This activity enables you to maintain records of the Investment Mediums available to products for which the administrator provides services. A super user will capture the Investment Mediums, which will be linked to the products via portfolio. Refer to Product Update Type: Investments under

Product Launch Requirements

Product Launch

Product Update

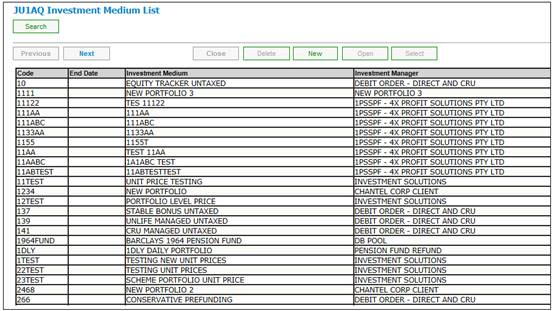

From the main menu on top, select Investment Medium. The JU1AQ Investment Medium List screen will be displayed. This screen lists all investment mediums that have already been coded on the system.

If the investment medium that you need does not appear on the list, then a new investment medium will have to be created.

The following options are available:

|

NEW |

Flows to the New Investment Medium dialog box to add a record. |

|

OPEN |

Flows to the Investment Medium Details dialog box to update the record. |

|

DELETE |

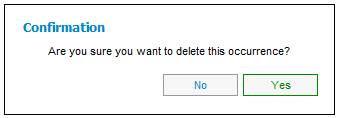

Flows to the Confirmation dialog box to confirm deletion of the record. |

|

|

|

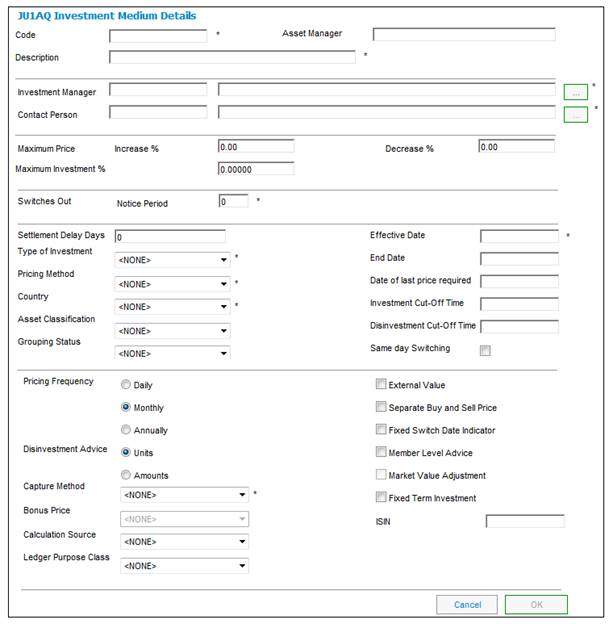

From the JU1AQ Investment Medium List screen, click NEW.

The JU1AQ Investment Medium Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Investment Medium |

|

|

||

|

Code |

Unique identifier for the investment medium - compulsory field |

|

||

|

Description |

Description of the investment medium - compulsory field |

|

||

|

Asset Manager |

The name of the Asset Manager. |

|||

|

Investment Manager |

Click the LIST button. This links to the JU1AP Corporate Client List screen and displays a list of corporate clients for selection. Once a selection has been made, click SELECT. If the Investment Manager that you need does not appear on this list, a new one will have to be created. Return to Corporate Client on the Infrastructure menu. |

|

||

|

Contact Person |

Click the LIST button. This links to the JU1CP Contact Person screen and displays a list of contact persons for selection. Once a selection has been made, click SELECT. |

|

||

|

Maximum Price |

|

|||

|

Increase % |

The maximum percentage by which the unit price is likely to increase |

|

||

|

Decrease % |

The maximum percentage by which the unit price is likely to decrease |

|

||

|

Maximum Investment % |

Maximum Investment Percentage. |

|

||

|

Switches Out |

|

|||

|

Notice Period |

The number of days notice required for a switch. In the case of daily priced portfolios, the effective date of the switch will be set by adding this number of days to the date of capture. In the case of monthly priced portfolios, the effective date of the switch will be set as the first day of the month greater than the date of capture plus this number of days. |

|

||

|

Settlement Delay Days |

Defines the number of days within which the asset management company undertakes to pay the money into the scheme’s bank account, after receiving an instruction to disinvest. i.e. when the buy leg can take place. Used in the realisation and switching processes.

