Section 13A; together with Regulation 33 of the Act, and the Rules of the funds contain provisions for regular monitoring of contributions.

Section 13A requires the payment of contributions to the funds by the employers and the obligations of the administrator, the principal officer and trustees in cases of non-payment of contributions.

Interest is calculated on contributions received after the prescribed date, and employers are billed in terms of section 13A of the Pensions Funds Act.

Interest on the amount of late contributions, or on the interest on late contributions, is calculated when the relevant contributions are received. I.e. if contributions were paid within the legislated cut-off time, but were not paid in full, then interest will be calculated on the outstanding amount once it is received.

The interest calculation is part of the nightly batch schedule. Once the run has taken place, late interest details are available for viewing and authorizing.

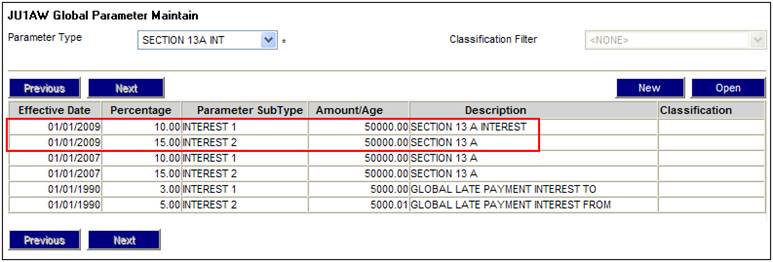

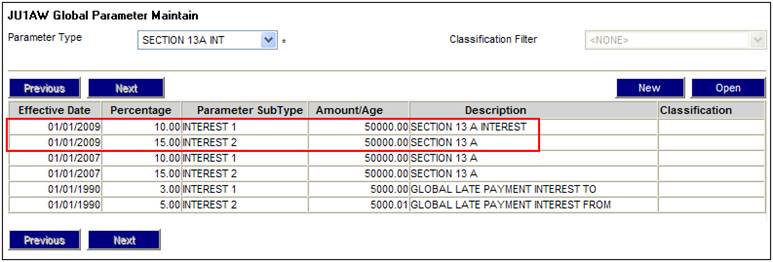

Under Infrastructure, select System data > Parameters > Global parameters. Interest rates for Section 13A interest are captured under Global Parameters.

Note:

When defining Section 13A Interest, a threshold amount is defined with a percentage applicable to amounts below the threshold and a percentage applicable to amounts above the threshold.

Example:

Interest1 10% on amounts up to 50000

Interest2 15% on amounts from 50000

If the contribution amount is less than the Amount for INTEREST 1, the INTEREST 1 Percentage will be applied. If the contribution amount is greater than the Amount for INTEREST 2 then the Percentage for INTEREST 2 will be applied.

Note:

In terms of current legislation, the (threshold) amounts up to and amounts from values are the same.

The following formula is used for the calculation of interest:

[Amount (1+Interest percentage / 100) x (number days / 365*)] – Accounting Activity Amount

*If the year is a leap-year , the denominator will be 366 for the month of February.

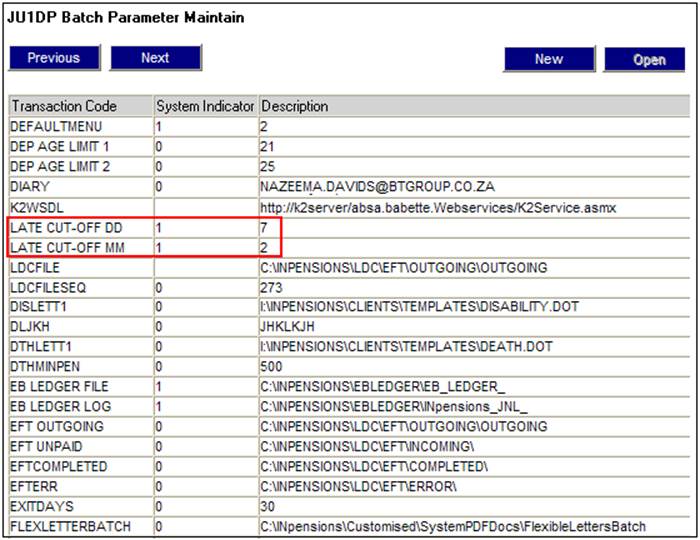

Cut off days for late payment interest and cut off months for interest on interest on late payment, are defined under Infrastructure > Batch > Batch Parameters.

LATE CUT-OFF DD

Number of days. To be used to determine the number of days after the date that contributions are due that interest will be calculated if the contributions are received after this period.

LATE CUT-OFF MM

Number of months. To be used to determine the number of months after the calculation of interest on late contributions that interest is calculated on the interest.

