Detail record

|

|

Field Name |

Field Size |

DEC |

ATTR |

O/M |

Start |

End |

Description /Value |

|

1 |

Mask code |

4 |

|

Char |

M |

1 |

4 |

BA01 |

|

2 |

Fund no. |

7 |

|

Char |

M |

5 |

11 |

Fund Code |

|

3 |

Income type code |

4 |

|

Char |

M |

12 |

15 |

Income Type Code |

|

4 |

Income type group |

15 |

|

Char |

M |

16 |

30 |

Income Group Type |

|

5 |

Membership group code |

15 |

|

Char |

M |

31 |

45 |

Mem. Grp Code |

|

6 |

Membership group type |

15 |

|

Char |

M |

46 |

60 |

Mem. Grp Type |

|

7 |

Inc. rule start dt |

8 |

|

Num |

M |

61 |

68 |

CCYYMMDD |

|

8 |

Income rule description |

50 |

|

Char |

M |

69 |

118 |

Inc. Rule Description |

|

9 |

Inc. rule end dt |

8 |

|

Num |

M |

119 |

126 |

CCYYMMDD |

|

10 |

Income rule max amount |

15 |

2 |

Num |

M |

127 |

141 |

Inc. Rule Max Amt |

|

11 |

Income rule min amount |

15 |

2 |

Num |

M |

142 |

156 |

Inc. Rule Min Amt |

|

12 |

Frequency |

15 |

|

Char |

M |

157 |

171 |

Frequency |

|

13 |

Formula type |

15 |

|

Char |

M |

172 |

186 |

Formula Type |

|

14 |

Salary basis |

15 |

|

Char |

M |

187 |

201 |

Salary Basis |

|

15 |

Type of scale |

15 |

|

Char |

M |

202 |

216 |

Type of Scale |

|

16 |

Contrib. amt |

15 |

2 |

Num |

M |

217 |

231 |

Contribution Amount |

|

17 |

Start salary |

15 |

2 |

Num |

M |

232 |

246 |

Start Salary |

|

18 |

End salary |

15 |

2 |

Num |

M |

247 |

261 |

End Salary |

|

19 |

Contrib type |

15 |

|

Char |

M |

262 |

276 |

Contribution Type |

|

20 |

Group alloc start date |

8 |

|

Num |

M |

277 |

284 |

CCYYMMDD |

|

21 |

Group alloc end date |

8 |

|

Num |

M |

285 |

292 |

CCYYMMDD |

|

22 |

Med aid code |

6 |

|

Char |

M |

293 |

298 |

Med Aid Code |

|

23 |

Med aid name |

150 |

|

Char |

M |

299 |

448 |

Med Aid Name |

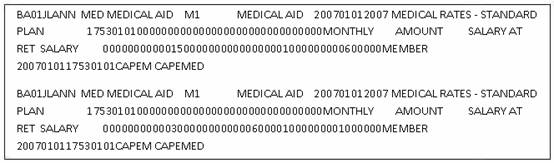

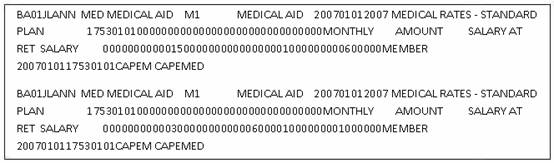

O = Optional field

M = Mandatory

Note:

All optional text fields must be padded with trailing spaces.

All numeric fields must be padded with leading zeroes.

When the Medical Aid Premium Rate file is created and an Employer Subsidy is applicable, the subsidy percentage will be included in the file as a row for each salary / annuity band with an Income Type Code of MERS and Income Type Group of SUBSIDY. It will not be added with the Contribution Type (MEMBER, ADULT DEPENDNT, ADD ADULT DEP or MINOR DEPENDNT) as the subsidy is a percentage of the total premium with a maximum that is applied to the percentage of the total premium.

If the Income Type Group is SUBSIDY a value for Contrib Type will not be mandatory.

When the file is loaded, an Expense Rule will be created for each Income Type with an Income Group Type of MEDICAL AID per Membership Group.

A Scale will be created per Contrib Type and per Salary/Annuity band.

If there is a value for an Income Type with an Income Type Group of SUBSIDY, an Income Rule per Membership Group and per Salary / Annuity band will be created.

If there is a value for MINIMUM AMOUNT or MAXIMUM AMOUNT the Minimum Amount or Maximum Amount fields will be updated respectively on the applicable Scale record.

For information on the processing of Medical Aid, refer to Processing medical aid when a new membership payment is created under

Processes

Annuities

Annuity Payments

Processing Medical Aid