This section explains the processing of debit orders for the amounts to be collected from members.

For details of the sequence of Batch jobs required to be run, refer to

Processes

Debit Orders

Debit Order Batch Processing

Log in to the system from the Logon page.

Click processes, then click debit orders.

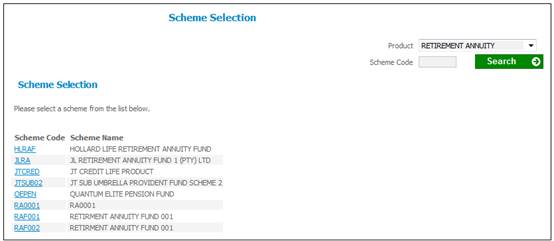

The Scheme Selection screen will be displayed.

To find a specific scheme, insert the scheme code (in full or partly) in the Scheme Code field and click SEARCH.

Select a product from the Product field drop-down list. Currently the following product selections may be made:

- ACTUARIAL

- ANNUITY FUND

- CREDIT LIFE

- BENEFICIARY FUND

- DEBIT ORDER UMBRELLA FUND

- ENDOWMENT

- INVESTMENT

- LIVING ANNUITY

- PRESERVATION FUND

- RETIREMENT ANNUITY

- RETIREMENT FUND

Note

Retirement Annuity schemes have a Type of Fund of RETIREMENT FUND and there is a Pay Centre for which the value for Collection Method is INDIVIDUAL DO

The schemes for the selected Product will be displayed for selection.

The Debit Orders sub-menu will be displayed on the left.

The current type of run (TOR) is indicated in brackets.

The following menu items are displayed on the menu on top for selection:

- Captured

- Processed

- Authorised

- Rejected

- New

- Batch

- System Management

Note:

Transactional security is applied when any of these menu options is selected. If the User is not authorised for the transaction, the following message will be displayed on the screen:

Access Denied.

To select a different scheme, click Scheme Selection above the main menu on the top.

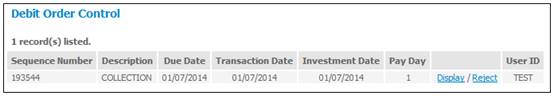

Select New from the menu on the top. The Debit Order Control screen will be displayed.

A sub-menu will be displayed on the left.

The available pay centres can be filtered based on the payment method, and the display of the pay centres can be sorted.

To filter the pay centres, select EFT,Cheque or All from the sub-menu on the left. Only pay centres with the selected payment method will be displayed.

Note:

The payment method is determined from the Collection Instruction Details screen. Refer to Add new instruction in Creating Collection Instructions under

Processes

Debit Orders

If there is no collection instruction, the payment method will be determined from the collection instruction details for the participating employer to which the pay centre is associated.

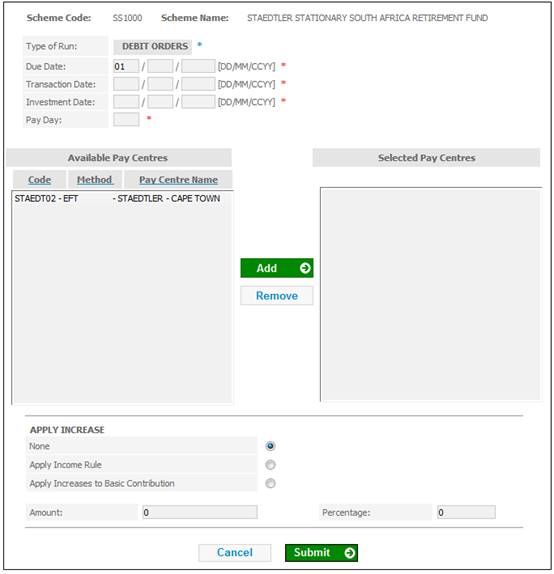

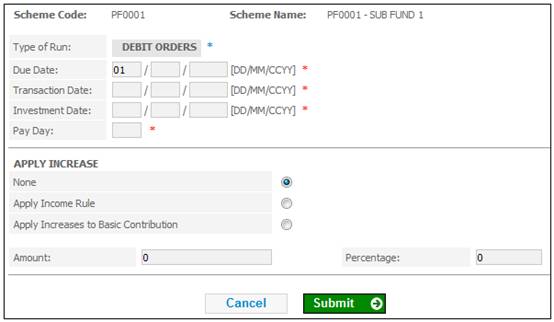

A screen will be displayed, allowing for the capture of data. This screen is used for the capturing of debit order information, and the creation of the debit order control record.

