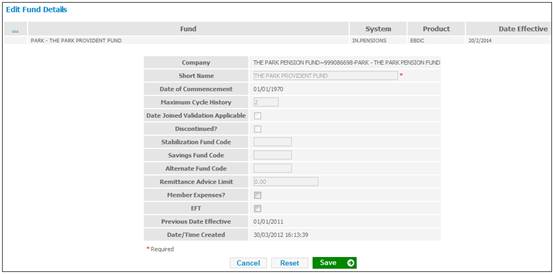

From the Fund Details List screen, click Edit at the end of the required line. The Edit Fund Details screen will be displayed.

This screen allows values for certain fields to be updated.

Some products may have separate codes for employee and employer contributions (e.g. employee contributions may go to a pension product while employer contributions go to a provident product). In order to avoid the duplication of submitting a payroll file for each product, a facility exists to allocate each set of contributions into the relevant products. This is done by setting an alternate product code.

Alternate product codes are relevant only in cases where payroll files are loaded, and will have the following effects:

- the employer contributions (RCS) are loaded to the main product, and the employee contributions (ECS) are loaded to the alternate product code

- if there are new entrants on the payroll file, they will be loaded to both the main product and the alternate product code

Expenses usually come from the main product.

From the Fund Details List screen, click Edit at the end of the required line. The Edit Fund Details screen will be displayed.

Enter the alternate product code, then click SAVE.

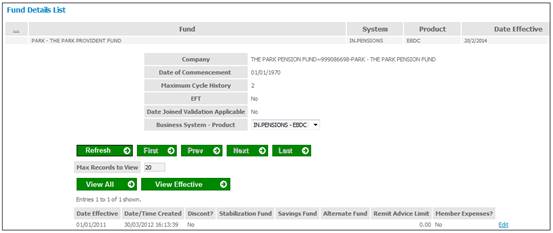

The Fund Details List screen will be re-displayed, and the alternate product code will appear in the relevant column.

This completes the product launch process and the system is now ready for the first update cycle to begin.

You will be able to upload the payroll file with fees and premiums regardless of whether the Member Expenses Flag is ticked or not. However, the Member Expenses Flag must be ticked in order for the expenses to automatically be calculated by the remittance.

Note:

When the Member Expenses Flag is ticked, the remittance will still override the values loaded.