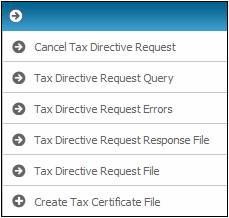

From the main menu on top, select Benefit Payments. A sub-menu will be displayed on the left.

Click ![]() alongside Create Tax Certificate File on the sub-menu on the left. Additional options will be displayed.

alongside Create Tax Certificate File on the sub-menu on the left. Additional options will be displayed.

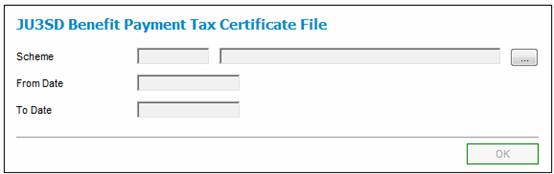

To define the parameters for the file extract, click New below Create Tax Certificate File. The JU3SD Benefit Payment Tax Certificate File screen will be displayed.

Capture details as follows:

|

Team |

Select a value from the drop-down box to define the Team. |

|

Scheme |

Click LIST to select a scheme from the JU1BK List screen. Enabled for all schemes or at a main umbrella scheme level. |

|

From Date |

The date from which the file extract must apply. |

|

To Date |

The date to which the file extract must apply. |

Once the data has been captured, click OK.

The system will read the TAX INTERFACE field on the Benefit Tax Directive Request. If the value is not SARS, the system will not extract the data from the Benefit Tax Directive table for the Member.

The system will read the Benefit Tax Directive table and extract the data as per the table below for the records for which the ISSUE DATE is less than or equal to the To Date and for which the IRP5 NUMBER is not null, the Type of Certificate is IRP5 or IT3(A) and the REQUEST STATUS is 07.

When the data has been successfully extracted the REQUEST STATUS will be updated to Z.

For the Scheme Code equal to the value for FUND NUMBER on the Benefit Tax Directive table the system will read the value for Description on the Scheme Parameter with a Parameter Type of TAX ENTITY.

Separate CSV files will be created for each group of records for which the Description on the TAX ENTITY Scheme Parameter is the same i.e. a file will be created for the records for which the TAX ENTITY Scheme Parameter Description is ADMINISTRATOR and a file for the records for which the TAX ENTITY Scheme Parameter Description is SCHEME.

Note:

A separate file will be created per employer.

In the context of retirement funds, the equivalent of Employer is either the Administrator or the Scheme. This varies per administrator and on the type of fund i.e. insured fund or private fund and therefore it is necessary to define how this is to be processed per Scheme.

In the file header, the name of the Employer (Administrator or Scheme) is defined as Trading or other Name (see Code 2010 in file layout below). Where the Scheme is Sub-Umbrella fund the Main Umbrella fund will be used as the equivalent of Employer i.e. The Main Umbrella fund Name must be supplied for Trading or Other Name.

The file will be created with a name as per the format below.

Each of the fields in the file will be created with the Code in the table below followed by a comma and the value for the field e.g. the value for PAYE Reference Number will be 2020,0123456789.

Any Alpha, Alpha Numeric or Free Text fields (Indicated by A, AN or FT in the table below) will be contained in opening and closing quotation marks e.g. the value for Employer Contact Person will be 2025,”AB Normal”.

Where there is a value in the Update Field column in the table below, the field on the Benefit Tax Directive record indicated with the value in the table will be updated if it is new or different.

Note:

The values in the Update Field column are for values that will not have been stored when the IRP5 or IT3(A) certificates were created or are different.

