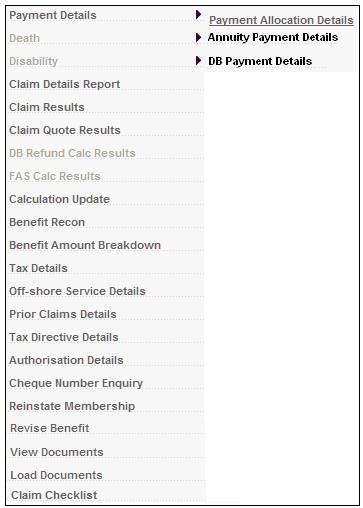

If the scheme uses the standard benefit rules, the following screens will be displayed:

Note:

If the scheme uses the flexible benefit rules, refer to Flexible Benefit Rules below.

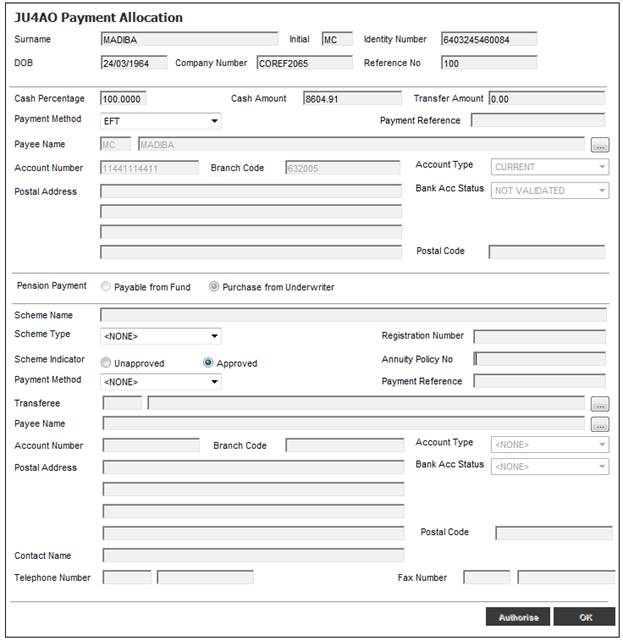

Payment details>Payment Allocation Details

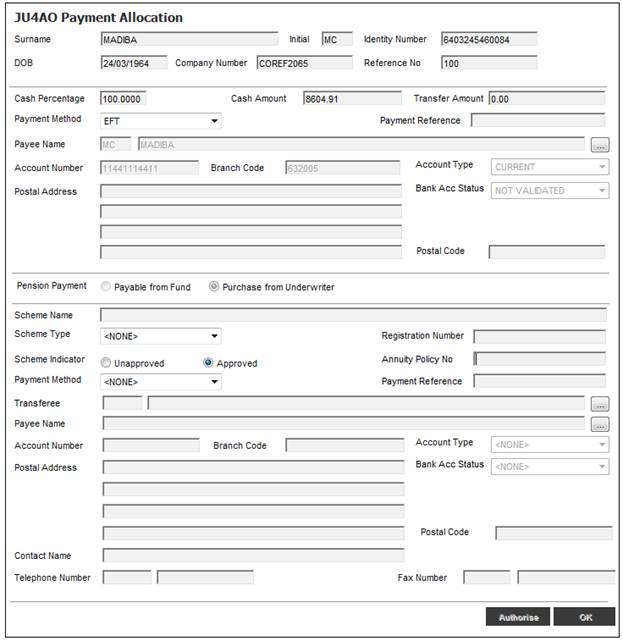

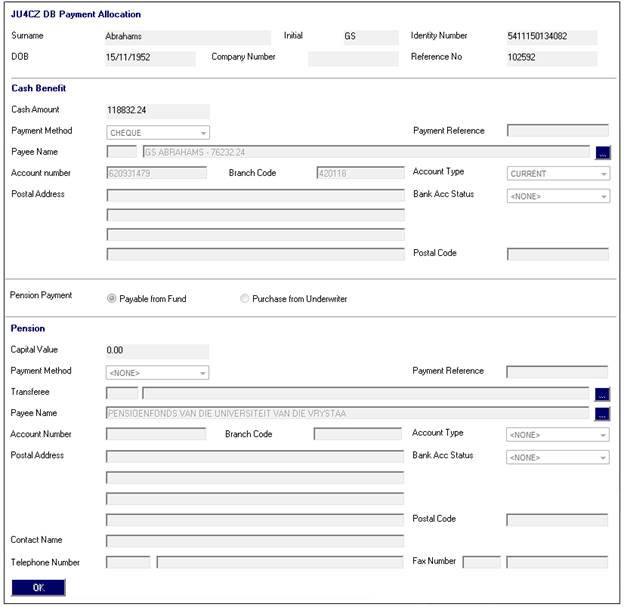

The JU4AO Payment Allocation or JU4CZ DB Payment Allocation screen will be displayed.

Payment Allocation

Allocation data is displayed on the screen as follows:

|

(Cash Benefit) |

|

|

|

Cash Percentage (Refer to Special Note below) |

The percentage of the pension that may be commuted for cash. Note: Per legislation, a maximum cash percentage of 33.3333 applies. This applies to retirements only. The first R300 000 is tax free.

The cash percentage may exceed the batch parameter value, but not by more than 100%. If the maximum cash percentage is less than 100, one of the following error messages may be generated when the claim details are submitted: |

|

|

|

||

|

Cash Amount (Refer to Special Note below) |

The amount that is to be commuted for cash. Note: If Type of Retirement Fund is PENSION, the system will compare the value of the commutation percentage (refer to the batch parameter), with the cash amount captured. If the cash amount is greater than the commutation value, the following warning message will be displayed: |

|

|

|

|

|

|

|

If the Type of Retirement Fund is not PENSION, and the percentage calculated is greater than 100, the following warning message will be displayed: |

|

|

|

||

|

Transfer Amount (Refer to Special Note below) |

The amount to be transferred to another financial institution during the benefit payment process. Note: If a transfer amount is captured, and the maximum cash percentage (refer to the batch parameter for COMMUTATION) is less than 100, the system will calculate the amount captured as a percentage of the benefit amount. If the value of the cash or transfer amount exceeds the benefit amount, a warning message will be displayed. |

