The process is as follows:

- schedule the batch run

- submit the batch run job

- view the report

- pay the premiums/fees

Note:

Expense Billing will have to be scheduled separately for each membership group.

For more detailed information refer to

Processes

Expense Billing

The JU3BH_BILL expense billing batch job calculates fees and premiums and produces a report of the fees and premiums payable. Once authorisation of the calculated fees and premiums has taken place, the necessary accounting transactions will be generated.

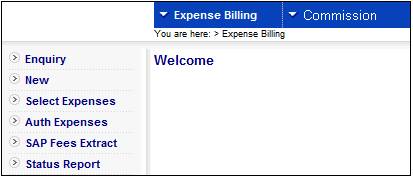

Log in to the system from the Logon page.

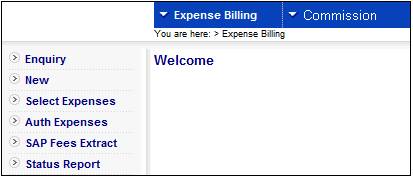

The following screen is displayed.

Select Expense Billing from the top menu.

The following sub-menu will be displayed on the left.

Select New from the sub-menu on the left.

Note:

Transactional security is applied when New is selected. The following message will be displayed if the User is not authorised for the transaction:

Error

User is not authorised for this transaction.

Click OK to remove the message.

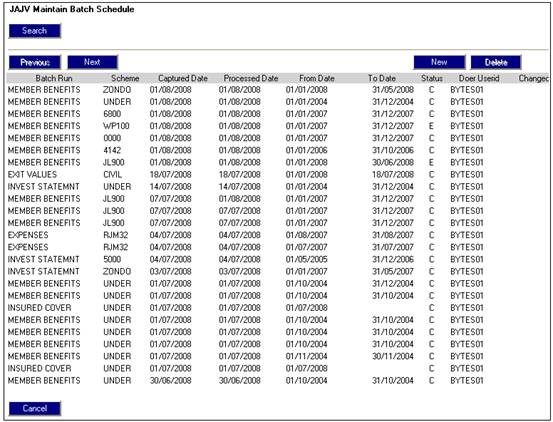

When New is selected, the JAJV Maintain Batch Schedule screen will be displayed.

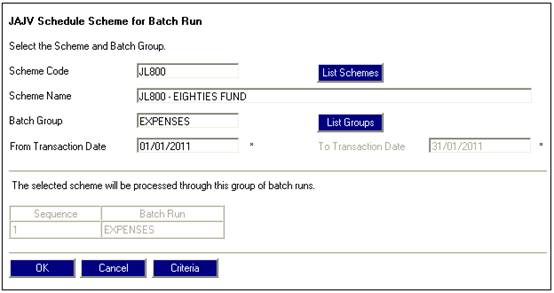

To schedule a new batch run, click NEW. The JAJV Schedule Scheme for Batch Run screen will be displayed.

Capture details for the screen as follows:

|

Scheme Code, Scheme Name |

Click LIST SCHEMES to select the relevant scheme. The scheme code, scheme name and effective date will be displayed in the appropriate fields. |

|

|

Batch Group |

Click LIST GROUPS and select EXPENSES from the list displayed |

|

|

Effective Date |

The month for which you are calculating the expenses. Input the 1st of the month and the system will default to end of the month. |

|

|

Criteria |

The criteria button provides the option of defining additional selection criteria for the Batch Run. |

|

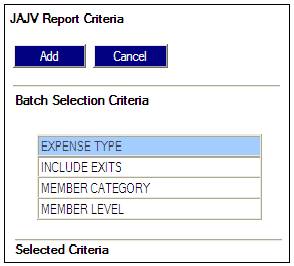

Click CRITERIA. The Report Criteria screen will be displayed, showing the batch items available for selection.

For EXPENSES, the following criteria must be added:

- EXPENSE TYPE – For certain membership groups, you will be running a fixed fee. Use this option for Administration Fee Inactive.

- INCLUDE EXITS –Add this option to both jobs scheduled. This will ensure that expense billing is calculated for members with an exit date within the month.

