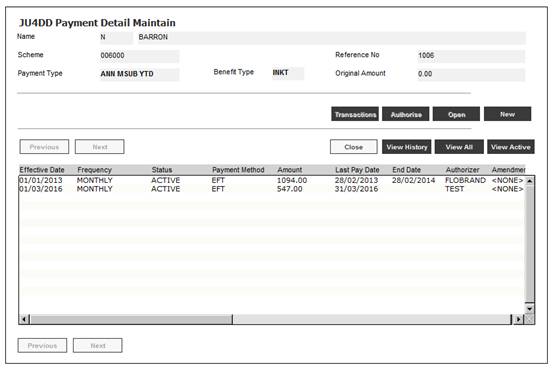

To maintain payment details, from the JU4DC Membership Payment Maintain screen, highlight the required payment, then select Payment Details from the sub-menu on the left.

For details of the capture and validation of JU4DC Membership Payment refer to:

Processes

Regular Payments

Annuitant Update Types

Annuitant Update Type: Annuity Amount

Add New Payment Details

The JU4DD Payment Detail Maintain screen will be displayed.

Select Create Payment Details from the sub-menu on the left.

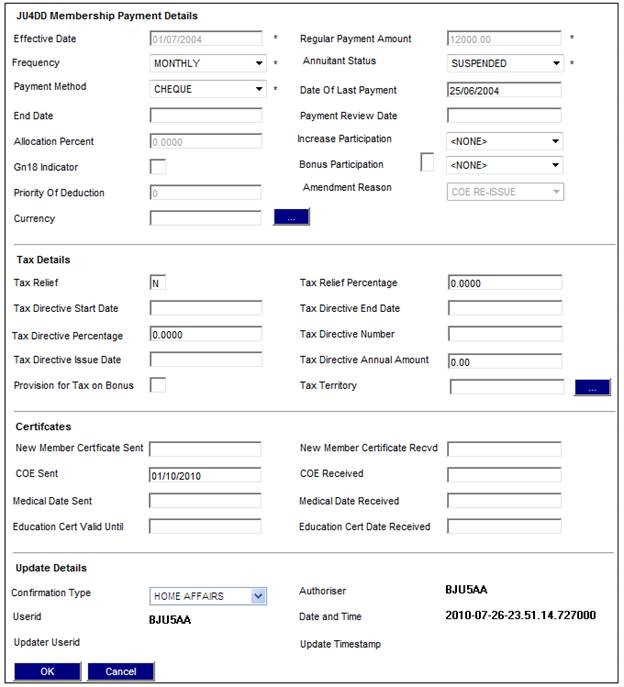

The JU4DD Membership Payment Details screen will be displayed.

Descriptions of the input fields appear below:

|

Effective Date |

The effective date on which a payment must be made. Note: This date will be the same as the START DATE only when the first payment takes place. Any subsequent updates to the detail record will be effective on EFFECTIVE DATE.

Mandatory |

||

|

Regular Payment Amount |

The amount of a payment to be made regularly, and the amount that must be taken into account for tax calculation purposes.

A negative amount can be captured here in cases where overpayments need to be offset against the following month’s deductions. Refer to the Recovering overpaid amounts section above.

Mandatory

Note: Where the benefit event category is RETIRAL, this field will display the monthly pension amount that is displayed on the Defined Benefit Retirement Calculation screen, and cannot be updated here. Refer to Processes Benefits Benefit Payment Update Type Benefit Payment Update Types (Standard Benefit Rules) Benefit Payment Update Types (Flexible Benefit Rules)

|

||

|

Frequency |

The frequency with which the regular payment must be made. Click on the drop-down box and select a frequency from the list: - ANNUALLY - BI-ANNUAL - MONTHLY - ONCE OFF - QUARTERLY

Mandatory – Defaults to MONTHLY |

||

|

Annuitant Status |

Indicates whether the member is already an annuitant, has died, or that this status is still pending. Click on the drop-down box and select a status from the list: - ACTIVE (already an annuitant) - CANCELLED (used e.g. for payments that have been added in error, or the information on the payment is incorrect and cannot be altered. The system will ignore these payments irrespective of whether the payment has been authorised or not). - SUSPENDED (see AMENDMENT REASON below) - ENDED Note: Do not use CLOSED or CANCELLED, as the View Active button does not display it on the Membership Payment Maintain screen. The End Date should rather be used.

