Interest is calculated on contributions received after the prescribed date, and employers are billed in terms of section 13A of the Pensions Funds Act.

Interest on the amount of late contributions, or on the interest on late contributions, is calculated when the relevant contributions are received (i.e. if contributions were paid within the legislated cut-off time, but were not paid in full, then interest will be calculated on the outstanding amount once it is received).

The interest calculation is part of the nightly batch schedule. Once the run has taken place, late interest details are available for viewing and authorizing.

In order for the accounting transactions to be created, the following accounting activities and rules must exist:

|

INCOME |

LATECONTBINT |

Interest on late paid contributions |

|

INCOME |

LATEINTINT |

Interest on interest on late paid contributions |

|

INCOME |

LATECONTINT |

Retrieval from LATECONTBINT account |

|

MANUAL INITIATE |

INTRESTALLOC |

Deposit allocation for late contribution interest received together with contributions |

|

MANUAL INITIATE |

DEPOSITINT |

Single deposit of late contribution interest received |

For more information, refer to:

Supplements

Processes

Running Section 13A Interest

The Late Contributions section in:

Processes

Contributions

Income

From the Late Contributions menu, select Late Interest from the sub-menu on the left.

The Late Interest Detail screen will be displayed.

Capture the following details:

|

Scheme |

Select a scheme from the drop-down box. Note: The selection of a scheme is mandatory. |

|

Pay Centre |

Capture the pay centre code. Details for all members of the specified pay centre will be displayed. Note: The selection of pay centre is optional. |

|

Income Type |

Capture the scheme income type. Details for the selected pay centre and/or members, and with the specified income type, will be displayed. Note: The selection of income type is optional. |

|

Member Reference No |

Capture the reference number of a member. Details for the specified member will be displayed. Note: The selection of a member reference number is optional. |

|

From Date |

The date from which the specified data must be extracted. Note: This date is mandatory. |

|

To Date |

The date up to which the specified data must be extracted. Note: This date is mandatory. |

Click SEARCH. The Late Interest Detail screen will be displayed.

The following columns are displayed:

- Pay centre

- Reference number

- Membership group

- Due date

- Income type

- Date received

- Amount received

- Interest due

- Interest amount

- Interest type

- Status

- User ID

Click SUMMARY at the bottom of the Late Interest Detail screen. The Authorise Provisional Late Interest screen will be displayed.

Note:

This screen can also be accessed by selecting Auth Provisional Late Int from the menu on the left.

This screen displays interest transactions for which the status is PROVISIONAL, and summarizes the detail shown on the previous screen, by pay centre, due date and scheme income type. The following columns are displayed:

- Pay centre

- Income type

- Due period

- Amount received

- Late contribution interest

- Late interest interest

- Total interest

To return to the Late Interest Detail screen, click DETAIL.

To authorize the late interest, click AUTHORISE PROVISIONAL.

Note:

The person who provisionally authorises the interest may not be the same as the person that finally authorises the transactions.

A confirmation message will be displayed.

Are you sure you want to Authorise this selection?

Click OK. The Authorise Provisional Late Interest screen will be re-displayed, and a message will confirm that the update has been successful.

The status will be set to PRE AUTH (i.e. ready for authorisation), and the data will no longer be displayed under Auth Provisional Late Int.

From the Late Contribution menu, select Auth Late Int from the sub-menu on the left.

The Authorise Late Interest Transactions screen will be displayed.

For information on capturing details on this screen, refer to View late interest details above.

Once the necessary details have been captured, click SEARCH. The Authorise Late Interest Transactions screen will be displayed.

This screen displays a list of all records that are ready for authorisation (i.e. where the status is PRE AUTH).

The following columns are displayed:

- Pay centre

- Process

- Accounting activity

- Due date

- Effective date

- Transaction date

- Amount

- Income type

To reject all transactions generated in the late contributions interest batch run for the selection, tick the box alongside Paycentre on the relevant line, then click REJECT. A confirmation message will be displayed.

Are you sure you want to Reject the selected transactions?

Click OK to confirm the rejection. The PRE AUTH transactions will be rejected, and the status of the interest detail records will return to PROVISIONAL, and the data will no longer be displayed under Auth Late Int.

To authorize the late interest transactions, tick the box alongside Paycentre on the relevant line, then click AUTHORISE.

Note:

The person who provisionally authorises the interest may not be the same as the person that finally authorises the transactions. If they are the same, the following message will be displayed:

The Authoriser userid may not be the same as the Doer userid (doer userid).

If the authoriser is different, the following confirmation message will be displayed.

Are you sure you want to Authorise the selected transactions?

Click OK to confirm. On successful completion, the status will be set to AUTHORISED.

Note:

Multiple lines can be rejected or submitted simultaneously, by ticking the relevant boxes.

