From the Structure sub-menu on the left, select Accounting Activity.

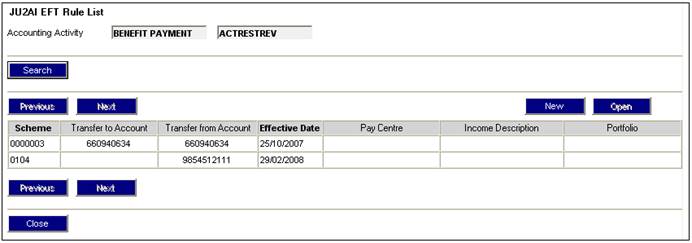

The JU2AI EFT Rule List screen will be displayed.

Note:

EFT Rules also apply to Cheque Payments. The ‘from’ account that will be debited for cheque payments must be defined. It also applies to the recording of deposits in a bank account.

Purpose:

Read and display all the records of EFT Rule associated with the selected Accounting Activity, and all subjects, i.e. combinations of association of Portfolio, Scheme Income Type and Client Data Site (CDS) with this particular Scheme / EFT Rule association. EFT Rules display when the Discontinue Date is not less than Current Date. The displayed list can be modified by including a "Scheme Code" starting value and/or filter value.

Definition:

An EFT Rule defines the bank accounts to be used in creating a Money Movement Instruction (EFT or Cheque) as a result of the occurrence of an Accounting Activity. It also defines the bank account to be used for recording deposits. (EFT = Electronic Fund Transfer)

Navigation:

This screen is called from the JU2AF Accounting Activity List screen via the EFT Rules menu selection to maintain the EFT Rule occurrences for the selected Accounting Activity.

Screen Pushbutton Functions

|

New |

Flows to the EFT Rule Details dialog box to insert a new record for the selected Accounting Activity The list is refreshed after creation of the new record. |

|

Open |

Flows to the EFT Rule Details dialog box to Update/Discontinue the record selected. The list is refreshed after update. |

|

Close |

Closes the screen displayed. |

|

Search |

Opens the JU2AI Search Criteria box to allow the search criteria to be entered. Search criteria for the list include a "starting" Scheme Code value and/or a "filter" Scheme Code value. |

|

Previous |

Displays the previous list screen. Enabled if rows exist prior to the current screen. |

|

Next |

Displays the next list screen. Enabled if rows exist after the current screen. |

Notes:

- The EFT rules are very specific to the Scheme and any combination of Portfolio, Scheme Income Type and/or Pay centre. An EFT is always associated with a Scheme. The other associations are optional and are determined by the indicators on the Accounting Activity.

- This activity is performed by an authorized "super user".

- Once an instance of EFT Rule has been created, it may not be deleted (and there is no delete facility) but may only be discontinued.

Note:

Once there is an EFT Rule for an Accounting Activity, it will not be able to be overridden. If accounting transactions must be created using a different Bank Account, a different Accounting Activity should be used. The old bank account can then be linked to this Accounting Activity via the EFT Rule. It is recommended that Manual Initiate Accounting Activities are used for manual accounting journals so that it is clear from the Process on the BT that the transaction was created manually.

- The above Menu actions are available to authorized users only

- Currently the following accounting activities require an EFT rule (bank account rule). This list could change as accounting activities are added or discontinued, and as the client configures the rules of these accounting activities:

|

Process |

Accounting Activity |

|

|

EFT Rules |

|

|

|

INCOME |

SFEFTPAY |

FROM ACC & TO ACC |

|

INCOME |

SFFEEIN |

FROM ACC & TO ACC |

|

INCOME |

SFFEEOUT |

FROM ACC & TO ACC |

|

INCOME |

SFINVIN |

FROM ACC & TO ACC |

|

INCOME |

SFPRMIN |

FROM ACC & TO ACC |

|

INCOME |

SFPRMOUT |

FROM ACC & TO ACC |

|

INCOME |

EXITCONEFT |

FROM ACC & TO ACC |

|

Bank Account Rules |

|

|

|

BENEFIT PAYMENT |

BENPAYEPAY |

TO ACCOUNT |

|

BENEFIT PAYMENT |

BENTRANSFER |

TO ACCOUNT |

|

BENEFIT PAYMENT |

BENPAYAMNT |

TO ACCOUNT |

|

MANUAL INITIATE |

BANKCHARGES |

TO ACCOUNT |

|

MANUAL INITIATE |

BANKINTEREST |

FROM ACCOUNT |

|

MANUAL INITIATE |

BENPAYEPAYRE |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPOSITALLOC |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPALLOCREV |

