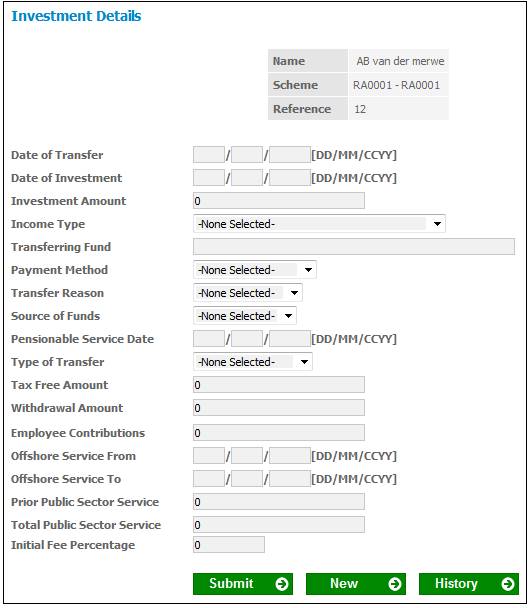

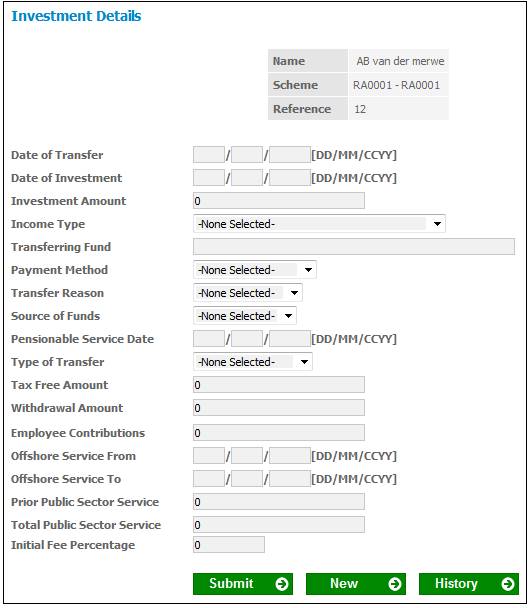

To view or capture investment details for an existing investor, select Investment Details from the sub-menu on the left.

The Investment Details screen will be displayed.

Existing investment details (if any) will be displayed.

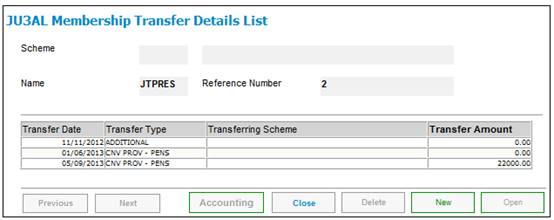

To view a history of transfers, click HISTORY. The JU3AL Membership Transfer Details List screen will be displayed.

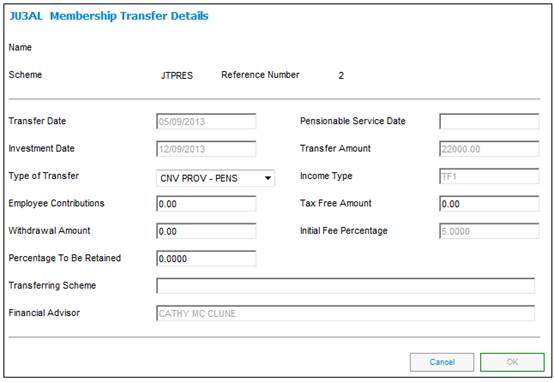

To view details of a transfer, highlight a line and click OPEN. The JU3AL Membership Transfer Details screen will be displayed.

To add new investment details, click NEW. The field values (if any) will be cleared.

Descriptions of the input fields on this screen appear below.

|

Date of Transfer |

The effective date of a transfer. |

|

Date of Investment |

The effective date of the investment. |

|

Transfer Amount |

The amount to be transferred. |

|

Income Type |

Select the applicable income type from the drop-down box. |

|

Transferring Fund |

The name of the fund from which the member is transferring. |

|

Payment Method |

The method of payment to be used. Select the applicable method from the drop-down box. |

|

Transfer Reason |

The reason why the transfer took place. Select the applicable reason from the drop-down box.

The following values may be selected: RESIGNATION RETRENCHMENT DISMISSAL LIQUIDATION (Winding up of Fund) MERGER TRANSFER DIVORCE ORDER |

|

Source of Funds |

Select the applicable source of funds from the drop-down box.