When the Authorise button is selected, the Status of all of the records for which the checkbox is ticked will be changed to AUTHORISED and the following accounting transactions will be created:

|

Interest Type |

Accounting Activity |

|

LATE CONTRB – Interest on contributions paid late |

INCOME / LATECONTBINT |

|

LATE INT – Interest on interest paid late |

INCOME / LATEINTINT |

The LATECONTBINT accounting activity will be created with a Transaction Date equal to the current date, Due Date equal to the Due Date of the CONTRIBALLOC or DEPOSITCONTR accounting activities and an Effective Date equal to the Transaction Date of the CONTRIBALLOC or DEPOSITCONTR accounting activities.

From the Late Contributions menu, click ![]() alongside Late Contributions Report on the sub-menu on the left. Additional options will be displayed.

alongside Late Contributions Report on the sub-menu on the left. Additional options will be displayed.

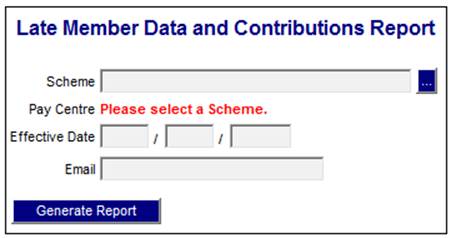

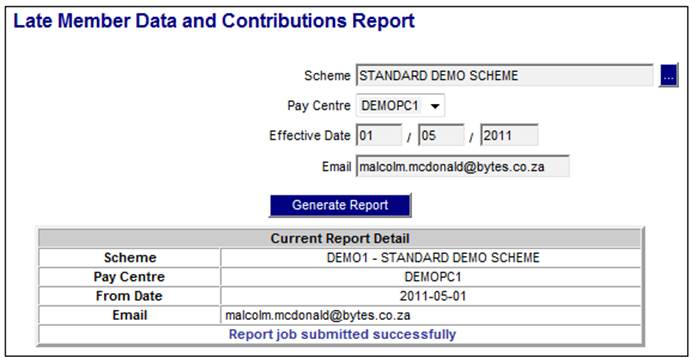

Click New below Late Contribution Report. The Late Member Data and Contributions Report screen will be displayed.

To specify the Report, capture details as follows:

|

Scheme |

Click the LIST button to display the Scheme Selection screen. Click on the hyperlinked number in the Scheme Code column.

Note: A drop-down list will now be displayed for the Pay Centre field. |

|

Pay centre |

Select a Pay centre from the drop-down list.

Note: The drop-down list will not be displayed until a Scheme has been selected.

The specification of a Pay Centre is optional. |

|

Effective date |

The effective date as at which the data must be extracted for the Report. |

|

|

The email address of the person to whom the Report must be sent. |

ClickGENERATE REPORT.

The current report detail will be displayed on the lower portion of the screen.

A message will indicate once the job has been successfully submitted (and an e-mail will be sent to the e-mail address, if provided).

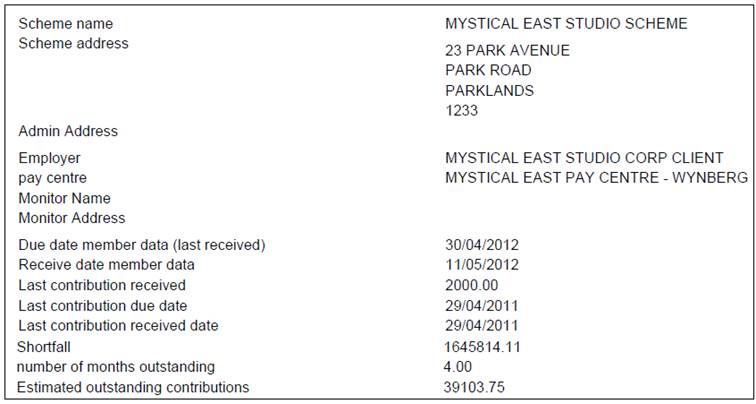

For each of the active Pay Centres linked to the Scheme selected, the system will find the latest Service Request with a Process of CONTRIBUTIONS and an Activity of REC MEMBER DATA and with a Due Date less than the Effective Date of the report.

The system will read the value for the Territory Parameter for the Territory equal to the Territory for the Scheme with a Parameter Type of MEMDATA CUT-OFF.

If the Due Date on the Service Request is equal to the Effective Date of the Report and the number of days between the Due Date and the Start Date on the Service Request is greater than the MEMDATE CUT-OFF value, the Pay Centre will be included in the Report and the value for Late will be set to Y and the value for Number of Months Outstanding set to 0.

If the Due Date on the Service Request is less than the Effective Date of the Report, the Pay Centre will be included in the report. If the number of days between the Due Date and the Start Date on the Service Request is greater than the MEMDATE CUT-OFF value the value for Late will be set to Y.

The number of months from the Due Date of the Service Request to the Effective Date of the report will be calculated and the value for Number of Months Outstanding will be set to this value.

The System will determine the Last Contribution Received for all of the Pay Centres. The Business Transactions (BT’s) in the Scheme’s CONTRECVABLE account will be retrieved per Pay Centre with the following Accounting Activities and with the latest Due Date and the amounts will be summed:

- MANUAL INITIATE CONTRIBALLOC

- MANUAL INITIATE CONTALLOCREV

- MANUAL INITIATE DEPCONTRIB

- MANUAL INITIATE DEPCONTRREV

If the sum of the amounts is zero, the BT’s will be retrieved with the latest Due Date prior to the Due Date of the BT’s previously retrieved. The Accounting Activities above include the deposit transactions and the equivalent reversal Accounting Activities and therefore if the sum of the BT amounts is zero it means that the deposit has been reversed in full. If it has been reversed then the BT’s for the previous Due Date will be retrieved.

