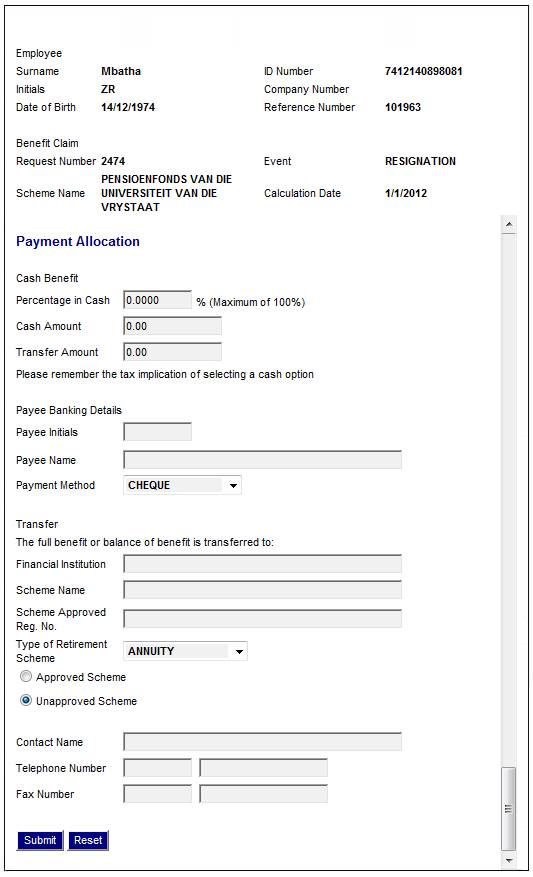

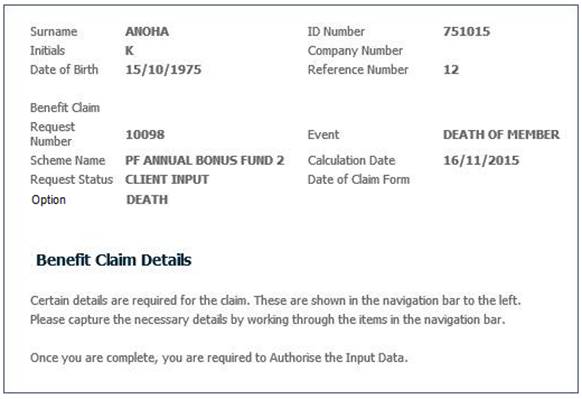

From the Benefit Claim Details screen, select Payment Allocation from the sub-menu menu on the left.

If the scheme uses the standard benefit rules, the lower portion of the screen expands to display Payment Allocation.

Note:

If the scheme uses the flexible benefit rules, refer to Flexible benefit rules below.

Note:

Always check to see if there are any documents that have been uploaded for the member as these documents may contain information required to be captured on this screen. Documents that have been uploaded are selected from the View Document menu option.

For more information, refer to

Processes

Benefits

Capturing of Exit Notifications

Complete a Claim

Documents

The following information is required:

|

Cash Benefit |

|

|

|

Percentage in Cash (Refer to Special Note below) |

The percentage of the pension that may be commuted for cash. Note: Per legislation, for pension funds a maximum cash percentage of 33.3333 applies. If the cash percentage exceeds the specified maximum, the following error message will be displayed: |

|

|

|

||

|

|

If the maximum cash percentage is less than 100 (e.g. an amount is being transferred to another financial institution), one of the following error messages may be generated when the claim details are submitted: |

|

|

|

|

|

|

Cash Amount (Refer to Special Note below) |

The amount that is to be commuted for cash. Note: In respect of retiral benefits, if a cash amount is captured, and the maximum cash percentage (refer to the Batch Parameter for Commutation) is less than 100, the system will calculate the amount captured as a percentage of the benefit quote amount. If the percentage calculated is greater than the Batch Parameter value, the following warning message will be displayed: |

|

|

|

||

|

|

|

|

|

Transfer Amount (Refer to Special Note below) |

The amount to be transferred to another financial institution during the benefit payment process. Note: If a transfer amount is captured, and the maximum cash percentage (refer to the batch parameter for COMMUTATION) is less than 100, the system will calculate the amount captured as a percentage of the benefit amount. If the value of the cash or transfer amount exceeds the benefit amount, the following warning message will be displayed: |

|

|

|

||

Special Note:

