To view or capture investment allocations, click ![]() alongside INVESTMENT ALLOCATION on the sub-menu on the left. Additional options will be displayed.

alongside INVESTMENT ALLOCATION on the sub-menu on the left. Additional options will be displayed.

Note:

For information on the Living Annuity Payment Batch process, refer to Living annuity payment batch processing below.

To change the allocation of future contributions, click CHANGE FUTURE ALLOCATIONS below IVEWSTMENT ALLOCATION.

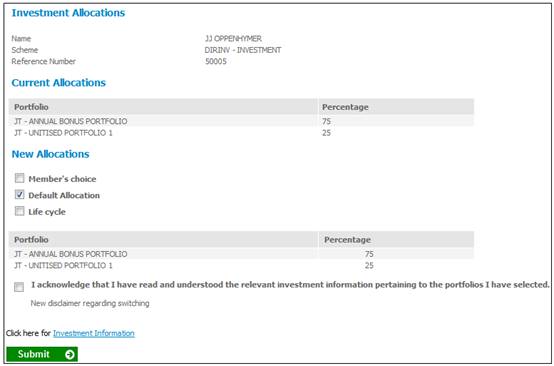

The Investment Allocations screen will be displayed.

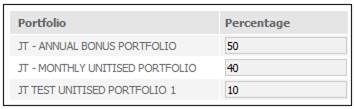

Tick the appropriate box below New Allocations. If Member's choice has been selected, enter a percentage for each portfolio in which the money should be invested, by entering a figure in the Percentage box alongside the applicable portfolio. You may choose to invest in more than one portfolio.

The System will not enable a Portfolio to be selected if the value for the Closed From Date field on the JU1BV Scheme Portfolio Details screen is less than or equal to the Effective Date of the Scheme Update.

Note:

The system will read the value for Fixed Term Investment on the Investment Linked to each Portfolio selected. If it is Y, the unit balance on the Member’s INVSTMEMUNIT account will be retrieved if the Earning Allocation Basis on the Investment Medium is UNITISED or on the Member’s INVESTMEMB account if the Earning Allocation Basis is BONUS. If the balance is zero the system will check if there is a Switch Buy in process for the Portfolio. If not, the following error message will be displayed:

You may only select this Portfolio if you have money invested in it. If you want to invest future contributions in this Portfolio please transfer money into it by capturing a switch.

Before updating the allocations, you must acknowledge that you have read the relevant investment information pertaining to the portfolios you have selected, by ticking the check box.

Click SUBMIT.

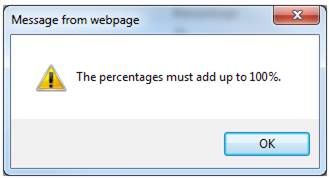

The sum of your allocations must add up to 100%. If not, an error message will be displayed.

The percentages must add up to 100%.

Click OK and change the percentages so that they total 100%.

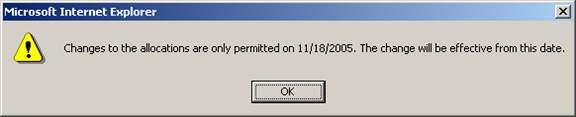

If the scheme rules provide for switching on a specific date only, a message will be displayed.

Example:

Changes to the allocations are only permitted on 11/18/2005. The change will be effective from this date.

Click OK to continue.

Click SUBMIT.

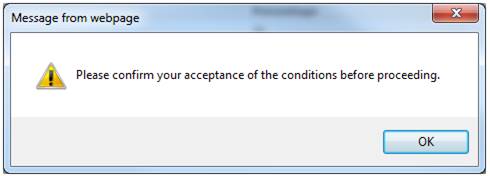

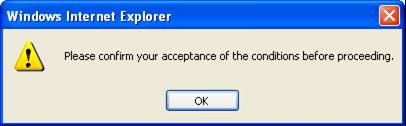

If you haven't ticked the check box, an error message will be displayed.

