Log in to the system from the Logon page.

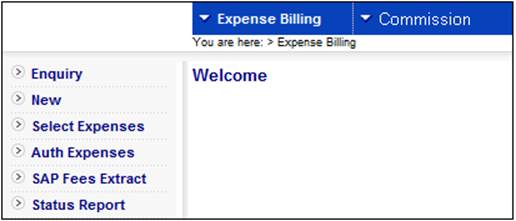

Click processes, then click expense billing.

The following screen is displayed.

Select Commission from the top menu.

The following sub-menu will be displayed on the left.

Select New from the sub-menu on the left.

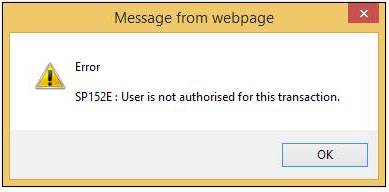

Note:

Transactional security is applied when New is selected. The following message will be displayed if the User is not authorised for the transaction:

Error

User is not authorised for this transaction.

Click OK to remove the message.

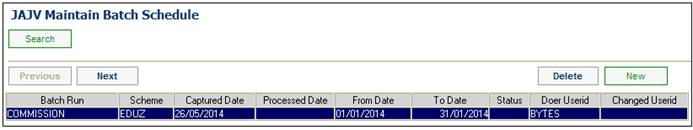

When New is selected, the JAJV Maintain Batch Schedule screen will be displayed.

Create a new COMMISSION BILLING batch run (JU3DH_COMM) or change the effective date of an existing batch run.

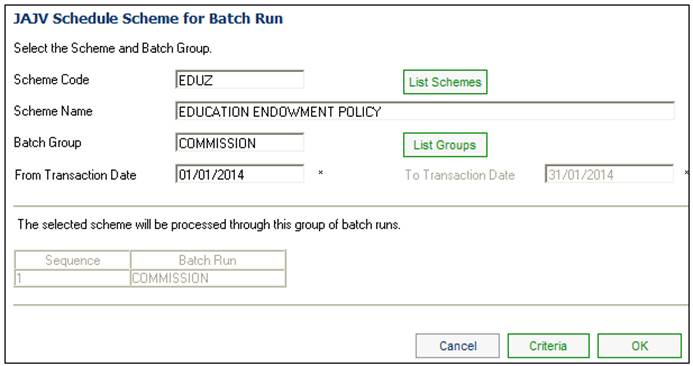

When the NEW button is selected, the JAJV Schedule Scheme for Batch Run screen will be displayed:

Click LIST SCHEMES to select the relevant Product code.

Click LIST GROUPS to select COMMISSION.

Capture values for the From Transaction Date and To Transaction Date.

Note: This will usually be run monthly.

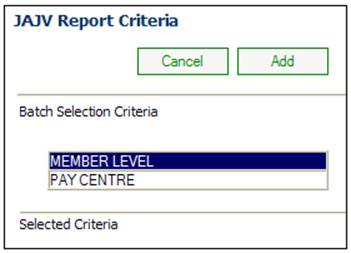

Select the CRITERIA button if you need member level accounting to be generated.

The JAJV Report Criteria screen will be displayed.

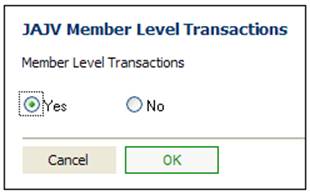

Select MEMBER LEVEL and click the ADD Button. The JAJVMember Level Transactions screen will be displayed.

For more information refer to Maintain Batch Schedule under

Infrastructure

Batch

Run the JU3DH_COMMISSION_EXPENSE batch job (Batch Job 942).

Once the batch job has successfully run, it can be viewed and authorised under the Select Commission menu option.

When the JU3DH_COMMISSION_EXPENSE batch job runs, it will run in the same way as expenses billing i.e. the existing EXPENSE batch job, but only for the Expense Types for which the Global Group Type is COMM EXPENSE.

The Schemes for which the Type of Scheme is DEBIT ORDER UMBRELLA are excluded from the run as these are currently processed via the Debit Order process.

When the COMMISSION or EXPENSE batch job runs and the value for Type of Scale on the applicable Expense Rule is RATE TABLE, the system will read the latest Rate Table with a Rate Table Type equal to the value on the Expense Rule and with an Effective Date less than or equal to the Due Date of the Expense Billing run and linked to the Scheme Membership Group to which the membership is associated. If a Rate Table is not found for the Membership Group, the system will read the Rate Table linked to the Scheme. If a Rate Table linked to the Scheme is not found, the system will read the Global Rate Table.