- MEMBER CATEGORY – A selection will have to be made for each membership group.

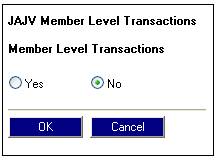

- MEMBER LEVEL – This selection will give you the options of whether to create accounting transactions at member level or not.

Click the ![]() YES or

YES or ![]() NO radio buttons to indicate whether or not accounting transactions must be created at a member level.

NO radio buttons to indicate whether or not accounting transactions must be created at a member level.

Click ![]() YES for the R 6.00 scheduled job. This will enable you to deduct a fee from the member’s investment transactions as opposed to the contribution transactions.

YES for the R 6.00 scheduled job. This will enable you to deduct a fee from the member’s investment transactions as opposed to the contribution transactions.

Once a selection has been made, click OK.

When all criteria have been selected, go back to the previous screen and click OK.

The above process must be followed for each membership group.

The JU3BH_BILL \ BJU3BHO0.BAT batch job for EXPENSE BILLING will be run.

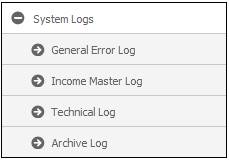

The progress of the run can be monitored via Infrastructure > System Management.

On the sub-menu on the left, click System Logs to expand the selections, then select General Error log from the sub-menu.

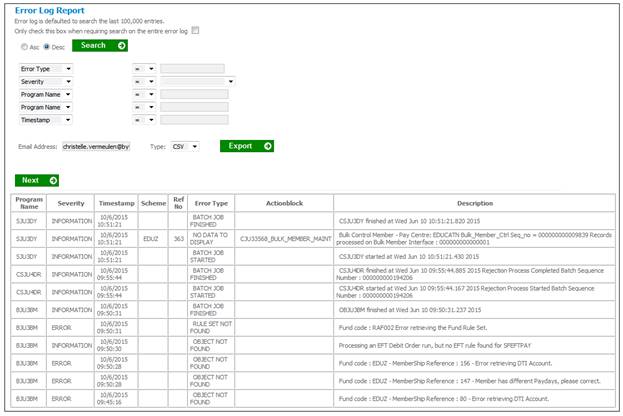

The Error Log Report screen will be displayed.

Capture BJU3BH (the Program Name for Expense Billing), in the Program Name field in the criteria input on top and click SEARCH.

Once the batch job has successfully run, it can be viewed and authorised under the Select Expenses menu option.

Note:

The Expense Billing batch job will only stop if the error is as a result of rule data not being found e.g. an Expense Rule not found for the Expense Type or for a Membership Group, and not as a result of individual Member data .e.g. Member does not have an investment balance.

If an individual Member error is encountered, an error message will be written to the Error Log and processing will continue.

Expense Billing cannot be run for the same Expense Type more than once for the same effective date and therefore any individual member errors must be fixed manually i.e. the fee calculated and apportioned manually and journals passed to update the member’s record.

Calculation of Stamp Duty

The following processing applies to the calculation of Stamp Duty for a new Endowment Policy for Barclays Africa:

When the Expense Billing batch job runs and the value for Formula Applied to is SUM ASSURED, the system will read the value for the latest Member Values record for the Membership with a Type ASSURANCE DETS and Sub Type SUM ASSURED and an Effective Date less than or equal to the Expense Billing run To Date.

If the Frequency is ADHOC, the system will find the Memberships for which the CAR Start Date is less than or equal to the Expense Billing To Date and greater than or equal to the Expense Billing From Date i.e. only calculate the expense once off in for the month when the policy started.

The system will apply the To Amount and From Amount in the Scale linked to the Expense Rule (JU1DZ Expense Rule Scale screen)to the Sum Assured value.

Unitised Portfolios

For unitised portfolios, Expense Billing will create a BT in the Member’s INVESTMEMB account and the BT in the Member’s INVSTMEMUNIT account will be created by UNITISATION when the unit price is available.