When the Home Affairs file is uploaded, the batch job will update the Annuitant Status to ENDED on the latest or last active record.

Mandatory – Defaults to ACTIVE

Note: If the ANNUITANT STATUS field is changed from ACTIVE to SUSPENDED, the AMENDMENT REASON drop-down box will be enabled for selection. An amendment reason and an effective date must both be provided as input. If the ANNUITANT STATUS is unsuspended, i.e. changed from SUSPENDED to another status, a new record showing the last payment date is automatically inserted. If the effective date is greater than the COE SENT DATE plus the GRACE PERIOD FOR RETURN OF CERTIFICATE OF EXISTENCE the ANNUITANT STATUS field will automatically be set to SUSPENDED. Refer to Processes Regular Payments Annuitant Update Types Examples of Payment Run Results

For more information on the accounting activities generated by the payment run, refer to Supplements Accounting Activities Generated by the Payment Run

If the annuitant is a dependant, and becomes older than the dependant age limit at the time of the annuity payment run, ANNUITANT STATUS field will automatically be set to SUSPENDED. Accounting transactions Note: Transactions are accrued for the suspended records in order that the fund is aware of the liability. The accounting transactions for accrued pensions can be viewed under the accounting enquiry facility, using the following retrieval rules: Process Code

ENQUIRY SUSPPENPAYBL

ENQUIRY MSUSPPENPBL

Refer to Accounting Enquiries Business Transactions |

||

|

Payment Method |

The method by which payment must be made to the member. Click on the drop-down box and select a payment method from the list, e.g. - BANK TRANSFER - CHEQUE - EFT - FOREIGN DRAFT

Mandatory

Note: BANK TRANSFER and EFT have the same end result in that payment is made to individual annuitants. However, in the ledger bank account, BANK TRANSFER will reflect the total paid as one amount, whereas EFT will create individual transactions at a fund level. The default value is BANK TRANSFER.

If a scheme parameter of PAYMENT METHOD exists and the description is BANK TRANSFER, the annuity payment method will be set to BANK TRANSFER. Note: If the member's payment is to be included in the total to be paid to a foreign bank and then the individual payment to be made by the bank, the payment method must be FOREIGNBANKTRFR. If the member's payment is to be made directly to a foreign bank account, the payment method must be FOREIGN DRAFT. Refer to Foreign Draft below. |

||

|

Date of Last Payment |

The date on which an annuitant was last paid (where the status of the annuitant is SUSPENDED). |

||

|

End Date |

The date on which an annuity will end. Note: If a suspended annuity for which annuities have been accrued is found to be deceased or untraceable, an end date must be captured, and a manually initiated accounting transaction must be processed to reverse the accrued payments. |

||

|

Payment Review Date |

The date on which a LIVING ANNUITY will be reviewed for increase purposes. This may also be for cases where the member wishes to change the amount that he wants paid to himself. An e-mail is sent to the team administrator of the fund one month prior to this date. |

||

|

Allocation Percent |

The percentage of the annuity allocated to a beneficiary. |

||

|

Increase Participation |

Indicates what the increase must be based on when increases are allocated by the system. Select a value from the drop-down list: - ANN ESCALATION - CPI PLUS PERC - CPI TIMES PERC - SCHEDULED

Note: Defaults to <NONE> which effectively means that the annuity does not participate in increases. A warning message will be displayed if nothing has been selected. |

||

|

GN18 Indicator |

In cases where the member purchases the annuity from an underwriter, this indicates whether or not the annuity must be in the name of the member (if not in the name of the member, it will be in the name of the scheme). Capture as follows: - Y = annuity purchased by the member - N = annuity not purchased by the member Per General Note 18 issued by SARS. |

||

|

Bonus Participation |

Select a value for the type of bonus participation from the drop-down list if a member is eligible for a bonus on his/her annuity, when bonuses are allocated by the system. The following values may be selected: - 13th CHEQUE - INDIVIDUAL - NO BONUS - SCHEDULED

Note: Defaults to <NONE> which effectively means that the annuity does not participate in increases. A warning message will be displayed if nothing has been selected.