The System will determine any differences per Pay Centre between the contributions in the contribution data received and the contributions actually deposited into the Scheme’s bank account. The balance on the Scheme’s CONTRECVABLE account will be retrieved per Pay Centre and the value for Shortfall will be set to this value.

The Estimated Outstanding Contributions will be determined. The System will read the value for Billed Amount Balance on the Member Control Balance records for all of the Members linked to each Pay Centre with a Due Date Period less than or equal to the report Effective Date and sum the values. The number of months from the Due Date of the Last Contribution Received to the Effective Date of the report will be determined and the value for the Last Contribution Received will be multiplied by this value. The result will be added to the total of the Billed Amount Balance values.

If no Service Request is found, the System will find the latest Cycle Control record for each Pay Centre and read the Cycle Date and the Payroll Comp Date. The Cycle Date will be converted to the last day of the month of the Cycle Date month as the Cycle Date is only MMCCYY. The Cycle Date and the Payroll Comp Date will be treated in the same way as the Due Date and Effective Date respectively on the Service Request i.e. compare the number of days to the value for the Territory Parameter MEMDATE CUT-OFF, etc.

The System will determine all of the other information (Number of Months Outstanding, Last Contribution Received, Due Date of Last Contribution Received, Date Last Contribution Received, Shortfall, Estimated Outstanding Contributions), in the same way as for the Pay Centres for which a Service Request record is found.

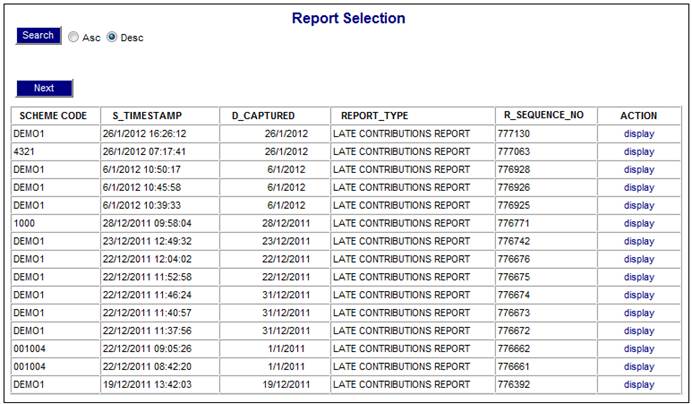

Click View below Late Contribution Report. The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme Code

- Timestamp

- Date Captured

- Report Type

- Sequence Number

- Action

To select a report, click on the hyperlinked display in the Action column alongside the appropriate report.

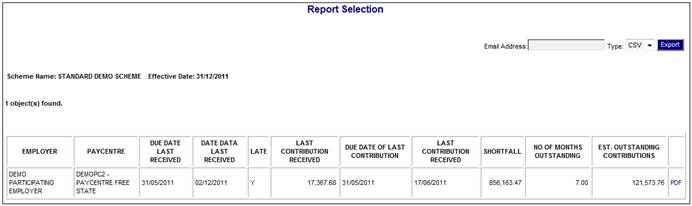

The Report Selection screen will be displayed.

The following columns are displayed:

Heading

- Scheme Name

- Effective Date

Detail

|

Field |

Source |

|

Employer |

Name of Participating Employer to which the Pay Centre is linked |

|

Pay Centre |

Name of the Pay Centre |

|

Due Date Last Received |

Due Date on the latest Service Request or Cycle Control record |

|

Date Data Last Received |

Start Date on the latest Service Request or Payroll Comp Date on the Cycle Control record |

|

Late |

Y if number of days from Due Date to Start Date on Service Request or from Cycle Date to Payroll Comp Date on Cycle Control record is greater than MEMDATA CUT-OFF value. N if it is less |

|

Last Contribution Received |

Latest BT’s on CONTRECVABLE account |

|

Due Date of Last Contribution |

Due Date of the Last Contribution Received |

|

Last Contribution Received |

Transaction Date of Last Contribution Received |

|

Shortfall |

Balance of CONTRECVABLE account |

|

No of Months Outstanding |

Number of months from Due Date Last Received to report Effective Date |

|

Est. Outstanding Contributions |

|

A letter is also provided for each Pay Centre to be sent to the monitoring person advising them of any non-compliance with Section 13A. This letter is set up using the flexible document structures.

Click the hyperlinked PDF in the last column on the screen to display the Report in PDF format.

When the PDF hyperlink is selected, the System will read the Document Template with a PDF Process Type of O/S CONTRIBS linked to the Scheme and create a PDF document with the data or the Document Tags linked to the Template. For details of the Document Template, refer to

Supplements

Tags

Tags for Outstanding Contributions Letter