If there is a change in the unit price and the market value is less than the market value that was calculated during the Expense Billing run, it would result in a negative balance in the Member’s INVSTMEMUNIT account. However the Unitisation batch job will not create the negative unitisation BT (UNITISATNEG) and will write a message to the Error Log. This is done to ensure that no negative unit balances are created on investment accounts.

For annuitants where the annuitants are being paid from a Retirement Fund or from a stand-alone Annuity Fund, then when the BJU3BH Expense Billing batch job runs:

If there is an Expense Type for the Scheme with an Expense Rule with a value for Formula Type of AMOUNT and a value for Formula Applied to of ANNUITY TYPE, the system will find the Memberships with a Membership Status of ANNUITANT or LIVING ANNUITY and find the latest Membership Payment Detail record with an Effective Date less than the run Effective Date and linked to a Membership Payment record with a Benefit Type Code equal to the Expense Type Code and the Membership Payment Detail records for the Beneficiaries linked to a Membership. The system will read the value on the Scale linked to the Expense Rule and calculate a fee equal to the value found, for each Membership Payment Detail record.

If there is an Expense Type for the Scheme with an Expense Rule with a value for Formula Type of PERCENTAGE and a value for Formula Applied To of ANNUITY TYPE, the system will find the latest Membership Payment Detail record with an Effective Date less than the run Effective Date and linked to a Membership Payment record with a Benefit Type Code equal to the Expense Type Code and for which the End Date is null or greater than the run Effective Date and a Membership Payment Detail records for the Beneficiaries linked to the Membership.

The system will read the Scale with a Type of Scale equal to FREQUENCY linked to the latest Expense Rule with an Effective date less than or equal to the run Effective Date.

If the Payment Frequency on the Membership Payment Detail record is MONTHLY, the system will read the Scale with a Type of Factor equal to MONTHLY and read the values for Percentage and Factor and calculate a fee for each Membership Payment Detail record as follows:

Regular Payment Amount x Percentage / 100 / Factor

If the Payment Frequency is ANNUAL, the system will calculate the fee as follows:

Regular Payment Amount x Percentage / 100 / 12 / Factor

If the Payment Frequency is BI-ANNUAL, the system will calculate the fee as follows:

Regular Payment Amount x Percentage / 100 / 6 / Factor

If the Payment Frequency is QUARTERLY, the system will calculate the fee as follows:

Regular Payment Amount x Percentage / 100 / 4 / Factor

The fee must be calculated irrespective of the Status of the Membership Payment Detail record i.e. include the records for which the Status is SUSPENDED.

For more information, refer to

Processes

Expense Billing

New

Capital budget

When the JU3BH_BILL Expense Billing batch job is run the system will read the Expense Rules for the Expense Types for which the Global Group Type is CAPITAL BUDGET in addition to the Expense Types currently included in the Expense Billing batch job.

Where there is a Rate Table Type on the Expense Rule and there is a value for Maximum on the Scale linked to the Rate Table, the Member expense will be calculated based on the Expense Rule and the Scale. If the value calculated is greater than the value for Maximum on the Scale, the calculated value will be set to the Maximum value.

Similarly if there is a value for Minimum on the Scale and the calculated value is less than the value for Minimum on the Scale, the calculated value will be set to the Minimum value.

If the Calculation Method is CAPITAL BUDGET, the system will retrieve the BT’s in the Member’s CAP BUDGET account with a Due Date greater than the first day of the current year. If no BT is found, a value will be calculated for the Membership and proportioned for the period from the Membership CAR Start Date to the last day of the current year as follows:

Calculated value / 12 x number of months from CAR Start Date to last day of current year

If the Global Group Type for the Expense Type is CAPITAL BUDGET, Business Transactions (BT’s) will be created with the MEMBERBUDGET Accounting Activity. A Fund level BT will not be created.

For details of the calculation and processing for Expense Billing using the JU3BH_BILL Expense Billing batch job, refer to Processing under

Processes

Expense Billing

New

Click processes, and then click expense billing.

The following screen is displayed.

Select Expense Billing from the top menu.

The following sub-menu will be displayed on the left.