CSV File Example:

2010,"PDNA Group Pension Fund",2015,"TEST",2020,7640753986,2022,"L640753986",2024,"U640753986" 2025,"LeandraScholtz",2026,"0415038614",2027,"[email protected]",2028,"Easy-Tax",2030,2011,2031, 201102,2035,2522,2063,"Cnr",2064,"nk and Parliament Streets",2065,"Central",2066,"Port Elizabeth", 2080,6001,9999

3010,"764075398620110200000000000006",3015,"IRP5",3020,"N",3025,2009,3030,"NOTHARD",3040, "BARRY",3050,"B",3060,6203085134082,3080,19620308,3100,1954015200,3160,"270",3170,20080930,3180,20080930,3200,1.0000,3210,1.0000,3213,"2",3214,"STATION ROAD",3215,"AXBRIDGE",3216, "SOMERSET",3217,"2000",3221," 2",3222,"STATION ROAD",3223,"AXBRIDGE SOMERSET",3229,"2000" ,3230,"0000010398273",3240,0,3909,19903,3698,19903,4101,0.00,4102,7961.22,4141,0.00,4142,0.00,4149,7961.22,9999

3010,"764075398620110200000000000008",3015,"IRP5",3020,"N",3025,2011,3030,"DOMANCIUC",3040, "NATALIA",3050,"N",3060,7112090784188,3080,19711209,3100,3035315146,3160,"1000032",3170,20100514,3180,20100514,3200,1.0000,3210,1.0000,3213,"63",3214,"KEI ROAD",3215,"FARRARMERE",3216, "BENONI",3217,"1501",3221," 63",3222,"KEI ROAD",3223,"FARRARMERE BENONI",3229,"1501",3230, "0000010546352",3240,0,3920,44283,3698,44283,4101,0.00,4102,0.00,4115,3920.98,4141,0.00,4142,0.00,4149,3920.98,9999

3010,"764075398620110200000000000014",3015,"IRP5",3020, "N",3025,2008,3030,"KROONEMAN",3040, "JEANPAUL BERNARD LOUIS",3050,"JBL",3060,6306275721087,3080,19630627,3100,0167363175,3160, "1",3170,20070731,3180,20070731,3200,1.0000,3210,1.0000,3213,"3",3214,"FULHAM ROAD",3215, "CAMPS BAY",3216,"CAPE TOWN",3217,"8005",3221," 3",3222,"FULHAM ROAD",3223,"CAMPS BAY CAPE TOWN",3229,"8005",3230,"0000010688126",3240,0,3902,3623,3698,3623,4101,0.00,4102,362.93, 4141,0.00,4142,0.00,4149,362.93,9999

3010,"764075398620110200000000000033",3015,"IRP5",3020, "N",3025,2011,3030,"XHAKAZA",3040, "SABELO MAXWELL",3050,"SM",3060,7709305485087,3080,19770930,3100,0078361151,3160,"162", 3170,20100729,3180,20100729,3200,1.0000,3210,1.0000,3214,"UNIT 4",3215,"CANTEBURY BELLE", 3216,"DURBAN",3217,"4001",3221," ",3222,"UNIT 4",3223,"CANTEBURY BELLE DURBAN",3229,"4001", 3230,"0000010825555",3240,0,3920,84446,3698,84446,4101,0.00,4102,0.00,4115,11150.33,4141,0.00,4142,0.00,4149,11150.33,9999

3010,"764075398620110200000000000035",3015,"IRP5",3020, "N",3025,2008,3030,"KHAMA",3040,"TEFO ABEL",3050,"TA",3060,7703225276080,3080,19770322,3100,2735252146,3160,"204",3170,20071231,3180,20071231,3200,1.0000,3210,1.0000,3214,"UNIT NO 2",3215,"2044 MARULA STREET",3216, "CENTURION",3217,"0157",3221," ",3222,"UNIT NO 2",3223,"2044 MARULA STREET CENTURION",3229, "0157",3230,"0000010834259",3240,0,3902,3275,3698,3275,4101,0.00,4102,275.83,4141,0.00,4142,0.00,4149,275.83,9999

3010,"764075398620110200000000000037",3015,"IRP5",3020, "N",3025,2011,3030,"MASOOA",3040, "MOTHOANA FRANCIS",3050,"MF",3060,7403295349087,3080,19740329,3100,1589029147,3160,"63", 3170,20100810,3180,20100810,3200,1.0000,3210,1.0000,3214,"7 WINCLIFF COMPLEX",3215,"DUKES AVENUE",3216,"WINDSOR WEST",3217,"2194",3221," ",3222,"7 WINCLIFF COMPLEX",3223,"DUKES AVENUE WINDSOR WEST",3229,"2194",3230,"0000010859035",3240,0,3920,67425,3698,67425, 4101,0.00,4102,0.00,4115,8086.56,4141,0.00,4142,0.00,4149,8086.56,9999

