This facility provides for the receipting of deposits for multiple sub-funds (Participating Employers) within an Umbrella Fund and the processing of a single payment at the Main Fund level for multiple Sub-Funds.

Examples of payments made at the Main Fund level for a number of Sub-Funds are:

- Investment fees paid to Brokers

- PAYE payments to SARS

- Investments where the funds are invested at the Main Product level

Note:

For details of the splitting of a single deposit or payment amount into multiple debit or credit allocations for non-Umbrella Funds refer to Allocations above.

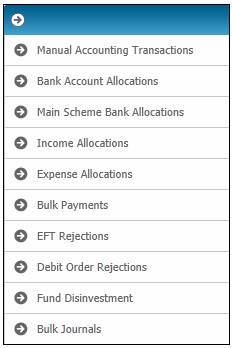

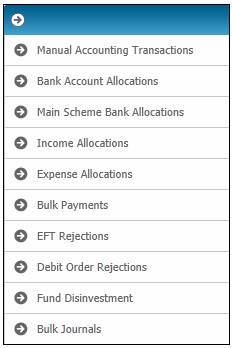

From the main menu on top, select Transaction Capture. A sub-menu will be displayed on the left.

Select Main Scheme Bank Allocations.

The JU2FA Manual Accounting Journal screen will be displayed.

This screen displays a list of the Accounting Activity Journals for which the Accounting Activity is one of the following:

|

M/FDEPALLOC |

Main fund deposit allocation |

|

M/FDEPALLOCR |

Main fund deposit allocation reversal |

|

M/FPMTALLOC |

Main fund payment allocation |

|

M/FPMTALLOCR |

Main fund payment allocation reversal |

Select Create Accounting Journal from the sub-menu on the left.

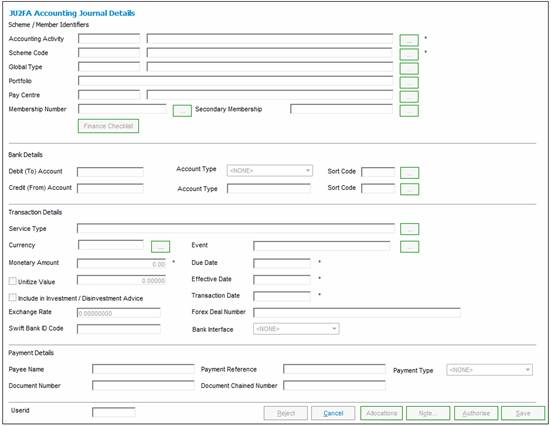

The JU2FA Accounting Journal Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Scheme / Member Identifiers |

|

|

Accounting Activity |

The code and process associated to the selected accounting activity. Click the LIST button at the end of the line. This links to the JU2AF Accounting Activity List screen and displays a list of accounting activities with a process of MANUAL INITIATE.

Select from the following Accounting Activities: MANUAL INITIATE M/FPMNTALLOC MAUNAL INITIATE M/FPMTALLOCR MAUNAL INITIATE M/FDEPALLOC MANUAL INITIATE M/FDEPALLOCR

Once a selection has been made, click SELECT. |

|

Scheme Code |

The code and name of the selected scheme. This is the name by which the scheme is registered with the Financial Services Board. Click the LIST button at the end of the line. This links to the JU1BK List screen and displays a list of schemes for which the Pooling Status is MAIN UMBRELLA, from which to select.

Once a selection has been made, click SELECT. |

|

Global Type |

The code and description of the selected global type. Click the LIST button at the end of the line. This links to the Scheme Global Type List screen and displays a list of income types to select from. Once a selection has been made, click SELECT. If the selected income type is not active, a warning message will be displayed. Note: The system determines via the accounting rule for the accounting activity selected whether the income type is mandatory or optional. |

|

Portfolio |

The description of the selected portfolio. Click the LIST button at the end of the line. This links to the JU1BV Scheme Portfolio List screen and displays a list of investment mediums to select from. Once a selection has been made, click SELECT. If the selected portfolio is not active, a warning message will be displayed. Note: The system determines via the accounting rule for the accounting activity selected whether the portfolio is mandatory or optional. |

