This facility allows the business to specify what types of income, premiums, expenses and benefits may be expected for products.

Global Types are defined in terms of the following parameters:

- Whether the income is Contributions, Expenses, Fee, Contributions to a Reserve or Scheme Income

- Whether it is Voluntary or Mandatory

- Whether it is Regular or Ad Hoc

- Whether the income is attributable to Members or to the Product

- Whether late income must be reported to the FSB

Note:

"Contribution to a Reserve" includes all Retirement Funding contributions as well as all other payments that are not immediately allocated in full to Fee or Premium payment. For example, it includes contributions to Stabilisation accounts, fee reserves, premium reserves and payment in respect of valuation deficits, as well as ordinary employer and employee contributions.

Income of all types may be specified to be either Employer or Employee paid

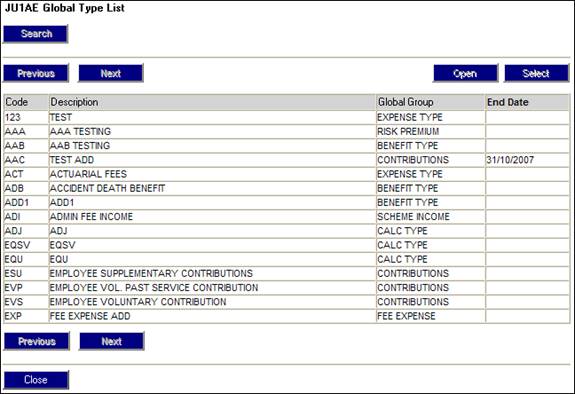

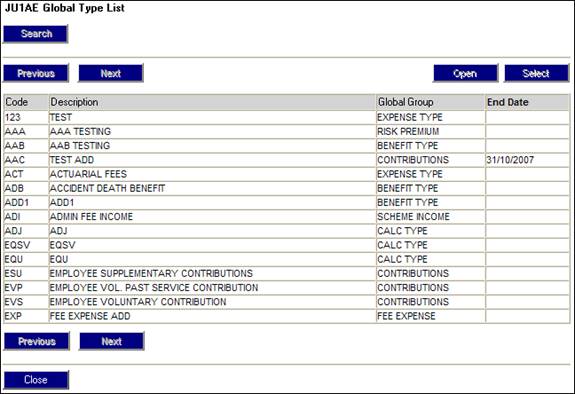

Select System Data > Parameters > Global Data Type.

The JU1AE Global Type List screen will be displayed.

The following options are available:

Buttons:

![]()

![]()

![]()

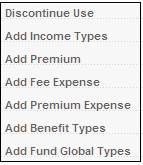

Menu options:

|

SELECT |

Passes the details of the selected record to the calling procedure |

|

OPEN |

Flows to the dialogue Income Type Details to view a selected income type. |

|

CLOSE |

Closes screen. |

|

SEARCH |

Opens the criteria box to allow the search criteria to be entered. |

|

Discontinue Use |

Flows to the dialogue Discontinue Global Type to terminate a global type |

|

Add Income Types |

Flows to the New Global Type dialogue box to add a record |

|

Add Premium |

Flows to the New Global Type dialogue box to add a record |

|

Fee Expenses |

Flows to the New Global Type dialogue box to add a record |

|

Add Premium Expenses |

Flows to the New Global Type dialogue box to add a record |

|

Add Benefit Type |

Flows to the Risk Benefit Type dialogue box to add a record |

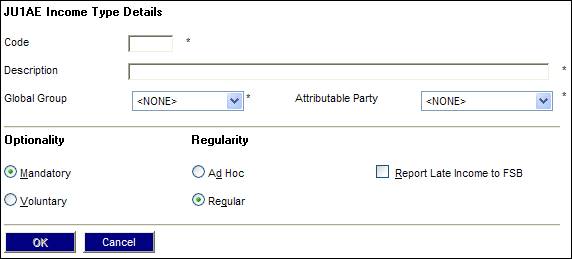

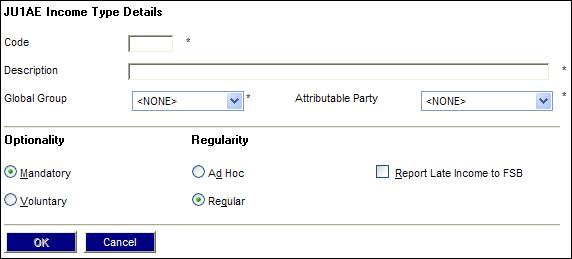

Select Add Income Types.

