Log in to the system from the Logon page.

Click clients.

The Welcome screen will be displayed.

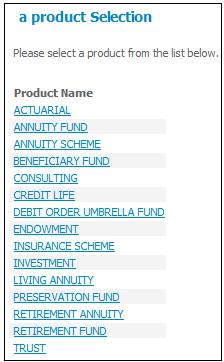

From the main menu on top, click Products.

The Product Selection screen will be displayed.

Click CREDIT LIFE.

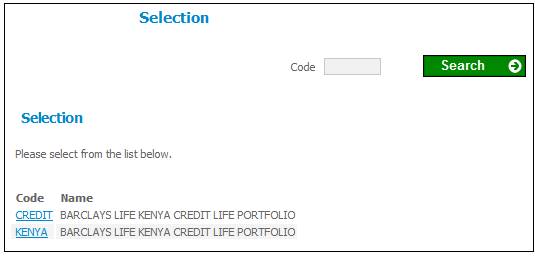

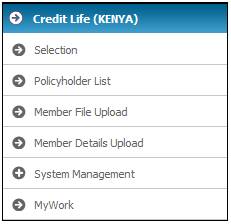

The Selection screen will be displayed.

Select the required code by clicking the hyperlinked code in the Code column.

Note:

To view more codes, click Next. To find a specific code, insert the code (in full or partly) and click SEARCH.

The selected code will be displayed.

A sub-menu will be displayed on the left.

To view existing members, select Policyholder List on the sub-menu on the left.

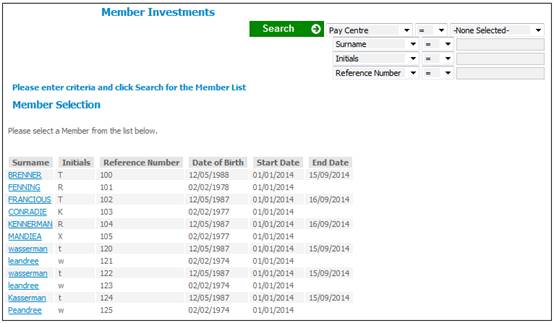

The Member Investments screen will be displayed.

The following Policyholder details will be displayed:

- Surname

- Initials

- Reference Number

- Date of Birth

- Start Date

- End Date

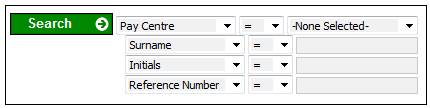

You can search for specific policyholders by selecting any of the following criteria or a combination thereof:

- Pay Centre

- Surname

- Initials

- Reference Number

For more information, refer to Searching for Records under Reports

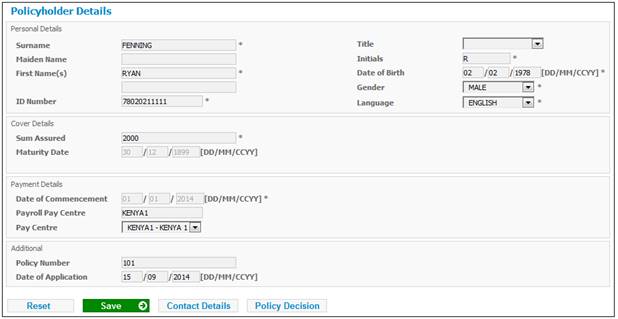

Click on the hyperlinked name in the Surname column. The selected policyholder will be displayed on the Policyholder Details screen.

Descriptions of the fields on this screen appear below.

Personal Details

|

Surname |

The policyholder’s name.

Note: If the Membership is linked to a Corporate Client, the Corporate Client Name will be displayed in this field

Mandatory field |

|

Maiden Name |

In the case of a married female, this is her family name before she was married. |

|

First Name(s) |

The policyholder’s first names.

The capture of at least one name is mandatory. |

|

Title |

Select the required title for the policyholder from the drop-down box.

Optional field |

|

Initials |

The policyholder’s initials.

Mandatory field |

|

Date of Birth |

The policyholder’s date of birth.

The Policyholder must not be older than 60 or younger than 18.

Mandatory field |

|

Gender |

Select the policyholder’s gender from the drop-down box.

Mandatory field |

|

Language |

The policyholder’s preferred language.

The system defaults to ENGLISH. If a different language applies, select a value from the drop-down box. |

|

ID Number |

The policyholder’s identity number.