|

Pay Centre |

The code and description of the selected pay centre. A pay centre is the entity from which income is received for a group of members. The code will have been defined by the user at the time of setting up the pay centre. Click the LIST button at the end of the line. This links to the JU1DL Scheme Pay Centre List screen and displays a list of pay centres to select from. Once a selection has been made, click SELECT. Note: The system determines via the accounting rule for the accounting activity selected whether the pay centre is mandatory or optional. |

|

Membership Number

|

The number identifies a person's membership of the product. Membership numbers are unique per product. Required if the transaction is for a specific member. Click the LIST button at the end of the line. This links to the JU3AO List of Members for a Scheme/Pay Centre screen and displays a list of members to select from. Once a selection has been made, click SELECT.

Note: If a selection is made for the Secondary Membership field (see below), the system will populate the Membership Number field with the Reference Number of the Membership to which the Secondary Membership is linked. |

|

Secondary Membership |

The number identifying an annuity beneficiary. Click the LIST button at the end of the line. This links to the JU4EU Annuity Beneficiaries screen and displays a list of all of the Natural Person records for which there is a Client Relationship with a Client Relationship Type of SPOUSE, DEPENDANT, DISABLED DEPENDNT or FIN DEPENDANT linked to a Membership that is linked to the Product selected. Once a selection has been made, click SELECT.

Note: When a Secondary Membership is selected, the system will populate the Membership Number field with the Reference Number of the Membership to which the Secondary Membership is linked.

For more information refer to Secondary Membership below. |

|

Finance Checklist |

Click the FINANCE CHECKLIST action button to display the Checklist.

Note: This action button will only be enabled when a Service Request for a Process of Finance is selected in My Work. For more information refer to My Work Process SR Finance

Supplements Tags Finance Checklist Income Checklist |

|

Bank Details |

|

|

Debit (To) Account |

For bank deposits – the account into which the money is deposited. For EFT payments – the account into which the money is to be transferred. Note: The system determines via the accounting rule for the accounting activity selected whether the debit account is mandatory or optional.

If no EFT Rule is found for the global type, the following error message will be displayed: EFT Rule for Global Type not found. |

|

Account Type |

The type of bank account. Valid bank account types are Current, Savings, Transmission. |

|

Sort Code |

If the bank account details are not supplied according to the bank account rule linked to the accounting activity, click the LIST button at the end of the line. This links to the JU1CC Product Bank Account List screen and displays a list of account holders to select from. Once a selection has been made, click SELECT. If the selected bank account is not active, a warning message will be displayed. Once selected, the account type and number will automatically populate the relevant fields above. |

|

Credit (From) Account |

For cheque payments and EFT’s – the account out of which the money is to be paid. For bank debits, e.g. bank charges, transaction reversals, etc. – the account to be credited.

Note: If no global type has been selected, the following error message will be displayed:

A Global Type must be selected.

Note: If the Credit Account in the Accounting Rule linked to the Accounting Activity selected is BANK, the Credit (From) Account under Bank Details will be enabled for selection from the list of Product Bank Accounts.

If the Bank Account selected is not the same as the Credit (From) Bank Account defined in the EFT Rule linked to the Accounting Activity and Product selected, the following warning message will be displayed:

The from bank account you have selected is not the same as the bank account in the bank account rule.

Click OK to remove the message. |

|

Account Type |

Unique identifier supplied by the bank. |

|

Sort Code |

If the bank account details are not supplied according to the bank account rule linked to the accounting activity, click the LIST button at the end of the line. This links to the JU1CC Product Bank Account List screen and displays a list of account holders to select from. Once a selection has been made, click SELECT. If the selected bank account is not active, a warning message will be displayed. Once selected, the account type and number will automatically populate the relevant fields above. Note: If the TRANSFER MONEY indicator on the accounting activity is set to Y, the bank account selected in the EFT rule will be inserted and cannot be changed. If the EFT indicator on the accounting activity is set to Y, the LIST button remains disabled. |

|

Transaction Details |

|

|

Service Type |

The description of the service for which a transaction fee is charged. Click the LIST button at the end of the line. This links to the JU1CX Scheme Services List screen and displays a list of services to select from. Once a selection has been made, click SELECT. If the selected service type is not active, a warning message will be displayed. |

|

Currency |

Identifies the currency in which the business transaction (BT) must be created.