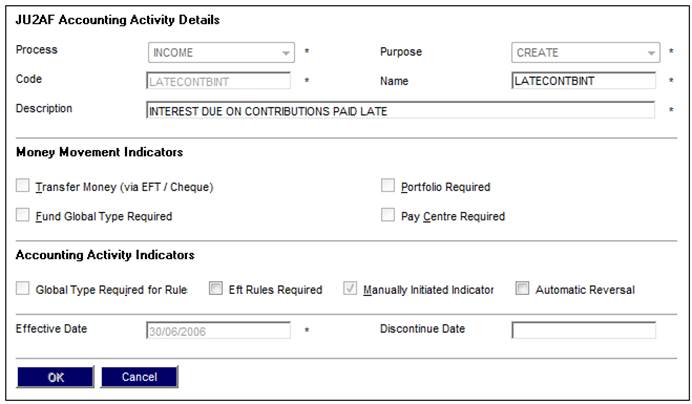

Under Accounting, select Structure > Accounting Activity.

When the JU2AF Accounting Activity List screen is displayed, select the following accounting activities, then select Accounting Rules from the sub-menu on the left:

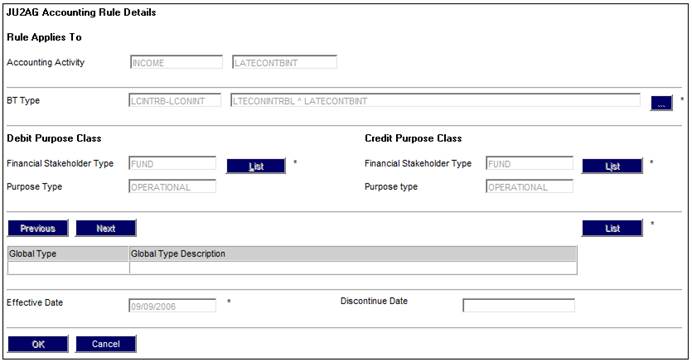

Accounting Activity LATECONTBINT for the INCOME Process.

Interest on late paid contributions

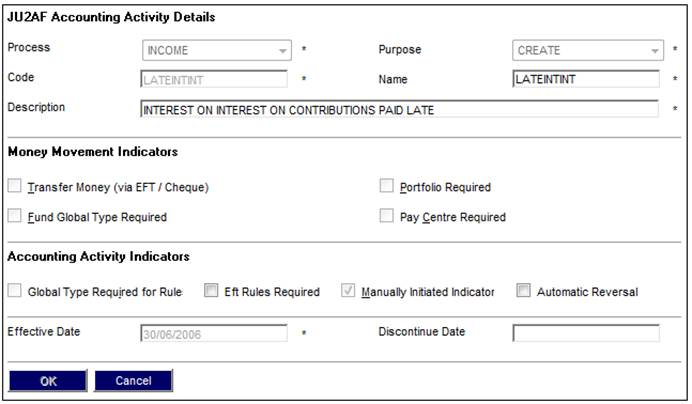

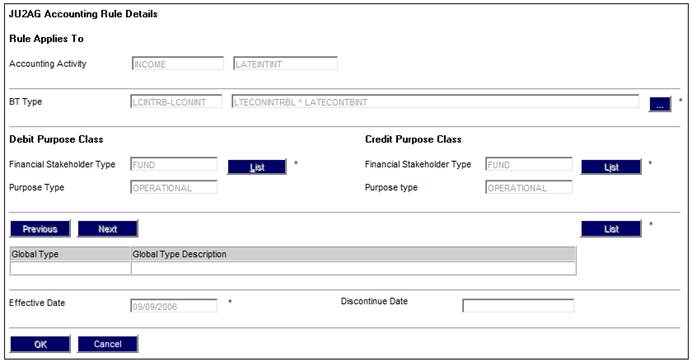

Accounting Activity LATEINTINT for the INCOME Process.