Please confirm your acceptance of the conditions before proceeding.

Click OK, then tick the check box.

Click SUBMIT.

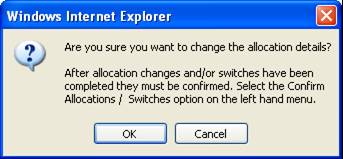

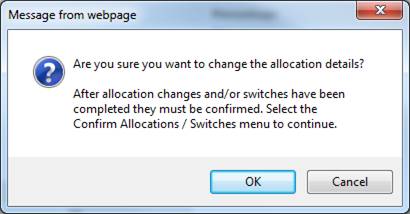

A confirmation message will be displayed.

Are you sure you want to change the allocation details?

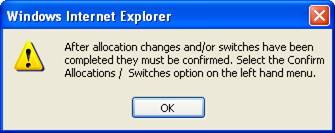

After allocation changes and / or switches have been completed they must be confirmed. Select the Confirm Allocations / Switches option on the left hand menu.

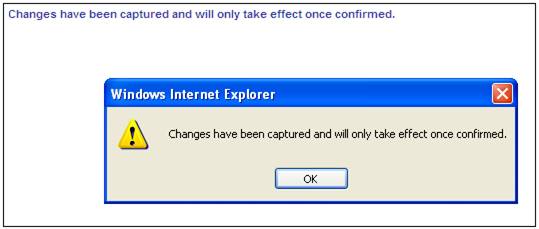

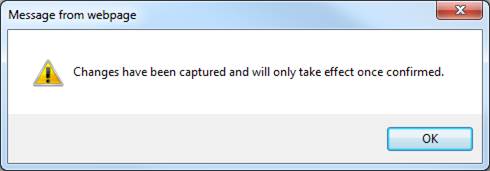

Click OK. A confirmation message will be displayed.

Changes have been captured and will only take effect once confirmed.

Click OK to remove the message.

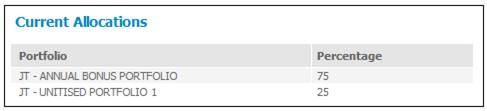

Once you have updated the screen, the Investment Allocations screen will be re-displayed, showing the new allocation.

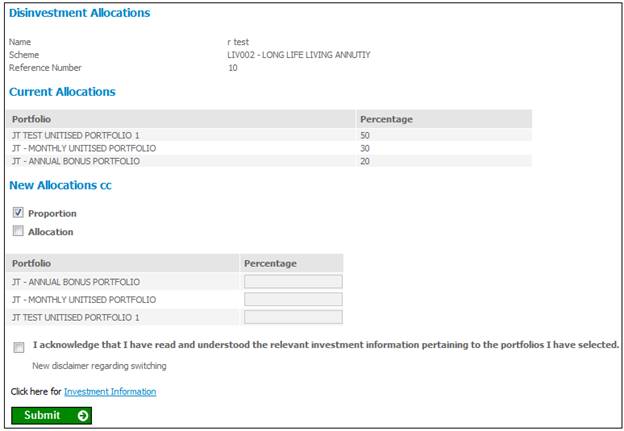

To change the disinvestment allocation of contributions, click CHANGE DISINVESTMENT ALLOCATION below INVESTMENT ALLOCATION.

The Disinvestment Allocations screen will be displayed.

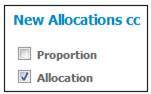

New Allocations tick boxes

- Place a tick in the Proportion box to indicate that disinvestment is proportioned across all portfolios.

- Place a tick in the Allocation box to indicate that the user may allocate disinvestment per portfolio.

If the Allocation box is ticked, the Percentage column will be enabled per Portfolio for the capture of a percentage.

Capture the percentage(s) in the Percentage column.

Note:

The sum of the percentages must equal 100%.

Tick the box to acknowledge that the investment information for these portfolios has been read and understood.