Click the LIST button at the end of the line. This links to the JU0AC Permitted Value List screen and displays a list of currencies to select from. Once a selection has been made, click SELECT. |

|

Event |

The benefit event to which the transaction refers (e.g. late retirement). Click the LIST button at the end of the line. This links to the BIAB Benefit Event List screen and displays a list of events to select from. Once a selection has been made, click SELECT. |

|

Monetary Amount |

The total of the business transaction. |

|

Due Date |

The date on which the transaction should have occurred. |

|

Unitize Value |

The unit amount of the business transaction, i.e. when the UNITIZE VALUE flag is set for one of the BT’s connected to the activity via the rules. To select this, click on the tick-box. This will enable the capture of a value in the field alongside it. |

|

Include in Investment / Disinvestment Advice |

Tick this box if the transaction must be included in an investment or disinvestment advice. Note: This selection will be displayed only if one of the accounts in the accounting rule associated to the selected accounting activity is INVESTTRANST or DISINVTRANST, and the stakeholder is FUND. |

|

Effective Date |

The date on which the financial implication of the transaction was expected or required to take effect. |

|

Transaction Date |

The date on which the business event occurred (e.g. date of deposit). |

|

Exchange Rate |

The specific deal exchange rate supplied by the foreign exchange department. Note: The specific deal exchange rate is requested from the foreign exchange department and must not be looked up on the exchange rate table. |

|

Forex Deal Number |

The deal number that was booked to obtain a rate of exchange. Note: If the payment is over GBP 25,000, a deal has to be booked two days in advance of the value date to receive the best rate of exchange. |

|

Swift Bank ID Code |

Society for Worldwide Interbank Financial Telecommunication Bank Identifier Code. |

|

Bank Interface |

A Bank Interface to enable the electronic transfer of funds between bank accounts. Select a value from the drop-down box. The drop down box displays a list of the different types of services available, i.e. Barclays Kenya, Barclays Zambia, Cashfocus, Nedinform, ACB, LDC, CPY, FNB Online, BIB, etc.

Note: When the BTs are extracted for the EFT, the system will read the Process and the Bank Interface fields defined for the Bank Account on the Account Details screen. If nothing has been defined, the system will read the Bank Interface on the JU1CC Product Bank Account Detail screen. |

|

Payment Details |

|

|

Payee Name |

The name of the person or organisation appearing on the cheque. This is mandatory if PAYMENT TYPE is selected. |

|

Payment Reference |

The Payment Reference that must appear on the recipient’s Bank Statement when payments are made via EFT. |

|

Payment Type |

Indicates the mode of payment out of the product’s account (e.g. cheque, EFT, group payment). Select from the drop-down list. If EFT is selected, the document number field will be cleared and disabled. |

|

Document Number |

A number referencing a source document that provides the base information for the business transaction. Note: This is not available if PAYMENT TYPE of EFT is selected, as this is then used to store the EFT number when the EFT is processed. The EFT number is automatically generated. |

|

Document Chained Number |

This field can contain a number referencing a source document that provides the base information for a previous business transaction to which this one is linked. This is a unique number that applies to all occurrences of one allocation in order to tie them all together. |

|

Userid |

The system user ID of the person who captured the manual accounting activity. If the Accounting Activity Journal has subsequently been edited, then the userid of the person making the change(s) will be stored. |

Secondary Membership

When the LIST button is selected for the Secondary Membership field, the system will display the JU4EU Annuity Beneficiaries screen.

This screen displays a list of all of the Natural Person records for which there is a Client Relationship with a Client Relationship Type of SPOUSE, DEPENDANT, DISABLED DEPENDNT or FIN DEPENDANT linked to a Membership that is linked to the Product selected.

The Status field displays the following values:

- ANNUITANT

- SPOUSE

- DEPENDANT

- DISABLED DEPENDNT

- FIN DEPENDANT

When a Secondary Membership is selected, the system will populate the Membership Number field with the Reference Number of the Membership to which the Secondary Membership is linked.

