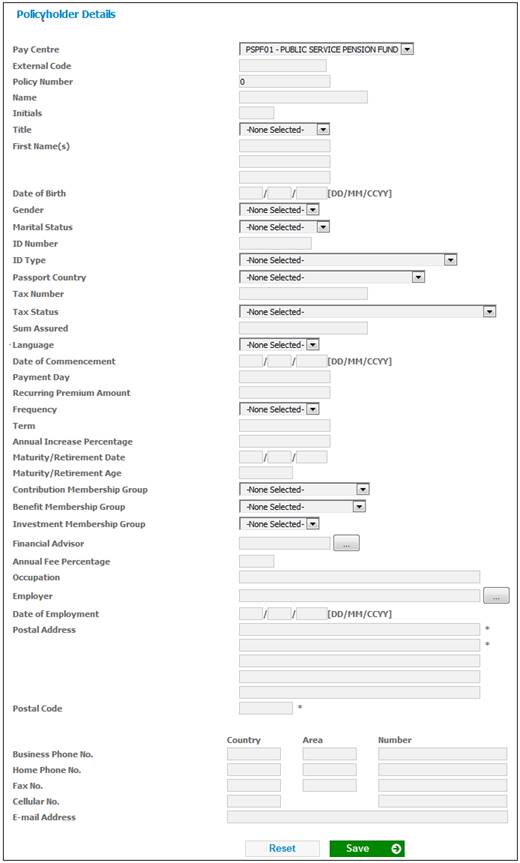

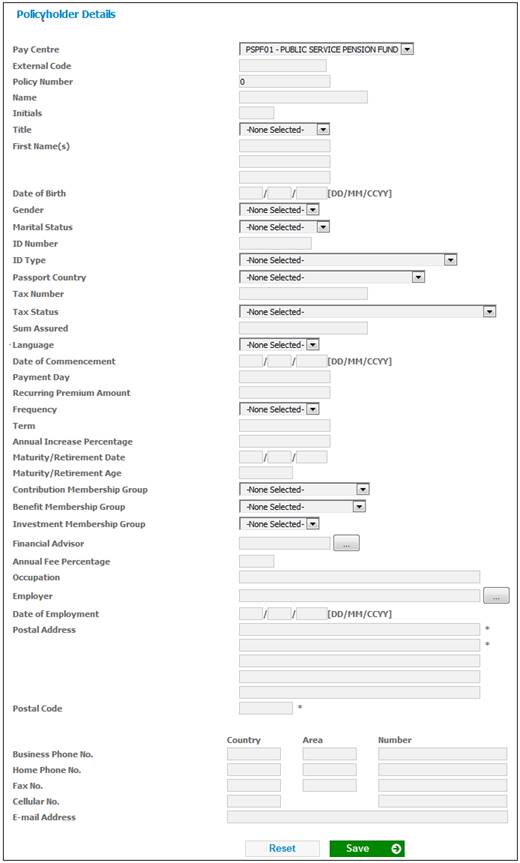

To add a new policyholder, select New Policyholder Details on the sub-menu on the left. The Policyholder Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Pay Centre |

The Pay Centre from which the policyholder’s contribution/ premium data is collected. Select a Pay Centre from the drop-down list. |

|

External Code |

The number identifying a Corporate Client or Person for external system purposes.

Optional |

|

Policy Number |

The number of the Policyholder. If this field is left blank, a number will be generated by the system. |

|

Name |

The policyholder’s name.

Note: If the Membership is linked to a Corporate Client, the Corporate Client Name will be displayed in this field |

|

Initials |

The policyholder’s initials. |

|

Title |

Select the required title for the policyholder from the drop-down box. |

|

First Name(s) |

The policyholder’s first names. |

|

Date of Birth |

The policyholder’s date of birth. |

|

Gender |

Select the policyholder’s gender from the drop-down box. |

|

Marital Status |

Select the policyholder’s marital status from the drop-down box. |

|

ID Number |

The policyholder’s identity number. |

|

ID Type |

Select the type of ID from the drop-down box.

Note: If the Identity Type is South African then the system will validate that the same ID Number does not exist on the system. |

|

Passport Country |

The country which issued the Passport. Select a Country from the LIST.

This field is mandatory if the Identity Type selected is PASSPORT. |

|

Tax Number |

The Tax Number of the policyholder.

Optional |

|

Tax Status |

The status of the policyholder’s tax. Select a status from the drop-down box. The following values may be selected: · TAX EXEMPT · UNTAXED · TAXED · UNTAXED – EXEMPT FROM DIVIDENDS WITHHOLDING TAX · TAXED - EXEMPT FROM DIVIDENDS WITHHOLDING TAX |

|

Sum Assured |

The guaranteed maturity value that the Policyholder will receive when the policy matures.

Mandatory if Type of Fund is ENDOWMENT. |

|

Language |

Select the policyholder’s preferred language from the drop-down box. |

|

Date of Commencement |

The date on which this membership commences. |

|

Payment Day |

The day on which payments must be made.