Mandatory field |

Cover Details

|

Sum Assured |

The guaranteed maturity value that the Policyholder will receive when the policy matures.

The sum assured amount must greater than 9999.00 ZMW and less than 250 000.01 ZMW.

Note: For more information, refer to Save policyholder details below. |

|

Maturity Date |

The date on which the Credit Life Policy matures.

Note: Once the policyholder has been saved, the system will display a date calculated as date of birth plus 66. |

Payment Details

|

Date of Commencement |

The date on which this membership / Policyholder commences.

The date may not be greater than 3 months from today’s date. The following message will be displayed if the date is greater than 3 months.

Date of commencement cannot be greater than 3 months from today.

Click OK to remove the message. Capture a date less than 3 months from today’s date.

Mandatory field |

|

Payroll Pay Centre |

The Payroll Pay Centre for the policyholder. |

|

Pay Centre |

The Pay Centre from which the policyholder’s contribution / premium data is collected.

Select a Pay Centre from the drop-down list.

Optional field |

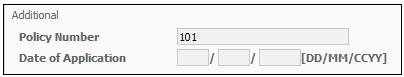

Additional

|

Policy Number |

The number of the Policyholder. If this field is left blank, a number will be generated by the system. |

|

Date of Application |

The date on which the Policy was applied for.

The system will pre-populate this field with the current date.

This field may be amended to a date that is less than or equal to the current date. |

Action Buttons on the Policyholder Details screen

Action buttons are displayed at the bottom of the Policyholder Details screen.

![]()

These buttons enable the maintenance of the following details for the Policyholder:

- Reset

- Save

- Contact Details

- Policy Decision

The system displays the Address Details loaded in the Credit File upload.

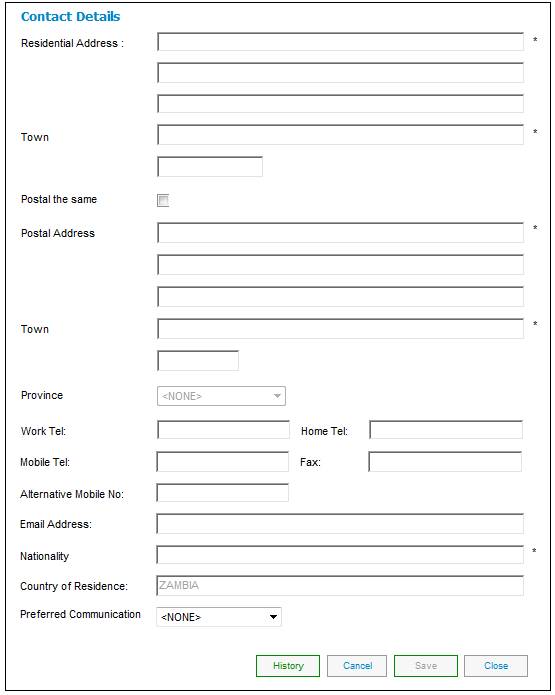

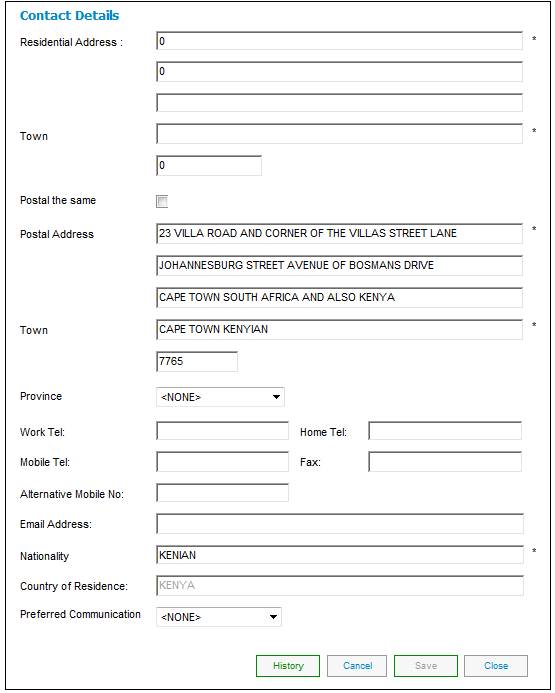

To maintain policyholder contact details, select CONTACT DETAILS at the bottom of the Policyholder Details screen.