![]()

Click SUBMIT.

The following message will be displayed requesting confirmation that you wish to change the allocation details:

Are you sure you want to change the allocation details?

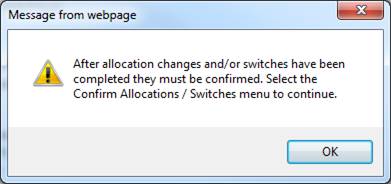

After allocation changes and / or switches have been completed they must be confirmed. Select the Confirm Allocations / Switches menu to continue.

Click OK to confirm that the allocation details must be changed. The following message will be displayed:

Changes have been captured and will only take effect once confirmed.

Click OK to remove the message.

The following message will be displayed on the screen:

Changes have been captured and will only take effect once confirmed.

In order to confirm the allocations, select CONFIRM ALLOCATIONS / SWITCHES from the sub-menu on the left. For more information, refer to Confirm allocations / switches below.

Data displayed under Current Allocation

The system will read the Investment Service (Investment Allocation) for the Membership with a Service Type of D (Disinvestment) or X (Proportionate disinvestment across all Portfolios).

If an Investment Service with a Service Type of D is found, the system displays the Code and Description for each Portfolio linked and the Allocation Percentage.

If an Investment Service with a Service Type of X is found, the system displays the word Proportioned.

If no existing Investment Service with a Type of D is found for the Membership, the system does not display anything under the Current Allocation section.

Data displayed under New Allocation

The system will retrieve the unit balances on the Member’s INVSTMEMUNIT account. If balances are found the system will find the latest unit price for the Portfolios for which balances are retrieved and calculate the market value. The system will sum the market values and for each Portfolio and calculate the market value of the Portfolio as a percentage of the total market value.

The system will retrieve the balances on the Member’s INVESTMEMB account and if there is a balance will display the value in an Un-unitised column for the Portfolio and include the value in the Market Value.

The following details will be displayed for each Portfolio for which a balance is found:

- Portfolio code and description

- % of Total Market Value

- Date of latest unit price

- Latest unit price

- Period of pricing (DAILY / MONTHLY)

- Un-unitised

- Number of units

- Market value

If no balances are retrieved from the Member’s INVSTMEMUNIT account or INVESTMEMB account the Portfolios linked to the Member’s Investment Allocation are listed.

The system will display the Portfolio Code and Description, Date of latest unit price, Latest unit price and Period of Pricing, and leave the values in the, % of Total Market Value, Un-unitised, Number of units and Market value values blank.

If the Proportion tick box is ticked the Percentage fields are disabled.

When the SUBMIT is selected, the system will check that the sum of the values for Percentage captured is equal to 100. If it is not, an error message will be displayed.

If the sum is equal to 100, the system will create an Investment Service record with a type of D.

If the Proportion tick box is ticked, the system will create an Investment Service record with a type of X and with a zero percentage for each Portfolio.

To switch investments of past contributions, click SWITCH PAST INVESTMENTS below INVESTMENT ALLOCATION.

Note:

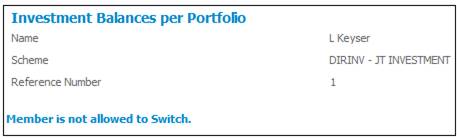

If the member is not allowed to switch then the Investment Balances per Portfolio screen will display the following message:

Member is not allowed to Switch.

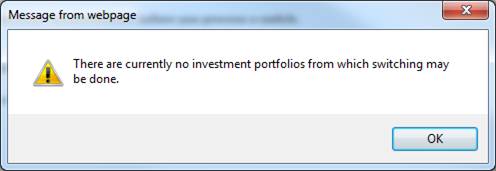

If no portfolios are available to switch, the following message will be displayed:

There are currently no investment portfolios from which switching may be done.

Click OK to remove the message.

