The payroll file is used to upload the membership data.

The following validations are performed during the process:

- The format is validated.

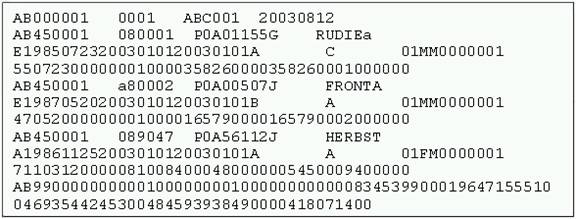

Examples

- A date of 19521560 will reject because the month and day are invalid.

- The month and day in a date field are invalid, e.g. a date of 19521560.

- The last column of a field designated (as per the mask) as being post signed is not a plus or minus sign.

- A non-numeric character is found in a field that is obviously numeric (by virtue of the database target field being numeric, e.g. ECS), or in a field that is designated as post signed, or in a field where decimal places is > 0

- A character that is not valid (i.e. any non-keyboard character) has been detected.

- The validity of the mask code is checked.

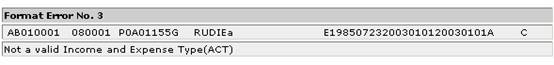

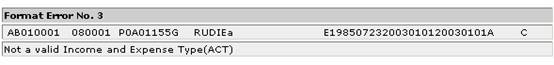

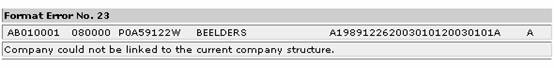

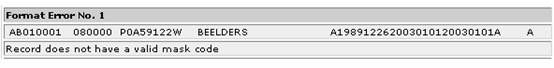

The following are examples of some format errors that may be displayed during the process:

Example: Income and Expense Type not linked

ACT (Income and Expense Type) has not been linked to the fund. A similar error message would appear when ECS and RCS have not been linked.

Note:

ECS, RCS and ACT are mandatory income and expense types that need to be linked to the scheme.

Example: Invalid branch

The branch is not valid as it has not been linked to the pay centre. Alternatively, the branch could be incorrect in the file.

Example: Invalid mask code

The mask code in the file is invalid.

Log in to the system from the Logon page.

Click ![]() , then click

, then click ![]() .

.

Note:

This will only be available to users with PAYROLL or SUPER USER security access.

The Welcome screen will be displayed.

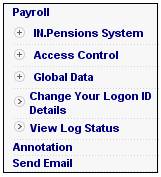

From the main menu on the top, select Payroll. The Payroll screen will be displayed.

From the main menu on the top, select Data Capture.

The Pay Centre / Fund Selection screen will be displayed. Select the required pay centre and cycle.

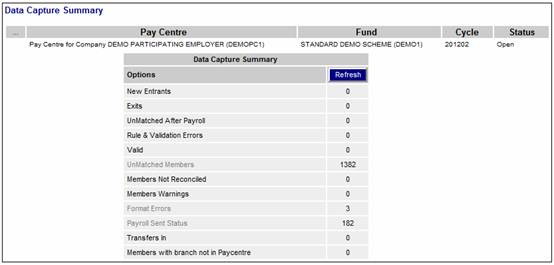

The Data Capture Summary screen will be displayed.

The above screen shows the data capture summary prior to the load of the payroll data via the conversion tool.

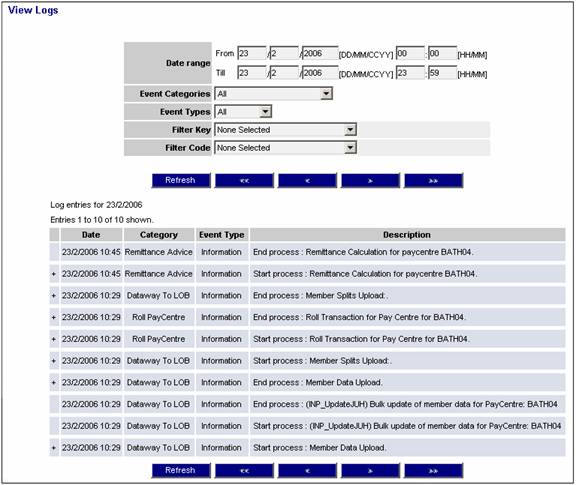

You can check on the progress of the payroll load. From the main menu on the top, select System Administration or Client Administration, then from the sub-menu on the left, select View Log Status.

The View Logs screen will be displayed.