3010,"764075398620110200000000000039",3015,"IRP5",3020, "N",3025,2009,3030,"POTGIETER",3040, "ALLEN",3050,"A",3060,6009295310085,3080,19600929,3100,1543203648,3160,"108",3170,20080630,3180,20080630,3200,1.0000,3210,1.0000,3214,"8 WINELANDS ESTATE",3215,"PAARL",3216,"WESTERN CAPE",3217,"7646",3221," ",3222,"8 WINELANDS ESTATE",3223,"PAARL WESTERN CAPE",3229,"7646", 3230,"0000010868967",3240,0,3909,203961,3698,203961,4101,0.00,4102,81584.62,4141,0.00,4142,0.00,4149,81584.62,9999

6010,8,6020,884359,6030,1080516.94,9999

|

Employer Information |

||||||

|

Field Name |

Code |

Size |

Format |

IN.sight value / Value |

Comment |

|

|

Trading or other name |

2010 |

90 |

FT |

If the value for Description on the Scheme Parameter with a Parameter Type of TAX ENTITY is ADMINISTRATOR populate this with the Administrator Name (NAME on ORGANISATION UNIT) If the value is SCHEME read the Pooling Status on the Scheme. If it is SUB-UMBRELLA then populate this with the REGISTERED NAME of the MAIN UMBRELLA Scheme to which the SUB-UMBRELLA Scheme is linked. If the Pooling Status is NONE then populate this with the REGISTERED NAME of the Scheme. |

Mandatory |

|

|

TEST / LIVE indicator |

2015 |

4 |

A |

TEST or LIVE |

Mandatory. TEST if the file is a test file or LIVE if it is a production file. |

|

|

PAYE Reference Number |

2020 |

10 |

N |

If the value for Description on the Scheme Parameter with a Parameter Type of TAX ENTITY is ADMINISTRATOR populate this with the value for SARS SYSTEM ID on Administrator. If the value is SCHEME read the Pooling Status on the Scheme. If it is SUB-UMBRELLA then populate this with the value for REGISTRATION NUMBER on FUND REGISTRATION for SARS for the MAIN UMBRELLA Scheme to which the SUB-UMBRELLA Scheme is linked. If the Pooling Status is NONE then populate this with the value for REGISTRATION NUMBER on FUND REGISTRATION for SARS for the Scheme to which the Member is linked. |

Mandatory |

|

|

SDL Reference Number |

2022 |

10 |

AN |

Blank |

Skills Development Levy reference number of the employer |

|

|

UIF Reference Number |

2024 |

10 |

AN |

Blank |

Unemployment Insurance Fund Reference Number |

|

|

Employer Contact Person |

2025 |

30 |

A |

If the Trading Name above is the Name of the Administrator populate this with the Contact Person linked to the Administrator Branch to which the Scheme is linked, with a Description for Role of Contact Person of TAX CONTACT PERSON. If a Contact Peron with a Role of TAX CONTACT PERSON is not found find the Contact Person linked to the Administrator with a Description for Role of Contact Person of TAX CONTACT PERSON. If the Trading Name above is the Name of the Scheme populate this with the Contact Person linked to the Scheme with a Role of TAX PROCESSOR. |

|

|

|

Employer Contact Number |

2026 |

70 |

FT |

Value for TELEPHONE AREA CODE 1 and TELEPHONE NUMBER 1 on the CLIENT ADDRESS record with an Address Type of SARS RESIDENTIAL, SARS POST STR, SARS POST BOX or SARS PRIVATEBAG linked to the Contact Person used in 2025. |

|

|

|

Employer E-mail address |

2027 |

70 |

FT |

Value for ELECTRONIC ADDRESS IDENTIFIER 1 on the CLIENT ADDRESS record with an Address Type of SARS RESIDENTIAL, SARS POST STR, SARS POST BOX or SARS PRIVATEBAG linked to the Contact Person used in 2025. |