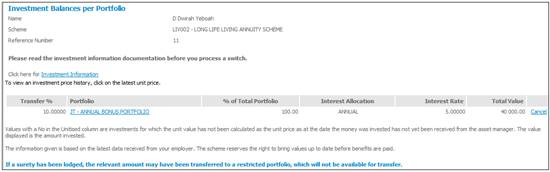

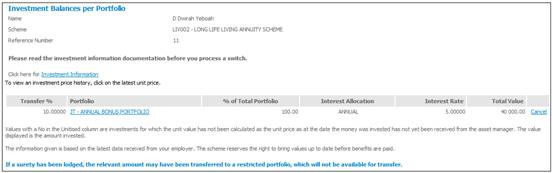

The Investment Balances per Portfolio screen will be displayed.

This screen displays both the unitised and non-unitised portfolios in which the member has invested, the percentages that have been allocated to each portfolio, and the market value of the investment in each portfolio.

Click the hyperlinked here to return to the Investment Balances per Portfolio screen.

To perform a switch, click on the hyperlinked investment medium name in the Portfolio column.

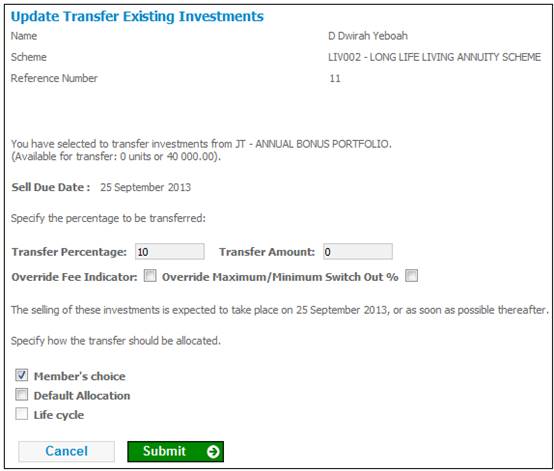

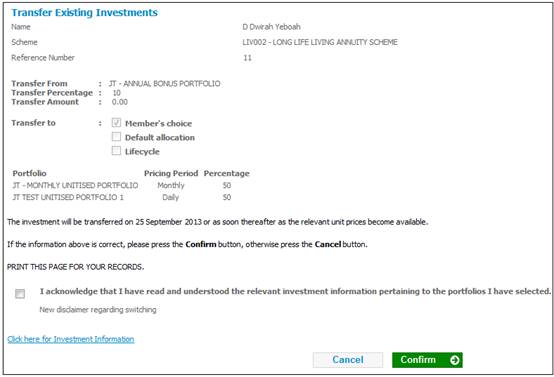

The Transfer Existing Investments screen will be displayed.

If you want to use the default investment allocation, tick the box alongside Default Allocation.

If you want to specify a different percentage, tick the box alongside Member's choice.

In the Transfer Percentage box, enter the percentage of the total units that you want to transfer.

Click SUBMIT.

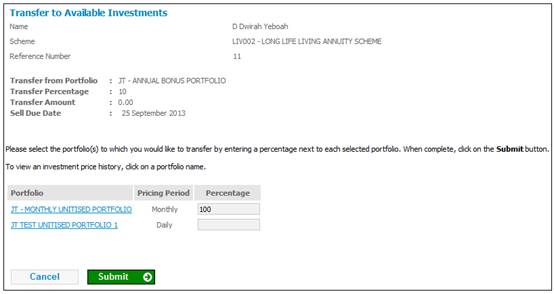

The Transfer to Available Investments screen will be displayed.