Note: If you want the sell and buy transactions to be created with the same day then the Settlement Delay Days must be set to 0. |

|

||

|

Type of Investment |

Choose from BONUS, UNITISED, SCHEME ONLY or DEFINED BENEFIT. |

|

||

|

Pricing Method |

Select a value from the drop-down list. Values may be SAME DAY, FORWARD or HISTORIC.

Note: SAME DAY - the unit price of the transaction date will be applied.

FORWARD - the unit price of the first working day after the transaction date will be applied.

HISTORIC the unit price with an effective date equal to the first working day prior to the transaction date will be applied. |

|

||

|

Country |

The country of the asset management company. |

|

||

|

Effective Date |

The date of commencement of the use of this investment medium in the scheme's investment portfolio. |

|

||

|

End Date |

End date |

|

||

|

Date of last price required |

The date from which unit prices are no longer required.

Note: These Investment Mediums will then be excluded from the list of Investment Mediums when unit prices are captured after the last price required has been authorised. |

|||

|

Investment Cut-off Time |

The cut-off time for investment in the format HH:MM:SS (Hours:Minutes:Seconds).

A value of 00:00:00 may be captured. |

|

||

|

Disinvestment Cut-off Time |

The cut-off time for disinvestment in the format HH:MM:SS (Hours:Minutes:Seconds).

A value of 00:00:00 may be captured. |

|

||

|

Same day Switching |

Tick the box to indicate that same day switching is allowed. |

|||

|

Asset Classification |

Select a value from the drop-down list: - BALANCED - BONDS - CASH - EQUITY - FIXED INTEREST |

|

||

|

Grouping Status |

Select a value from the drop-down list: - FUND OF FUNDS - MAIN FUND - PART OF FOF - SUB FUND |

|

||

|

Pricing Frequency |

Select the frequency of pricing for the Investment Medium by clicking on the applicable Radio Button. Investment Medium pricing options: |

|

||

|

Disinvestment Advice |

Select either Units or Amounts as the unit for Investment Advice for the Investment Medium by clicking on the applicable Radio Button. The option selected will determine whether disinvestments should be done as a number of units or as an amount |

|

||

|

Capture Method |

Defines the level at which unit prices or bonus/interest rates must be captured. CAPTURE/INV MED means that the unit price or bonus/interest rate is captured at Investment Medium level and indicates that the unit price or bonus/interest rate is applicable to all schemes utilising that investment medium. CAPTURE/PORTF means that the unit price or bonus/interest rate is captured at a scheme level and is applicable only to that scheme. DERIVED applies only to unit trusts and means that the unit price applicable to each scheme is derived from one basic price captured at the investment medium level. The initial charge applicable to the scheme and captured on the investment portfolio is used to calculate the scheme’s price. |

|

||

|

External Value |

If coded Y, and provided the member has an investment balance in one or more of the investment mediums, a benefit adjustment update type will be created automatically during the benefit payment process. |

|

||

|

Separate Buy and Sell Price |

This is relevant when there is a difference in the price that units are sold at and the price that they are purchased at. |

|

||

|

Fixed Switch Date Indicator |

This will be relevant if the asset manager has specified set dates on which switches may occur. Note: If this field is ticked, the fixed annual date must be captured on the Portfolio to ensure that switches only happen on a fixed date. |

|

||

|

Member Level Advice |

This must be selected if the asset manager managing the scheme's investments requires investment advice to be specified at member level. |

|

||

|

Market Value Adjustment |

This field will only be enabled if the value selected for the Type of Investment field is BONUS.

