When the JU3UC_LIQUID Liquidity Review Batch Job runs each month, the system will calculate the market value of each of the Member’s investments in the Liquidity Portfolio. If the market value is less than the value for the Top Up Cash Amount for the scheme, the system will create switching transactions required to increase the market value of the Liquidity Portfolio to the value of the Top Up Cash Amount.

Switching Detail records will be created to switch the money to the Liquidity Portfolio. These Switching Detail records will all be created with the same Bulk Switch Number.

A Service Request will be created in order to authorise these switches.

Liquidity Review Batch Job

When the JU3UC_LIQUID Liquidity Review Batch Job is run, the system will read the value for Description on the Scheme Parameter with a Parameter Type of LIQUIDITY PORT and the value for the Scheme Parameter with a Parameter Type of TOP UP CASH AMT.

The system will calculate the market value of each of the Member’s investments in the Portfolio with a Name equal to the LIQUIDITY PORT Scheme Parameter Description.

If the Portfolio is unitised, the market value will be calculated based on the latest unit price.

If the market value is less than the value for the TOP UP CASH AMT Scheme Parameter, the system will calculate the value to which the balance must be topped up to as follows:

A. Read the value for Minimum Investment on the Investment Medium to which the Portfolio with a Code equal to the LIQUIDITY PORT Scheme Parameter Description.

B. Read the value for the Scheme Parameter CASHMINPERIOD 2 (number of months of regular payments to be covered, currently 6).

C. Read the value for Regular Payment Amount on the latest Membership Payment Detail record linked to the Membership Payment record with a Benefit Type of REGP. If the value for Frequency captured on the JU3EO Payment Details page is MONTHLY, multiply the Regular Payment Amount by the CASH MIN PERIOD Scheme Parameter value. If the value for Frequency is QUARTERLY, multiply the Regular Payment Amount by the CASH MIN PERIOD Scheme Parameter value divided by 3. If the value for Frequency is BI-ANNUAL, multiply the Regular Payment Amount by the CASH MIN PERIOD Scheme Parameter value divided by 2. If the value for Frequency is ANNUAL, multiply the Regular Payment Amount by the CASH MIN PERIOD Scheme Parameter value divided by 1

D. Set the value that the balance must be topped up to as the greater of A and C.

The system will create the switch transactions required to increase the market value of the LIQUIDITY PORT Portfolio to the value of D above.

The system will read the Inv to Port records for the Investment Membership Group to which the Membership is linked and find the Portfolio with a value for Sequence of SECOND. The system will calculate the market value for the Portfolio found and if the Market Value is greater than the value required to top up the LIQUIDITY PORT Portfolio, will create the switch transactions for the difference between the TOP UP CASH AMT value and the market value of the LIQUIDITY PORT Portfolio.

If the Market value of the Portfolio with a Sequence value of SECOND is less than the difference between the TOP UP CASH AMT value and the market value of the LIQUIDITY PORT Portfolio, then the system will create the switch transactions for the market value of the Portfolio less the difference between the TOP UP CASH AMT value and the market value of the LIQUIDITY PORT Portfolio.

The system will calculate the market value of the Portfolio with a Sequence value of THIRD and create the switch transactions for the difference between the TOP UP CASH AMT value and the market value of the LIQUIDITY PORT Portfolio less the value for the switch transactions created for the Portfolio with a value for Sequence of SECOND.

If the market value is not sufficient, then the system will calculate the value required to be switched from the next Portfolio, etc.

If the Member does not have a balance in another Portfolio, then the system will create the switch for the amount available and write a message to the error log to indicate than the full TOP UP CASM AMT could not be switched.

Switching Transactions

The system will create Switching Detail records to switch the money to the Liquidity Portfolio.

The system will retrieve the latest Unit Prices for the switch out Portfolios and calculate the number of units to be switched out by dividing the top up amount by the Unit Price and create the transfer out switches in units.

All of the Switching Detail records will be created with the same Bulk Switch Number.

The system will create a Service Request with a Process Name of LIQUIDITY REVIEW and an Activity Name of AUTHORISE SWITCHES.

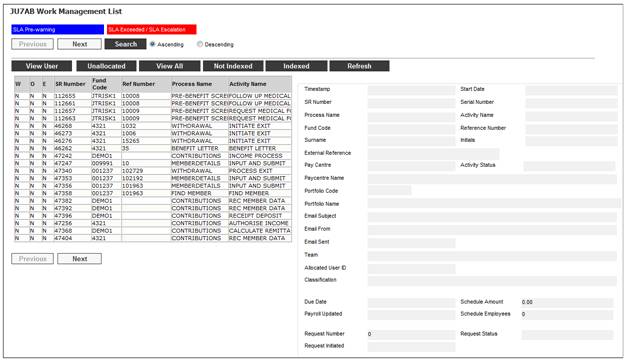

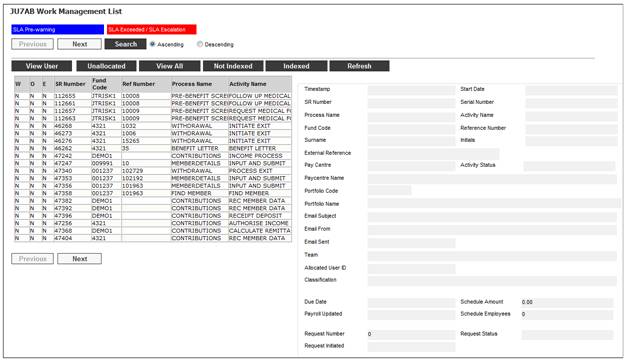

When you select my work from the main functionality menu, the JU7AB Work Management List screen will be displayed.

This screen displays a list of the service requests allocated to you.

For detailed information on the JU7AB Work Management List screen and the functionality of the action buttons refer to

My Work

Service Requests

Activity Name: Authorise Switches

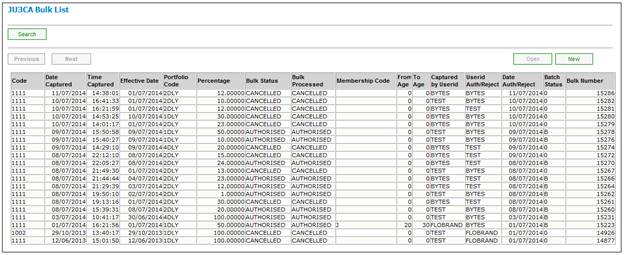

When a Service Request for which the Process is LIQUIDITY REVIEW and the Activity Name is AUTHORISE SWITCHES is selected on the JU7AB Work Management List screen and the Process option is selected, the system will flow to the JU3CA Bulk List screen and display the Bulk switch with the Bulk Switch Number to which the Service Request is linked.

The Switching Transactions must be authorised.

For more information refer to Authorising bulk switches under

Processes

Switches

Bulk Switches

When the Bulk Switch is authorised, the system will update the Status of the Service Request to COMPLETED.