|

|

|

Payroll Software |

2028 |

12 |

FT |

Blank |

Optional |

|

|

Transaction year |

2030 |

4 |

N |

Tax year for which extract processed |

Mandatory CCYY |

|

|

Period of Reconciliation |

2031 |

6 |

N |

To Date |

Mandatory CCYYMM |

|

|

Employer SIC7 Code |

2082 |

5 |

AN |

66300 |

Mandatory Employer Standard Industry Classification Code |

|

|

Employer SEZ Code |

2083 |

3 |

AN |

ZAR |

Optional Employer’s Special Economic Zone Code |

|

|

Employer Trade Classification |

2035 |

4 |

N |

|

Mandatory |

|

|

Employer Physical Address: Unit Number |

2061 |

8 |

AN |

Value for LINE 1 on the CLIENT ADDRESS record with an Address Type of SARS RESIDENTIAL linked to the Contact Person used in 2025. |

Optional |

|

|

Employer Physical Address: Complex |

2062 |

26 |

FT |

LINE 2 on the CLIENT ADDRESS record used for 2061 |

Optional |

|

|

Employer Physical Address: Street Number |

2063 |

8 |

AN |

LINE 3 on the CLIENT ADDRESS record used for 2061 |

Optional |

|

|

Employer Physical Address: Street / Name of Farm |

2064 |

26 |

FT |

LINE 4 on the CLIENT ADDRESS record used for 2061 |

Mandatory |

|

|

Employer Physical Address: Suburb / District |

2065 |

33 |

FT |

LINE 5 on the CLIENT ADDRESS record used for 2061 |

Mandatory |

|

|

Employer Physical Address: City / Town |

2066 |

21 |

FT |

LINE 6 on the CLIENT ADDRESS record used for 2061 |

Mandatory |

|

|

Employer Physical Address: Postal Code |

2080 |

4 |

N |

POSTAL CODE on latest CLIENT ADDRESS record used for 2061 |

Mandatory |

|

|

End of record |

9999 |

4 |

N |

|

|

|

|

Employee Information |

||||||

|

Field Name |

Code |

Size |

Format |

IN.sight value / Value |

Comment |

|

|

Certificate number |

3010 |

30 |

AN |

IRP5 NUMBER on Benefit Tax Directive |

Mandatory |

|

|

Type of Certificate |

3015 |

6 |

AN |

TYPE OF CERTIFICATE on Benefit Tax Directive |

|

|

|

Nature of person |

3020 |

1 |

A |

If an ID Number is found for the Membership then set this to A. If not then set to B |

Mandatory |

|

|

Year of Assessment |

3025 |

4 |

N |

TAX YEAR on Benefit Tax Directive |

Mandatory CCYY |

|

|

Mark with an X if Certificate has ETI (Employment Tax Incentive) |

3026 |

1 |

A |

Blank |

Optional |

|

|

Employee surname or trading name |

3030 |

120 |

FT |

TAXPAYER SURNAME on Benefit Tax Directive |

Mandatory |

|

|

First two names |

3040 |

90 |

FT |

TAXPAYER FIRSTNAME 1 TAXPAYER FIRSTNAME 2 on Benefit Tax Directive |

Mandatory |

|

|

Initials |

3050 |

5 |

A |

TAXPAYER INTITALS on Benefit Tax Directive |

Mandatory |

|

|

Identity number |

3060 |

13 |

N |

TAXPAYER IDENTITY NUMBER on Benefit Tax Directive |

Mandatory if Passport Number is not supplied |

|

|

Passport number |

3070 |

18 |

A |

TAXPAYER OTHER IDENTITY NUMBER on Benefit Tax Directive |

Mandatory if Identity Number is not supplied |

|

|

Country of Issue |

3075 |

3 |

A |

If the value for 3070 is not null then populate this with the value for System Value field on the RT Permitted Value for the UDPV Object TERRITORY for the value for Passport Country of Issue on the Natural Person record for the Membership |