Interest on interest on late paid contributions

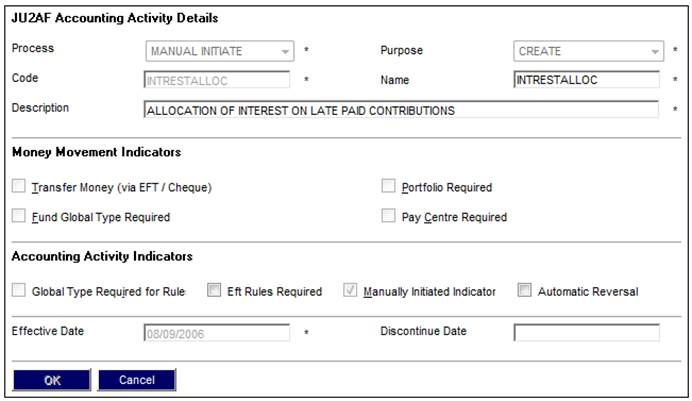

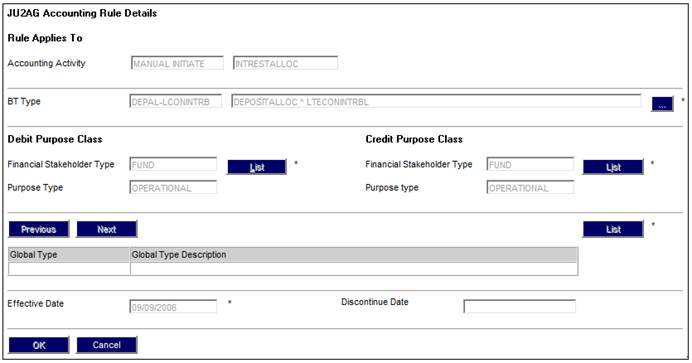

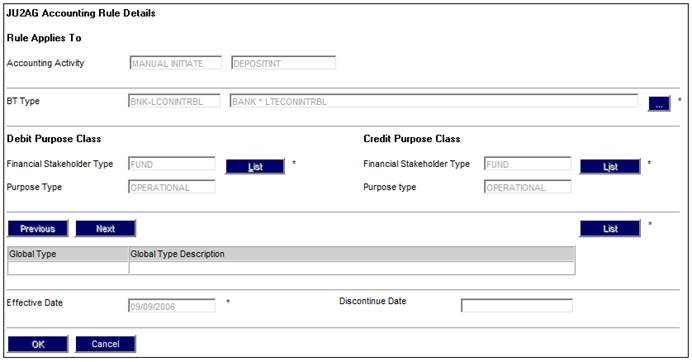

Accounting Activity INTRESTALLOC for the MANUAL INITIATE Process.

Deposit Allocation for late contribution interest received together with contributions

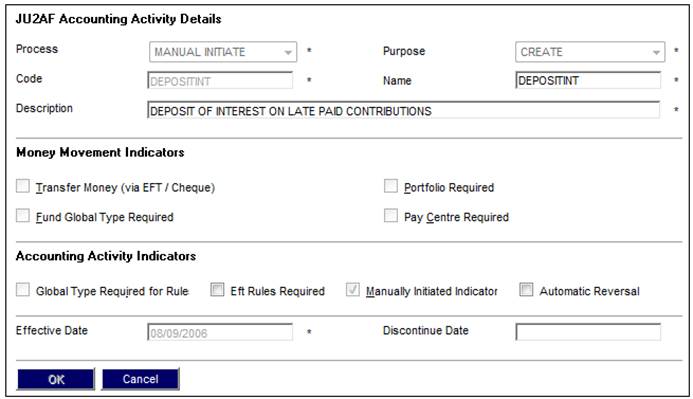

Accounting Activity DEPOSITINT for the MANUAL INITIATE Process.

Single deposit of late contribution interest received

The user processes the monthly cycle and records the contributions received. Once the income batch has been processed and the business transaction has been posted via the BJU2AA batch run, the BJU3BS Late Payment Interest – Section 13A batch job will run. This is an automated process as these batches are included in the normal nightly batches.

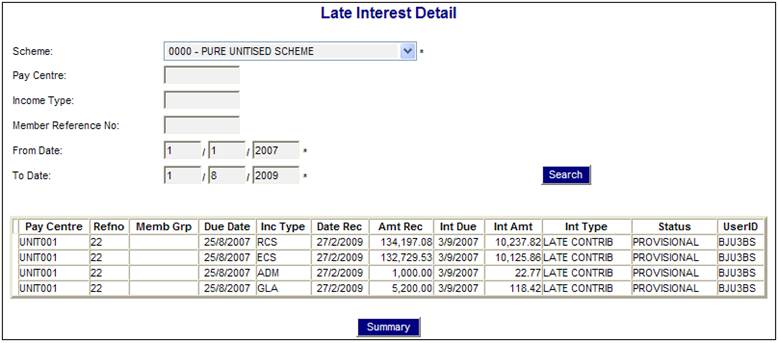

Once BJU3BS Late Payment Interest batch job has run successfully, the results can be viewed under Processes > Contributions >Late Contributions > Late Interest.

For more information, refer to the Late Contribution Interest section in:

Processes

Contributions

Income

Supplements

Processes

Running Section 13A Interest

Late Interest Detail

Click SUMMARY to view the totals and check whether correct.

