement, Preservation)

- Tax Status

- Sector

- Type of Service (e.g. Full Admin)

- Pooling Status (None, Main Umbrella, Sub Umbrella)

- Type of Launch (New Product, Takeover)

- Type of Retirement Product (e.g. Pension, Provident)

- Risk Benefits (Yes, No)

- Flexible Investment Choice (Yes, No)

- Underwriting Basis (Audit Exempt, Non Audit Exempt, Not Applicable)

- Original Commencement Date

- Financial Year End

- Interest on Late Contribution Payment (Yes, No)

- Member Switching Restriction After Date of Joining Product (Number of Months)

- Administrator Branch (Code and Description)

Association of Principal Employers and Participating Employers for a Product. Participating Employers are companies whose Employees may be Members of a Product. This could be a single company or several companies, e.g. a company and its subsidiary companies. The Participating Employers are set up as Corporate Clients in the Infrastructure and when they are associated to a Product, they are selected from the list of Corporate Clients.

A Participating Employer could be linked to more than one Product where Employees of the same company belong to different Products.

- Legislative Body Details

- Product Registration Number

- Effective Date

- Deregistration Date.

Association of Contact Persons with a Product and definition of:

- their role (Principal Officer, Trustee, etc.)

- role of Trustee (Chairman, Trustee, Employee Representative).

The capture of Bank Accounts and Association of Bank Branch and capture of:

- account number

- account type (current, savings, etc.)

- account limits

- Line Number (for Electronic Fund Transfers (EFT)).

Association of applicable Administrator Bank Accounts, Administrator Branch Accounts, Participating Employer Accounts and Principal Employer Accounts used in the administration of a Product.

Capture, update and enquiry of interest rates applicable to a Product for Late Contributions, Benefit Payments and VAT. If no rates are specified at this level, the Global Interest Rate is used.

Association of Pay Centres for a Product. A Pay Centre represents the entity from which Member and contribution data is collected for a group of Members. It is usually the Payroll Office.

Definition of groups (categories) of Members per type of group (Contributions, Benefits). Any number of Membership groups per Membership Group Type can be created.

Selection of the Investment Mediums to be used by the Product and information or rules specific to the Product:

- Investment Account Number

- Minimum Switch Out Percentage

- Investment Switching Dates

- Initial Charge (for Unit Trusts)

- Net Investment Indicator

When the Net Investment Indicator is not set it indicates that contributions will be invested automatically when received and disinvested for Benefit Payments. If it is set, it indicates that the net contributions (contributions less benefit payment provisions) are invested at regular intervals. A Product's use of an Investment Medium is referred to as an Investment Portfolio.

- Capture of interest rate applicable to Product (monthly or annual interim or final).

- Capture of instruction to allocate annual final interest.

- Capture of instruction to apportion Income or expense amounts (Dividends, surpluses, Investment Management Fees, etc.) to Members invested in a specified Investment Portfolio.

Also refer to Distribution below.

Selection of the Income Types to be used by a Product and specification of Income Rules per Membership Group (rate / amount of contribution). Specification of default allocation to Investment Portfolio(s). This includes the specification of administration fees and Insured Benefit Premiums to be collected from employers or employees.

Selection of the Expense Types to be used by a Product and specification of Expense Rules per Membership Group (rate / amount of cost). This includes the specification of administration fees and Insured Benefit Premiums to be paid to the administrator and insurers respectively.

Selection of the services provided for a Scheme, e.g. switching, and specification of the transaction based fees charged for the service.

Set-up of Benefit Structure (BS) for a Product.

A Benefit Structure (BS) is created to define Product benefits and insured benefits for a Product. A history of changes to a Benefit Structure is maintained by creating a Benefit Structure Version (BSV) for each effective date of a change. Each Benefit Structure Version is linked to a Membership Group and a Benefit Event (e.g. Resignation, Retirement, Death of Member, etc.) via a Benefit Package. The Benefit Package defines the benefit(s) a Member will be paid on a specific event.

Normal retirement dates (NRD) and early retirement dates (ERD) are also defined in the Benefit Structure and linked to Membership Groups.

Association of Product to a defined set of Accounting Rules.

Capture the rules to define the bank accounts to be used when generating EFT's.

Define the opening and closing dates for which accounting transactions can be posted to a particular financial period. These dates will also be used in the production of financial reports.

Customise benefit statements, investment statements and new entrant certificates by defining the contents for a product. Define projection assumptions and translation values for a product.

Provide the specific disclaimer text, per event, to be added to the display of benefits or switching. Disclaimers can be defined at either a global level or at a product level.

The distribution structure for Reserves, to be applied at a product level for:

- all members of a product, and all of the portfolios to which they are linked

or

- all members of a membership group or membership groups for a product, and all of the portfolios to which they are linked

or

- the participating employer for which the reserve must be distributed

Distribution Detail (per Portfolio):

- Distribution Type

- Effective Date

- Amount

- Product Income Type Details

- Status

- Membership Group Type

- Participating Employer

Also refer to Investments above.

Capture rules for members who have elected to invest according to a life cycle investment strategy. This allows the system to automatically switch the investments for these members according to these rules.

Capture of free text notes for a product.

Capture of Product Events, frequency and starting date. An e-mail reminder is sent to the Administrator for these events based on the starting date and frequency.

Enquire on the history record of the salaries per salary grade and notch.

Capture of date of discontinuance of a product.

View the details of all income groups and membership groups defined for the product, from a single screen.

View the details of all income groups, participating employers, pay centres and investment portfolios defined for the product, from a single screen.

Set up document templates to be used for the production of documents in a system process, e.g. benefit statements, benefit payments, benefit quotes, etc.

Create a template for the upload of Board of Trustee nominee images and details for viewing and voting on by members via the member website.