|

Special Note:

The Cash Percentage, Cash Amount and Transfer Amount fields are interactive. Changing the value in one of the amount fields may result in the automatic change to the percentage field, and vice versa. The following rules will be applied:

- If a value for Cash Percentage is captured, values for Cash Amount and Transfer Amount will be calculated and displayed.

- If a value for Cash Amount is captured, values for Cash Percentage and Transfer Amount will be calculated and displayed.

- If a value for Transfer Amount is captured, values for Cash Amount and Cash Percentage will be calculated and displayed.

|

Payment Method |

The type of payment, e.g. cheque, EFT, group payment. |

|

Payment Reference |

The Payment Reference that must appear on the recipient’s Bank Statement when payments are made via EFT. |

|

Payee Name |

The name of the party to whom the benefit will be paid.

Click LIST to flow to the JU1CN Member Bank Account screen and select. |

|

Account Type |

The type of account to which payment should be made, e.g. current, savings or transmission.

Note: If bank account details exist for the member on the JU1CN Bank Account Details screen, then the value for this field will automatically be displayed here by the System. The User validation defined under Members of a Scheme will also be applied under Payment Allocation. |

|

Account Number |

The number of the account to which payment should be made.

Note: If bank account details exist for the member on the JU1CN Bank Account Details screen, then the value for this field will automatically be displayed here by the System. The User validation defined under Members of a Scheme will also be applied under Payment Allocation. |

|

Branch Code |

The branch code of the bank where the account is held.