If the Payment Method selected is EFT or BANK TRANSFER, the system will read the Client DTI Account record linked to the Person selected for the Secondary Membership and populate the values below with the details of the DTI Account found:

- Account Type (Bank Account Type)

- Account Number (DTI Account Number)

- Branch Code (DTI Branch Code)

When SAVE is selected, the Business Transaction will be created with the Ben Client Instance ID equal to the Instance ID of the Secondary Membership selected.

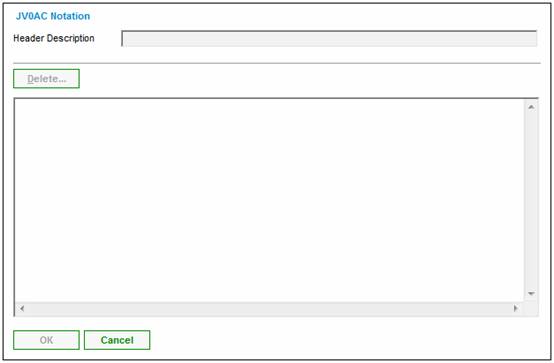

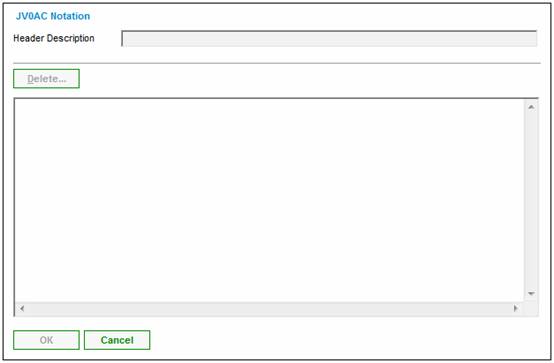

Notation

You can attach comments to the accounting activity journal. Click NOTE. The JV0AC Notation screen will be displayed.

Enter the relevant text details, then click OK.

For further information regarding the Notes facility, refer to Notes under

Product Launch Requirements

Additional Menu Options

If the Money Movement Indicator on the Accounting Activity selected is Y and the Payment Method selected is EFT, the system will read the value for Description on the Global Parameter with a Parameter Type of EFT CUT-OFF.

If the current time is greater than the value found and the Transaction Date is equal to current date, the following message will be displayed:

It is after the cut-off time for EFT payments. The transaction date will be set to the next working day

When the OK button is selected on the message, the Pre-authorised Business Transaction will be created with the Transaction Date and Effective Date equal to the next working day.

If the next working day is a Saturday, the Transaction Date will be set to the next working day after the Saturday.

If the Transaction Date is less than the current date, the following error message will be displayed:

The transaction date must be equal to current date or greater than current date.

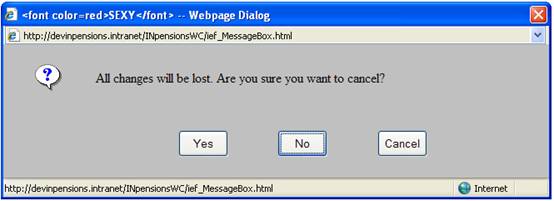

To cancel the creation of the accounting journal, click CANCEL. A confirmation message will be displayed

Click YES to confirm that the Accounting Activity Journal must be cancelled, or click NO or CANCEL to remain on the JU2BK Accounting Journal Details screen.

Once all the required information has been completed, click SAVE.

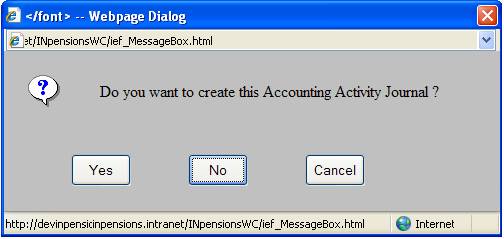

A confirmation message will be displayed

Click YES to confirm that the Accounting Activity Journal must be created, or click NO or CANCEL to cancel the creation and remain on the JU2BK Accounting Journal Details screen.

Click ALLOCATIONS on the JU2FA Accounting Journal Details screen. The JU2FA Accounting Activity Journal – Allocation List screen will be displayed.