Mandatory if Identity Number is not supplied |

|

|

Date of birth |

3080 |

8 |

N |

TAXPAYER DATE OF BIRTH on Benefit Tax Directive |

Mandatory |

|

|

Income Tax reference number |

3100 |

10 |

N |

INCOME TAX REFERENCE NUMBER on Benefit Tax Directive |

Mandatory |

|

|

Employee SIC7 Code |

3263 |

5 |

AN |

66300 ????????

|

Mandatory Standard Industry Classification Code for the industry in which the member is employed. |

|

|

Employee SEZ Code |

3264 |

3 |

AN |

Blank |

Optional Special Economic Zone Code where the employee mainly works |

|

|

Employee contact E-mail |

3125 |

70 |

FT |

ELECTRONIC ADDRESS IDENTIFIER on Client Address linked to Membership with an Address Type of RESIDENTIAL or SARS RESIDENTIAL |

Optional |

|

|

Employee Home Tel No |

3135 |

11 |

AN |

TELEPHONE AREA CODE and TELEPHONE NUMBER on Client Address linked to Membership and with an Address Type of RESIDENTIAL or SARS RESIDENTIAL |

Optional |

|

|

Employee Bus Tel No |

3136 |

11 |

AN |

TELEPHONE AREA CODE and TELEPHONE NUMBER 1 on Client Address linked to Membership and with an Address Type of BUSINESS |

Optional |

|

|

Employee Fax No |

3137 |

11 |

AN |

FAX AREA CODE and FAX NUMBER 1 on Client Address linked to Membership and with an Address Type of RESIDENTIAL, SARS RESIDENTIAL or BUSINESS. |

Optional |

|

|

Employee Cell No |

3138 |

11 |

AN |

ELECTRONIC ADDRESS IDENTIFIER on Client Address linked to Membership with an Address Type of RESIDENTIAL or SARS RESIDENTIAL |

Optional |

|

|

Employee Address Details: - Business: Unit Number |

3144 |

8 |

AN |

Blank |

Optional |

|

|

Employee Address Details: - Business: Complex |

3145 |

26 |

FT |

Blank |

Optional |

|

|

Employee Address Details: - Business: Street Number |

3146 |

6 |

AN |

Blank |

Optional |

|

|

Employee Address Details: - Business: Street/Name of Farm |

3147 |

26 |

FT |

Blank |

Optional |

|

|

Employee Address Details: - Business: Suburb/District |

3148 |

33 |

FT |

Blank |

Optional |

|

|

Employee Address Details: - Business: City/Town |

3149 |

21 |

FT |

Blank |

Optional |

|

|

Employee Address Details: - Business: Postal Code |

3150 |

9 |

AN |

Blank |

Optional |

|

|

Employee number |

3160 |

25 |

AN |

TAXPAYER MEMBER NUMBER on Benefit Tax Directive |

Optional |

|

|

Date Employed From |

3170 |

8 |

N |

EMPLOYMENT START DATE on Benefit Tax Directive |

Mandatory CCYYMMDD |

|

|

Date Employed To |

3180 |

8 |

N |

EMPLOYMENT END DATE on Benefit Tax Directive |

Mandatory CCYYMMDD |

|

|

Pay Periods in year of assessment |

3200 |

3.4 |

N Fixed decimal |

1.0000 |

4 decimals e.g. 12 months = 012.0000 For IT3(a) records this must be zeroes. |

|

|

Pay periods worked |

3210 |

3.4 |

N Fixed decimal |

1.0000 |

4 decimals e.g. 7 months 14 days = 7 +14/31 = 007.4516 For IT3(a) records this must be zeroes |

|

|

Employee Address Details – Residential: Unit Number |

3211 |

8 |

AN |

LINE 1 on the Client Address record with an Address Type of SARS RESIDENTIAL linked to the Membership |

Optional |

|

|

Employee Address Details – Residential: Complex |

3212 |

26 |

FT |

LINE 2 on the Client Address record with an Address Type of SARS RESIDENTIAL linked to the Membership |

Optional |

|

|

Employee Address Details – Residential: Street Number |

3213 |

8 |

AN |

LINE 3 on the Client Address record with an Address Type of SARS RESIDENTIAL linked to the Membership |