![]()

The Contact Details screen will be displayed.

History

To view a history of addresses click HISTORY.

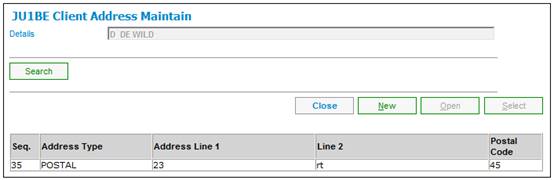

The JU1BE Client Address Maintain screen will be displayed.

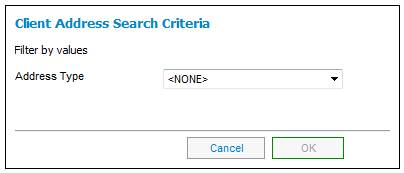

To search for a client address type, click SEARCH. The Client Address Search Criteria screen will be displayed.

Select an address type from the drop-down list and click OK. If the address type exists, then the system will display it on the JU1BE Client Address Maintain screen.

To view details of any of the addresses listed, highlight the required address, then click OPEN. The Contact Details screen will be displayed.

To maintain existing Contact Details or create new details, capture data on the Contact Details screen as follows:

|

Residential Address |

The details of the residential address.

The capture of two address lines is mandatory. |

|

Town |

The name of the town for the residential address captured. |

|

Postal the same |

Select the tick box if a Residential Address has been captured and the Postal Address is the same. |

|

Postal Address |

The details of the postal address.

The capture of two address lines is mandatory. |

|

Town |

The name of the town for the postal address captured. |

|

Province |

Select a Province from the drop-down list. |

|

Work Tel |

The telephone number to be used to contact the Client at work.

At least one number must be captured. If a number has not been captured for one of the Work Tel, Home Tel or Mobile Tel fields, the following message will be displayed:

At least one Contact Number is required.

Click OK to remove the message and capture a number in one of these fields. |

|

Home Tel |

The telephone number to be used to contact the Client at home.

At least one number must be captured. If a number has not been captured for one of the Work Tel, Home Tel or Mobile Tel fields, the following message will be displayed:

At least one Contact Number is required.

Click OK to remove the message and capture a number in one of these fields. |

|

Fax |

The number to be used to contact the Client by fax. |

|

Mobile Tel |

The number to be used to contact the Client via mobile.

At least one number must be captured. If a number has not been captured for one of the Work Tel, Home Tel or Mobile Tel fields, the following message will be displayed:

At least one Contact Number is required.

Click OK to remove the message and capture a number in one of these fields. |

|

Alternative Mobile No |

The alternative number to be used to contact the Client via a mobile number. |

|

Email Address |

The email address of the Client. |

|

Nationality |

The nationality of the address. |

|

Country of Residence |

Currently the system automatically defaults to a value of ZAMBIA. |

|

Preferred Communication |

Select the preferred mode of communication with the Client from the drop-down list. The following values are currently available for selection: LETTER SMS |

Once the required details have been captured, click SAVE.

Click CLOSE to return to the Policyholder Details screen.

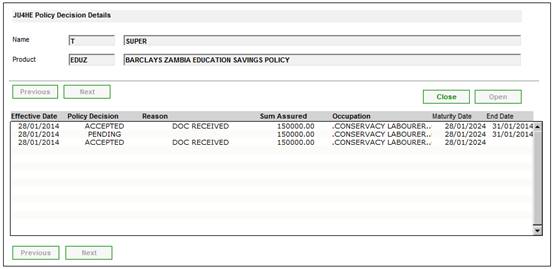

The system displays the Effective Date and Sum Assured that was loaded in the Credit File Upload File.

This functionality displays a list of the Member Values records with a Type of ASSURANCE DETAILS.

Select POLICY DECISION at the bottom of the Policyholder Details screen.

![]()

The JU4HE Policy Decision Details screen will be displayed.

To view existing policy decisions for the policyholder, select a line and click OPEN. The JU4HE Policy Decision Details screen will be displayed.

This screen displays the following data:

|

Product and Personal Details |

|

||||||||||||||||

|

Name |

The Initials and Surname of the Policyholder. |

||||||||||||||||

|

Product |

The Scheme Code and Scheme Name. |

||||||||||||||||

|

Cover Option Details |

|

||||||||||||||||

|

Effective Date |

The effective date of these assurance details. |

||||||||||||||||

|

Sum Assured |

The sum assured amount.