This screen will initiate batch runs that will:

– calculate the amounts to be collected from the members

– produce a report of the amounts that will be collected

– process the investment advice, member contribution transactions, investment transactions, fee transactions

– create the ACB file

To filter the pay centres again, select EFT,Cheque or All from the sub-menu on the left. All pay centres with the selected payment method will be displayed.

To sort the display of the pay centres, click the hyperlinked Column Heading for Code, Method or Pay Centre Name.

Descriptions of the input fields appear below:

|

Due Date |

The due date of the contributions. Note: This date is mandatory. |

|

Transaction Date |

The date of collection of the contributions. |

|

Investment Date |

The date the contributions are to be invested. |

|

Pay Centres |

The pay centres to which the debit order applies. |

|

APPLY INCREASE |

|

|

None |

No increase is applicable. |

|

Apply Income Rule |

The increase will be based on the income rule. |

|

Apply Increases to Basic Contribution |

The increase will apply to the basic contributions only. |

|

Amount |

The monetary amount of the increase (either an increase amount or an increase percentage may be captured, but not both).

Note: This field will be disabled if APPLY INCOME RULE is selected. |

|

Percentage |

The increase percentage (either an increase amount or an increase percentage may be captured, but not both).

Note: This field will be disabled if APPLY INCOME RULE is selected. |

To select a pay centre, highlight the required pay centre in the Available Pay Centres pane on the left and click ADD. The selected pay centre will be displayed in the Selected Pay Centres pane on the right.

To remove a selection, highlight the relevant pay centre in the Selected Pay Centres pane on the right and click REMOVE.

Note:

If no pay centres are specifically selected, all pay centres will be included by default.

Once all the necessary data has been completed, click SUBMIT.

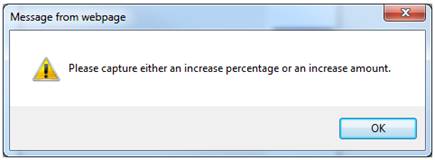

If you have indicated that increases are to apply to contributions, and no amount or percentage is provided (or both, an amount and a percentage are provided), and error message will be displayed.

Please capture either an increase percentage of an increase amount.

Click OK to remove the message and capture either an increase percentage of an increase amount.

Click SUBMIT.

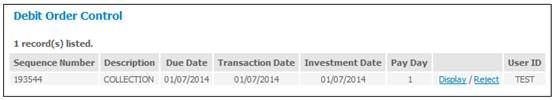

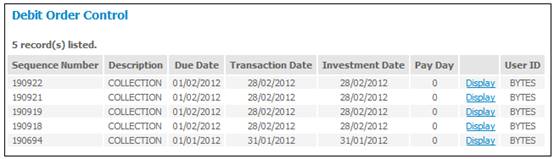

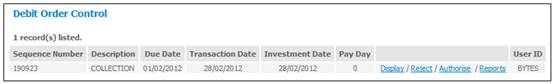

The Debit Order Control screen will be displayed.

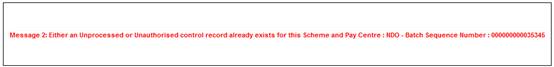

If an unprocessed or unauthorized record already exists, an error message will be displayed:

Either an Unprocessed or Unauthorised control record already exists for this Scheme and Pay Centre : NDO - Batch Sequence Number : xxxxxx

If you wish to process all pay centres without first listing them, select All EFT or All Cheque from the sub-menu on the left. Pay centres with the selected payment method will be selected for processing, but will not be displayed.

The following screen will be displayed:

Continue as described above (refer to Method 1 – display pay centres).

Processing

Apply Income Rule

When the BJU3BM Debit Order batch job runs and the Apply Income Rule tick box on the Debit Orders > New screen has been ticked, the system will read the Scheme Income Rule for the Income Types for which the value for Income Optionality is M (Mandatory) and Income Regularity is R (Regular), and for which the Group Type is CONTRIBUTION with an Effective Date equal to the Effective Date of the Debit Order run.

If found and the Formula Type is % OF SALARY, the system will calculate the Member’s monthly contribution amount based on the value for Percentage for the Income Rule and the Member’s salary as at the Debit Order run Effective Date.

The system will read the latest Actual Earning record with a Type of BASIC for each Member with an Effective Date less than or equal to the Effective Date of the run.

