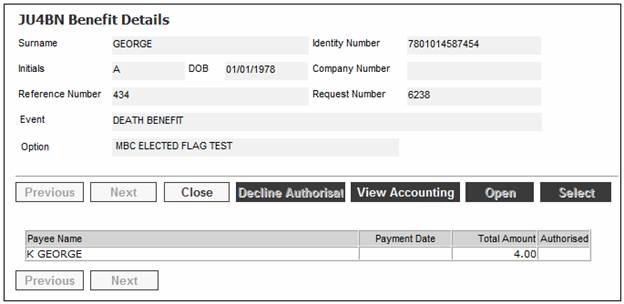

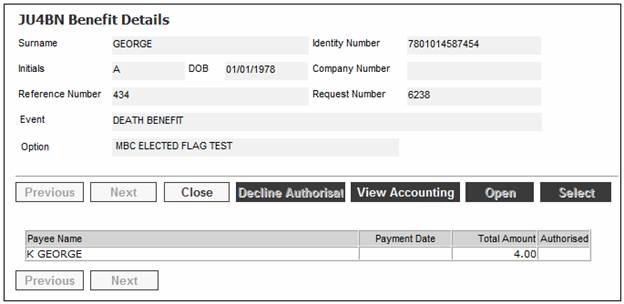

Display the JU4BN Benefit Details screen.

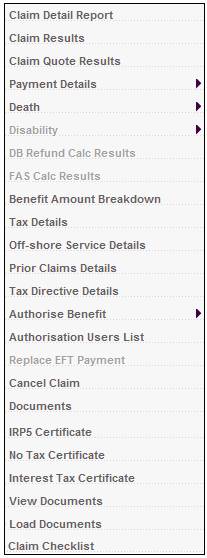

The following sub-menu will be displayed on the left.

Select No Tax Certificate from the sub-menu on the left.

The JU4GA No Tax Certificate screen will be displayed.

Capture data as follows:

|

Employee |

|

|

Surname Initials DOB Identity Number Company Number Reference Number |

Capture the details for each of these fields. |

|

IRP5 option |

|

|

Certificate for Member |

Click the radio button to select a certificate for the member. |

|

Blank Certificate |

Click the radio button to select a blank certificate. |

|

No Tax Reason |

If the Blank Certificate radio button was selected, select a value from the drop-down box. |

Click OK when the data has been captured.

The system will read the Scheme Parameter with a Parameter Type of TAX INTERFACE for the Scheme. If the value is EASYTAX or ITAX, the following warning message will be displayed:

The tax certificate will be created within the external tax interface for this scheme.

If a Scheme Parameter is not found, the system will read the Territory Parameter with a Parameter Type of TAX INTERFACE and if the value is EASYTAX or ITAX, the warning message above will be displayed.

If a Business Address is not defined for the Administrator, the IRP5 will not be generated and an Error Message will be displayed.

If the Country for the Scheme to which the Membership is linked is SOUTH AFRICA and the value for PAYE AMOUNT is zero, the system will read the Document Template with a Process Type of BEN PAYMENT and a Template Type of IT3(a) and create a IT3(a) certificate.

The STATUS on the Benefit Tax Directive record will be updated to A, the TYPE OF CERTIFICATE with IT3(A) and IT3(A) REASON with the value selected.

If the value for Description on the Scheme Parameter with a Parameter Type of TAX ENTITY for the Scheme to which the Membership is linked is ADMINISTRATOR, the IRP5 NUMBER will be updated with the value for the Territory Parameter BENNOTAXCERTNO and the value for the Territory Parameter BENNOTAXCERTNO will be updated with the current value plus 1.

If the value for Description on the Scheme Parameter with a Parameter Type of TAX ENTITY for the Scheme to which the Membership is linked is SCHEME, the system will read the Pooling Status for the Scheme. If it is SUB UMBRELLA, the IRP5 NUMBER will be updated with the value for the Scheme Parameter BENNOTAXCERTNO for the Main Scheme to which the Scheme is linked and the value for the Scheme Parameter BENNOTAXCERTNO will be updated with the current value plus 1.

If the Pooling Status is NONE, the IRP5 NUMBER will be updated with the value for the Scheme Parameter BENNOTAXCERTNO for the Scheme to which the Membership is linked and the Scheme Parameter BENNOTAXCERTNO will be updated with the current value plus 1.