Context

The business requires listings of Business Transactions to be extracted from the system for various purposes.

Question

How do I obtain a list of Year To-Date (YTD) Totals from the system?

Answer

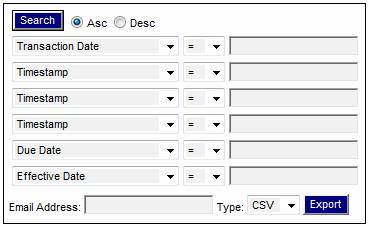

Select Scheme Reports > (Select a Scheme) > Financial > Business Transactions.

On the Business Transactions Report screen, select the following criteria in the dropdown boxes:

- Transaction Date > Date (the last day of the previous month) - (This will give you all the business transactions, transacted and paid in this tax year regardless of when they were due).

- Stakeholder = MEMBER (only member and not fund transactions will be extracted for the fund).

- Process = ANNUITY PAYMENT (transactions generated by the payment run only).

- Debit Credit = D

Export this extract to an excel file and from their filter on the following for YTD values:

For ANNUITY GROSS YTD filter and sum the following accounting activities:

- SUSPENPAID

- BONUSPAYBL

- PENSIONPAYBL

For PAYE YTD filter and sum the following accounting activities:

- ARRTAXPAYABL

- TAXPAYABLE

- ADDTAXPAYABL

For DEDUCTION YTD filter and sum the following accounting activities:

- PENSIONDED

- MAIDERCONDED

- MEMPENDEDJNL