The table will be applied as per the Type of Scale and the Formula Type and the Formula Applied To on the Expense Rule.

The system will read the Income Types associated to the Expense Rule.

If the Formula Applied To is INCOME TYPE and the Formula Type is PERCENTAGE and the Rate Table Type is equal to TERM, the system will:

Retrieve the Business Transactions in the Members’ Contribution account with transaction dates greater than or equal to the From Date and less or equal to the To Date of the Commission Billing Run. The duration of membership will be calculated to establish the percentage to be applied. The percentage will be multiplied with the transactions and the results will be totalled.

Member Level (optional)

If MEMBER LEVEL has been selected, the system will retrieve the BT’s in each Member’s CONTRIBUTION account with the latest Due Date less than or equal to the COMMISSION run Effective Date and sum the BT’s per Member and per Income Type. The system will:

- Sum all of the BT’s.

- Calculate each Member’s portion of the total commission amount plus VAT as follows per Income Type:

- Total Commission plus VAT x Member’s Contribution / Total Contributions for all Members

Rounding

For Products in countries where decimal places are rounded, any premium amounts collected via debit order and any payment values will have their financial transactions values rounded to the nearest 5 cents.

When values are calculated in the Commission Billing batch job, the system will read the value for Calculation Method on the Expense Rule for the Expense Type and the Membership for which the expense is being calculated and if it is NEAREST 0.05, will round the calculated premium amount to the nearest 0.05 e.g. if the value calculated is 95.03 it will be rounded to 95.05, if it is 95.02 it will be rounded to 95.00, if it is 95. It will be rounded to 95.00, etc.

When the JU3DH_COMMISSION_EXPENSE batch job runs, it will run in the same way as expenses billing i.e. the existing EXPENSE batch job, but only for the Expense Types for which the Global Group Type is COMM EXPENSE.

The Schemes for which the Type of Scheme is DEBIT ORDER UMBRELLA are excluded from the run as these are currently processed via the Debit Order process.

When the COMMISSION or EXPENSE batch job runs and the value for Type of Scale on the applicable Expense Rule is RATE TABLE, the system will read the latest Rate Table with a Rate Table Type equal to the value on the Expense Rule and with an Effective Date less than or equal to the Due Date of the Expense Billing run.

The table will be applied as per the Type of Scale and the Formula Type and the Formula Applied To on the Expense Rule.

Note:

It might be applicable to be able to calculate expenses other than commission using a global scale and then this hasn’t been limited to the COMMISSION batch job.

The system will read the Income Types associated to the Expense Rule.

If the Formula Applied To is ANNUALISED CONS, the system will:

- retrieve the Business Transactions (BT’s) in the Scheme’s CONTRIBFUND account with the latest Due Date for all of the Pay Centres linked to the Scheme for the Income Types associated to the Expense Rule.

- retrieve the BT’s for all of the Pay Centres linked to the Scheme irrespective of whether or not the latest Due Date is the same.

- sum the Amounts.

The system will read the Frequency on the Income Types as and calculate as follows:

- if the Frequency is MONTHLY, multiply the sum of the contributions by 12.

- If the Frequency is QUARTERLY, multiply by 4.

- If the Frequency is HALF YEARLY, multiply by 2,

- If the Frequency is ANNUAL, do not multiply.

If the Type of Scale on the Rate Table is SLIDING SCALE, the system will calculate the expense for each portion of the amount based on the percentage on the table for each portion and sum each of the values calculated.

- if the Frequency on the Expense Rule is MONTHLY, divide the sum of the calculations by 12.

- if the Frequency on the Expense Rule is QUARTERLY, divide the result by 4.

- if the Frequency on the Expense Rule is HALF YEARLY, divide the result by 2

- if the Frequency on the Expense Rule is ANNUAL, do not divide the result.

If the Type of Scale on the Rate Table is AMOUNT, the system will calculate the expense using the percentage on the table applicable to the sum of the contributions.

- If the Rate Table has a value for Amount in place of Percentage and the Type of Scale is SLIDING SCALE, the amounts will be summed per each portion of the value based on the From Amount and To Amount.

- If the Rate Table has a value for Amount in place of Percentage and the Type of Scale is AMOUNT, the system will read the value for Amount for the applicable values based on the From Amount and To Amount.