Optional |

|

|

Employee Address Details – Residential: Street Name/Farm |

3214 |

26 |

FT |

LINE 4 on the Client Address record with an Address Type of SARS RESIDENTIAL linked to the Membership |

Mandatory |

|

|

Employee Address Details – Residential: Suburb/District |

3215 |

33 |

FT |

LINE 5 on the Client Address record with an Address Type of SARS RESIDENTIAL linked to the Membership |

Conditional (3215 or 3216 must be supplied) |

|

|

Employee Address Details – Residential: City/Town |

3216 |

21 |

FT |

LINE 6 on the Client Address record with an Address Type of SARS RESIDENTIAL linked to the Membership |

Conditional (3215 or 3216 must be supplied) |

|

|

Employee Address Details – Residential: Postal Code |

3217 |

9 |

AN |

POSTAL CODE on the Client Address record with an Address Type of SARS RESIDENTIAL linked to the Membership |

Mandatory |

|

|

Mark here with an “X” if same as above or complete your Postal Address |

3218 |

1 |

A |

If the Client Address linked to the Member with an Address Type of SARS POST STR is the same as the Client Address with an Address Type of SARS RESIDENTIAL set this to X. If not leave blank. |

Optional X = postal address same as residential address |

|

|

Is your Postal Address a Street Address? (Y/N) |

3247 |

1 |

A |

If the value for 3218 is blank and there is a Client Address record linked to the Annuitant/Beneficiary with an Address Type of SARS POST STR set this to Y. If not set this to N. |

Y or N Mandatory if 3218 is not marked with an X |

|

|

Employee Postal Address Details PO Box |

3249 |

1 |

A |

If the value for 3247 is N then if there is a Client Address record linked to the Annuitant/Beneficiary with an Address type of SARS POST BOX set this to X else leave blank. |

Optional |

|

|

Employee Postal Address Details – Private Bag |

3250 |

1 |

A |

If the value for 3247 is N then if there is a Client Address record linked to the Annuitant/Beneficiary with an Address type of SARS PRIVATEBAG set this to X else leave blank. |

Optional |

|

|

Employee Postal Address Details – Postal Agency or Sub-unit (if applicable) (e.g. Postnet Suite ID) |

3251 |

21 |

FT |

Blank |

Optional |

|

|

Other PO Special Service (specify) |

3280 |

10 |

FT |

Blank |

Optional |

|

|

Employee Postal Address Details - Number |

3262 |

8 |

FT |

LINE 1 on the Client Address record with an Address Type of SARS POST BOX or SARS PRIVATEBAG linked to the Membership |

|

|

|

Employee Postal Address Details – Post Office |

3253 |

23 |

FT |

If the value for 3247 is Y then LINE 1 of Client Address record with an Address Type of SARS POST STR linked to the Membership |

Mandatory if value for 3247 is N |

|

|

Employee Postal Address Details – Postal Code |

3254 |

9 |

AN |

If the value for 3247 is Y then LINE 2 of Client Address record with an Address Type of SARS POST STR linked to the Membership |

Mandatory |

|

|

Employee Postal Address Details – Number |

3262 |

8 |

FT |

If the value for 3247 is Y then LINE 3 of Client Address record with an Address Type of SARS POST STR linked to the Membership |

Mandatory if value for field 3249 0r 3250 is X |

|

|

Employee Address Details – Postal: Unit Number |

3255 |

8 |

AN |

If the value for 3247 is Y then LINE 4 of Client Address record with an Address Type of SARS POST STR linked to the Membership |

Optional |

|

|

Employee Address Details – Postal: Complex |

3256 |

26 |

FT |

If the value for 3247 is Y then LINE 2 of Client Address record with an Address Type of SARS POST STR linked to the Membership |

Optional |

|

|

Employee Address Details – Postal: Street Number |

3257 |

5 |

AN |

If the value for 3247 is Y then LINE 3 of Client Address record with an Address Type of SARS POST STR linked to the Membership |

Optional |

|

|

Employee Address Details – Postal: Street Name/Farm |

3258 |

25 |

FT |

If the value for 3247 is Y then LINE 4 of Client Address record with an Address Type of SARS POST STR linked to the Membership |