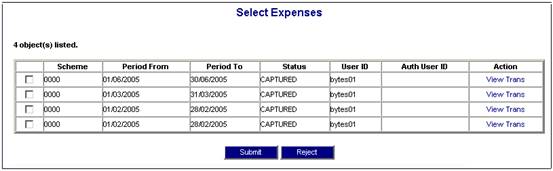

This menu option displays a list of all records that are ready for authorisation (i.e. where STATUS = CAPTURED).

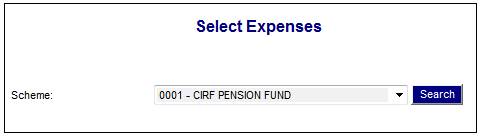

On the menu, select Select Expenses from the sub-menu on the left. The Select Expenses screen will be displayed.

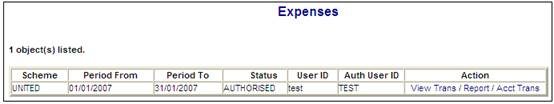

Select a scheme from the drop-down box, and then click SEARCH. The Select Expenses screen will be displayed.

To view all transactions affected by the batch selection created on the batch schedule, click View Trans in the Action column alongside the required line. The View Transactions screen will be displayed.

This spreadsheet can be emailed to an email address.

You have the option to reject the expenses.

To create the accounting transactions generated by the batch run, on the Select Expenses screen tick the box alongside Scheme on the relevant line. You can tick the box for all the batches you have created.

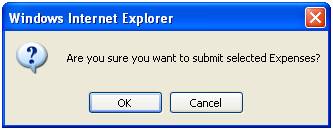

Click SUBMIT. A confirmation message will be displayed.

Click OK to confirm.

On successful completion, the status will be set to PRE AUTH (i.e. ready for authorisation), and the data will no longer be displayed under Select Expenses.

Log in to the system from the Logon page.

Click processes, then click expense billing.

The following screen is displayed.

Select Expense Billing from the top menu.

The following sub-menu will be displayed on the left.

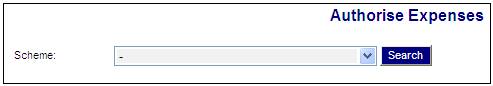

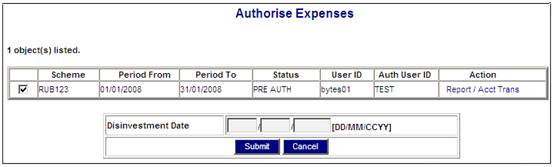

Select Auth Expenses from the sub-menu on the left. The Authorise Expenses screen will be displayed.

Select a scheme from the drop-down box, and then click SEARCH. The Authorise Expenses screen will be displayed.

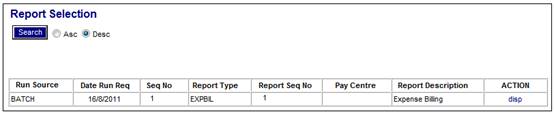

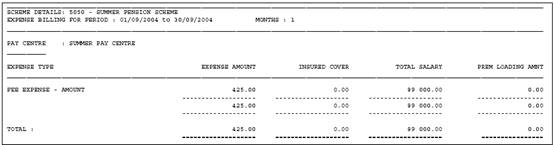

To see a summarized list per organization unit per expense type for the selected period, click Report in the Action column alongside the required line.

The Report Selection screen will be displayed with a list of all available reports.

A list of all available reports will be shown. Click disp in the Action column alongside the required line. The Expense Billing report will be displayed in PDF format.

Note:

The Expense Type column will display the scheme expense type description.

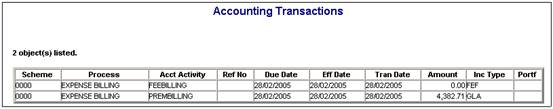

To view a list of all accounting transactions generated when submitting expenses under Select Expenses, from the Expenses screen click Acct Trans in the Action column alongside the required line. The Accounting Transactions screen will be displayed.

To authorise the expense billing tick the box alongside Scheme on the relevant line, then click SUBMIT.