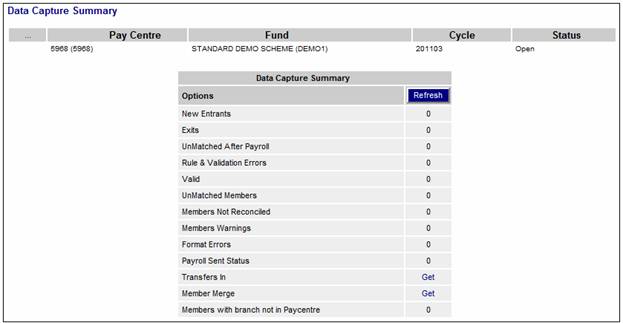

The following screen shows the data capture summary after the load of the payroll data via the conversion tool.

The usual payroll validation will apply, and you will be able to correct the rule and validation errors online.

Header record

|

|

Field Name |

Field Size |

DEC |

ATTR |

Start |

End |

Description / Value |

|

1 |

File id code |

4 |

|

Char |

1 |

4 |

AB00 |

|

2 |

Fund number |

7 |

|

Char |

5 |

11 |

fund number |

|

3 |

IN.pensions scheme code |

7 |

|

Char |

12 |

18 |

IN.pensions scheme code |

|

4 |

Pay Centre Code |

8 |

|

Num |

19 |

26 |

Pay Centre Code |

|

5 |

System date |

8 |

|

Num |

27 |

34 |

CCYYMMDD - system date |

|

6 |

System time |

6 |

|

Num |

35 |

40 |

Hhmmss - system time |

Detail record

|

|

Field Name |

Field Size |

DEC |

Start |

End |

ATTR |

O/M |

Description / Value |

|

1 |

Mask Code |

4 |

|

1 |

4 |

Char |

M |

AB45 |

|

2 |

Scheme Code |

7 |

|

5 |

11 |

Num |

M |

Scheme Code |

|

3 |

Membership Reference number |

20 |

|

12 |

31 |

Num |

M |

Membership Reference number |

|

4 |

Company reference |

8 |

|

32 |

39 |

Char |

M |

Company reference |

|

5 |

Initials |

5 |

|

40 |

44 |

Char |

O |

Initials |

|

6 |

Surname |

30 |

|

45 |

74 |

Char |

M |

Surname |

|

7 |

Language |

1 |

|

75 |

75 |

Char |

O |

Language |

|

8 |

Date of Birth |

8 |

|

76 |

83 |

Num |

M |

Date of Birth |

|

9 |

Date Joining Fund |

8 |

|

84 |

91 |

Num |

M |

Date Joining Fund |

|

10 |

Date Joining Company |

8 |

|

92 |

99 |

Char |

M |

Date Joining Company |

|

11 |

Contribution Category |

8 |

|

100 |

107 |

Char |

M |

Contribution Category |

|

12 |

Benefit Category |

8 |

|

108 |

115 |

Char |

M |

Benefit Category |

|

13 |

Investment Option Code |

2 |

|

116 |

117 |

Char |

O |

Investment Option Code |

|

14 |

Gender |

1 |

|

118 |

118 |

Char |

O |

Gender |

|

15 |

Marital Status |

1 |

|

119 |

119 |

Char |

O |

Marital Status |

|

16 |

Branch Code |

10 |

|

120 |

129 |

Num |

M |

Branch Code |

|

17 |

ID Number |

15 |

|

130 |

144 |

Num |

M |

ID Number |

|

18 |

ID Type |

1 |

|

145 |

145 |

Num |

M |

ID Type |

|

19 |

ECS |

9 |

2 |

146 |

154 |

Num |

M |

ECS |

|

20 |

RCS |

9 |

2 |

155 |

163 |

Num |

M |

RCS |

|

21 |

ACT |

10 |

2 |

164 |

173 |

Num |

M |

ACT |

O = Optional field

M = Mandatory

Note:

All optional text fields must be padded with trailing spaces.

All numeric fields must be padded with leading zeroes.

Trailer record

|

|

Field Name |

Field Size |

DEC |

Start |

End |

ATTR |

Description / Value |

|

1 |

File indicator |

4 |

|

1 |

4 |

Char |

AB99 |

|

2 |

Number of detail records |

13 |

|

5 |

17 |

Num |

Total number of detail records |

|

3 |

Fund number |

13 |

|

18 |

30 |

Num |

# Total of scheme codes on file |

|

4 |

Member number |

13 |

|

31 |

43 |

Num |

# Total of member numbers |

|

5 |

Date of Birth |

13 |

|

44 |

56 |

Num |

# Total of date of births |

|

6 |

Number of ECS |

13 |

2 |

57 |

69 |

Num |

# Total of ECS records |

|

7 |

Number of RCS |

13 |

2 |

70 |

82 |

Num |

# Total of RCS records |

|

8 |

Number of ACT |

13 |

2 |

83 |

95 |

Num |

# Total of ACT records |

Note:

If the member reference number is greater than 20 characters, the trailer record will not produce the correct results.