The contribution amount for each member will be calculated based on the Percentage on the Income Rule for the Contribution Membership Group to which the Member is linked and the Member’s Actual Earning Amount.

A Membership Payment record will be created for each contribution amount calculated with a Benefit Type equal to the Income Type.

A Membership Payment Details record will be created with a value for Regular Payment Amount equal to the contribution amount calculated.

Once Off Payment

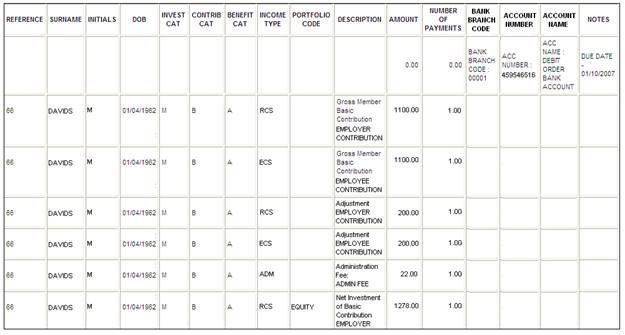

When the BJU3BM Debit Order batch job runs and a Membership Payment Detail record is found with a Frequency of ONCE-OFF and the Effective Date is less than or equal to the run date and the Date of Last Payment is null, the system will include the amount for each Income type in the Member Contribution Report with a Description of Adjustment followed by the Income Type Description. For more information, refer to Member Contribution Report above.

Net Income

When calculating the Net Investment Amount per Income Type, the system will add the Gross Member Basic Contribution amount and the Adjustment amount per Income type.

The system will read the Income Type to which the Income Rule for the Income Types for which the Group Type is FEE, RISK PREMIUM or COST RESERVE is associated and deduct the relevant fee or premium from the Income Type found. If no association is found, the fee or premium will be deducted from the Income Type with a Code of RCS as per current functionality.

Business Transactions (BT’s) will be created for the Adjustments (ONCE-OFF amounts) with the same Accounting Activity as per the regular payments per Income Type.

Adjustments will be included in the same Fund Level BT’s as the per the regular payments.

The system will sum all of the contribution amounts and include the adjustments, when calculating the Contribution amount for the Collection Instruction report.

For details of the sequence of Batch jobs required to be run, refer to

Processes

Debit Orders

Debit Order Batch Processing

New records that have been captured will remain available for viewing and rejecting until the batch run has been successfully completed.

To view records that have already been captured, from the menu on the top, select Captured. The Debit Order Control screen will be displayed.

To view the original input screen click Display alongside the required record.

To reject a record, click Reject alongside the relevant record. The Debit Order Control screen will be displayed, and the rejected record will be listed together with any other records that have been rejected. Refer to Rejected below.

You can view rejected records.

From the menu on the top, select Rejected. The Debit Order Control screen will be displayed.

To view the original input screen click Display alongside the required record.

A batch job for debit order processing must be initiated.

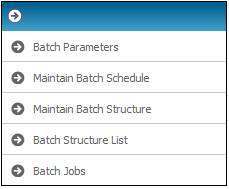

Select Batch from the menu on the top.

A sub-menu will be displayed on the left.

Note:

The Batch menu and these sub-menu items are also available for selection under Infrastructure > Batch

For more information on these menu items, refer to

Infrastructure

Batch

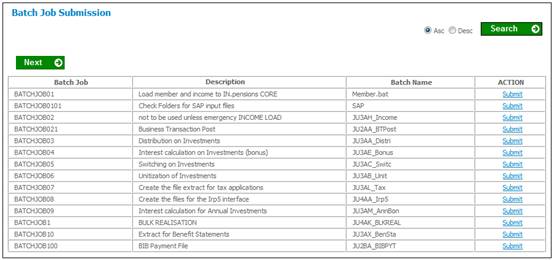

To submit a batch run job, select Batch Jobs from the sub-menu on the left.

The Batch Job Submission screen will be displayed.

If the Product is DEBIT ORDER UMBRELLA FUND, locate the JU3BM_UMBR batch job from the list:

![]()

If the Product is RETIREMENT ANNUITY, locate the JU3CM_INDDO batch job from the list:

![]()

To initiate the batch job, click Submit in the Action column.

Processing for Individual Debit Orders

JU3CM_INDDO batch job is scheduled to run every day to find the individual debit orders for collection. The system will read the Membership Payment Details records for the Memberships linked to a Pay Centre for which there is a Collection Instruction record with a Collection Method of INDIVIDUAL DO.