Note: If a value has been captured on the JU4DC Payment Details screen for either Bonus Amount or Bonus Percentage, the system will default the value for Bonus Participation to INDIVIDUAL on the JU4DD Membership Payment Details screen.

Note: The system allows for bonuses to be payable to both monthly and non-monthly annuitants. |

||

|

Priority of Deduction |

Enter a number to denote the priority that must be placed on this payment. This is to set the order of any deductions against the annuity, especially for cases where there are insufficient funds available. Note: The lowest number indicates the highest priority. |

||

|

Amendment Reason |

When the annuitant status is SUSPENDED, this field will be enabled and is mandatory. Select a reason from the drop-down box and provide an effective date. The following are some of the values that can be selected: - DECEASED - ADJUSTMENT - CLOSED - PRORATA - REVERSAL - NONE - BONUS - FRAUD - MIN PENSION (minimum pension) - OUTSTANDING COE (certificate of existence) - OUTSTANDING COED (certificate of education) - OVERPAYMENT - SALARY INCREASE - UNCASHED CHEQUE - ADHOC (used for once off payments - no end date is required, as the system will end date the payment once it is paid). It can be used in cases where an amount for overpaid deductions or annuities must be recovered. Refer to the Recovering overpaid amount section above. Adhoc can also be done if the pensioner was not paid his first months pension due to a delay. Note: If the annuitant status is SUSPENDED and no amendment reason is selected, the following error message will be displayed:

|

||

|

Currency |

The currency in which payment is made.

Note: This is only required if the annuitant is paid by Foreign Draft in a currency other than the currency of the Scheme. An error message will be displayed if a Currency is not selected where the Payment Method is Foreign Draft. |

||

|

Tax Details Refer to Example below for an example of a tax calculation |

|

||

|

Tax Relief |

Indicates whether or not this member is eligible for tax relief. Capture a Y or an N. |

||

|

Tax Relief Percentage |

The percentage allowed for tax deduction by the tax authority. If no percentage is coded, the tax rates per country will be applied. |

||

|

Tax Directive Start Date |

The start date of a tax rate percentage, for which a tax directive has been received. |

||

|

Tax Directive End Date |

The end date of a tax rate percentage, for which a tax directive has been received. |

||

|

Tax Directive Percentage |

The tax rate percentage for a pension payment that a member or beneficiary has applied for, and for which a tax directive has been received. Note: This field will only be enabled if no value has been captured for Tax Directive Annual Amount. |

||

|

Tax Directive Number |

The number identifying a Tax Directive. |

||

|

Tax Directive Issue Date |

The date on which a Tax Directive was issued. |

||

|

Provision for Tax on Bonus |

Indicates whether or not provision is made for advance deduction of tax in respect of bonus in a number of months prior to the actual payment of bonus, so as to give the effect of a bonus that is apparently free of tax. |

||

|

Tax Directive Annual Amount |

The tax directive annual amount for a pension payment that a member or beneficiary has applied for, and for which a tax directive has been received. Note: This field will only be enabled if no value has been captured for Tax Directive Percentage. |

||

|

Tax Territory |

A territory bound by a common set of tax laws. Select a value from the drop-down box. |

||

|

Certificates |

For more information on this section, refer to Supplements Processes Managing Child Pensions |

||

|

New Member Certificate Sent |

The date on which a new member certificate was sent. |

||

|

New Member Certificate Recvd |

The date on which a new member certificate was received. |

||

|

COE Sent |

The date on which a request for a certificate of existence (COE) for the member was sent. |

||

|

COE Received |

The date on which a request for a certificate of existence (COE) for the member was received. |

||

|

Medical Date Sent |

The date on which a request for medical evidence of health for the member was sent. |

||

|

Medical Date Received |

The date on which a request for medical evidence of health for the member was received. |

||

|

Education Cert Valid Until |

The date until which the certificate of education is valid.