The JU1AE Income Type Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Code |

Unique identifier |

|

Description |

Description |

|

Global Group |

Select a permitted value from the drop-down box |

|

Attributable Party |

Select member or fund from the drop-down box |

|

Optionality |

Select mandatory or voluntary |

|

Regularity |

Select ad hoc or regular |

|

Report Late Income to FSB |

Indicates whether the income type is to be reported to FSB on late payment |

Click OK. The new income type will be added to the Global Type List screen.

From the JU1AE Global Type List screen, select Add Premium.

The JU1AE Income Type Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Code |

Unique identifier |

|

Description |

Description |

|

Global Group |

Select a permitted value from the drop-down box |

|

Attributable Party |

Select member or fund from the drop-down box |

|

Optionality |

Select mandatory or voluntary |

|

Regularity |

Select ad hoc or regular |

|

Report Late Income to FSB |

Indicates whether the premium is to be reported to FSB on late payment |

Click OK. The new income type will be added to the Global Type List screen.

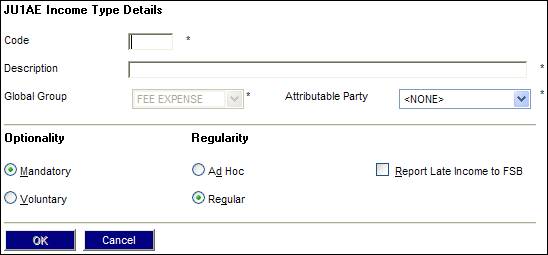

From the JU1AE Global Type List screen, select Add Fee Expense.

The JU1AE Income Type Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Code |

Unique identifier |

|

Description |

Description |

|

Global Group |

Select a permitted value from the drop-down box |

|

Attributable Party |

Select member or fund from the drop-down box |

|

Optionality |

Select mandatory or voluntary |

|

Regularity |

Select ad hoc or regular |

|

Report Late Income to FSB |

Indicates whether the fee expense is to be reported to FSB on late payment |

Click OK. The new fee expense will be added to the Global Type List screen.

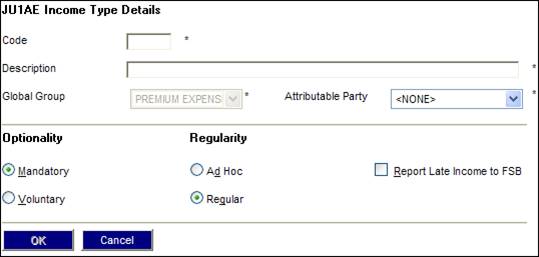

From the JU1AE Global Type List screen, select Add Premium Expense.

The JU1AE Income Type Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Code |

Unique identifier |

|

Description |

Description |

|

Global Group |

Select a permitted value from the drop-down box |

|

Attributable Party |

Select member or fund from the drop-down box |

|

Optionality |

Select mandatory or voluntary |

|

Regularity |

Select ad hoc or regular |

|

Report Late Income to FSB |

Indicates whether the premium expense is to be reported to FSB on late payment |

Click OK. The new premium expense will be added to the Global Type List screen.

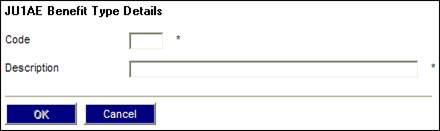

From the JU1AE Global Type List screen, select Add Benefit Types.

The JU1AE Benefit Type Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Code |

Unique identifier |

|

Description |

Description |

Click OK. The new benefit type will be added to the Global Type List screen.

From the JU1AE Global Type List screen, select Add Fund Global Types.

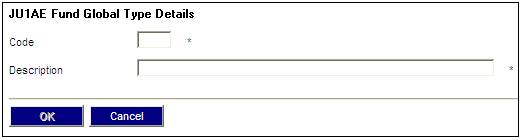

When Add Fund Global Types is selected from the sub-menu on the left, or when a line with Global Group = FUND GLOBAL TYP is selected by clicking OPEN, the JU1AE Fund Global Type Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Code |

Unique identifier |

|

Description |

Description |

Click OK. The new fund global type will be added to the Global Type List screen.