TO ACCOUNT |

|

MANUAL INITIATE |

DEPDISINV |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPOSITCONTR |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPCONTRREV |

TO ACCOUNT |

|

MANUAL INITIATE |

DEPOSITFEES |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPFEESREV |

TO ACCOUNT |

|

MANUAL INITIATE |

DEPOSITPREM |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPPREMREV |

TO ACCOUNT |

|

MANUAL INITIATE |

DEPCOVERRREC |

FROM ACCOUNT |

|

MANUAL INITIATE |

DEPCOVERREV |

TO ACCOUNT |

|

MANUAL INITIATE |

INVESTMENT |

TO ACCOUNT |

|

MANUAL INITIATE |

MISCFUNDEXP |

TO ACCOUNT |

|

MANUAL INITIATE |

FEESPAID |

TO ACCOUNT |

|

MANUAL INITIATE |

PREMIUMPAID |

TO ACCOUNT |

|

MANUAL INITIATE |

MISCFUNDINC |

FROM ACCOUNT |

|

MANUAL INITIATE |

PAYMENTALLOC |

TO ACCOUNT |

|

MANUAL INITIATE |

RFTPAY |

TO ACCOUNT |

A bank account rule must be captured in all cases where the Process is not Manual Initiate.

For the Manual Initiate accounting activities, if a bank account rule is not captured then every time a manual accounting activity journal is processed using one of these accounting activities the relevant bank account must be selected. If a bank account rule has been captured the bank account will be selected automatically according to the bank account rule.

Rules must be captured for the accounting activities listed under EFT Rules. These rules define the internal and external bank accounts between which money will be transferred via electronic fund transfer (EFT) on a regular basis. In these cases EFT’s will always take place according to these pre-defined rules. One of the accounts, depending on whether money is being transferred in or out of the scheme’s bank account, will also define the bank account that must be credited or debited in the scheme's ledger.

EFT Rules can be specific to an Income Type. For example, if SFPRMOUT is set up, then for Risk Premiums, a separate EFT Rule can be set up for each Income Type:

- Group Life Assurance premiums to Insurer 1

- Disability premiums to Insurer 2

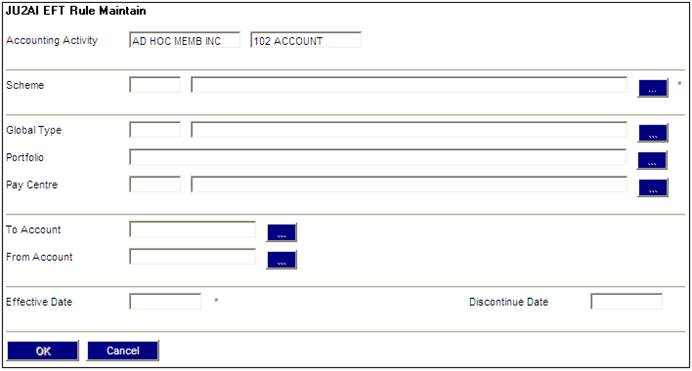

Purpose:

Facilitates the creation, update or display of the EFT Rule record associated with a selected Accounting Activity. The screen displays the parent Accounting Activity, associated Scheme and any linked subjects (i.e. combinations of EFT Rule associations, Income Type, Portfolio and CDS ) including existing values of remaining attributes for this EFT Rule.

Navigation:

Called from the JU2AI EFT Rule List screen.

Screen Field Definitions

|

Accounting Activity |

Process and Accounting Activity Code identifies an Accounting Activity, e.g. Benefit Payment/ Allocate PAYE TAX |

|

Scheme Code |

A unique identifier for a Scheme. Mandatory, Select from List. The Scheme Registered Name will be displayed |

|

Global Type |

Relationship to Global Type. Value displayed is derived from Lookup Table. Default:<None>. |

|

Portfolio |

Relationship to Portfolio. Value displayed is derived from Lookup Table. Default:<None>. |

|

Pay centre |

Relationship to Pay centre. Value displayed is derived from Lookup Table. Default:<None>. Select from List. The Pay Centre and Pay centre Site Name are displayed. Note: The system determines via the Rules in Accounting Activity and Qualified By Code whether the value is Mandatory or Optional. |