The Cash Percentage, Cash Amount and Transfer Amount fields are interactive. Changing the value in one of the amount fields may result in the automatic change to the percentage field, and vice versa. The following rules will be applied:

- If a value for Cash Percentage is captured, values for Cash Amount and Transfer Amount will be calculated and displayed.

- If a value for Cash Amount is captured, values for Cash Percentage and Transfer Amount will be calculated and displayed.

- If a value for Transfer Amount is captured, values for Cash Amount and Cash Percentage will be calculated and displayed.

|

Payee Banking Details |

|

|

|

Payee Initials |

Initials of the payee to whom the benefit is paid.

Note: If the Sub-Category for the Benefit Event is not DIVORCE, the system will default the value to the initials of the member and the this field will not be enabled for update. |

|

|

Payee Name |

Name of the payee to whom the benefit is paid.

Note: If the Sub-Category for the Benefit Event is not DIVORCE, the system will default the value to the surname of the member and the this field will not be enabled for update.

Note: If the cash percentage is less than 100, an error message will be generated, requiring this field to be completed. Refer to Cash Percentage above. |

|

|

Payment Method |

The type of payment, e.g. cheque, EFT, group payment. Select from the drop-down list. |

|

|

Transfer The full pension or balance of benefit is transferred to: |

|

|

|

Financial Institution |

The name of the financial institution from which the pension will be purchased. If the pension is to be paid from the fund, display the name of the scheme. Note: If the cash percentage is less than 100, an error message will be generated, requiring this field to be completed. Refer to Cash Percentage above. |

|

|

Scheme Name |

The name of the scheme to which the benefit must be transferred. |

|

|

Scheme Approved Reg. No. |

The registration number of the scheme to which the benefit must be transferred. |

|

|

Type of Retirement Scheme |

The type of Retirement Fund to which the benefit will be transferred. Select a value from the drop-down box. E.g. Beneficiary Fund, Pension or Provident. |

|

|

Approved Scheme |

Click on the Radio Button to indicate that the scheme is approved. |

|

|

Unapproved Scheme |

Click on the Radio Button to indicate that the scheme is unapproved. |

|

|

Contact Name |

The name of a person who can be contacted in connection this allocation. |

|

|

Telephone Number |

The telephone number of the contact person. |

|

|

Fax Number |

The fax number of the contact person. |

|

|

Pension Banking Details where the Payment Method is EFT Note: The following section will only appear if the Event is for Retirement or if the Payment Method selected here is EFT.

|

||

|

Payee Initials |

Initials of person to whom the pension is payable.

Note: If the Sub-Category for the Benefit Event is not DIVORCE, the system will default the value to the initials of the member and the this field will not be enabled for update. |

|

|

Payee Name |

Name of person to whom the pension is payable.

Note: If the Sub-Category for the Benefit Event is not DIVORCE, the system will default the value to the surname of the member and the this field will not be enabled for update. |

|

|

Account Type |

The type of account to which payment should be made, e.g. current, savings or transmission. |

|

|

Account Number |

The number of the account to which payment should be made. |

|

|

Bank |

The name of the bank. Click the LIST button to display a list of banks. To select a bank from the list click on its name.

