Select the required employee membership as described under

Processes

Benefits (Insurance Products)

Claims Administration Overview

Selecting Members

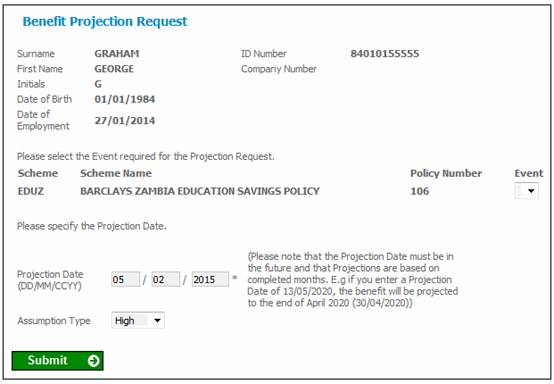

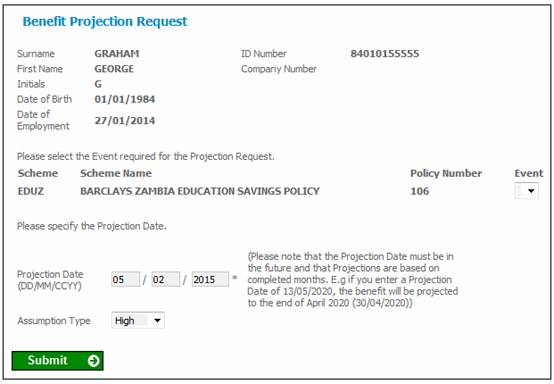

Select Projections from the top menu and then select New Projection from the sub-menu on the left. The Benefit Projection Request screen will be displayed.

All of the memberships linked to the person will be displayed. Click the appropriate radio button to select the membership to be processed (if applicable).

Select an event from the drop-down list by clicking on the Event drop-down box .

If a retirement event is selected, then a system generated default value will be displayed as the Projection Date.

To change the date of the event, enter a new date in the Projection Date field. The date entered must be a future date (i.e. later than the current date).

Select a value from the Assumption Type drop-down list (High, Low or Core).

Click SUBMIT.

If the Fixed Date field on the BADI NRA Definition Maintain screen has been set, then the following warning message will be displayed:

Fixed Retirement Date has been overridden. Do you wish to continue?

Click CANCEL to cancel the date override or click OK to confirm that the date override is valid, and to continue processing.

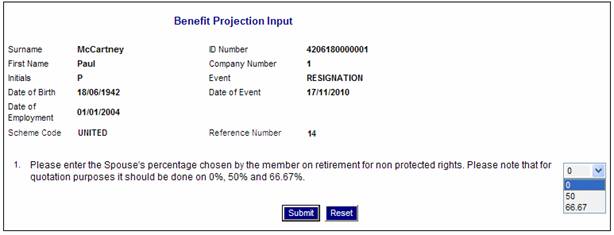

If there is a scale linked to the benefit product, and there is therefore a choice of values, the values will be displayed in a drop-down list on a Benefit Projection Input screen for selection.

Select the required value from the drop-down list and click SUBMIT.

For more details refer to

Supplements

Claim, Quote and Projection Input Questions

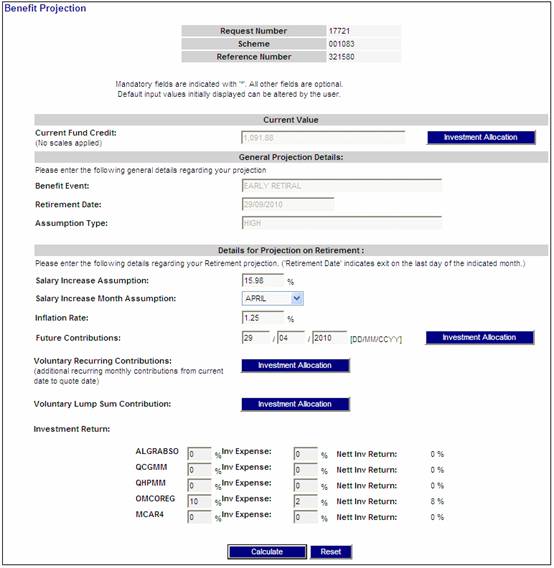

The Benefit Projection screen will be displayed.