Optional |

|

Recurring Premium Amount |

The recurring amount of premium that the policyholder will pay.

Optional |

|

Frequency |

The frequency of payments. Select a value from the drop-down list.

Optional |

|

Term |

The term of a payment. |

|

Annual Increase Percentage |

The percentage by which an annuity must be increased annually.

Optional |

|

Maturity / Retirement Date |

The date on which the Endowment Policy matures.

Optional |

|

Maturity / Retirement Age |

The policyholder age at which the Endowment Policy matures.

Optional |

|

Contribution Membership Group |

The membership group to which the policyholder is allocated for contributions. |

|

Benefit Membership Group |

The membership group to which the policyholder is allocated for benefits. |

|

Investment Membership Group |

The membership group to which the policyholder is allocated for investments. |

|

Financial Advisor |

Select the policyholder’s Financial Advisor from the drop-down box.

Note: The system will display a list of the Intermediaries linked to the Participating Employer to which the Member is linked. If the Membership is not linked to a Participating Employer or there are no Intermediaries linked to the Participating Employer, a list of all Organisation Units with an EXTERNAL ORG UNT value of INTERMEDIARY will be displayed. |

|

Annual Fee Percentage |

The annual fee percentage charged. |

|

Occupation |

The policyholder's occupation. Select a value from the drop-down box.

Optional field |

|

Employer |

The name of the Employer. Select an Employer from the drop-down list.

Optional field |

|

Date of Employment |

The date the policyholder commenced employment with the current employer.

Optional field |

|

Postal Address |

The policyholder’s postal address. |

|

Postal Code |

The postal code of the policyholder’s postal address. |

|

Business Phone No. |

The policyholder’s business phone number. |

|

Home Phone No. |

The policyholder’s home phone number. |

|

Fax No. |

The policyholder’s fax number. |

|

Cellular No. |

The policyholder’s cellular number. |

|

E-mail Address |

The policyholder’s e-mail address. |

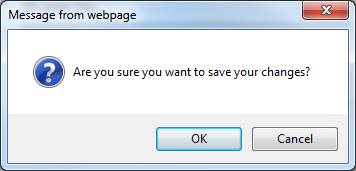

Once all the necessary details have been added, click SAVE.

A confirmation message will be displayed.

Are you sure you want to save your changes?

Click OK to confirm that the changes must be saved.

The Policyholder Details screen will be displayed, and a message will confirm that the data has been successfully captured.

Validation of Natural Person

When SAVE is selected, the system will check if there is a Natural Person record with the same Surname, Initials and Date of Birth or the same ID Number and ID Type.

If there is a Natural Person record with the same Code, the following message will be displayed:

There is an existing person with the same Code please select the person via the Person List menu option.

If there is a Natural Person record with the same Surname, Initials and Date of Birth, the following message will be displayed:

There is an existing person with the same surname, initials and date of birth; please select the person via the Person List menu option.

If there is an existing Natural Person record with the same ID Number and ID Type, the following message will be displayed:

There is an existing person with the same ID Number; please select the person via the Person List menu option.

If there is no Natural Person record with the same Surname, Initials and Date of Birth or the same ID Number and ID Type, the system will create a new Natural Person record with the following data:

- Surname

- Initials

- Title

- First Name 1

- First Name 2

- First Name 3

- Date of Birth

- ID Number

- ID Type

- Tax Number

A Client record will be created with a Client Type of Natural Person and with the External Code.

Validation of Term, Maturity Date and Maturity Age

The system will validate that a value is captured for only one of the following fields:

- Term

- Maturity Date

- Maturity Age

If a value for Term is captured, the Maturity Date will be derived as per existing functionality.

If a value for Maturity Date is captured, the system will perform validation in terms of the Fund Rules as per the existing functionality.

If a value for Maturity Age is captured, the Maturity Date will be derived based on the Member’s age as at Date of Commencement and the value for Maturity Age captured. This will be validated in terms of the Fund rules as per existing functionality.

The system will create a Member Values record to record the Maturity Date, Sum Assured and Employer information.

Validation of Minimum and maximum terms

Where there is a maximum and minimum value for the Term, a Product Term must be created in the Benefit Rules with a Description of MAXIMUM TERM when the product is launched.

A minimum and maximum scale can be setup for this Product. The From value on the Scale linked to the Benefit Product will define the minimum and the To value the maximum.

A Package with a Purpose of Validation must be linked to the Benefit Event with an Event Category of MATURITY.

When a term is captured or derived on the Policyholder Details screen, the system will read for a Benefit Package with a Purpose of VALIDATION and with a Benefit Event with an Event Category of MATURITY and will read the Scale linked to the Benefit Product with a Description of MAXIMUM TERM.

If the value captured or derived for Term is less than the From value, the following message will be displayed:

The term is less than the minimum term allowed.