Total Salary and Number of Members

The system will retrieve the BT’s in the Members’ CONTRIBUTION account with a Due Date equal to the Due Date of the BT’s retrieved for the Pay Centre and for each member for which a BT is retrieved, find the Member’s salary.

The system will read the Amount on the latest ACTUAL EARNING record for which the Salary Type on the Salary Nomination is BASIC.

The system will sum the values for all of the salaries and store the result and the number of members for which a BT was retrieved together with the Due Date of the calculation, the Pay Centre name, and the commission amount.

Vat

The system will read the value for VAT NUMBER on the Intermediary Client (of type INTERMEDIARY GP or INTERMEDIARY) linked to the Scheme.

If the value is null, no VAT will be calculated.

If it is not null, the system will read the latest Global Percentage of type VAT with an Effective Date less than or equal to the batch run effective date and calculate the VAT portion of each Commission Amount as follows:

[Commission amount*] – [Commission amount / (1 + VAT percentage / 100)]

Paycentre

If PAY CENTRE is selected, the system will retrieve the Business Transactions (BT’s) in the Scheme’s CONTRIBFUND account and with a Due Date equal to the Commission run Effective date for the Pay Centres selected.

The system will read the Frequency on the Income Types:

- if the Frequency is MONTHLY, multiply the sum of the contributions by 12.

- if the Frequency is QUARTERLY, multiply by 4.

- if the Frequency is HALF YEARLY, multiply by 2.

- if the Frequency is ANNUAL do not multiply.

The commission for the Pay Centre will be calculate based on the sum of the Contributions for the Pay Centre but based on the rate on the Scale applicable to the sum of the annualised contributions for the whole.

VAT will be calculated as per the above.

Member Level

If MEMBER LEVEL has been selected, the system will retrieve the BT’s in each Member’s CONTRIBUTION with the latest Due Date less than or equal to the COMMISSION run Effective Date and sum the BT’s per Member and per Income Type. The system will:

- Sum all of the BT’s.

- Calculate each Member’s portion of the total commission amount plus VAT as follows per Income Type:

- Total Commission plus VAT x Member’s Contribution / Total Contributions for all Members

Pay Centre and Member Level

If PAY CENTRE and MEMBER LEVEL has been selected, the system will calculate the commission for the Pay Centre selected and apportion the amount calculated to the Members linked to the Pay Centre. The BT’s in the CONTRIBUTION account will be retrieved for only the Members linked to the Pay Centre.

The following pre-authorised BT’s will be created for the values calculated:

Total Commission

|

Process |

Accounting Activity |

Stakeholder |

Debit Account |

Credit Account |

|

COMMISSION |

COMMBILLING |

FUND |

COMMISSION |

COMMPAYABLE |

VAT

|

Process |

Accounting Activity |

Stakeholder |

Debit Account |

Credit Account |

|

COMMISSION |

COMMISSIONCOMM VAT |

FUND |

COMMISSION |

COMMPAYABLE |

Member Portions

|

Process |

Accounting Activity |

Stakeholder |

Debit Account |

Credit Account |

|

COMMISSION |

MEM COMM |

MEMBER |

CONTRIBUTION |

MEM DEPOSIT |

|

COMMISSION |

MEMCOMMREAL |

MEMBER |

MEM DEPOSIT |

INVESTMEMB |

Note:

Commission reversed in the Benefit Payments Process is offset. For more information refer to

Processes

Benefits (All Products)

Commission Claw Back and Refund of Future Premiums

When the BJU3BR_COMM Commission Billing batch job runs, only the Expense Rules linked to an Expense Type for which the Global Group Type is COMMISSION and the Frequency is not AD HOC, will be processed.

The system will read the Income Types associated to the Expense Rule.

If the Formula Applied To is INCOME TYPE and the Formula Type is PERCENTAGE and the Rate Table Type is equal to TERM, the system will:

Retrieve the Business Transactions in the Members’ Contribution account with transaction dates greater than or equal to the From Date and less or equal to the To Date of the Commission Billing Run. The duration of membership will be calculated to establish the percentage to be applied. The percentage will be multiplied with the transactions and the results will be totalled.

Member Level (optional)

If MEMBER LEVEL has been selected, the system will retrieve the BT’s in each Member’s CONTRIBUTION account with the latest Due Date less than or equal to the COMMISSION run Effective Date and sum the BT’s per Member and per Income Type. The system will:

- Sum all of the BT’s.