Note: This field can only be updated at the time of creation of the Investment Medium.

Refer to Take-on of MV for Bonus Funds with MV adjustments. |

|

||

|

Fixed Term Investment |

Select this field if there are structured portfolios that can only be switched into or out of on a fixed date annually. |

|||

|

Calculation Source |

Select a value from the drop-down list: - NONE - ACCOUNTING - INPUT - INV STATEMENT

Notes: If the Calculation Source selected is ACCOUNTING then the Ledger Purpose Class field will be mandatory as this will indicate which set of Accounts to retrieve from when deriving the Market Value for the calculation of the unit price.

If the Calculation Method selected is CALCULATED then the Calculation Source field will be mandatory. |

|||

|

Ledger Purpose Class |

Select a value from the drop-down list. Examples are: - ALLOCATION - EMPLOYER - EXPENSE - MEMBER - OPERATIONAL |

|||

|

Bonus Price |

Select a value from the drop-down list. Values are MONTHLY or DAILY.

This field will only be enabled if the Market Value Adjustment field is ticked. |

|

||

|

ISIN |

International Securities Identification Number.

A 12 digit code that uniquely identifies a security, such as stocks or bonds. |

|

||

Once the data has been captured, click OK.

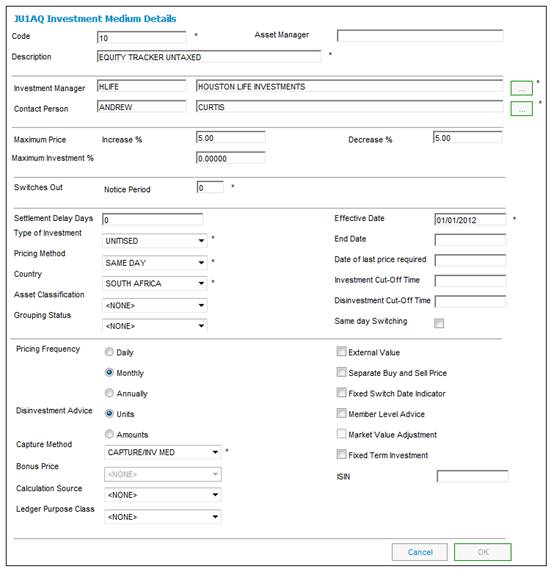

From the JU1AQ Investment Medium List screen, highlight an investment medium and click OPEN.

The JU1AQ Investment Medium Details screen will be displayed.

From the JU1AQ Investment Medium List screen, highlight an investment medium and click DELETE.

The Confirmation screen will be displayed.

Click YES to confirm the deletion or click NO to cancel the deletion.

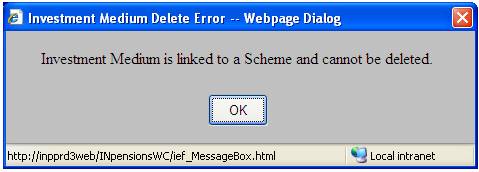

If the investment medium selected is linked to a scheme, the following message will be displayed:

Investment Medium is linked to a Scheme and cannot be deleted.

Click OK to remove the message.

The following actions must be taken before deletion can take place:

- The investment medium must be discontinued for the scheme(s) to which it is linked under the Product Update Type: Investments. For more information refer to Product Update Type: Investments under

Product Launch Requirements

Product Launch

Product Update

- The investment medium must be unlinked from the Income Rule(s) for the scheme(s) to which it is linked under Scheme Update Type: Income. For more information refer to Product Update Type: Income under

Product Launch Requirements

Product Launch

Product Update

-

For examples of accounting transactions (T-accounts), refer to

Supplements

Accounting Transaction Examples 1

Accounting Transaction Examples 2