The following values may be selected: EXISTING ACCOUNT BONUS SAVINGS INHERITANCE SALARY OTHER |

|

Pensionable Service Date |

Commences at the date of joining the scheme, or from the transfer date if the member has transferred from another scheme |

|

Type of Transfer |

Select the applicable transfer type from the drop-down box. |

|

Tax Free Amount |

The tax free portion of the amount. |

|

Withdrawal Amount |

The full amount due to the member. |

|

Employee Contributions |

The employee's previous contributions to a provident fund. |

|

Offshore Service From |

The start date of the offshore service. |

|

Offshore Service To |

The end date of the offshore service. |

|

Prior Public Sector Service |

The amount of prior Public Sector service. |

|

Total Public Sector Service |

The total amount of prior Public Sector service. |

|

Percentage to be Retained |

Applicable where the transferring fund has a vesting scale applicable to the employer contributions. Indicates what percentage of the contributions must not be paid to the member on withdrawal prior to retirement if the member was not entitled to the full value of the employer contributions at the time of withdrawal from the transferring fund. |

|

Initial Fee Percentage |

The percentage fee payable to the financial advisor. |

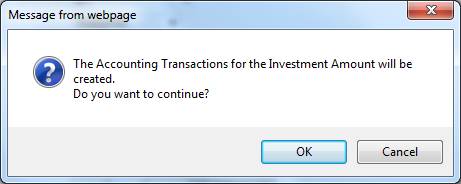

Once all the necessary details have been added, click SUBMIT. The following message will be displayed:

The Accounting Transactions for the Investment Amount will be created. Do you want to continue?

Click OK to remove the message. The contribution and investment accounting activities will be created. If commission and administration fees are chargeable, these will be calculated and moved to accounting. The commission calculation is based on the initial fee captured, but if no fee has been captured, then it is based on the expense rules of type COM set up at a scheme level.

The Investment Details screen will be re-displayed.

A message will confirm that the record has been saved.

Note:

When AUTHORISE is selected, the system will flow to the JU3EP Membership Payment screen to authorise a regular payment amount.

Refer to the Authorise section below.

When SUBMIT on the Investment Details screen is selected, the system will check the Payment Method selected and if it is EFT check if a Client DTI Account record exists for the Membership. If not, the following error message will be displayed:

The payment method selected is EFT but no bank account details have been captured.

If the Payment Method is EFT and the Bank Account Details have been captured, an income control record will be created with the following details:

- Scheme Code

- Membership Reference Number

- Amount

- Income Type

- Payment Date

If the Membership is linked to a Financial Advisor i.e. a Financial Advisor was selected on the Policyholder Details screen and the Initial Fee Percentage value is zero, the following warning message will b e displayed:

A financial advisor has been selected and the initial fee percentage is zero. Do you wish to continue?

If a value for Annual Fee Percentage is captured, the system will find the Expense Rule with a Formula Type of MEM INIT FEE PR linked to the Expense Type with a Global Group Type of COMMISSION and for which the Frequency is AD HOC. The system will read the value for Percentage on the Scale linked to the Expense Rule. If the value captured for Initial Fee Percentage is greater than the Percentage on the Scale, the following error message will be displayed:

The initial fee percentage exceeds the maximum allowable.

If an Expense Rule linked to the Expense Type with a Global Group Type of COMMISSION and for which the Frequency is AD HOC is not found, any value for Annual Fee Percentage will be enabled to be captured.

If REJECT is selected, the Control record will be deleted.

When AUTHORISE is selected, the values will be created on the Member Values table with a Type of INVESTMENT DETS including the Initial Fee Percentage and the Annual Fee Percentage.

The Initial Fee Percentage will be stored with a Sub-Type of MEM INIT FEE PR.

When the BJU3EC Individual Calc batch job runs to calculate the admin fee, commission, net investment amount and investment allocations, it will create the business transactions (BT’s) as per the functionality for Preservation Funds.

The system will read the income control record and for each record:

Calculate the Financial Advisor commission amount (A):

Read the Initial Fee percentage on the Member Values record for the Membership and calculate the commission amount as follows:

Investment Amount X Initial Fee Percentage / 100

If the Initial Fee percentage is null read the Expense Type rule effective as at the Date of Transfer and associated with the Expense Type with a Global Group Type of FEE EXPENSE and a Code equal to COM and for which the Frequency is AD HOC, and calculate the commission as per the Expense Type rule.

The system will read the Minimum and Maximum amount on the Expense Type rule. If the calculated amount is less than the minimum amount, the commission amount will be set to the minimum. If the calculated amount is greater than the maximum amount, the commission amount will be set to the maximum.

If no Expense Type Rule is found for Expense Type COM then it will be ignored.