Note: If bank account details exist for the member on the JU1CN Bank Account Details screen, then the value for this field will automatically be displayed here by the System. The User validation defined under Members of a Scheme will also be applied under Payment Allocation. |

|

Bank Acc Status |

The status of the account holder validation for the bank account, e.g. NOT VALIDATE, VALIDATED, REJECTED, USER VALIDATED, etc. Note: The account holder validation (AHV) via LDC only validates account numbers for ABSA, First National Bank (FNB) and Standard Bank (SBSA). Where the account is held at any other bank, the status will be able to be updated to MANUAL VALIDATE and the user ID of the person who updated the status will be displayed. The authorizer can take this into account when checking the status of the account.

Note: If bank account details exist for the member on the JU1CN Bank Account Details screen, then the value for this field will automatically be displayed here by the System. The User validation defined under Members of a Scheme will also be applied under Payment Allocation. |

|

Postal Address |

The address of the Payee. |

|

Postal Code |

The Postal code for the Payee’s address. |

|

Pension Payment |

Click the appropriate radio button to indicate whether the pension must be paid from the fund or purchased from an underwriter.

Select from the following options:

Pension Payment Payable from Fund Purchase from Underwriter

Note: When the Payable from Fund indicator has been selected and the claim has been authorised by the user, the system creates a Service Request in My Work with a Process Name of CAPTURE ANNUITY and an Activity name of CAPTURE ANNUITY. For more information refer to My Work Process SR Capture Annuity |

|

(Transfer Benefit) |

|

|

Scheme Name |

The name of the scheme to which the non-cash portion will be transferred. Note: If the cash percentage is less than 100, an error message will be generated, requiring this field to be completed. Refer to Cash Percentage above. |

|

Scheme Type |

The type of scheme, e.g. pension or provident fund. Note: If the cash percentage is less than 100, an error message will be generated, requiring this field to be completed. Refer to Cash Percentage above. |

|

Registration Number |

The registration number of the scheme to which the benefit will be transferred. Note: If the cash percentage is less than 100, an error message will be generated, requiring this field to be completed. Refer to Cash Percentage above. |

|

Annuity Policy No |

|

|

Scheme Indicator |

To indicate whether the scheme is approved or unapproved, for tax purposes. |

|

Payment Method |

The type of payment, e.g. cheque, EFT, group payment. Note: If the cash percentage is less than 100, an error message will be generated, requiring this field to be completed. Refer to Cash Percentage above. |

|

Payment Reference |

The Payment Reference that must appear on the Bank Statement when payments are made via EFT. |

|

Transferee |

Click LIST to flow to the JU1AP Corporate Client screen and select a Transferee. |

|

Payee Name |

The person to whom the money must be paid. |

|

Account Type |

The type of account to which payment should be made, e.g. current, savings or transmission. |

|

Bank Account Status |

The status of the account holder validation for the bank account, e.g. NOT VALIDATE, VALIDATED, REJECTED, USER VALIDATED, etc. |

|

Account Number |

The number of the account to which payment should be made. |

|

Branch Code |

The branch code of the bank where the account is held. |

|

Postal Address |

The address of the scheme to which money must be transferred. |

|

Postal Code |

The Postal code for the scheme’s address. |

|

Contact Name |

The name of a person who can be contacted in connection with the transfer. Note: If the cash percentage is less than 100, an error message will be generated, requiring this field to be completed. Refer to Cash Percentage above. |

|

Telephone Number |

The telephone number of the contact person. |

|

Fax Number |

The fax number of the contact person. |

Note:

Where a payment method of GROUP PAYMENT is selected, once the claim has been authorised, the payments will be available for bulk payment processing. Refer to Bulk Payments under