The following details are displayed on the screen:

|

Request Number |

The system generated number identifying the projection request. |

|

Scheme |

The code of the scheme to which the member belongs. |

|

Reference Number |

The number identifying membership of the scheme. |

|

Current Value Note: This depends on the value of the Type of Benefit field. Refer to Product Launch Requirements Product Update Product Update Type: Maintain Scheme Benefit Rules |

|

|

Current Fund Credit |

The total contributions with interest up to the current date.

Click INVESTMENT ALLOCATION to allocate the current fund credit. (Refer to the Investment Allocation section below). |

|

General Projection Details |

|

|

Benefit Event |

The event you selected on the Benefit Projection Request screen. |

|

Retirement Date / Withdrawal Date |

The date captured in the Projection Date field. |

|

Assumption Type |

The value captured in the Assumption Type field. |

You will need to define the parameters that will be used in the calculation of the benefit projection by completing the following fields:

|

Details for Projection on Retirement / Withdrawal |

|

|

|

Salary Increase Assumption |

The assumed percentage by which the latest salary stored on the system will increase. This determines the projected contributions from the current date to the projection date.

Note: You can change the default percentage that appears on the screen. |

|

|

Salary Increase Month Assumption |

The assumed month in which the salary increase will be applied. Note: You can accept the system default month that appears on the screen, or you can select a different month from the drop-down list. |

|

|

Inflation Rate Note: This only applies to a Standard Benefit – Scheme Credit (STD) |

The percentage for inflation to be used in the projection calculation.

If the Projection Inflation option has been selected on the Benefit Statement Format for the Scheme, the value for Inflation Rate captured on the JU1EO New Projection Assumptions screen for the Scheme will be offset against the Salary Increase Percentage and the Investment Return i.e. these values will be calculated using the net rate. If a value is not found for the Scheme, the Batch Parameter value will be used.

Refer to Infrastructure Batch Batch Parameters If no specific batch parameter is stored for inflation, this field will not display a value, and you must capture a value. |

|

|

Future Contributions |

The date from which contributions must be allocated to one or more Portfolio for this projection.

Click INVESTMENT ALLOCATION to allocate the future contributions. (Refer to the Investment Allocation section below). |

|

|

Voluntary Recurring Contributions |

The selection of the Portfolio(s) to which additional recurring monthly contributions must be allocated from the current date to the quote date.

Click INVESTMENT ALLOCATION to allocate voluntary recurring contributions. (Refer to the Investment Allocation section below). |

|

|

Voluntary Lump Sum Contributions |

The selection of the Portfolio(s) to which additional lump sum recurring contributions must be allocated from the current date to the quote date.

Click INVESTMENT ALLOCATION to allocate voluntary lump sum contributions. (Refer to the Investment Allocation section below). |

|

|

Investment Return |

The rate at which returns on the current contribution value and future contributions will be calculated.

You can change the Investment Expense and Nett Investment Return default percentages that appear on the screen. Note: This parameter will only be displayed for a defined contribution scheme. |

|

Once the necessary information has been provided, click CALCULATE.

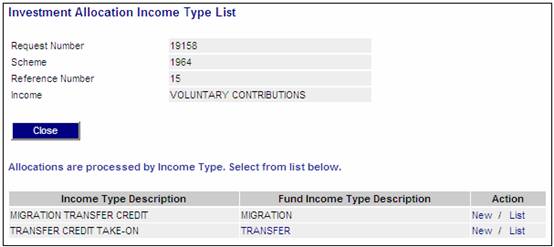

The INVESTMENT ALLOCATION allows the user to view the Investment Allocation Income Type List screen. This screen displays a list of Portfolios available for selection.