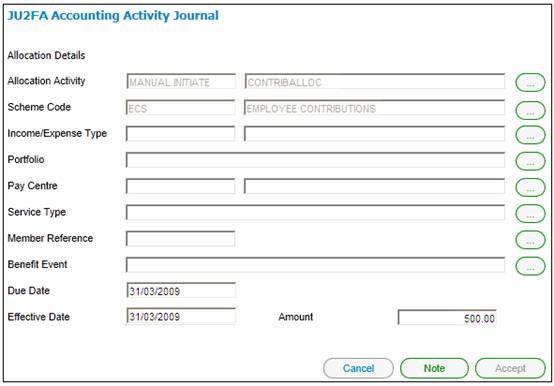

Click NEW. The JU2FA Accounting Activity Journal screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Allocation Activity |

The code associated to the selected allocation activity. Click the LIST button at the end of the line. This links to the JU2AF Accounting Activity List screen and displays a list of accounting activities for which the Debit Account or the Credit Account in the BT Type linked to the Accounting Activity is BANK ALLOC. Once a selection has been made, click SELECT. |

|

Scheme Code |

Click the LIST button at the end of the line. A list of Products for which the Pooling Status is SUB UMBRELLA that are linked to the Main Product selected on the JU2FA Accounting Journal Details screen will be displayed. Once a selection has been made, click SELECT. |

|

Income / Expense Type |

The code and description of the selected income type. Click the LIST button at the end of the line. This links to the Scheme Global Type List screen and displays a list of income types to select from. Once a selection has been made, click SELECT. If the selected income / expense type is not active, a warning message will be displayed. Note: The system determines via the accounting rule for the accounting activity selected whether the income type is mandatory or optional. |

|

Portfolio Description |

The description of the selected portfolio. Click the LIST button at the end of the line. This links to the JU1BV Scheme Portfolio List screen and displays a list of investment mediums to select from. Once a selection has been made, click SELECT. If the selected portfolio is not active, a warning message will be displayed. Note: The system determines via the accounting rule for the accounting activity selected whether the portfolio is mandatory or optional. |

|

Pay Centre |

The code and description of the selected pay centre. A pay centre is the entity from which income is received for a group of members. The code will have been defined by the user at the time of setting up the pay centre. Click the LIST button at the end of the line. This links to the JU1DL Scheme Pay Centre List screen and displays a list of pay centres to select from. Once a selection has been made, click SELECT. Note: The system determines via the accounting rule for the accounting activity selected whether the pay centre is mandatory or optional. |

|

Service Type |

The description of the service for which a transaction fee is charged. Click the LIST button at the end of the line. This links to the JU1CX Scheme Services List screen and displays a list of services to select from. Once a selection has been made, click SELECT. If the selected service type is not active, a warning message will be displayed. |

|

Member Reference Number |

The number identifies a person's membership of the product. Membership numbers are unique per product. Required if the transaction is for a specific member. Click the LIST button at the end of the line. This links to the JU3AO List of Members for a Scheme/Pay Centre screen and displays a list of members to select from. Once a selection has been made, click SELECT. |

|

Benefit Event |

The benefit event linked to the benefit package (e.g. late retirement). Click the LIST button at the end of the line. This links to the BIAB Benefit Event List screen and displays a list of events to select from. Once a selection has been made, click SELECT. |

|

Due Date |

The date on which the transaction should have occurred. Note: This date defaults to the due date captured on the JU2BK Accounting Activity Journal screen, but it can be changed here if necessary. |

|

Effective Date |

The date on which the financial implication of the transaction was expected or required to take effect. Note: This date defaults to the effective date captured on the JU2BK Accounting Activity Journal screen, but it can be changed here if necessary. |

|

Amount |

The amount to be allocated in terms of the details provided on this screen. |

You can attach comments to the allocation details. Click NOTE. The JV0AC Notation screen will be displayed.

Enter the relevant text details, then click OK.

For further information regarding the notes facility, refer to Notes under

Product Launch Requirements

Additional Menu Options

Once all the required information has been completed, click ACCEPT.

The JU2FA Accounting Activity Journal - Allocation List screen will be displayed.

Details of each amount allocated per Sub-Fund will be displayed on the screen. This information is updated as each allocation is made. Continue the process until all allocations have been completed (i.e. the UNALLOCATED AMOUNT field will be 0.00 and the RUNNING TOTAL field will show the total amount to be allocated.