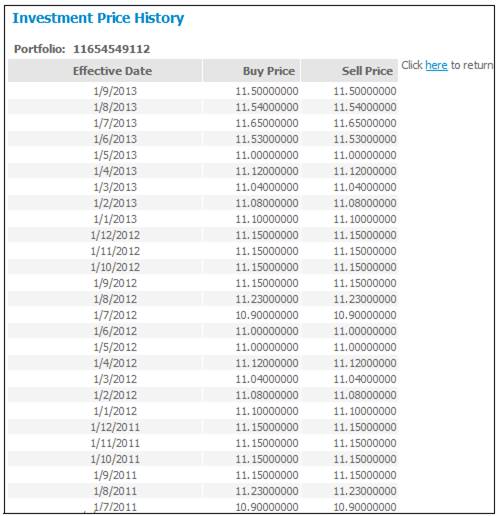

You can view the investment price history for each of the available portfolios. Click the hyperlinked name in the Portfolio column. The Investment Price History screen will be displayed for the selected investment medium.

Enter a percentage for the portfolio(s) in which you would like the money invested, by entering a figure in the Percentage box alongside the applicable portfolio. You may choose to invest in more than one portfolio.

Click SUBMIT.

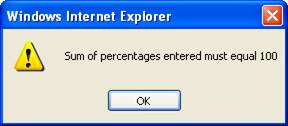

The sum of your switch percentage must add up to 100%. If not, the following error message will be displayed:

Sum of percentages entered must equal 100

Click OK and change the percentages so that they total 100%.

The Transfer Existing Investments screen will be re-displayed.

Click CONFIRM.

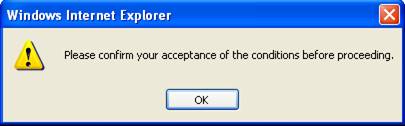

If you haven't ticked the check box, the following error message will be displayed:

Please confirm your acceptance of the conditions before proceeding.

Click OK, then tick the check box.

Click CONFIRM.

The following confirmation message will be displayed:

After allocation changes and / or switches have been completed they must be confirmed. Select the Confirm Allocations / Switches menu to continue.

Click OK.

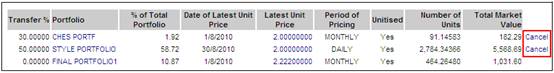

The Investment Balances per Portfolio screen will be displayed.

Note:

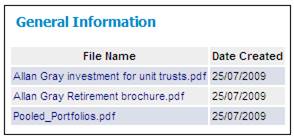

To access the relevant investment information, click the Investment Information hyperlink. The General Information screen will be displayed. Refer to Investment Information.

On the Transfer Existing Investments screen, click CONFIRM.

If you haven't ticked the check box, the following error message will be displayed:

Please confirm your acceptance of the conditions before proceeding.

Click OK and then tick the check box.

Click CONFIRM.

The following confirmation message will be displayed:

After allocation changes and / or switches have been completed they must be confirmed. Select the Confirm Allocations / Switches menu to continue.

Click OK.

The Investment Balances per Portfolio screen will be displayed.

To cancel the unconfirmed switch, click the hyperlinked Cancel on the appropriate line.

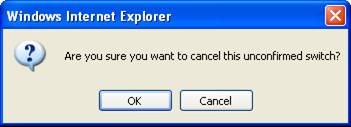

The following confirmation message will be displayed:

Are you sure you want to cancel this unconfirmed switch?

Click OK to confirm the cancellation.

To confirm the allocation or switches, click CONFIRM ALLOCATIONS below INVESTMENT ALLOCATION.

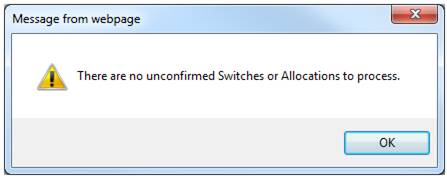

If there are no switches or allocations to be processed, the following message will be displayed.

There are no unconfirmed Switches or Allocations to process.

Click OK to remove the message.