The system will read the value for Description on the Global Parameter with a Parameter Type of D/O RUN DAYS.

The system will find the Membership Payment records for which the value for Payment Day is equal to current date plus the number of working days equal to the value for the D/O RUN DAYS Global Parameter and if found create a Batch Control record with a Type of Run equal to DEBIT ORDERS and with an Effective Date equal to Pay Day (current date plus the number of working days equal to the value for the D/O RUN DAYS Global Parameter).

Note:

When the Debit Order Collection batch job runs, it will exclude Policyholders with a Membership Status of PARTIAL MATURITY.

If the Member’s Pay Day is equal to a date that is not valid for the current month, it will be set to the first valid day immediately prior to the Pay Day e.g. if Pay Day is 31 and the current month is June set the Member’s Pay Day to 30.

When the run has completed and Membership Payment Details records were found, a Service Request will be created.

Currently when the Debit Order Batch Job runs for an Individual Debit Order Scheme it reads for a Scheme or Global Parameter for PAIDUP NO PREMS and it calculates the number of payments for each member based on the Last Payment Date and if the number of Premiums is greater than the value of the Scheme or Global Parameter, it updates the Membership Status to DEFERRED with an Effective Date of Last Payment.

As this will already have been done in the Debit Order Rejection batch job a check needs to be performed to see if this has already been done. It will not always have been done as for some products the EFT rejections are processed via an Unpaid EFT file received from the bank and this functionality has not been built into that process at this stage.

If the Type of Fund for the Scheme is ENDOWMENT and the Country for the Scheme is not SOUTH AFRICA, the Membership Status will not be updated.

For more information refer to Processing under

Accounting

Transaction Capture

Debit Order Rejections

You are able to monitor the progress of the batch.

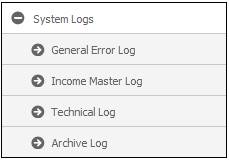

Under Infrastructure > System Management, click ![]() alongside System Logs on the sub-menu on the left. Additional options will be displayed.

alongside System Logs on the sub-menu on the left. Additional options will be displayed.

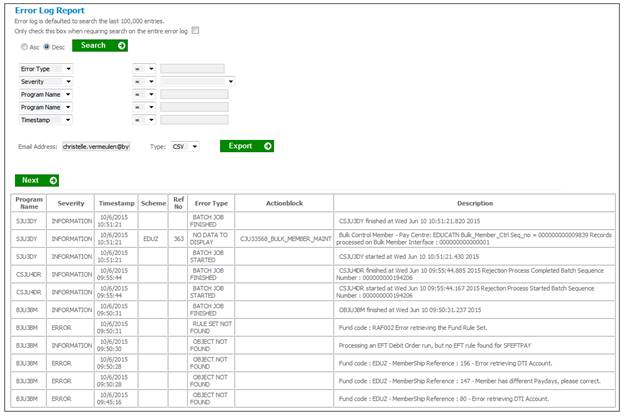

Select General Error Log from the menu at the top. The Error Log Report menu will be displayed on the left.

The following columns are displayed:

- Program Name

- Severity

- Timestamp

- Scheme

- Reference Number

- Error Type

- Action Block

- Description

Once the batch job has finished, return to the debit orders section on the web.

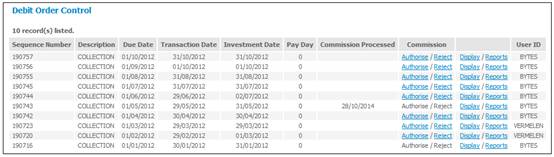

From the menu on the top, select Processed. The Debit Order Control screen will be displayed.

To view the original input screen click Display alongside the required record.

To reject a record, click Reject alongside the relevant record. The Debit Order Control screen will be displayed, and the rejected record will be listed together with any other records that have been rejected. Refer to Rejected above. A message will be displayed advising that the request should be monitored in the error log.

To authorise a record, click Authorise alongside the relevant record. The Debit Order Control screen will be re-displayed. Refer to Authorised below. A message will be displayed advising that the request should be monitored in the error log. Once the record has been authorised, the transactions will be created, and the ACB file will be written to a location on the application server as specified in the batch parameter.