Calculate the VAT on the commission amount (B):

If there is an Expense Type linked to the Scheme with a Global Group Type of EXPENSE TYPE and a Code of VAT, the system will read the VAT Number on the Corporate Client and if found read the Expense Rule for the Expense Type with a Code of VAT. If found, the system will read the value for Percentage on the Territory Parameter with a Sub-Type of VAT. The VAT amount will be calculated as follows:

Commission Amount (A) X VAT Percentage / 100

If no VAT Expense Type or no VAT number is found or no Expense Rule for an Expense Type with a Code of VAT is found, then VAT will not be calculated.

Calculate the admin fee amount (C):

The system will read the Expense Rule effective as at the Date of Transfer and associated to the Expense Type with a Global Group Type of FEE EXPENSE and for which the Frequency is AD HOC.

If not found, the system will read the Expense Type rule effective as at the Date of Transfer and associated with the Expense Type ADM, and calculate the admin fee as per the Expense Type rule.

The system will read the Minimum and Maximum amount on the Expense Type rule. If the calculated amount is less than the minimum amount, the admin fee amount will be set to the minimum. If the calculated amount is greater than the maximum amount, the admin fee amount will be set to the maximum.

Calculate the VAT on the admin fee amount (D):

If there is an Expense Type linked to the Scheme with a Global Group Type of EXPENSE TYPE and a Code of VAT, the system will read the VAT Number on the Corporate Client and if found read the Expense Rule for the Expense Type with a Code of VAT. If found, the system will read the value for Percentage on the Territory Parameter with a Sub-Type of VAT. The VAT amount will be calculated as follows:

Admin Fee Amount (C) X VAT Percentage / 100

If no VAT Expense Type or no VAT number is found or no Expense Rule for an Expense Type with a Code of VAT is found, VAT will not be calculated.

Calculate the net investment amount (E) as follows:

Investment Amount – Commission (A) – VAT (B) – Admin fee (C) – VAT (D)

Calculate the investment amount per investment portfolio (F):

The system will read the investment allocation percentage per investment portfolio and calculate the amount to be allocated to each investment portfolio as follows:

Investment Amount X Allocation Percentage / 100

The system will read the Payment Method and create the Business Transactions (BT’s) with the Accounting Activity as per the table below depending on the Payment Type.

|

|

Value |

Process |

Accounting Activity |

Income Type |

|

|

Payment Method: CHEQUE |

|

|

|

|

1 |

Investment Amount |

IND INVESTMENT |

CONTRIBUTION |

Income type selected |

|

2 |

Commission (A) |

IND INVESTMENT |

COMMISSION |

Expense Type to which the Expense Rule used is linked |

|

3 |

VAT on Commission (B) |

IND INVESTMENT |

MEMVATONCOMM |

VATF |

|

4 |

Admin Fee (C) |

IND INVESTMENT |

ADMIN |

Expense Type to which the Expense Rule used is linked |

|

5 |

VAT on Admin Fee (D) |

IND INVESTMENT |

MEMVATONADM |

VATA |

|

6 |

Net Investment Amount per Portfolio (E) |

IND INVESTMENT |

INVESTMENT |

Income type selected |

|

|

Payment Method: EFT |

|

|

|

|

6 |

Investment Amount |

IND INVESTMENT |

EFTCONTRIB |

Income type selected |

|

7 |

Commission (A) |

IND INVESTMENT |

COMMISSION |

Expense Type to which the Expense Rule used is linked |

|

8 |

VAT on Commission (B) |

IND INVESTMENT |

MEMVATONCOMM |

VAT |

|

9 |

Admin Fee (C) |

IND INVESTMENT |

ADMIN |

Expense Type to which the Expense Rule used is linked |

|

10 |

VAT on Admin Fee (D) |

IND INVESTMENT |

MEMVATONADM |

VAT |

|

11 |

Net Investment Amount per Portfolio (E) |

IND INVESTMENT |

INVESTMENT |

Income type selected |

The Accounting Activity for item 6 is a new Accounting Activity and must be set up with the Money Movement Indicator set to Y.

The Accounting Rule for the EFT CONTRIB Accounting Activity must be as follows:

|

MEMBER |

DEBIT ACCOUNT |

MEM DEPOSIT |

|

|

CREDIT ACCOUNT |

CONTRIBUTION |

|

SCHEME |

DEBIT ACCOUNT |

BANK |

|

|

CREDIT ACCOUNT |

CONTRIBFUND |

The Debit DTI Account must be created with the Debit DTI Account defined in the EFT Rule and the Credit DTI Account created with the Member’s bank account details.

If the Payment Method is EFT, the system will read the Service Type on the Bank Interface record with a Process of INCOME linked to the Scheme’s Bank Account (Debit DTI Account) and check that the Investment Date is greater than current date plus the Service Type e.g. if the Service Type is TWO-DAY and the Investment Date is less than the current date plus two days, the following error message will be displayed:

Update the Portfolio Advice Detail table.