If the member level transactions criteria were set as YES when scheduling the batch run , input fields will be displayed to enable you to provide the disinvestment date. For this process, the date will default to current date.

ClickSUBMIT. A confirmation message will be displayed.

Click OK to confirm. On successful completion, status will be set to AUTHORISED.

After the income has been authorised, an accounting transactions to facilitate the payment of the expense, can be created.

Log in to the system from the Logon page.

Click Accounting.

The Welcome screen will be displayed.

From the main menu on top, select Transaction Capture.

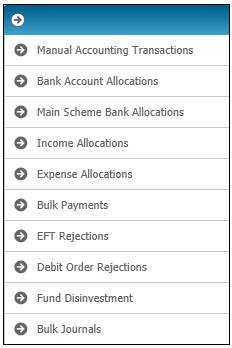

A sub-menu will be displayed on the left.

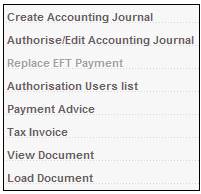

Select Manual Accounting Transactions from the sub-menu on the left.

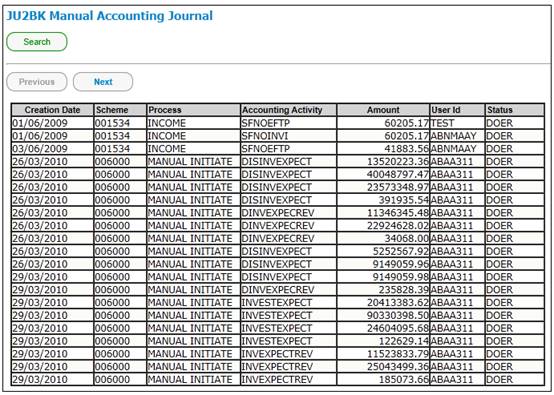

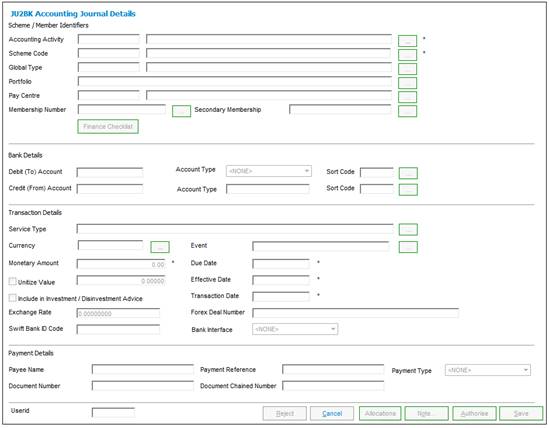

The JU2BK Manual Accounting Journal screen will be displayed.

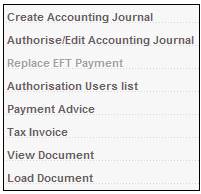

Select Create Accounting Journal from the menu on the left.

The JU2BK Accounting Journal Details screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Scheme / Member Identifiers |

|

|

|

Accounting Activity |

The code and process associated to the selected accounting activity.

Click the LIST button at the end of the line and select FEESPAID. |

|

|

Scheme Code |

The code and name of the selected scheme. |

|

|

Global Type |

The code and description of the selected global type. E.g. ADM for Admin.

This field is mandatory for this particular transaction. |

|

|

Portfolio |

The selected portfolio |

|

|

Bank Details |

|

|

|

Debit (To) Account |

For EFT payments. The account into which the money is to be transferred. |

|

|

Credit (From) Account |

For cheque payments and EFT’s. The account out of which the money is to be paid. |

|

|

Transaction Details |

|

|

|

Currency |

ZAR. |

|

|

Monetary Amount |

The total of the business transaction. |

|

|

Due Date |

The date on which the transaction should have occurred. |

|

|

Effective Date |

The date on which the financial implication of the transaction was expected or required to take effect. |

|

|

Transaction Date |

The date on which the business event occurred (e.g. date of deposit). |

|

|

Payment Details |

|

|

|

Payee Name |

Payee Name. |

|

|

Payee ID Number |

The identity number of the payee in the case of a natural person. |

|

|

Payment Type |

EFT. |

|

|

Document Number |

Automatically generated. |

|

|

Userid |

User ID of person capturing payment. |

|

Once all the required information has been completed, click SAVE.