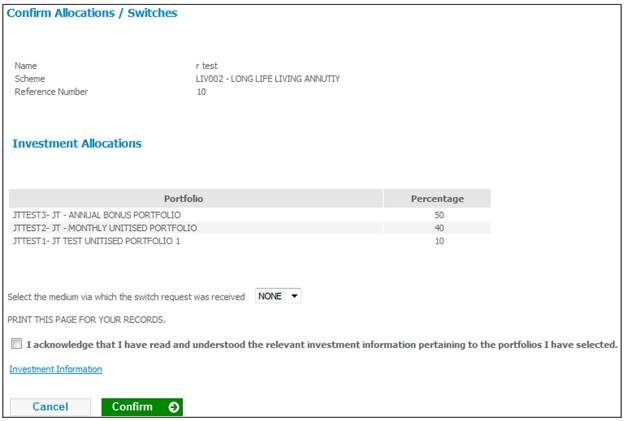

Allocations and switches available for confirmation will be displayed on the Confirm Allocations / Switches screen.

Before confirming the allocations or switches, you must acknowledge that you have read the relevant investment information pertaining to the portfolios you have selected, by ticking the check box.

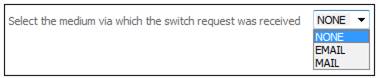

In addition, the request method should be updated by selecting a value from the drop-down box.

Note:

When a switch is created via the JU3CA Bulk Switch From screen, the request method on the switching detail will be updated to BULK.

When a switch is created via the BJU3BN_LCSWI Life Cycle Switches batch job, the request method on the switching detail will be updated to LIFE CYCLE.

When a switch is captured via the Member Website the request method on the switching detail will be update to MEMBER WEB.

In the BJU3BN Life Cycle Switches batch job, when the number of years to Normal Retirement Date (NRD) is determined for a Member, the system will check if the Member has a Member Values record with a Member Value Type of PLANNED RET DTE. If found, the system will determine the Number of years to NRD based on the value for Period End Date in place of Normal Retirement Age.

To confirm the allocations or switches, click CONFIRM.

If you haven't ticked the check box, the following error message will be displayed:

Please confirm your acceptance of the conditions before proceeding.

Click OK and then tick the check box.

The Confirm Allocations / Switches screen will be re-displayed for final confirmation.

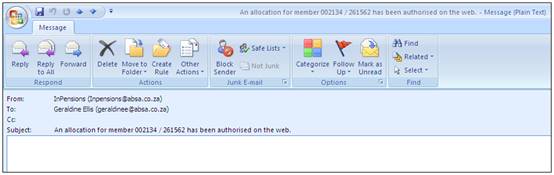

If the member has captured switches or changes in allocation (or both), on the Member Website, an email will automatically be sent to the Administrator Team Address.

Switch captured by member

A switch for member (number) / (scheme) has been authorised on the web.

Allocation captured by member

An allocation for member (number) / (scheme) has been authorised on the web.

Switch and allocation captured by member

A switch and allocation for member (number) / (scheme) has been authorised on the web.

During the Living Annuity Payment Batch process, when calculating the number of units to be disinvested for a Living Annuitant, the system will read the Member’s Disinvestment Allocation (Investment Service with a Service Type of D).

If an Investment Service with a Service Type of X is found the proportion of the annuity amount to be disinvested will be calculated for each Portfolio for which the Member has a unit balance.

The system will retrieve the unit balances on the Member’s INVSTMEMUNIT account and retrieve the latest unit price for each Portfolio for which a unit balance is retrieved and calculate the market value per Portfolio. The values will be summed. The system will divide the market value for the Portfolio by the sum of the market values and multiply by 100 to derive the amount to be disinvested per Portfolio. The system will check that the sum of the disinvestment amounts is equal to the annuity amount. If not, as a result of rounding, the difference will be added or subtracted to/from the largest amount.

If an Investment Allocation is not found for the Member, the system will check if the member is linked to a Membership Group with a Type of INVESTMENT.

If the member is linked to an IINVESTMENT Membership Group the system will read the Investment Allocation.

If the Member does not have an individual Investment Allocation and is not linked to an INVESTMENT Membership Group, the system will read the Scheme Investment Allocation.