Accounting

Transaction Capture

DB Payment Allocation

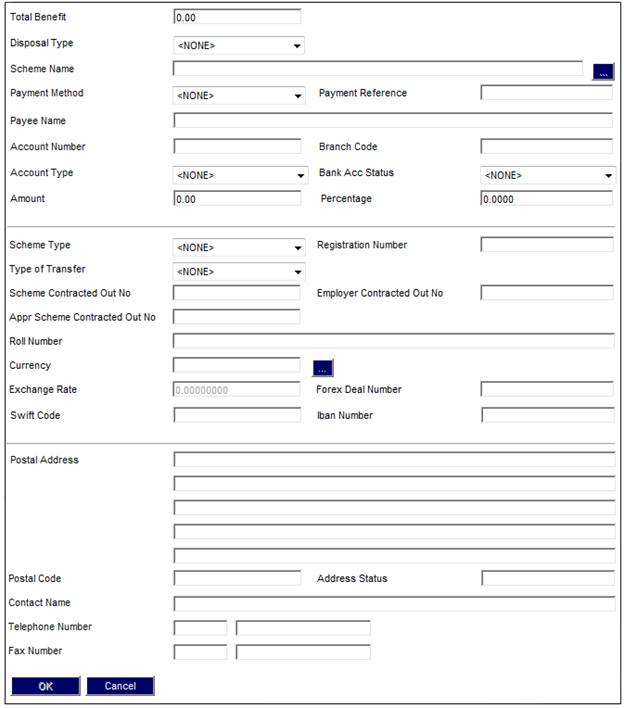

If the scheme uses the flexible benefit rules, and the Payment Type field on the BAGA Benefit Product Details screen has a value of CASH, TRANSFER or PURCH ANNUITY, the JU4AO Payment Allocation screen will be displayed.

Note:

If the scheme uses the standard benefit rules, refer to Standard Benefit Rules above.

To specify the allocation of the payment, click ADD. The following screen will be displayed.

Allocation data is displayed on the screen as follows:

|

Total Benefit |

The total amount of the member’s benefit. |

|

Disposal Type |

How the benefit monies must be paid or transferred. Select a value from the drop-down list. Values could be Cash, Purchase Annuity or Transfer to Fund. |

|

Scheme Name |

The name of the scheme to which monies must be paid or transferred.

Click LIST to flow to the JU1AP Corporate Client screen and select a scheme.

Note: This will only be enabled for selection if the value selected for the Disposal Type field is TNSFR TO FUND. |

|

Payment Method |

The method by which payment must be made. Select a value from the drop-down list. Values could be EFT, Cheque, Billing, Group Payment, Foreign Draft or Bank Transfer, etc. |

|

Payment Reference |

The Payment Reference that must appear on the Bank Statement when payments are made via EFT. |

|

Payee Name |

The name of the person to whom the money must be paid. |

|

Account Number |

The number of the account to which payment should be made.

Note: If bank account details exist for the member on the JU1CN Bank Account Details screen, then the value for this field will automatically be displayed here by the System. The User validation defined under Members of a Scheme will also be applied under Payment Allocation.

Note: If the value selected for Payment Method is Cheque, then this field can be left blank. |

|

Branch Code |

The branch code of the bank where the account is held.

Note: If bank account details exist for the member on the JU1CN Bank Account Details screen, then the value for this field will automatically be displayed here by the System. The User validation defined under Members of a Scheme will also be applied under Payment Allocation. |

|

Account Type |

The type of account to which payment should be made. Select a value from the drop-down box e.g. credit card, current, savings or transmission.

Note: If the Account Type selected is BUILDING SOCIETY, then the Building Society Roll Number screen will be displayed. |

|

|

|

|

|

Capture the Building Society Roll Number.

Note: This field will accept special characters. It has a sort code of 6 digits and an account number of 8 digits, and in addition a roll number of 15 characters, 5 digits followed by a forward slash and then 10 digits e.g. 0505/1111111111. The forward slash can be captured anywhere in the number.

Click CANCEL to return to the JU4AO Payment Allocation screen. Once the number has been captured, click OK. The JU4AO Payment Allocation screen will be displayed.

Note: If bank account details exist for the member on the JU1CN Bank Account Details screen, then the value for this field will automatically be displayed here by the System. The User validation defined under Members of a Scheme will also be applied under Payment Allocation. |

|

Bank Acc Status |

The status of the account holder validation for the bank account, e.g. NOT VALIDATE, VALIDATED, REJECTED, USER VALIDATED, etc. Note: The account holder validation (AHV) via LDC only validates account numbers for ABSA, First National Bank (FNB) and Standard Bank (SBSA). Where the account is held at any other bank, the status will be able to be updated to MANUAL VALIDATE and the user ID of the person who updated the status will be displayed. The authorizer can take this into account when checking the status of the account.