Click INVESTMENT ALLOCATION. The Investment Allocation Income Type List screen will be displayed.

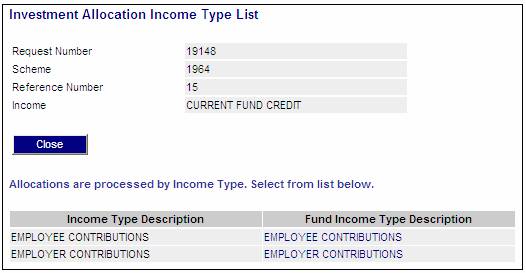

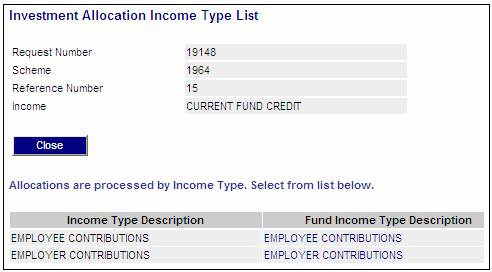

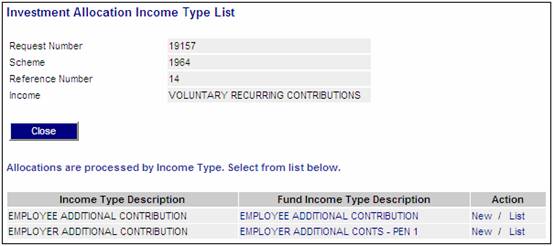

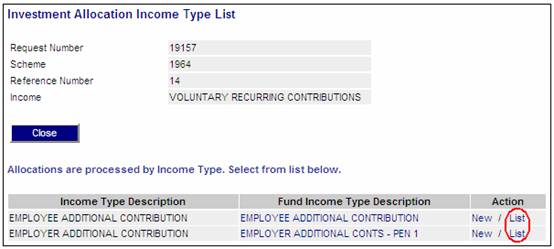

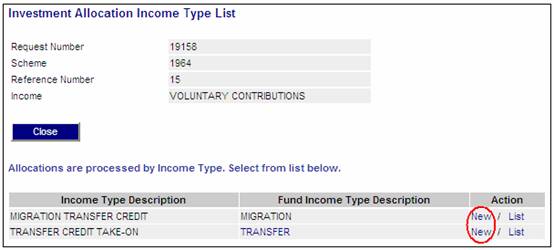

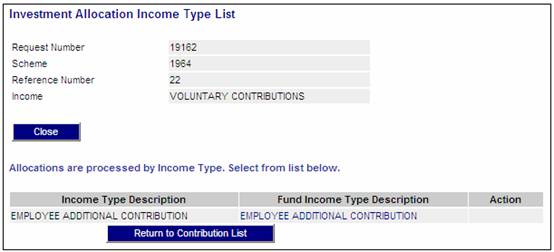

The following Investment Allocation Income Type List screen will be displayed when the Investment Allocation selections are for:

- Current Fund Credit

- Future Contributions

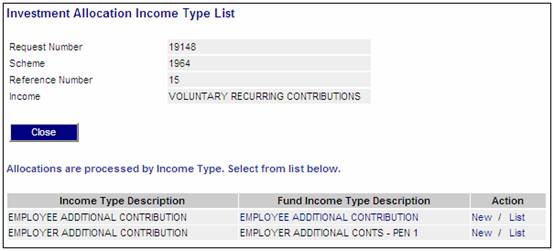

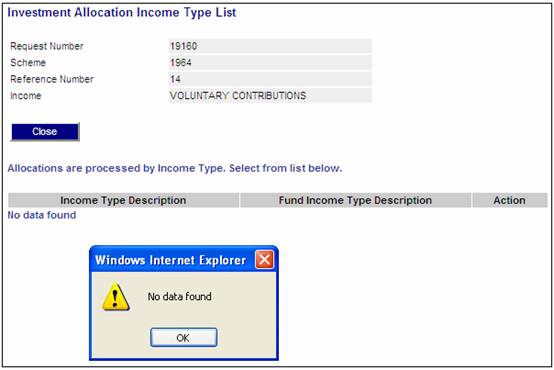

The following Investment Allocation Income Type List screen will be displayed when the Investment Allocation selections are for:

- Voluntary Recurring Contributions

- Voluntary Lump Sum Contribution

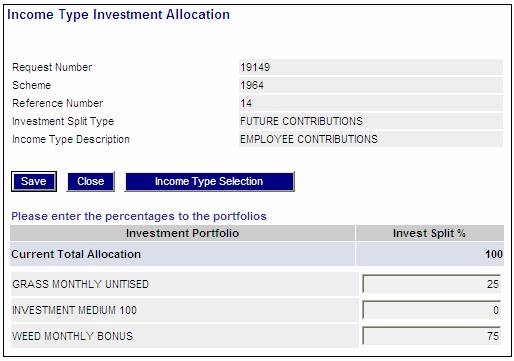

These screens display a list of the portfolios available for the user to select. The following details are displayed on these screens:

|

Request Number |

The system generated number identifying the projection request. |

|

Scheme |

The code of the scheme to which you belong. |

|

Reference Number |

The reference number by which you are identified within this scheme. |

|

Income Type Description |

The description of an Income Type. |

|

Fund Income Type Description |

The description of a Fund Income Type. Each item displayed is a hyperlink. When the hyperlink is selected, the system will display the Income Type Investment Allocation screen to allow you to capture an amount or percentage to be allocated. |

|

Action |

Note: The Action column will only be displayed when the Investment Allocation selection is for Voluntary Recurring Contributions or Voluntary Lump Sum Contribution.

The New / List hyperlinks will be displayed.

If you select the New hyperlink, the system will display the Income Type Investment Allocation screen and allow you to capture an amount or percentage to be allocated.

If you select the List hyperlink, the system will display the Investment Allocation Income Type List screen to allow you to view a Fund Income Type selection, and to end date a contribution. |

Current Fund Credit / Future Contributions

If the field is for either Current Fund Credit or Future Contributions, click INVESTMENT ALLOCATION alongside Current Fund Credit or alongside Future Contributions.

The Investment Allocation Income Type List screen will be displayed.

This screen displays a list of Portfolios available for selection.

To return to the Benefit Projection screen, click CLOSE.

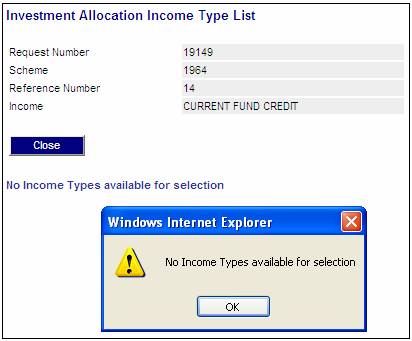

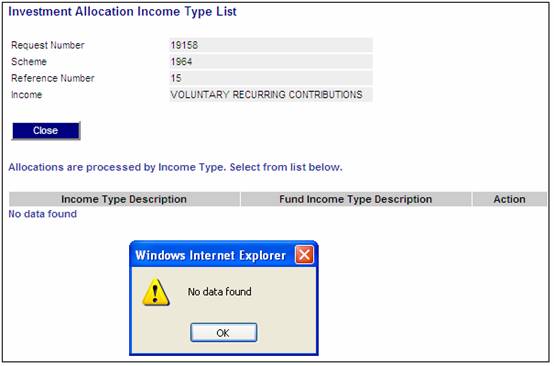

If there are no Income Types available for selection then the following message will be displayed:

Click OK to remove the message.

To return to the Benefit Projection screen, click CLOSE.