- Calculate each Member’s portion of the total commission amount plus VAT as follows per Income Type:

- Total Commission plus VAT x Member’s Contribution / Total Contributions for all Members

When the BJU3BR_COMM Commission Billing batch job runs, only the Expense Rules linked to an Expense Type for which the Global Group Type is COMMISSION and the Frequency is not AD HOC, will be processed.

If the Formula Type on the Expense Rule is MEM ANN FEE PER, the system will read the value for Annual Fee Percentage on the Member Values table for each Membership.

If the Formula Applied to is MARKET VALUE, the system will calculate the commission on the Market Value of the Member’s investments as at the effective date of the run based on the Unit Balance on the Member’s INVSTMEMUNIT account and the unit price as at the run effective date

If the Calculation Method is PROPORTION, the system will calculate the commission per Income Type and create the disinvestment transaction (MEMECOMMREAL BT’s) per Income Type and Portfolio.

If the Calculation Method is SEQUENTIAL, the system will create the MEMCOMMREAL BT’s with the Income Type linked to the Expense Rule and if there the value is insufficient then from the next Income Type linked, etc.

If the Formula Type on the Expense Rule is MEM ANN FEE PER and the Frequency on the Expense Rule is MONTHLY, the system will calculate the commission amount per Portfolio as follows:

Market Value x Annual Fee Percentage / 100 / 12

If the Formula Type on the Expense Rule is MEM ANN FEE PER and the Frequency on the Expense Rule is QUARTERLY, the system will calculate the commission amount per Portfolio as follows:

Market Value x Annual Fee Percentage / 100 / 4

If the Formula Type on the Expense Rule is MEM ANN FEE PER and the Frequency on the Expense Rule is BI-ANNUAL, the system will calculate the commission amount per Portfolio as follows:

Market Value x Annual Fee Percentage / 100 / 2

If the Formula Type on the Expense Rule linked is MEM ANN FEE PER and the Frequency on the Expense Rule is ANNUAL, the system will calculate the commission amount per Portfolio as follows:

Market Value x Annual Fee Percentage / 100

VAT on the commission amount will be calculated as follows:

If there is an Expense Type linked to the Scheme with a Global Group Type of EXPENSE TYPE and a Code of VAT, the system will read the VAT Number on the Corporate Client with a Type of INTERMEDIARY to which the Membership is linked and if found, will read the Percentage on Global Percentage where the Percentage Type is VAT.

The VAT amount will be calculated as follows:

Commission Amount X VAT Percentage / 100

No VAT will be calculated if a VAT Number is not found.

The system will create Member MEM COMM BT’s for the sum of the commission amount and MEMVATONCOMM BT’s for the VAT calculated per Member with the Expense Type of the Expense Type on which the VAT is calculated and will create MEMECOMMREAL BT’s for the sum of the commission amount per Portfolio and the VAT amount calculated per Portfolio with the relevant Contribution Income Type.

Separate BT’s will be created for the VAT.

The system will create the Scheme COMM VAT BT’s with the Expense Type of the Expense Type on which the VAT is calculated for the sum of all of the VAT amounts calculated.

The EXPENSE BILLING / DISINVESTMNT BT’s are created for the sum of the MEMCOMMREAL BT’s per Portfolio and therefore this will be taken care of automatically.

Example

Member’s Annual Fee Percentage: 0.50

Frequency: Monthly

Member’s Investment Market Value: Portfolio 1 400,000

Portfolio 2 600,000

Portfolio 3 800,000

Commission per Portfolio:

Portfolio 1 400.000 x 0.50 / 100 /12 = 166.67

Portfolio 2 600,000 x 0.50 / 100 /12 = 250.00

Portfolio 3 800,000 x 0.50 / 100 /12 = 333.33

Vat per Portfolio:

Portfolio 1 166.67 x 14.00 / 100 = 23.33

Portfolio 2 250.00 x 14.00 / 100 = 35.00

Portfolio 3 333.33 x 14.00 / 100 = 46.67

Business Transactions (BT’s):

Contribution Account:

Commission (MEM COMM) 750.00

VAT (MEMANNCOMVAT) 105.00

Investment Account:

Commission + VAT (MEMCOMMREAL) Portfolio 1 190.00

Commission + VAT (MEMCOMMREAL) Portfolio 2 285.00

Commission + VAT (MEMCOMMREAL) Portfolio 3 380.00