This facility allows you to enquire on details of debit order payments (if any).

For debit order schemes, the end date on the payment details records may be updated and the effective date is enabled to be captured with a date earlier than the last payment date of the current record, to enable the system to collect the arrear payments where reversals have been processed for the incorrect payments.

Note:

This will only be enabled for users with a specific security access. For more information refer to Security Setup for Payment Details above

Select the required member as described under Finding Members.

From the JU3AO List of Members for a Scheme/Pay Centre screen, highlight the required member, then select Payment Details from the sub-menu on the left.

The JU4ER Membership Payment Maintain screen will be displayed.

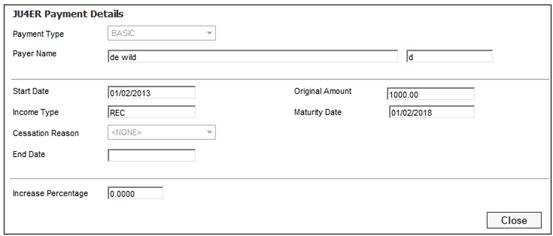

To view these details, highlight the required payment, then click OPEN. The JU4ER Payment Details screen will be displayed.

For more detailed information on this screen refer to

Processes

Regular Payments

Annuitant Update Types

Annuitant Update Type: Annuity Amount

Add New Payment Details

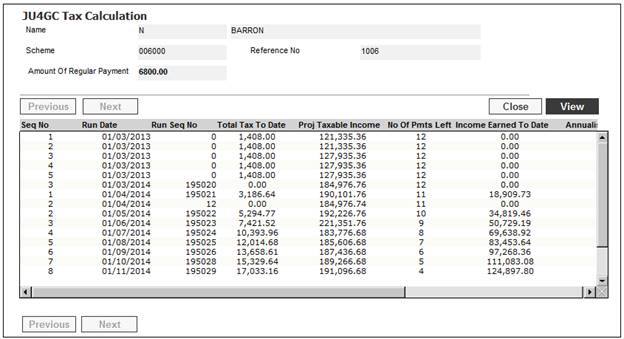

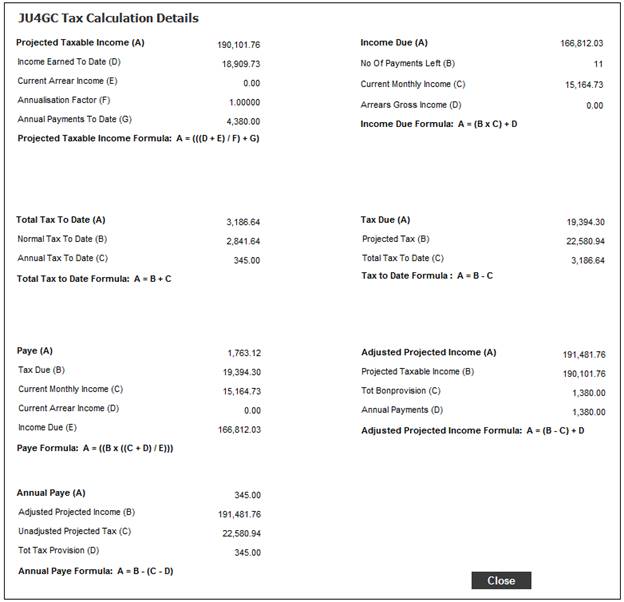

To view details of the tax calculation, highlight the required payment on the JU4DD Payment Detail Maintain screen, then select View Tax Calculation from the sub-menu on the left.

The JU4GC Tax Calculations screen is displayed.

This screen shows the tax calculated for each month as generated by the Payment Run.

Highlight a tax calculation and click VIEW. The JU4GC Tax Calculation Details screen is displayed.

This screen displays the exact details of the Projected Taxable Income calculation.