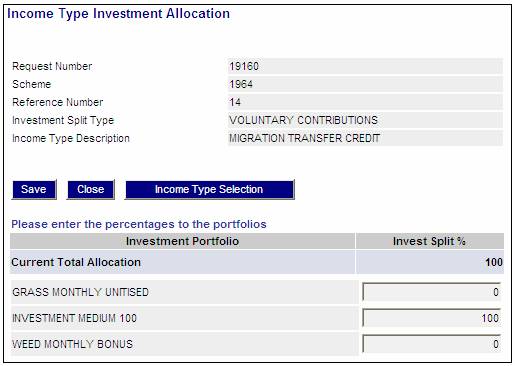

To select a Portfolio, click on a hyperlinked Portfolio in the Fund Income Type Description column.

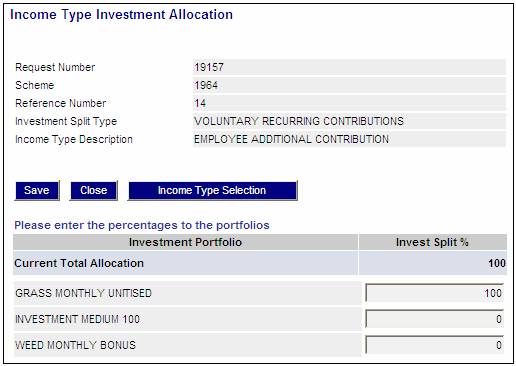

The Income Type Investment Allocation screen will be displayed.

This screen displays a list of Investment Portfolios with the current allocation for each Investment Portfolio displayed in the Invest Split % column. You have the option to change the current investment split percentage allocated for each. .

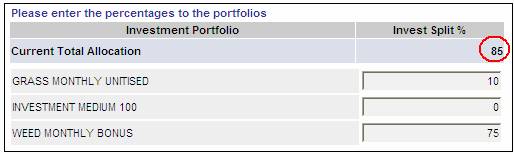

Capture the percentage to be allocated to each Portfolio in the Invest Split % column, and ensure that the total of the split percentages is 100%.

Note:

As percentages are captured, the total percentage will be displayed alongside Current Total Allocation in the Invest Split % column.

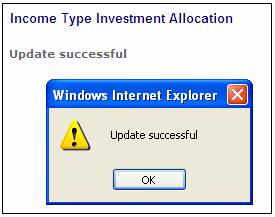

Once all of the percentages have been captured, click SAVE.

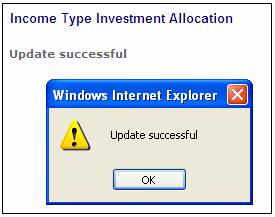

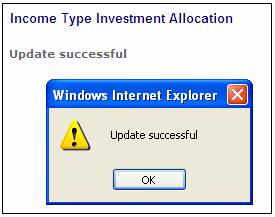

If the percentages captured are valid, a message will be displayed on the screen to indicate that the update was successful.

Click OK to remove the message.

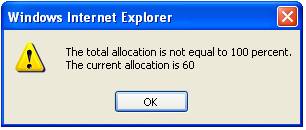

If the total allocation is not equal to 100%, an error message will be displayed.

The total allocation is not equal to 100 percent. The current allocation is 60

Click OK to remove the message. Capture percentages so that the total allocation is equal to 100%

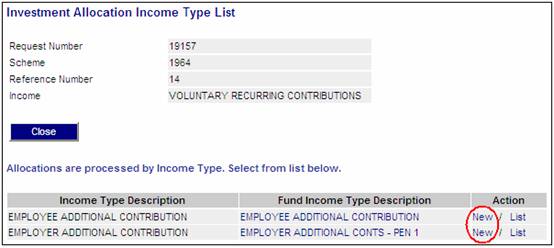

To select another Fund Income Type, click Income Type Selection. The system will display the Investment Allocation Income Type List screen.

To return to the Benefit Projection screen, click CLOSE.

