This file layout enables the loading of Natural Person records.

Navigate the system as follows:

From the Main Functionality menu select Process > File Transfer > File Transfer

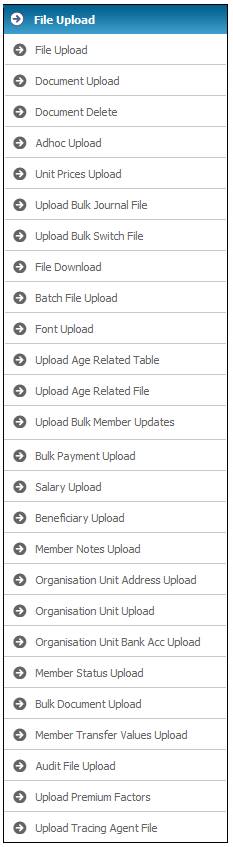

Select Batch File Upload from the sub-menu on the left.

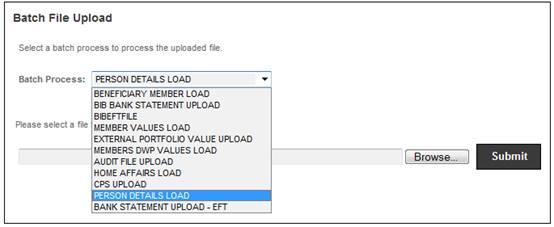

The Batch File Upload screen will be displayed.

Select PERSON DETAILS LOAD from the Batch Processes drop-down list.

Use BROWSE (refer to File upload above) to find the document to be uploaded, then click SUBMIT. A message will confirm that the file has been successfully

Once the file has been loaded, the relevant batch job can be submitted.

For information about submitting batch jobs refer to

Reports

Batch Runs

Locate the required batch job from the list.

To initiate the batch job, click Submit in the action column.

The progress of the batch job can be monitored in the error log.

After the batch job has completed, the error log must be checked for any errors.

For more information refer to

Reports

General

Error Log Report

For details of the file layout, refer to

Processes

File Transfer

File Layouts

Batch Files

For more details on uploading a file received from Home Affairs refer to

Supplements

Processes

Processing the Home Affairs File

When the file is uploaded, the system will create a Natural Person record and a Client record, if applicable, with the fields as per the details in the table below.

|

|

Field Name |

Field Size |

DEC |

ATTR |

O/M |

Start |

End |

Description / Value |

|

1 |

File indicator |

4 |

|

Char |

M |

1 |

4 |

PERS |

|

2 |

Surname |

30 |

|

Char |

M |

5 |

34 |

Member’s Surname |

|

3 |

Title |

15 |

|

Char |

O |

35 |

49 |

Member's Title |

|

4 |

Initials |

5 |

|

Char |

M |

50 |

54 |

Member's Initials |

|

5 |

First Name |

20 |

|

Char |

O |

55 |

74 |

Member's First Name |

|

6 |

ID |

15 |

|

Char |

M |

75 |

89 |

ID Number |

|

7 |

Identity Type |

15 |

|

Char |

O |

90 |

104 |

ID Type: SA ID OTHER NATIONAL ID PASSPORT |

|

8 |

DOB |

8 |

|

Char |

M |

105 |

112 |

YYYYMMDD |

|

9 |

Gender |

15 |

|

Char |

O |

113 |

127 |

M or F |

|

10 |

Marital Status |

15 |

|

Char |

O |

128 |

142 |

M, S or D |

|

11 |

Tax Number |

20 |

|

Char |

O |

143 |

162 |

Tax Reference Number |

|

12 |

Language |

15 |

|

Char |

O |

163 |

177 |

Value for Language UDPV: ENGLISH AFRIKAANS Etc. |

O = Optional field

M = Mandatory

Note:

All optional text fields must be padded with trailing spaces.

All numeric fields must be padded with leading zeroes.