If the value captured or derived for Term is greater than the To value on the Scale, the following error message will be displayed:

The term is greater than the maximum term allowed.

If a Benefit Product with a Description of MAXIMUM TERM is not found, the system will validate the Maturity Date as per the current functionality i.e. based on the Normal Retirement Ages in the Benefit Rules.

Validation of Minimum and maximum Sum Assured

Where there is a maximum and minimum value for the Sum Assured, a Benefit Product with a Description of MAXIMUM SUM ASSURED must be created in the Benefit Rules when the product is launched. A minimum and maximum scale can be setup for this Benefit Product.

The From value on the Scale linked to the Benefit Product will define the minimum and the To value the maximum. A Package with a purpose of VALIDATION must be linked to a Benefit Event with an Event Category of MATURITY. When a sum assured is captured on the Policyholder Details screen, the system will read for a Benefit Package with a Purpose of VALIDATION and with a Benefit Event with an Event Category of MATURITY and will read the Scale linked to the Benefit Product with a Description of MAXIMUM SUM ASSURED. If the value captured or derived for Term is less than the From value, the following error message will be displayed:

The sum assured is less than the minimum allowed.

If the value captured or derived for Term is greater than the To value on the Scale, the following error message will be displayed:

The sum assured is greater than the maximum allowed.

If there is a Benefit Product with a Description of MAXIMUM SUM ASSURED, the Sum Assured will not be validated i.e. enable any value to be captured.

The system will create a Member Values record with a Type of ASSURANCE DETS to record the following values with an Effective Date equal to the Date of Commencement captured:

- Maturity Date (Period End for UDPV SUBTYPE of MATURITY DATE)

- Sum Assured (Amount for UDPV SUBTYPE of SUM ASSURED)

- Occupation. (Description for UDPV SUBTYPE of OCCUPATION)

- Tax Status (Value for UDPV SUBTYPE DETAIL linked to UDPV SUBTYPE of TAX STATUS)

If a value for Annual Fee Percentage is captured, the system will find the Expense Rule with a Formula Type of MEM ANN FEE PER linked to the Expense Type with a Global Group Type of COMMISSION and for which the Frequency is AD HOC. The system will read the value for Percentage on the Scale linked to the Expense Rule. If the value captured for Annual Fee Percentage is greater than the Percentage on the Scale, the following error message will be displayed:

The annual fee percentage exceeds the maximum allowable.

If an Expense Rule linked to the Expense Type with a Global Group Type of COMMISSION and for which the Frequency is AD HOC is not found, any value for Annual Fee Percentage will be enabled to be captured.

The system will create a Member Values record with a Type of INVESTMENT DETS to record the following value with an Effective Date equal to the Date of Commencement captured:

Annual Fee Percentage (Percentage for UDPV SUBTYPE of MEM ANN FEE PER

Note:

If the value for Type of Fund is INVESTMENT, these fields are optional as there is no fixed maturity date and the investments can be disinvested at any time.

The system will create a Client Relationship record with a Client Relationship Type of EMPLOYS linking the Person to the Employer selected with a Start Date equal to Date of Commencement captured.

If the value selected for Frequency is MONTHLY, QUARTERLY, BI-ANNUAL or ANNUAL a Membership Payment and Membership Payment Detail record will be created as per existing functionality.

If the value selected for Frequency is ONCE OFF, a Membership Payment and Membership Payment Detail record will not be created as this will be processed via the Investment Details screen.

If the Type of Fund is LIVING ANNUITY the Membership record will be created with a Status of LIVING ANNUITY.

If the Type of Fund is ANNUITY the Membership record will be created with a Status of ANNUITANT.

If the Type of Fund is not LIVING ANNUITY or ANNUITY the Membership record will be created with a Status of LIVE.

As a person can have multiple active retirement annuity, living annuity or endowment policies, multiple Memberships can be created for the same person and Scheme if the Type of Scheme is not PRESERVATION or RETIREMENT FUND irrespective of the Membership Status.

If the person is a member of a Preservation Fund or an Investment Fund then additional investments can be added to the existing investment and therefore it is not necessary to create a new Membership.

Another Membership will only be enabled if the Type of Fund is PRESERVATION FUND, RETIREMENT FUND if the Membership Status of the existing Membership is EXIT IN PROCESS, EXIT FINALISED, ANNUITANT or LIVING ANNUITNT.

If the Type of Fund is PRESERVATION FUND or INVESTMENT and there is an existing Membership for which the Membership Status is not EXIT IN PROCESS, EXIT FINALISED, ANNUITANT or LIVING ANNUITNT the following error message will be displayed:

There is an existing membership for this person. Please process a new investment for the existing membership.

If there is an existing Natural Person record with the same Surname, Initials and Date of Birth a message will be displayed to indicate that it is a potential duplicate and the option will be provided to link the Membership to the existing Natural Person record. When a Member is selected the details listed above will be displayed for the Membership selected.