Mandatory if value for 3247 is Y |

|

|

Employee Address Details – Postal: Suburb/District |

3259 |

33 |

FT |

If the value for 3247 is Y then LINE 5 of Client Address record with an Address Type of SARS POST STR linked to the Membership |

Mandatory if value for 3247 is Y |

|

|

Employee Address Details – Postal: City/Town |

3260 |

21 |

FT |

If the value for 3247 is Y then LINE 6 of Client Address record with an Address Type of SARS POST STR linked to the Membership |

Mandatory if value for 3247 is Y |

|

|

Employee Address Details – Postal: Postal Code |

3261 |

9 |

AN |

If the value for 3247 is Y then POSTAL CODE of Client Address record with an Address Type of SARS POST STR linked to the Membership |

Mandatory if value for 3247 is Y |

|

|

Mark with an X if postal address is C/O |

3279 |

1 |

A |

Blank |

Optional |

|

|

Directive number |

3230 |

13 |

A |

TAX DIRECTIVE NUMBER on Membership Payment Details. If it is null then blanks. |

Mandatory |

|

|

Employee Bank Account Type |

3240 |

1 |

N |

If the value for Nature of Person is not N and the value for CLAIM PAYMENT TYPE on the Benefit Disposal Instruction is EFT and the value for the DISPOSAL TYPE is CASH read the BANK ACCOUNT TYPE on the Disposal Instruction. Set the value as follows: CURRENT – 1 SAVINGS – 2 TRANSMISSION – 3 CREDIT CARD – 5 If the CLAIM PAYMENT TYPE is not EFT set this value to 0 (Not paid by electronic bank transfer). |

Mandatory |

|

|

Employee Bank Account Number |

3241 |

17 |

N |

If the value for Employee Bank Account Type is not 0 read the DTI ACCOUNT NUMBER on the Benefit Disposal Instruction. |

Optional |

|

|

Employee Bank Branch Number |

3242 |

6 |

N |

If the value for Employee Bank Account Type is not 0 read the DTI BRANCH CODE on the Benefit Disposal Instruction. |

Optional |

|

|

Employee Bank Name |

3243 |

50 |

A |

If the value for Employee Bank Account Type is not 0 read the NAME on the CLIENT linked to the DTI BRANCH CODE on the DTI Account linked to the Benefit Disposal Instruction. |

Optional |

|

|

Employee Bank Branch Name |

3244 |

50 |

A |

If the value for Employee Bank Account Type is not 0 read the NAME on the DTI BRANCH with a DTI BRANCH CODE on the Benefit Disposal Instruction. |

Optional |

|

|

Employee Account Holder Name |

3245 |

50 |

FT |

If the value for Employee Bank Account Type is not 0 read the NAME on the DTI Account linked to the Benefit Disposal Instruction. |

Optional |

|

|

Employee Account Holder Relationship |

3246 |

1 |

N |

1 – Own 2 – Joint 3 – Third Party |

Optional |

|

|

Income Received |

3601 – 3617 3651 – 3667 3701 – 3718 3751 – 3768 3801 – 3810 3813 3851 – 3860 3863 3901 – 3909 3915 3920 3921 3951 – 3957 |

15 |

N |

Combination of the value for INCOME CODE1 and GROSS LUMPSUM on Benefit Tax Directive e.g. 3920,150000, Where 3920 is the Income Code for Withdrawal and 150000 is the gross lump sum amount. |