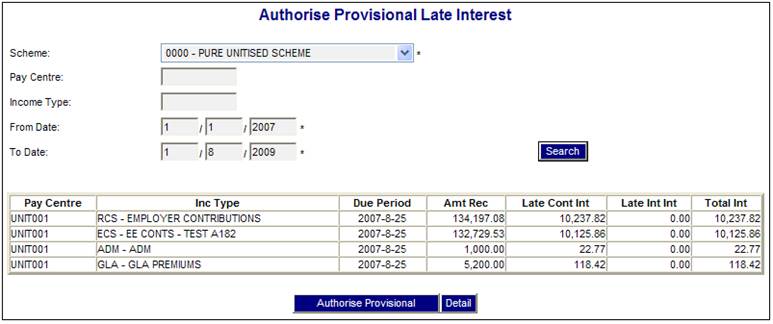

Authorise Provisional Late Interest

This displays a list of provisional interest calculated. After the results have been confirmed, the provisional interest can be authorized.

Click AUTHORISE PROVISIONAL to move the transactions to the Authorise Late Int step.

Note:

The person who provisionally authorises the interest may not be the same as the person that finally authorises the transactions.

Click DETAIL to view a breakdown at member level.

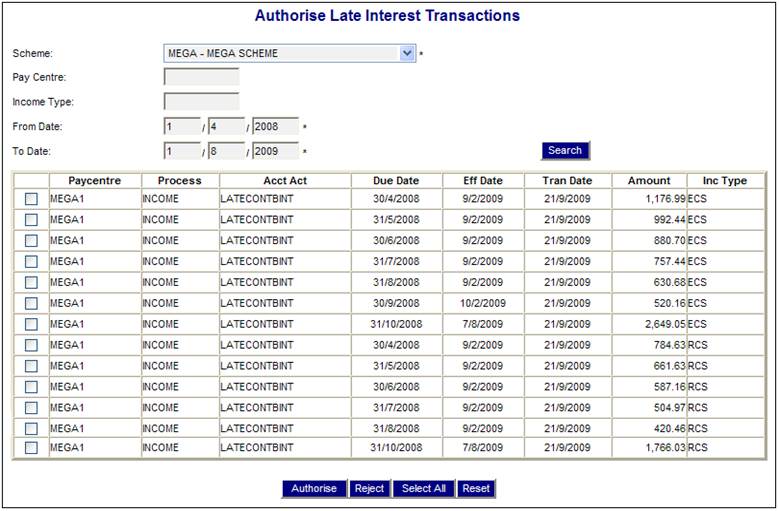

Authorise Late Interest Transactions

Once late interest has been authorized using the Auth Late Int selection, the following receivable accounting transactions will be created:

- Accounting Activity LATECONTBINT for the INCOME Process

- Accounting Activity LATEINTINT for the INCOME Process.

The information may then be sent to the employer.

The employer can either send the outstanding amount directly or together with the next contribution.

- If the employer sends the outstanding amount directly, then you must record a manual journal:

Accounting Activity DEPOSITINT for the MANUAL INITIATE Process

- If the employer sends the outstanding amount together with the next contribution, then you must record a bank account allocation:

Accounting Activity INTRESTALLOC for the MANUAL INITIATE Process

When the deposit paid by the employer is recorded, it offsets the amount receivable.

Currently there is no automated process that writes the interest received to the member’s records.

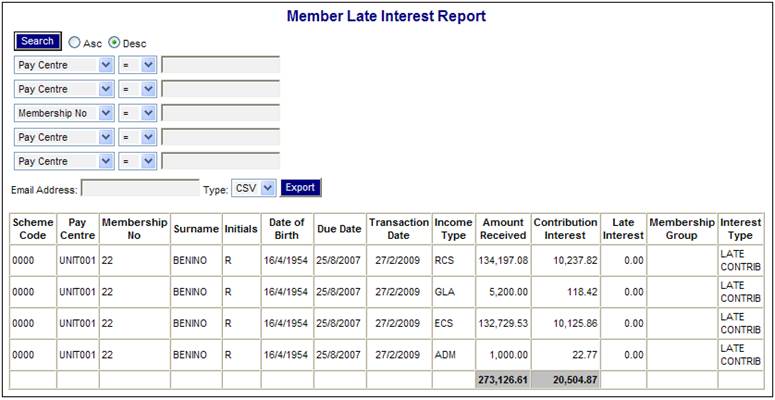

When the interest has been received, the late interest report that shows the interest calculated at a member level can be used to load, either an ad hoc income or a bulk journal load. Alternatively, distribution can be used to apportion the interest received.

It all depends on the type of investment. If it is unitised then it should be apportioned to the members. If it is bonus using due date then it should not.

This will depend on how the interest amount has been allocated. This is a separate process from the receipting of the money.

If the interest is loaded via the adhoc income file, then it will be automatically split according to the members' investment allocations. The money will then need to be invested accordingly.

If it isn't allocated to the members then it would have to be invested in the same way as the reserves are invested.

Under Reports, select the required scheme then select Member > Late Member Interest

Notes:

|

Amount Received |

The contribution amount received. |

|

Contribution Interest |

The interest calculated / received on the late contribution. |

|

Late Interest |

The interest calculated / received on the interest on the late contribution. |