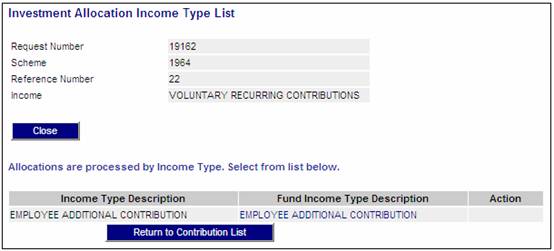

Voluntary Recurring Contributions

Click INVESTMENT ALLOCATION alongside Voluntary Recurring Contributions.

The Investment Allocation Income Type List screen will be displayed.

This screen displays a list of Portfolios available for selection.

To return to the Benefit Projection screen, click CLOSE.

To select a Portfolio, click on a hyperlinked Portfolio in the Fund Income Type Description column.

The Income Type Investment Allocation screen will be displayed.

This screen displays a list of Investment Portfolios with the current allocation for each Investment Portfolio displayed in the Invest Split % column. You have the option to change the current investment split percentage allocate for each.

Capture the percentage to be allocated to each Portfolio in the Invest Split % column, and ensure that the total of the split percentages is 100%.

Once all of the percentages have been captured, click SAVE.

For more details, refer to Current Fund Credit / Future Contributions under the topic Capturing allocations above.

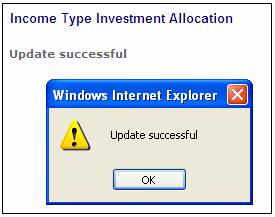

If the percentages captured are valid, the following message will be displayed on the screen to indicate that the update was successful:

Click OK to remove the message.

To return to the Benefit Projection screen, click CLOSE.

To select another Fund Income Type, click INCOME TYPE SELECTION. The system will display the Investment Allocation Income Type List screen again.

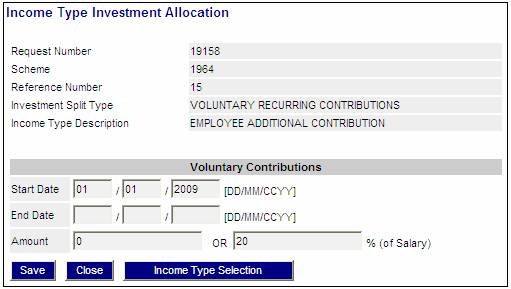

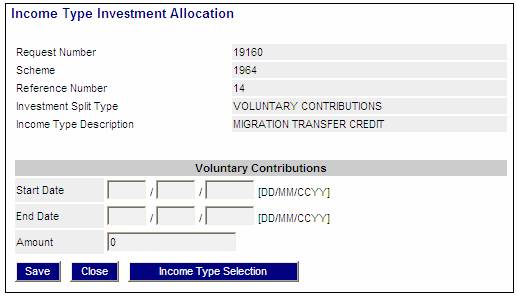

To define a new voluntary recurring contribution, click the hyperlinked New in the Action column alongside the required Portfolio.

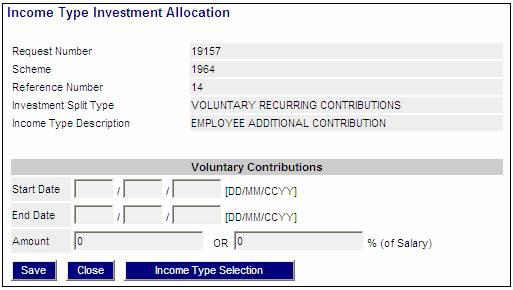

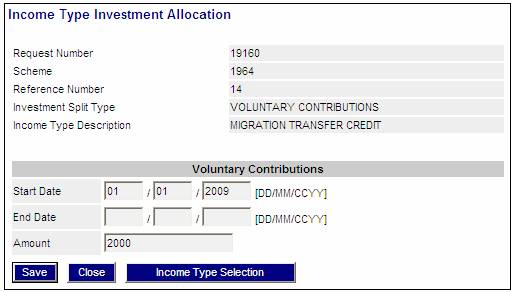

The Income Type Investment Allocation screen will be displayed.

This screen provides for the capture of new recurring voluntary contribution details.

Capture voluntary recurring contributions data as follows:

|

Start Date |

The date from which your recurring contributions will be paid.

