This report provides a report of salary sacrifice contributions made for a specified period.

The Business Transactions listing provides a listing of contribution transactions for any selected period. The report can be extracted for all members and contribution types or per contribution type and per member.

From the Financial menu, click ![]() alongside Contributions on the sub-menu on the left. Additional options will be displayed.

alongside Contributions on the sub-menu on the left. Additional options will be displayed.

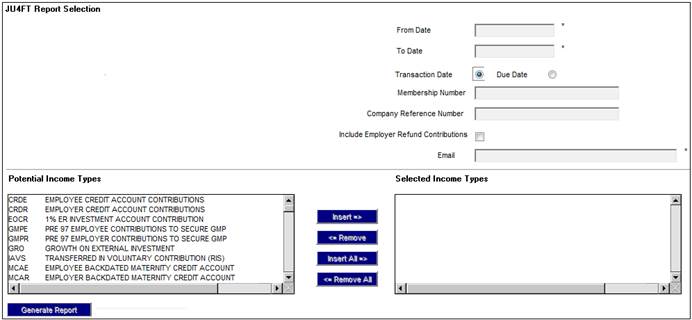

Click New below Contributions. The JU4FT Report Selection screen will be displayed.

To generate the report, specify the following:

|

Transaction Date

Due Date |

Click the appropriate Radio Button to select either a Transaction Date or a Due Date. Once selected, a From Date and To Date must be captured.

Note: If a From Transaction Date is captured then a To Transaction Date must be captured and vice versa. Similarly, if a From Due Date is captured then a To Due Date must be captured and vice versa. If a From and To Transaction Date is captured then a From and To Due Date will not be able to be captured and vice versa. |

|

Membership Number |

The capture of this field is optional. |

|

Company Reference Number |

The capture of this field is optional. |

|

Include Employer Refund Contributions |

To include employer refund contributions, click the Tick Box. |

|

|

Capture the Email address to which notification of the availability of the completed report must be sent. |

|

Income Types |

Select the Income Types to be included in the Report as follows:

To select an Income Type, click on an Income Type in the Potential Income Types list and then click INSERT. The selected Income Type will be moved to the Selected Income Types list.

To remove an Income Type, click on an Income Type in the Selected Income Types list and then click REMOVE. The selected Income Type will be moved to the Potential Income Types list.

To select all Income Types listed in the Potential Income Types list, click INSERT ALL. The Income Types will be moved to the Selected Income Types list.

To remove all Income Types listed in the Selected Income Types list, click REMOVE ALL. The Income Types will be moved to the Potential Income Types list. |

Once the necessary selections have been made and all data has been captured clickGENERATE REPORT. The Business Transactions will be extracted the from the Members’ accounts according to the criteria captured / selected.

Contributions

The Business Transactions will be retrieved from the Members’ CONTRIBUTION account.

If a From Transaction Date and a To Transaction Date was captured, the system will extract all of the Business Transactions with a Transaction Date greater than or equal to the From Transaction Date and less than or equal to the To Transactions Date.

If a From Due Date and a To Due Date was captured, the system will extract all of the Business Transactions with a Due Date greater than or equal to the From Due Date and less than or equal to the To Due Date.

If one or more Income Types were selected, the system will extract all of the Business Transactions with an Income Type equal to the Income Type(s) selected.

If a Membership Reference Number was captured, the system will extract the Business Transactions with a Membership Reference Number equal to the Membership Reference Number selected.

If a Company Reference Number was captured, the system will extract the Business Transactions with a Membership Reference Number for the Memberships linked to the Person for which the Company Reference Number is equal to the Company Reference Number captured.

Refund Contributions

If the Include Employer Refund Contributions tick box was ticked, the system will find the member’s with a Membership Status of EXIT IN PROCESS or EXIT FINALISED and for which the date of exit is less than or equal to the To Transaction Date (or To Due Date) and greater than or equal to the From Transaction Date (or From Due Date). The member’s service will be determined as at the date of exit and if it is less than 2 years service, the Business Transactions from the Members’ ER REFUND account will be extracted.

If a From Transaction Date and a To Transaction Date was captured, the system will extract all of the Business Transactions with a Transaction Date greater than or equal to the From Transaction Date and less than or equal to the To Transactions Date.

If a From Due Date and a To Due Date was captured, the system will extract all of the Business Transactions with a Due Date greater than or equal to the From Due Date and less than or equal to the To Due Date.

If a Membership Reference Number was captured, the system will extract the Business Transactions with a Membership Reference Number equal to the Membership Reference Number selected.

If a Company Reference Number was captured, the system will extract the Business Transactions with a Membership Reference Number for the Memberships linked to the Person for which the Company Reference Number is equal to the Company Reference Number captured.

The transaction retrieved will be summed.

Note:

The withdrawal benefit will be configured with a Benefit Product for the contribution types that will not be paid to a member with less than 2 years service and will be set up with an accounting sub- process of EMPLOYER REFUND.

The accounting activity linked to this sub-process will create accounting transactions for these contributions in a Member account called ER REFUNDS.

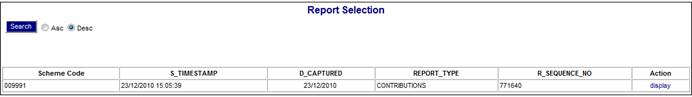

Click View below Contributions. The Report Selection screen will be displayed.

The following columns are displayed:

- Scheme Code

- Timestamp

- Date Captured

- Report Type

- Report Seq No

- Action

To select a report, click on the hyperlinked display in the Action column alongside the appropriate selection in the Report Type column.

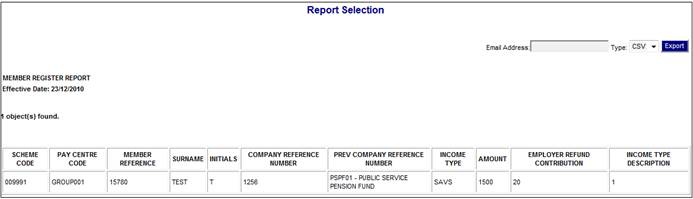

The Contributions Report will be displayed.

The following columns are displayed:

- Scheme Code

- Pay Centre Code

- Member Reference

- Company Reference Number (as at the To Date of the Report)

- Income Type

- Amount (Sum of Contribution transactions per Income Type)

- Income Type description