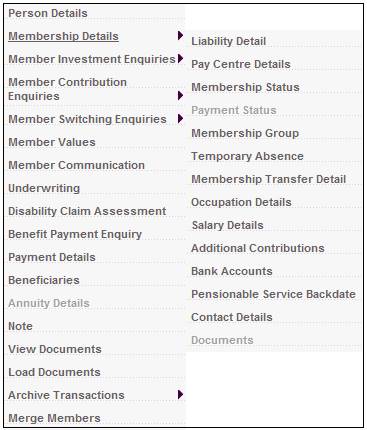

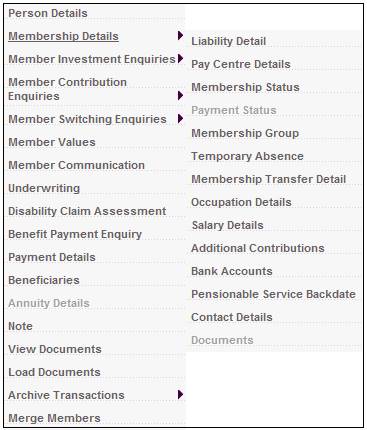

From the JU3AO List of Members for a Scheme/Pay Centre screen, highlight the required member, then select Membership Details>Membership Transfer Detail.

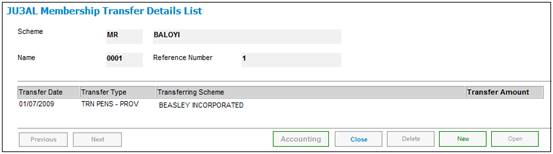

The JU3AL Membership Transfer Details List screen will be displayed.

To add a new membership transfer details record, click NEW. The JU3AL Membership Transfer Details screen will be displayed.

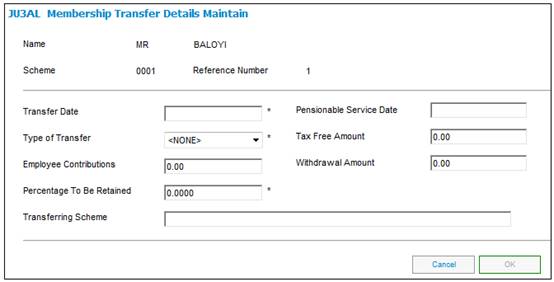

Capture data as follows:

|

Transfer Date |

The date on which the member transferred.

Completion of this field is mandatory. |

|

Pensionable Service Date |

The Start Date of Temporary Absence or Offshore Service, or Service Date for backdated service.

Completion of this field is mandatory. |

|

Type of Transfer |

Select a value from the Type of Transfer drop-down list. E.g. Transfer from Pension Fund to Provident Fund, Additional etc.

Completion of this field is mandatory. |

|

Tax Free Amount |

The portion of employee contributions that should not be taxed in future.

For transfers from a provident fund to a pension or provident fund, the member contributions not previously allowed as a tax deduction.

For transfers from a pension fund to a provident fund, the member contributions taxed on transfer.

For transfers from a public sector fund to a pension or provident fund, the full transfer value less the taxable portion (for the period after 1 March 1998, per GN21). |

|

Employee Contributions |

The amount of employee contributions transferred to a Provident Fund. |

|

Withdrawal Amount |

The portion of a withdrawal benefit that was paid where the balance was transferred to a preservation fund.

Used to determine if the member is entitled to a partial withdrawal prior to retirement age. Applicable only to preservation funds. |

|

Percentage To Be Retained |

The percentage of salary (to purchase service, if applicable), percentage of LTA.

Completion of this field is mandatory. |

|

Transferring Scheme |

The name of the ttransferring scheme.

Completion of this field is mandatory. |