Note: The system defaults to the current date. |

|

End Date |

The date up until when your recurring contributions will continue to be paid.

Note: The system defaults to the current date. |

|

Amount |

The recurring contribution amount that you wish to allocate. (Allocation is defined by the Invest Split % per Investment Portfolio).

Note: You must capture either an amount or a percentage of salary, but not both. |

|

% (of Salary) |

The recurring contribution defined as a percentage of salary that you wish to allocate. (Allocation is defined by the Invest Split % per Investment Portfolio).

Note: You must capture either an amount or a percentage of salary, but not both. |

Once all of the data has been captured, click SAVE.

The following message will be displayed on the screen to indicate that the update was successful:

Click OK to remove the message from the Income Type Investment Allocation screen.

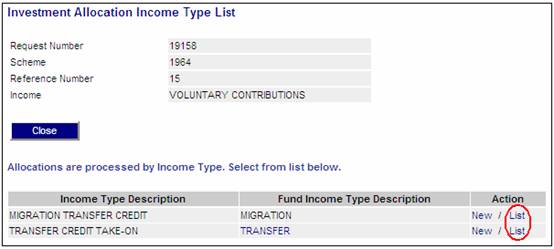

The new recurring voluntary contribution that you have captured will be added to the Investment Allocation Income Type List screen (refer to the section covering the List hyperlink below).

If an End Date has not been captured, the following message will be displayed.

Please enter an End Date.

Click OK to remove the message. Capture an End Date.

If neither an amount nor a percentage have been captured, the following message will be displayed.

Please enter an Amount or Percentage.

Click OK to remove the message. Capture either an amount or a percentage.

If both an amount and a percentage have been captured, the following message will be displayed.

Please enter either Amount or Percent.

Click OK to remove the message. Capture either an amount or a percentage.

To return to the Benefit Projection screen, click CLOSE.

To select another Fund Income Type, click INCOME TYPE SELECTION. The system will display the Investment Allocation Income Type List screen again.

To view a list of existing voluntary recurring contributions, click the hyperlinked List in the Action column alongside the required Portfolio.

The Investment Allocation Income Type List screen will be displayed.

This screen displays a list of the existing recurring voluntary contributions defined.

If no voluntary recurring contributions exist, the following message will be displayed:

Click OK to remove the message.

To return to the Benefit Projection screen, click CLOSE.

To view details, click on a hyperlinked item in the Fund Income Type Description column on the Investment Allocation Income Type List screen.

The Income Type Investment Allocation screen will be displayed.

This screen displays recurring voluntary contribution details.

The following fields are displayed:

|

Start Date |

The date from which your recurring contributions are being paid. |

|

End Date |

The date up until when your recurring contributions will continue to be paid. |

|

Amount |

The recurring contribution amount that you have allocated. (Allocation is defined by the Invest Split % per Investment Portfolio).

Note: This may be either an amount or a percentage of salary, but not both. |

|

% (of Salary) |

The recurring contribution defined as a percentage of salary that you have allocated. (Allocation is defined by the Invest Split % per Investment Portfolio).

Note: This may be either an amount or a percentage of salary, but not both. |

Note:

You may only update the End Date field. To discontinue a voluntary recurring contribution, you must capture a valid End Date and click SAVE.

The following message will be displayed to indicate that the update was successful.

Click OK to remove the message.

To select and view another Fund Income Type on the Income Type Investment Allocation screen, click INCOME TYPE SELECTION. The system will display the Investment Allocation Income Type List screen again.

To return to the Benefit Projection screen, click CLOSE.

Voluntary Lump Sum Contribution

Click INVESTMENT ALLOCATION alongside Voluntary Lump Sum Contribution.

The Investment Allocation Income Type List screen will be displayed.

This screen displays a list of Portfolios available for selection.

To return to the Benefit Projection screen, click CLOSE.

To select a Portfolio, click on a hyperlinked Portfolio in the Fund Income Type Description column.