Note: If the Account Number captured is the same as that for an existing Bank Account with the same Bank and Bank Branch but for which the values for Initial and Name is not equal to Initials and Surname of the Member, the following error message will be displayed:

The bank account details are incorrect

The system will not link the Bank Account unless the values for Initial and Name is equal to the vales for Initials and Surname of the Member. |

|

|

Branch |

The branch of the bank. Click the LIST button to display a list of bank branches. To select a bank branch from the list click on its name. |

|

Note:

When the Annuity update is processed and the Bank Account update is selected, the above bank account records will be displayed. Refer to:

Processes

Regular Payments

Annuitant Update Types

Annuitant Update Type: Bank Accounts

Once all the details have been captured, click SUBMIT.

The Benefit Claim Details screen will be re-displayed.

The claim is now ready to be authorised.

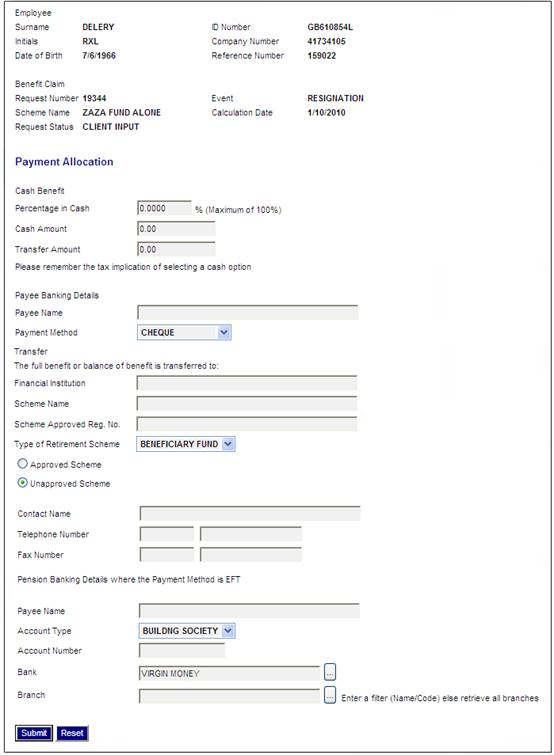

If the scheme uses the flexible benefit rules, the lower portion of the screen expands to display Payment Allocation.

Note:

If the scheme uses the standard benefit rules, refer to Standard benefit rules above.

This screen displays products where the payment type field on the BAGA Benefit Product Details screen is CASH, TRANSFER or PURCH ANNUITY.

Note:

If the payment type for the product is anything other than CASH, TRANSFER or PURCH ANNUITY, these items will not appear in this list as they are not treated as disposable cash.

However, any annuity payment records will be created when the claim is authorized on the web. This depends on the SYSTEM TAG field value on the BAGA Benefit Product Details screen, which determines which field will be updated on the annuity payment record.

Capture payment allocation data on the screen as follows:

Cash Benefit

Note: This section relates to preservation.

|

Percentage in Cash (Refer to Special Note below) |

The percentage of the benefit that may be commuted for cash. Note: Per legislation, for pension funds a maximum cash percentage of 33.3333 applies. If the cash percentage exceeds the specified maximum, the following error message will be displayed: |

||

|

|

|||

|

|

If the maximum cash percentage is less than 100 (e.g. an amount is being transferred to another financial institution), one of the following error messages may be generated when the claim details are submitted: |

||

|

|

|||

|

Cash Amount (Refer to Special Note below) |

The amount of benefit to be taken in cash.

Note: In respect of retiral benefits, if a cash amount is captured, and the maximum cash percentage (refer to the Batch Parameter for Commutation) is less than 100, the system will calculate the amount captured as a percentage of the benefit quote amount. If the percentage calculated is greater than the Batch Parameter value, the following warning message will be displayed: |

||

|

|

|||

|

Transfer Amount (Refer to Special Note below) |

The amount to be transferred to another financial institution during the benefit payment process. Note: If a transfer amount is captured, and the maximum cash percentage (refer to the batch parameter for COMMUTATION) is less than 100, the system will calculate the amount captured as a percentage of the benefit amount. If the value of the cash or transfer amount exceeds the benefit amount, the following warning message will be displayed: |

||

|

|

|||

|

Payee Banking Details |

|

||

|

Payee Name |

The name of the party to whom the benefit will be paid. |

||

|

Payment Method |

The method that must be used to pay the money. Select a value from the drop-down box. E.g. cheque, EFT, group payment, billing, bank transfer. |

||

|

Transfer The full benefit or balance of benefit is transferred to: |

|

||

|

Financial Institution |

The name of the financial institution from which the benefit will be transferred. If the benefit is to be paid from the fund, display the name of the scheme.