Note: If bank account details exist for the member on the JU1CN Bank Account Details screen, then the value for this field will automatically be displayed here by the System. The User validation defined under Members of a Scheme will also be applied under Payment Allocation. |

|

Amount |

The amount to be paid transferred or used to purchase an annuity.

Note: If the amount captured exceeds the amount captured in the Total Benefit field, then the following Error Message will be displayed: “Amount may not be greater than the Total Benefit”. |

|

Percentage |

The percentage of the total benefit to be paid transferred or used to purchase an annuity. |

|

Scheme Type |

The type of scheme which is captured in the Scheme Name field. Select a value from the drop-down list. Values could be Beneficiary Fund, Pension or Provident. |

|

Registration Number |

The registration number of the scheme. |

|

Type of Transfer |

The HM Revenue & Customs (HMRC) designators that indicate the type of transfer.

Note: Applicable to UK schemes only. |

|

Scheme Contracted Out No |

The Scheme Contracted Out Number for the termination of a contracted out scheme. |

|

Employer Contracted Out No |

The Employer Contracted Out Number for the termination of a contracted out scheme. |

|

Appr Scheme Contracted Out No |

The Approved Scheme Contracted Out Number for the termination of a contracted out scheme. |

|

Roll Number |

The Building Society Roll Number.

Note: If the Account Type selected is BUILDING SOCIETY, then Roll Number will be enabled for capture. This field will accept special characters.

This field has a sort code of 6 digits and an account number of 8 digits, and in addition a roll number of 15 characters, 5 digits followed by a forward slash and then 10 digits e.g. 0505/1111111111. The forward slash can be captured anywhere in the number. |

|

Currency |

The currency of the payment. Select a value from the drop-down list.

Click LIST to flow to the JU0AC Permitted Value List screen and select a currency.

Note: This field will only be enabled if the Currency selected is not equal to the Currency for the Scheme to which the Membership is linked. |

|

Exchange Rate |

The exchange rate arranged with Foreign Exchange for the payment.

Note: This field will only be enabled if the Currency selected is not equal to the Currency for the Scheme to which the Membership is linked. |

|

Forex Deal Number |

The number of the deal arranged for the exchange rate.

Note: This field will only be enabled if the Currency selected is not equal to the Currency for the Scheme to which the Membership is linked. |

|

Swift Code |

Society for Worldwide Interbank Financial Telecommunication Bank Identifier Code. |

|

Iban Number |

International Bank Account Number. |

|

Postal address |

The postal address of the scheme that has been captured. |

|

Postal Code |

The Postal code for the scheme’s address. |

|

Address Status |

The name of the Organisation Unit. This will be supplied by the System when a name is selected for the Scheme Name field. |

|

Contact Name |

The name of a person who can be contacted in connection with the transfer. |

|

Telephone Number |

The telephone number of the contact person. |

|

Fax Number |

The fax number of the contact person. |

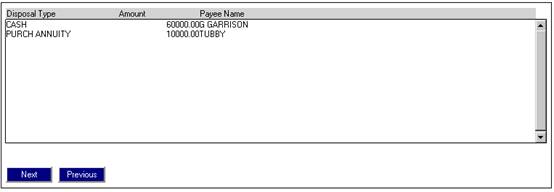

Once all of the data has been captured, click OK. The following screen will be displayed, showing the disposal type, amount and payee name captured.

To view an existing allocation, highlight a disposal line and click OPEN.

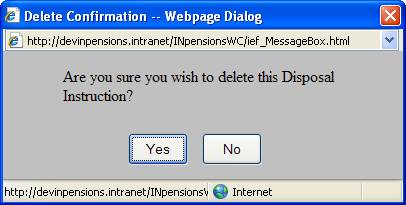

To delete an allocation, highlight a disposal line and click DELETE. The Delete Confirmation screen will be displayed.

Click YES to confirm deletion or click NO to cancel it.