When Authorise is selected on the Debit Order Control screen for a Type of Run of DEBIT ORDERS, and if the Transaction Date is equal to the current date, the system will read the value for Description on the Global Parameter with a Parameter Type of EFT CUT-OFF. If the current time is greater than the value found the following message will be displayed:

It is after the cut-off time for EFT collections. The transaction date will be set to the next working day

When the OK button is selected on the message, the Business Transactions will be created with the Transaction Date and Effective Date equal to the next working day.

When the batch control record has been authorised, batch job SJU4DR will be kicked off. This batch job creates all of the EFT transactions on the EFT instruction list.

Note:

When the Bureau Focus file is created for EFT collections for Debit Orders, the system will read the value for Description on the Global Parameter with a Parameter Type of EFT CUT-OFF. If the current time is greater than the value found and the Date Effective on the EFT Instruction is less than or equal to current date, the value for Action Date on the EFT file will be set to the next working day.

Note:

Comments pertaining to the batch parameter transaction codes appear below:

|

ACBDATE |

The last date that the ACB batch job processed. The process updates this date each time it runs. |

|

ACBFILE |

The location to where the ACB file is written. Should end with a backslash (\). |

|

ACBOPER |

Field no. 6 on the ACB header (last action date). |

|

ACBSEQNO |

Field no. 7 on the ACB header (first sequence number). The process updates this number each time it runs. |

|

ACBSERVTP |

Field no. 9 on the ACB header (type of service). |

|

ACBUSER |

Field no. 2 on the ACB header (user code). |

The name allocated to the file will be the current date plus the ACBSEQNO. The file extension will be TXT.

To view reports, click Reports alongside the required record. Refer to Reports below.

From the menu on the top, select Authorised. The Debit Order Control screen will be displayed.

The income has now been processed, and the ACB file has been created.

The system will update the FORMAT TYPE field on the JU2BM EFT Instructions List screen with an indicator to identify that the entry was created for the purpose of collections.

Initiate the JU3BU_COLL batch job. This job will write the accounting to the member record and create the fund level accounting.

The processing and authorization of commission must now be done.

The JU3BR_COMM batch job to process the commission billing must be initiated. This job collates all of the commission payable to the intermediaries and creates the commission reports.

Refer to Initiate batch run above. Locate the following batch job from the list:

![]()

To initiate the batch job, click Submit in the Action column.

Once the batch job has finished, return to the debit orders section on the web.

Records that are available for processing will have active hyperlinks in the Commission column.

To create commission transactions, click Authorise alongside the required record. The Debit Order Control screen will be displayed, and the authorised record will be listed together with any other records that have been authorised. The authorisation date will be displayed in the Commission Processed column. A message will be displayed advising that the request should be monitored in the error log.

Once the Commission Batch has been authorised, the batch job SJU4DR will be kicked off again to create all of the EFT transactions.

To reject the record, click Reject alongside the required record. A message will be displayed advising that the request should be monitored in the error log.

To view the original input screen click Display alongside the required record.

From the Debit Order Control screen, click Reports alongside the required record.

A sub-menu will be displayed on the left, and the available reports will be listed.

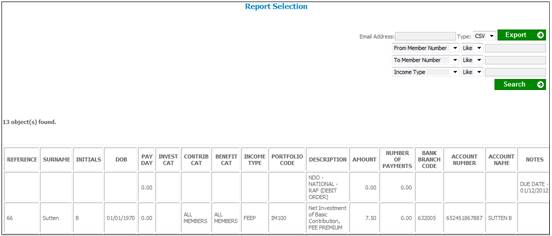

Member Contribution Report

Click Member Contribution Report on the sub-menu on the left.

The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme code

- Timestamp

- Date captured

- Report type

- Report sequence number

- Report Header sequence number

- Action

Display

Click display in the Action alongside the required report. The Report Selection screen will show the member contribution details.

The following columns are displayed:

- Reference number

- Surname

- Initials

- Date of birth

- Pay Day

- Investment category

- Contribution category

- Benefit category

- Income type

- Portfolio code

- Description

- Amount

- Number of Payments

- Bank Account Branch Code

- Bank Account Number

- Bank Account Name

- Notes

The report can be summarised using the following criteria:

- From Member Number

- To Member Number

- Income Type

Note:

Exited members (i.e. members for whom the benefit process has been started) are excluded from the collection process, and will therefore not appear on this report.

