The system caters for defined benefit and defined contribution products, with or without member investment choice, with or without insured benefits, with or without annuitants. All of these combinations can be achieved within one fund.

The entire system is underpinned by accounting principles with all transactions recorded in a fund and member ledger.

- An internet member web site that allows members to view their benefits and switch their monies between investment houses (if applicable to the fund). Members may enquire on personal details, contribution or salary history details, investment details, investment unit price histories, and process benefit quotations, thus enabling a high degree of self-service.

- Integrated fund accounting with accounting disciplines imposed at a member level.

- Parameter driven fund rules facilitating new products without development.

- Utilizes internet technology and automated links with employers and payrolls, thereby significantly reducing error-prone manual work.

- Data capture can be done by interface to any payroll format or via keyboard update of changes to the previous cycle's data, either processed at the administrator's office, or by the payroll office via the internet.

- Validation of member and income data with error and exception reporting, and facilities for the correction of the data before submission.

- Electronic collection of fund income based on member data and inherent reconciliation of monies collected.

- Automatic investment of monies according to member choices and creation of asset manager investment advices and electronic payment to their bank accounts.

- Reporting of late contributions and status of monthly data cycles, and automatic calculation of interest on late contributions where applicable.

- Flexible member reporting facilities available to the payroll office and administrator.

- Unlimited number of contribution, investment, commission and benefit types.

- Caters for all types of investment mediums with unitisation daily or monthly.

- Interest allocation – monthly or annually with final and interim interest rates.

- Unlimited number of investment funds and member investment allocations with default allocations for members who do not provide a personal choice.

- Investment switching rules – notice periods, fixed switching dates, maximum and minimum switch levels.

- Automated life stage investment switching with unlimited periods.

- Automatic switch fee charging with minimum and maximum charges.

- Automatic processing of switch transactions on due dates.

- Bulk investment switching.

- Automatic generation of investment advices and money movements for contributions received and switches in, and disinvestments for benefit payments and switches out – or investment on net basis.

- Access controls with security and authorization levels, both data and functional levels.

- Audit trails on relevant transactions.

- Highly flexible accounting infrastructure with accounting transactions at fund and member level.

- Unlimited number of reserve accounts and sub accounts

- Capture and authorise online accounting transactions governed by predefined rules.

- Easy access to extracts of all accounting transactions.

- On-line trial balance and cash flow report.

- Financial period closing facilities.

- Bank reconciliation.

- Online capture and authorization of claim details via the internet, with validation of required information.

- Maintenance of membership liabilities, e.g. sureties, divorce court orders, housing loans.

- The production of tax directive requests and tax deductions for benefit payments.

- Benefit payment status reporting – also available to employer via the internet.

- Flexible benefit structures for defined contribution and defined benefit products.

- Management of insured cover limits and premium loading on individuals.

- Cheque printing facility.

- Bulk membership and relevant data take-on facilities.

- Expense billing for unlimited types of admin fees and insured benefit premiums.

- Extensive facilities for the apportionment of surpluses based on members' investments or members' contribution to specific reserves, and apportionment of costs, e.g. asset management levies.

- Apportionment of surpluses or costs, across members' investments for all members of a fund.

- Production of benefit statements and investment statements with contributions, investments and benefit projections customisable per fund.

- Flexible benefit statement formats and text and logo customisation.

- Benefit statements available to members via the internet.

- Fund rules and rule summaries available to the members via the internet.

- Communication of fund events and rule amendments to members via the internet.

- Comprehensive "how-to" on-line user manual of over 2000 pages, and monthly guides.

- Valuation reporting.

- Trustee reporting.

- Audit reporting.

- Management reporting.

- Monthly payment of annuitants with unlimited payments and deductions.

- Third party accumulation and schedules produced.

- Multiple beneficiaries in the form of multiple spouses and children with ability to pay guardians.

- Production of annuity payslips, certificates of existence and tax certificates.

- Living annuitant functionality including disinvestments on an individual choice.

- Numerous enquiry facilities for all data.

- Caters for all types of umbrella funds.

- Caters for preservation funds.

- Ability to collect premiums from individual bank accounts or employer bank accounts for unlimited products.