Note: This date is used to determine if the member is within three months of the expiry of the certificate and will be suspended if a new certificate for the next period of enrolment is not received. |

||

|

Education Cert Date Received |

The date on which the certificate of education was received. |

||

|

Update Details |

|

||

|

Confirmation Type |

Indicates the method used to confirm the ID type, e.g. HOME AFFAIRS. Select the relevant value from the drop-down box. The following values may be selected: CERTIFICATE H/A DO NOT SUSP HOME AFFAIRS NO ID/NO ADDRES

Mandatory |

||

|

Userid |

The Userid of the person who created these payment details. This field is not updateable and is updated by the system. |

||

|

Authoriser |

The Userid of the person who authorised these payment details. This field is not updateable and is updated by the system. |

||

|

Date and Time |

The system date and time stamp of when the payment was authorised. |

||

|

Updater Userid |

The User Id of the last user to update the membership payment details.

If no subsequent updates have been made, this field will be blank. |

||

|

Update Timestamp |

The timestamp of the last update made to the membership payment details.

If no subsequent updates have been made, this field will be blank. |

||

Example:

Monthly pension R5000.00

Medical aid deduction R50.00 (tax-free)

Tax scale 10% of the first R25000

10% of the next R30000

15% above R55000

In the above example, the annual pension will be

R59400.00 (R5000.00 – R50.00) x 12

The tax calculation will be

10% of R25000 R2500.00

10% of R30000 R3000.00

15% of R4400 R660.00

Annual tax R6160.00

Monthly tax R513.33

Note:

The values coded for EFFECTIVE DATE, ANNUITANT STATUS, DATE OF LAST PAYMENT and END DATE will determine the results of the annuity payment run for each annuitant. For some examples of what will happen, refer to Examples of Payment Run Results.

Refer to

Supplements

Calculation of Monthly PAYE for Annuities

For more information, refer to Annuity Increase History under

Reports

Annuity

Foreign Draft

When the annuity payment run is processed, if the payment method is FOREIGN DRAFT and the base currency on the membership payment detail record is not equal to the currency for the scheme to which the membership is linked,

- The system will calculate the scheme currency value of the base currency amount.

- If the base currency on the membership payment detail record is null or equal to the scheme currency, the base currency amount will be set to be equal to the regular payment amount.

- The system will calculate the foreign currency amount to be paid.

- Details will be included on the Foreign Draft Schedule.

Refer to

Processes

Regular Payments

Schedules

Foreign Draft Schedule

The system will create the necessary accounting activities.

Refer to Annuities under

Supplements

Annuity Accounting Rules

Click OK.

When OK is selected on the JU4DD Membership Payment Details screen for a new record linked to a Membership Payment record for which the Payment Type is ANNUITY and a value has not been captured in any of the fields in the table below, the system will display the warning message as per the details in the Message column in the table below with Yes and No buttons:

|

Field |

Message |

|

Increase Participation |

A value for Increase Participation has not been selected. Are you sure you want to create this record without it? |

|

Bonus Participation |

A value for Bonus Participation has not been selected. Are you sure you want to create this record without it? |

|

Currency |

If the. Payment Method selected is FOREIGN DRAFT and a value for Currency is not selected, the following error message will be displayed with an OK button:

The Payment Method is Foreign Draft and therefore a currency must be selected.

When the OK button is selected, the system will flow back to the JU4DD Membership Payment Details screen. |

If the Yes button is selected the record will be created.

If the No button is selected, the system will flow back to the JU4DD Membership Payment Details screen.

Note:

These validations are in addition to the existing validations and do not replace the existing validations.

When values on the JU4DD Membership Payment Detail screen are updated, the system will create a history record with all of the details on the Membership Payment Detail record after the update of the changes and with the Date and Timestamp the record is created and with the User ID of the user that created updated the record.

For information on the processing of Medical Aid, refer to Processing medical aid when a new membership payment is created under

Processes

Regular Payments

Annuity Payments

Processing Medical Aid