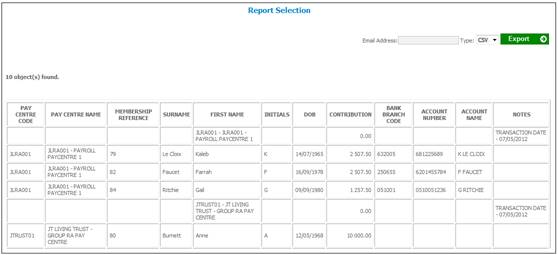

Collection Invoice

Click Collection Invoice on the sub-menu on the left.

The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme code

- Timestamp

- Date captured

- Report type

- Report sequence number

- Action

Click display in the Action alongside the required report. The Report Selection screen will show the collection invoice details.

The following columns are displayed:

- Pay centre code

- Pay centre name

- Membership reference

- Surname

- First name

- Initials

- Date of birth

- Contribution

- Payment Method

- Benefit Plan

- Contribution Plan

- Notes

When the Report is extracted, the Member’s bank account details will be displayed on each row for the Members on the Report.

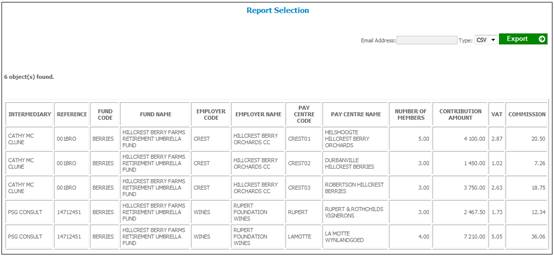

Commission Statement

Note:

This report will only be available if the commission batch job has been successfully run. If the pre-authorized run is subsequently rejected, the report will no longer be available.

Click Commission Statement on the sub-menu on the left.

The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme code

- Timestamp

- Date captured

- Report type

- Report sequence number

- Action

Click display in the Action alongside the required report. The Report Selection screen will show the commission statement details.

The following columns are displayed:

- Intermediary

- Reference

- Fund code

- Fund name

- Employer code

- Employer name

- Pay centre code

- Pay centre name

- Number of members

- Contribution amount

- VAT

- Commission

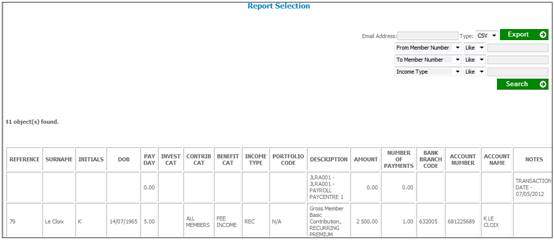

Member Contribution Report Individual

Click Member Contribution Report Individual on the sub-menu on the left.

The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme code

- Timestamp

- Date captured

- Report type

- Report sequence number

- Header sequence number

- Action

Display

Click display in the Action alongside the required report. The Report Selection screen will show the member contribution details.

The following columns are displayed:

- Reference number

- Surname

- Initials

- Date of birth

- Pay Day

- Investment category

- Contribution category

- Benefit category

- Income Category

- Portfolio Code

- Description

- Amount

- Number of Payments

- Bank Account Branch Code

- Bank Account Number

- Bank Account Name

- Notes

Note:

If the value for Collection Method on the Pay Centre is INDIVIDUAL DO then the option to select Pay Centre, Member or Income Type on the Report Selection screen will not be displayed.

Exited members (i.e. members for whom the benefit process has been started) are excluded from the collection process, and will therefore not appear on this report.

Collection Invoice Individual

Click Collection Invoice Individual on the sub-menu on the left.

The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme code

- Timestamp

- Date captured

- Report type

- Report sequence number

- Header sequence number

- Action

Click display in the Action alongside the required report. The Report Selection screen will show the collection invoice details.

The following columns are displayed:

- Pay centre code

- Pay centre name

- Membership reference

- Surname

- First name

- Initials

- Date of birth

- Contribution

- Bank Branch Code

- Account Number

- Account Name

- Notes

Commission Statement

Click Commission Statement on the sub-menu on the left.

The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme code

- Timestamp

- Date captured

- Report type

- Report sequence number

- Action

Click display in the Action alongside the required report. The Report Selection screen will show the collection invoice details.

The following columns are displayed:

- Intermediary

- Reference

- Fund Code

- Fund Name

- Employer Code

- Employer Name

- Pay Centre Code

- Pay Centre Name

- Number of Members

- Contribution Amount

- VAT

- Commission