- Ability to pay commission to individuals or companies with commission statements.

- Calculation of expected contributions out of process and ability to bill separately for monies.

- Contribution billing for backdated rate or salary changes.

- Ability to handle recoveries in the form of negative contributions from employers.

The system comprises several fully integrated components:

- rules and parameters used across all products

- product details and rules

- person and membership data

- member and product accounting data

and for processing

- investment return allocations

- member investment income/expense apportionments

- investment switching transactions

- benefit claims

- annuity and living annuity payments

- An internet enabled front end for the collection and validation of employee, membership and contribution data via a download from an employer's payroll or on-line capture by an employer's payroll personnel. If required, the data capture or processing can also be performed by the administrator from data submitted by the employer in any format (paper, electronic file).

- An intranet enabled income batch processing component that apportions contributions according to investment selections. It informs the administrator users that a contribution cycle has been completed by the payroll personnel and enables checking and authorization of the accounting transactions and electronic fund transfers where appropriate.

- A cheque printing component.

A person record is maintained for all natural persons for whom details are required to be stored. One or more roles can then be assigned to each of these persons, e.g. contact person, trustee, principal officer or member. If a person is a member of more than one product administered on the system then these memberships can be linked to the one person record.

The legal entity to which members belong is called a product on the system. In the retirement fund industry these are also generally referred to as schemes, funds or plans.

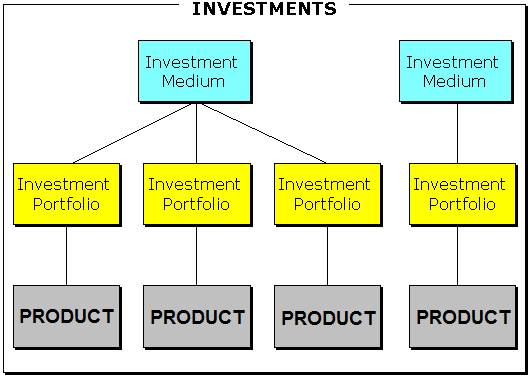

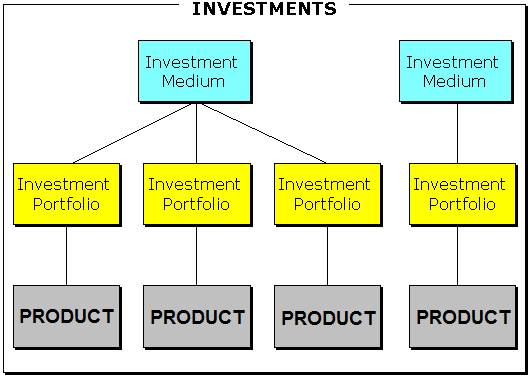

Arrangements for investing the product's assets are referred to as investment mediums and investment portfolios on the system. An investment medium represents the fund administered by an asset manager, which can be used by several products. An investment portfolio represents the product's own investment in an investment medium.

In cases where a fund is managed specifically for a product, the investment medium and investment portfolio are essentially the same.

One record is maintained for all corporate entities, e.g. banks, risk insurers, asset managers, etc., that interact with one or more products. This obviates the need for multiple records of the same entity and ensures that the details for the same entity remain consistent.

All financial transactions (contributions, risk premiums, investments, benefit payments, etc.) are recorded as accounting transactions at both a member and product level. The accounting transactions form the nucleus of the system. The enquiries on these transactions are provided by user definable accounting transaction retrievals.

The following table defines the general meaning of terms used within the system.

|

Term |

General definition |

|

Product |

Scheme, Fund, Plan |

|

Investment Medium |

Asset manager's investment fund |

|

Investment Portfolio |

Product's use of the investment medium |

|

Pay Centre |

Entity from where member data is sent |

|

Membership Group |

Category / Class of member |

|

Benefit Payment |

Claim |

|

Benefit Event |

Reason for claim, e.g. resignation |

|

Accounting Activity Journal / Manual Initiate |

On-line journal |

|

BSV (Benefit Structure Version) |

Version of benefit rules |

|

Person |

Members, contact people, beneficiaries, etc. |

|

Client |

Member, Membership |

|

Regular Payments |

Annuities |