|

To Account |

The Account code where the Money must be moved to. When using this Rule in the creation of a Business Transaction and Money Movement Instruction, if this value is not supplied here, the Process initiating an Accounting Activity Occurrence must supply the "To Account" (e.g. with the Payment of a Member Benefit). If the Process does not supply it in such a case, the Payment Type must be by Cheque, otherwise the "Create BT " Process will reject. Optional, Number,Length:16, Decimal places:0 Default: <None> |

|

From Account |

The Account code where the Money must be moved from. When using this Rule in the creation of a Business Transaction and Money Movement Instruction, if this value is not supplied here, the Process initiating an Accounting Activity Occurrence must supply the "From Account". If the Process does not supply it, the "Create BT " Process will reject. Optional,Number,Length:16 Decimal places:0 Default: <None> |

|

Effective Date |

The date when the EFT becomes effective. Mandatory, Date, Length:8, Default:<None> |

|

Discontinue Date |

The end date of this EFT Rule. Optional, Date, Length: 8 Default: <None> |

Screen Pushbutton Functions

|

Scheme Details |

Flows to the Scheme List screen to select a valid Scheme record. |

|

|

Global Type |

Flows to Global Type List screen to select a Global Type. |

|

|

Portfolio |

Flows to Scheme Portfolio List screen to select a Scheme Portfolio. |

|

|

Pay center |

Flows to CDS List screen to select a Pay center. |

|

|

To Account and From Account |

Flows to the Scheme DTI Account List screen to select a valid DTI account for To as well as From account. The "From" DTI account is mandatory. |

|

|

OK |

Saves the entered information. This pushbutton remains disabled until all mandatory fields on the screen are populated. |

|

|

Cancel |

Ignores any values entered on this screen and returns to the previous screen without refreshing the list. |

|

Notes:

- In an "Update", only the discontinue date is available for update, with all other screen fields remaining protected.

- Depending on the Accounting Activity indicators, the associations to the Portfolio, Scheme Income Type or pay center becomes mandatory and validation checks will be performed in this regard.

- When the Money movement creation process creates an EFT instruction and it is found that no DTI limits are set up for one of the accounts, it will be assumed that the Debit and Credit limits for the Mandate on this account are unlimited. The Mandate limit usage counters will not be updated in this situation as there is no need to test for the possible exceeding of the limits.

- When a line number is not supplied for a DTI-Account number (Bank Account), the account cannot be used as a "FROM" account in an EFT instruction. The reason is that the Banks are using Line-Numbers to identify and validate "FROM" accounts. In this case, when an Accounting Activity is transacted, using such a "FROM" bank account in the EFT-Rules with the "Payment Type" as "EFT", the Process creating the Money Movement/EFT Instruction will fail. This will cause the creation of the BT to fail as well. The process creating the Accounting Activity Transaction will be notified about the failure. (The message is "DEBIT DTI ACCOUNT NOT FOUND"). Only a cheque payment can be used against such an account. These values can be looked up in the Infrastructure DTI Accounts from the Main Menu.

- When OK is selected, the system will check whether, for the selected Accounting Activity, either of the following conditions apply:

- The FUND GLOBAL TYPE REQUIRED tick-box on the JU2AF Accounting Activity Details screen has been ticked

or

- The FUND GLOBAL TYPE REQUIRED tick-box on the JU2AF Accounting Activity Details screen has been deemed to have been ticked (i.e. the scheme is using an Accounting Rule Set where GLOBAL TYPE OVERWRITE = Y)

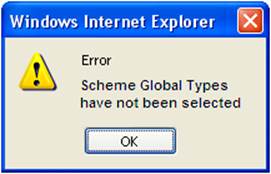

If either condition applies, and if OK is selected without any selection of SCHEME GLOBAL TYPES having been made, a message will be displayed.

Date Validation Checks.

- Effective Date cannot be less than current date (may be future dated).

- Discontinue Date cannot be less than current date (may be future dated).

- Discontinue Date cannot be less than Effective date.

- If Discontinue Date has a value greater than current date, then the Discontinue Date may be changed. If Discontinue Date has a value less than or equal to current date, then it may not be changed.

For more information on setting up a new EFT Rule, refer to

Supplements

Processes

Adding a new EFT Rule