Mandatory |

|

|

Non-taxable income |

3696 |

15 |

N |

Blank |

|

|

|

Gross retirement funding income |

3697 |

15 |

N |

Blank |

|

|

|

Gross non-retirement funding income |

3698 |

15 |

N |

Blank |

|

|

|

Deductions |

4001 – 4003 4005 - 4007 4018 4024 4026 4030 4474 |

15 |

N |

Blank |

|

|

|

Medical Aid contribution paid on behalf of the Employee |

4493 |

15 |

N |

Blank |

|

|

|

Total Deductions / Contributions |

4497 |

15 |

N |

Blank |

|

|

|

SITE |

4101 |

11.2 |

N |

Blank |

. |

|

|

PAYE |

4102 |

11.2 |

N |

Blank |

|

|

|

PAYE on retirement lump sum benefits |

4115 |

11.2 |

N |

PAYE AMOUNT on Benefit Tax Directive |

|

|

|

Medical Aid Tax Credit |

4116 |

11 |

N |

The Medical Aid Tax Credit stored on the Tax Record on a monthly basis |

Only for persons under age 65 who has Medical Aid |

|

|

Employee & Employer UIF Contribution |

4141 |

11.2 |

N |

Blank |

|

|

|

Employer SDL Contribution |

4142 |

11.2 |

N |

Blank |

|

|

|

Total Tax, SDL & UIF (employer and employee contribution) |

4149 |

11.2 |

N |

PAYE AMOUNT on Benefit Tax Directive |

|

|

|

Reason code for IT3(a)

|

4150 |

2 |

N |

IT3(A) REASON CODE on Benefit Tax Directive |

|

|

|

End of record |

9999 |

4 |

N |

|

|

|

|

Employer Trailer Record |

||||||

|

Employer total number of records |

6010 |

15 |

N |

Total number of Employee records |

|

|

|

Employer total code value |

6020 |

15 |

N |

Sum total of the value of all CODES in the file |

|

|

|

Employer total amount |

6030 |

12.2 |

N |

Sum total of all of the AMOUNTS in the file |

|

|

|

End of record |

9999 |

4 |

N |

|

|

|

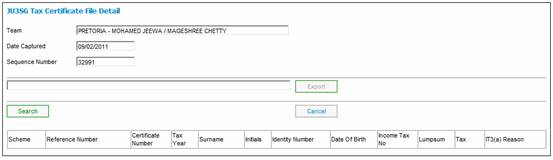

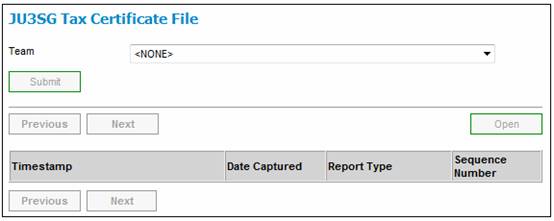

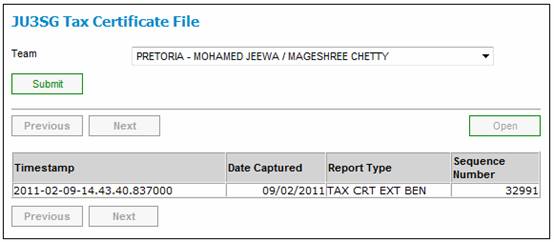

To view the Certificate, click View below Create Tax Certificates File. The JU3SG Tax Certificate File screen will be displayed.

Select a Team from the drop-down list and click SUBMIT.

The JU3SG Tax Certificate File screen will be displayed. This screen display a list of the Tax Certificate Files created for the Scheme selected or for the Schemes linked to the Team selected.

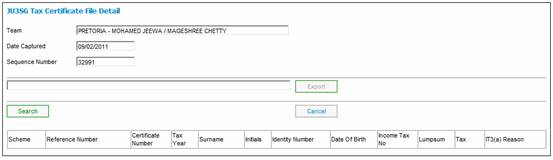

To view details of a Tax Certificate File, highlight a line and click OPEN. The

JU3SG Tax Certificate File Detail screen will be displayed.

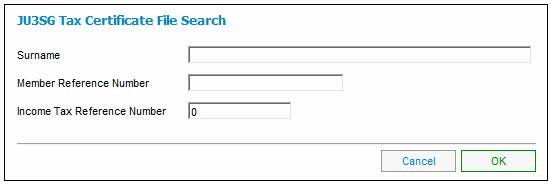

In order to search for a tax certificate file, click SEARCH. The JU3SG Tax Certificate File Search screen will be displayed.

Capture the required data into one or more of the fields and click OK. The JU3SG Tax Certificate File Detail screen will be displayed.