Note: The system will display the Amount on the Member Values record with a UDPV TYPE of ASSURANCE DETAILS and value for UDPV SUBTYPE of SUM ASSURED. |

||||||||||||||||

|

Policy Purpose |

The specific purpose of the Policy for the Policyholder. |

||||||||||||||||

|

Maturity Date |

The date on which the Policy matures.

Note: The system will display the End Date on the Member Values record with a UDPV TYPE of ASSURANCE DETAILS and value for UDPV SUBTYPE of MATURITY DATE. |

||||||||||||||||

|

Client Classification |

PREMIER or STANDARD. |

||||||||||||||||

|

Occupation |

The occupation of the member / policyholder. |

||||||||||||||||

|

Replacement Policy Details |

|

||||||||||||||||

|

Company |

The name of the Company for the replacement policy. |

||||||||||||||||

|

Policy Number |

The Policy Number of the Policy. |

||||||||||||||||

|

Insured Amount |

The amount insured. |

||||||||||||||||

|

Policy Decision Details |

|

||||||||||||||||

|

Policy Decision |

Selection from the following drop down list of values: ACCEPTED * CANCELLED DECLINED * LAPSED NOT TAKEN UP PENDING REINSTATED

* Note: The system will automatically update the value in this field to ACCEPTED if the answers to the medical questions (accessed from the MEDICAL action button) are per the table below:

If the answers to the questions or combination of answers to the questions are not as per above, this field will be updated to DECLINED. For more information, refer to the Medical section above. |

||||||||||||||||

|

Reason |

Selection from drop down of values. E.g. EXTERNAL CLIENT MEDICAL REASONS OVER MAX AGE

Note: The Reasons displayed for selection will depend upon the value in the Policy Decision field.

The following reasons will be displayed for selection per Policy Decision field value:

If Policy Decision field has been updated to DECLINED due to Medical Reasons, the Decision field will not be updateable. |

||||||||||||||||

|

End Date |

The End Date on the Member Values record. |

Click SAVE once all of the relevant data has been captured.

Once all the necessary details have been added, click SAVE.

A confirmation message will be displayed.

Are you sure you want to save your changes?

Click OK to confirm that the changes must be saved.

The Policyholder Details screen will be displayed, and a message will confirm that the data has been successfully captured.

Updating the Sum Assured field

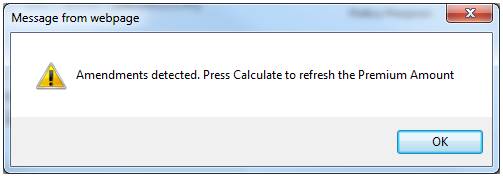

When the Sum Assured field is amended and then SAVE is selected, the following message will be displayed:

Amendments detected. Press Calculate to refresh the Premium Amount.

Click OK to remove the message and click CALCULATE.

Note:

The Policy Decision field on the JU4HE Policy Decision Details screen will not be automatically updated.

Registration Status for Zambian Schemes

When a new Policyholder has been added and the Country field on the JU1BK Nature of Product screen for the scheme selected is ZAMBIA, the system will update the value in the Registration Status field for the Policyholder on the JU1BA Client Details screen to APPROVED.

Validation of Natural Person

When SAVE is selected, the system will check if there is a Natural Person record with the same Surname, Initials and Date of Birth or the same ID Number and ID Type.

If there is a Natural Person record with the same Code, the following message will be displayed:

There is an existing person with the same Code please select the person via the Person List menu option.

If there is a Natural Person record with the same Surname, Initials and Date of Birth, the following message will be displayed:

There is an existing person with the same surname, initials and date of birth; please select the person via the Person List menu option.

If there is an existing Natural Person record with the same ID Number and ID Type, the following message will be displayed:

There is an existing person with the same ID Number; please select the person via the Person List menu option.

If there is no Natural Person record with the same Surname, Initials and Date of Birth or the same ID Number and ID Type, the system will create a new Natural Person record with the following data:

- Surname

- Initials

- Title

- First Name 1

- First Name 2

- First Name 3

- Date of Birth

- ID Number

- ID Type

A Client record will be created with a Client Type of Natural Person and with the CSA Reference Number.