Note: If the cash percentage is less than 100, an error message will be generated, requiring this field to be completed. Refer to Cash Percentage above. |

||

|

Scheme Name |

The name of the scheme to which the benefit must be transferred. |

||

|

Scheme Approved Reg. No. |

The registration number of the scheme to which the benefit must be transferred. |

||

|

Type of Retirement Scheme |

The type of Retirement Fund to which the benefit will be transferred. Select a value from the drop-down box. E.g. Beneficiary Fund, Pension or Provident. |

||

|

Approved Scheme |

Click on the Radio Button to indicate that the scheme is approved. |

||

|

Unapproved Scheme |

Click on the Radio Button to indicate that the scheme is unapproved. |

||

|

Contact Name |

The name of a person who can be contacted in connection this allocation. |

||

|

Telephone Number |

The telephone number of the contact person. |

||

|

Fax Number |

The fax number of the contact person. |

||

|

Pension Banking Details where the Payment Method is EFT Note: This section will only appear if the value for Payment Method selected above is EFT. |

|

||

|

Payee Name |

Name of person to whom the benefit is payable.

Note: If the Sub-Category for the Benefit Event is not DIVORCE, the system will default the value to the name and initials of the member and the this field will not be enabled for update. |

|

|

|

Account Type |

The type of account to which payment should be made. Select a value from the drop-down box. E.g. Building Society, Credit Card, Current, Savings or Transmission. |

|

|

|

Account Number |

The number of the account to which payment should be made. |

|

|

|

Bank |

The name of the bank. Click the LIST button to display a list of banks. To select a bank from the list click on its name.

Note: If the Account Number captured is the same as that for an existing Bank Account with the same Bank and Bank Branch but for which the values for Initial and Name is not equal to Initials and Surname of the Member, the following error message will be displayed:

The bank account details are incorrect

The system will not link the Bank Account unless the values for Initial and Name is equal to the vales for Initials and Surname of the Member. |

|

|

|

Branch |

The branch of the bank. Click the LIST button to display a list of bank branches. To select a bank branch from the list click on its name. |

|

|

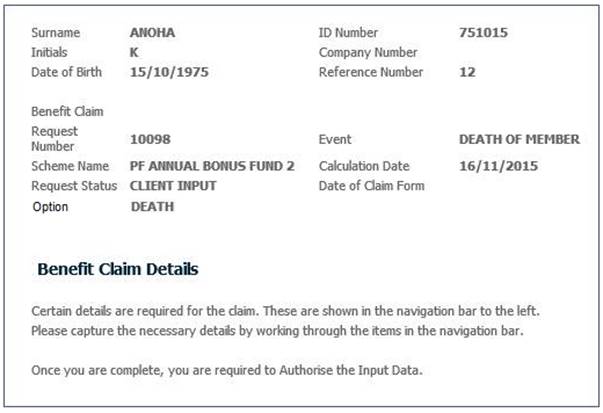

Once all of the data has been captured, click SUBMIT. The following screen will be displayed.

Continue to process the claim by providing the other details necessary to complete the claim. These details can be captured by selecting the sub-menu items on the left.

Once these details have been captured, the claim will be ready to be authorised

The process of authorising a claim can be continued from the screens above. Alternatively, this can be done at a later stage. Refer to

Processes

Benefits

Capturing of Exit Notifications

Authorize Claim

Authorize the Claim

Refer to

Processes

Benefits

Capturing of Exit Notifications

Cancel a Claim

Claim Cancellation