The Income Type Investment Allocation screen will be displayed.

This screen displays a list of Investment Portfolios with the current allocation for each Investment Portfolio displayed in the Invest Split % column. You have the option to change the current investment split percentage allocate for each.

Capture the percentage to be allocated to each Portfolio in the Invest Split % column, and ensure that the total of the split percentages is 100%.

Once all of the percentages have been captured, click SAVE.

For more details, refer to Current Fund Credit / Future Contributions under the topic Capturing allocations above.

If the percentages captured are valid, the following message will be displayed on the screen to indicate that the update was successful:

Click OK to remove the message.

To return to the Benefit Projection screen, click CLOSE.

To select another Fund Income Type, click INCOME TYPE SELECTION. The system will display the Investment Allocation Income Type List screen.

To define a new voluntary recurring contribution, click the hyperlinked New in the Action column alongside the required Portfolio.

The Income Type Investment Allocation screen will be displayed.

This screen provides for the capture of new recurring voluntary contribution details.

Capture voluntary recurring contributions data as follows:

|

Start Date |

The date on which you will pay the lump sum contribution. |

|

Ends Date |

Leave blank. Only capture a date if an existing lump sum amount has been discontinued. |

|

Amount |

The lump sum contribution amount that you wish to allocate. (Allocation is defined by the Invest Split % per Investment Portfolio). |

Once all of the data has been captured, click SAVE.

The following message will be displayed on the screen to indicate that the update was successful:

Click OK to remove the message from the Income Type Investment Allocation screen.

The new lump sum contribution that you have captured will be added to the Investment Allocation Income Type List screen (refer to the section covering the List hyperlink, below).

If an End Date has been captured, the following message will be displayed.

Please enter an End Date.

Click OK to remove the message. Capture an End Date.

If neither an amount nor a percentage have been captured, the following message will be displayed.

Please enter an Amount or Percentage.

Click OK to remove the message. Capture either an amount or a percentage.

If both an amount and a percentage have been captured, the following message will be displayed.

Please enter either Amount or Percent.

Click OK to remove the message. Capture either an amount or a percentage.

To return to the Benefit Projection screen, click CLOSE.

To select another Fund Income Type, click INCOME TYPE SELECTION. The system will display the Investment Allocation Income Type List screen.

To view a list of existing voluntary recurring contributions, click the hyperlinked List in the Action column alongside the required Portfolio.

The Investment Allocation Income Type List screen will be displayed.

This screen displays a list of existing recurring voluntary contributions defined.

If no voluntary lump sum contributions exist, the following message will be displayed:

Click OK to remove the message.

To return to the Benefit Projection screen, click CLOSE.

To view details, click on a hyperlinked item in the Fund Income Type Description column.

The Income Type Investment Allocation screen will be displayed.

This screen displays voluntary contribution details.

The following fields are displayed:

|

Start Date |

The date from which your voluntary contributions are being paid. |

|

End Date |

The date up until when your voluntary contributions will continue to be paid. |

|

Amount |

The voluntary contribution amount that you have allocated. (Allocation is defined by the Invest Split % per Investment Portfolio).

Note: This may be either an amount or a percentage of salary, but not both. |

|

% (of Salary) |

The voluntary contribution defined as a percentage of salary that you have allocated. (Allocation is defined by the Invest Split % per Investment Portfolio).

Note: This may be either an amount or a percentage of salary, but not both. |

Note:

The End Date field may only be updated. To discontinue a voluntary contribution, you must capture a valid End Date and click SAVE.

The following message will be displayed to indicate that the update was successful.

Click OK to remove the message.

To select and view another Fund Income Type, click INCOME TYPE SELECTION. The system will display the Investment Allocation Income Type List screen again.

To return to the Benefit Projection screen, click CLOSE.

Once all of the necessary information has been captured on the Benefit Projection screen, click CALCULATE.

For information on the formulae and methods used by the system to calculate benefit projections for member benefits, refer to:

Supplements

Benefit Statement Setup for Projection