If the Account Number Format specified for the selected Bank is numeric and text characters have been captured in the Account Number field, the following error message will be displayed:

The Account number is not numeric.

Click OK to remove the message and capture a numeric Account Number.

Note:

For foreign bank accounts, the bank account number field must allow for text characters.

For more information refer to

Infrastructure

Systems Entities

Bank Structure

Capturing a Transaction on a Saturday

When SAVE is selected and one of the Accounts in the Accounting Rule linked to the Accounting Activity selected is INVESTMEMB or INVSTMEMUNIT, or if the Money Movement Indicator on the Accounting Activity is Y and the Payment Method is EFT, the existing Transaction Date validation will be applied, i.e. if the Status of the Date on the Calendar is WEEKEND or PUBLIC HOLIDAY, an error message will be displayed.

For all other Accounting Activities, the system will read the Status on the Calendar for the Date equal to the Transaction Date, and if it is WEEKEND, will check if the Date is a Saturday. If it is, the journal will be enabled to be saved.

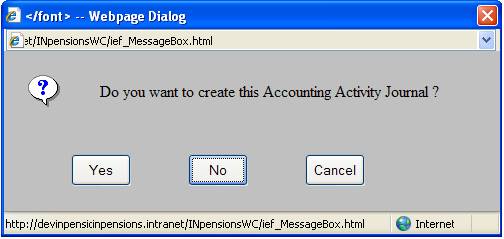

When SAVE is selected on the JU2BK Accounting Journal Details screen, and all validation requirements have been met, the following confirmation message will be displayed:

Do you want to create this Accounting Activity Journal?

Click YES to confirm that the Accounting Activity Journal must be created or click NO or CANCEL to remain on the JU2BK Accounting Journal Details screen.

This is now available for authorisation.

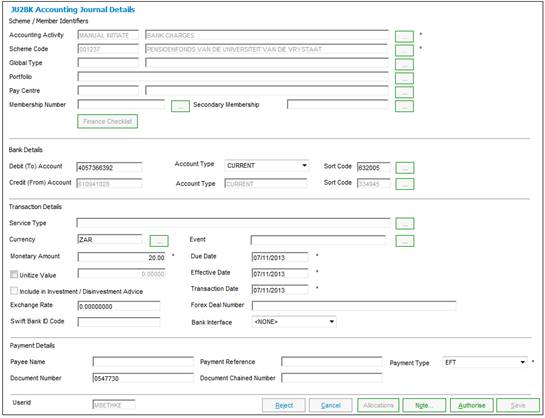

Highlight the relevant transaction and select Authorise/Edit Accounting Journal from the sub-menu on the left.

The JU2BK Accounting Journal Details screen will display.

On this screen you will have the option to authorise or reject the payment.

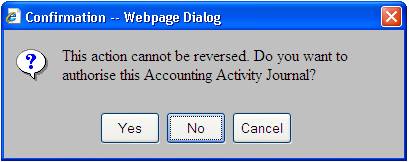

When AUTHORISE is selected, the following warning message will display:

Click YES and the transaction will be authorised

The status of this transaction will now be changes to AUTHORISED BT.

If the Money Movement Indicator on the Accounting Activity selected is Y and the Payment Method selected is EFT, the system will read the value for Description on the Global Parameter with a Parameter Type of EFT CUT-OFF.

If the current time is greater than the value found and the Transaction Date is equal to the current date current date, the following message will be displayed:

It is after the cut-off time for EFT payments. The transaction date will be set to the next working day

When the OK button is selected on the message, the Business Transaction will be created with the Transaction Date and Effective Date equal to the next working day.

If the Transaction Date is less than current date, the following error message will be displayed:

The transaction date must be equal to current date or greater than current date.